NAPLES, Fla., Oct. 07, 2024 (GLOBE NEWSWIRE) -- Beasley Broadcast Group, Inc. (Nasdaq: BBGI) (the "Company"), a multi-platform media company, today announces the expiration and final results of its previously announced offers (the "Offers") including (i) an exchange offer (the "Exchange Offer") of the Company's existing 8.625% Senior Secured Notes due 2026 (the "Existing Notes"), (ii) a cash offer to purchase up to $68.0 million of Existing Notes at a purchase price of 62.5% (the "Tender Offer"), (iii) a new notes offer (the "New Notes Offer") of $30.0 million aggregate principal amount of 11.000% Superpriority Senior Secured Notes due August 1, 2028 (the "New Notes"), and (iv) the solicitation of consents (the "Consent Solicitation") of the terms and conditions set forth in the Exchange Offer Memorandum (the "Exchange Offer Memorandum").

Caroline Beasley, Chief Executive Officer of the Company, said, "We are incredibly pleased with the outcome of our Exchange Offer and Tender Offer. These transactions will provide immediate debt reduction, meaningfully extend our maturities, and position our business for sustained success, thereby creating significant value for both our shareholders and noteholders. The transactions are supported by 98.4% of our outstanding indebtedness, reflecting our stakeholders' confidence in the Company's future."

In the Exchange Offer, holders of the Existing Notes (the "Existing Noteholders"), had the opportunity to exchange their holdings into: (i) newly issued 9.200% Senior Secured Notes due August 1, 2028 (the "Exchange Notes") at an exchange ratio of 95.0% of the aggregate principal amount (or $950 per $1,000 of principal amount) of the Existing Notes tendered for exchange; (ii) a pro rata share of 179,424(1) shares of Class A Common Stock of the Company (the "Exchange Shares"), based upon pro rata ownership of the Exchange Notes, pursuant to the terms and conditions described in the Exchange Offer Memorandum and Consent Solicitation Statement, dated September 5, 2024 and (iii) a consent fee of $5.00, in each case per $1,000 principal amount of Existing Notes tendered.

Subject to the terms and conditions set forth in the Exchange Offer Memorandum, the Company has the option to increase the Exchange Shares issued and/or the cash amount paid to each exchanging holder in the Exchange Offer by an amount not to exceed, in the aggregate, a pro rata portion of $3.0 million (with the value of any additional Exchange Shares issued determined on the settlement date of October 8, 2024) if, and to the extent the Company determines, in its sole discretion, that such issuance or payment would improve the Company's financial position after giving effect to the Exchange Offer, including the payment of fees and potential taxes associated therewith. The Company expects to make a final determination regarding an increase in the amount of Exchange Shares to be issued and/or cash to be paid to each exchanging holder shortly prior to settlement of the Exchange Offer on October 8, 2024.

A holder (the "Supporting Holder") of approximately 73% of the Existing Notes agreed to fully backstop the New Notes Offer and previously entered into a transaction support agreement to support the Exchange Offer, subject to certain customary conditions, including a minimum participation condition (the "TSA Minimum Participation Condition") requiring 100% of Existing Noteholders to participate in the Exchange Offer or Tender Offer. The Supporting Holder waived the TSA Minimum Participation Condition on October 7, 2024.

The following table describes the final results as of the expiration of the Exchange Offer and the Tender Offer at 5:00 p.m., New York City time, on October 4, 2024 in more detail:

| Title | Aggregate Principal Amount Tendered and Accepted | Percentage of Outstanding Notes Validly Tendered | Aggregate Principal Amount of Exchange Notes Issued | Number of Shares of Exchange Shares Issued | ||

| Tender Offer | $68,000,000 | 25.5% | N/A | N/A | ||

| Exchange Offer | $194,705,000 | 72.9% | $184,969,750 | 179,424(1) | ||

| Total | $262,705,000 | 98.4% | $184,969,750 | 179,424(1) | ||

The Company further announces the expiration and completion of its Consent Solicitation of the terms and conditions set forth in the Exchange Offer Memorandum from Existing Noteholders of the Existing Notes. The Company received the requisite consents from Existing Noteholders to adopt the proposed amendments to the existing indentures, and it previously entered into supplemental indentures with the trustee to reflect the proposed amendments, but the proposed amendments will become operative only upon the consummation of the Offers. For additional details on the Offers and the Consent Solicitation, including the anticipated consideration to be received by holders upon settlement of the Offers, please refer to the Company's press release issued on September 6, 2024.

This press release is neither an offer to purchase nor a solicitation of an offer to buy any notes in the Offers.

The New Notes, the Exchange Notes and the Exchange Shares have not been and will not be registered under the federal securities laws or the securities laws of any state or any other jurisdiction. We are not required to register the Exchange Notes, the New Notes and the Exchange Shares for resale under the U.S. Securities Act of 1933, as amended (the "Securities Act"), or the securities laws of any other jurisdiction and are not required to exchange the Existing Notes for notes registered under the Securities Act or the securities laws of any other jurisdiction, and we have no present intention to do so. The offering was made in reliance on the exemption provided by Section 4(a)(2) of the Securities Act, only to persons who are (i) reasonably believed to be "qualified institutional buyers" (as defined in Rule 144A under the Securities Act) or (ii) not "U.S. persons" (as defined in Rule 902 under the Securities Act) and are in compliance with Regulation S under the Securities Act.

Latham & Watkins LLP served as legal counsel to the Company, and Moelis & Company LLC served as exclusive financial advisor to the Company, and dealer manager and solicitation agent. Gibson, Dunn & Crutcher LLP served as legal advisor to the Supporting Holder.

About Beasley Broadcast Group

The Company is a multi-platform media company whose primary business is operating radio stations throughout the United States. The Company offers local and national advertisers integrated marketing solutions across audio, digital and event platforms. The Company owns and operate stations in the following markets: Atlanta, GA, Augusta, GA, Boston, MA, Charlotte, NC, Detroit, MI, Fayetteville, NC, Fort Myers-Naples, FL, Las Vegas, NV, Middlesex, NJ, Monmouth, NJ, Morristown, NJ, Philadelphia, PA, and Tampa-Saint Petersburg, FL. Approximately 20 million consumers listen to the Company's radio stations weekly over-the-air, online and on smartphones and tablets, and millions regularly engage with the Company's brands and personalities through digital platforms such as Facebook, X, text, apps and email.

Contact

Joseph Jaffoni, Jennifer Neuman JCIR

(212) 835-8500

bbgi@jcir.com

Heidi Raphael, BBGI

(239) 263-5000

Note Regarding Forward-Looking Statements

This release contains "forward-looking statements" about the Company, which relate to future, not past, events. All statements other than statements of historical fact included in this release are forward-looking statements. These forward-looking statements are based on the current beliefs and expectations of the Company's management and are subject to known and unknown risks and uncertainties. Forward-looking statements, which address the Company's expected business and financial performance and financial condition, among other matters, contain words such as: "expects," "anticipates," "intends," "plans," "believes," "estimates," "may," "will," "plans," "projects," "could," "should," "would," "seek," "forecast," or other similar expressions.

Forward-looking statements, by their nature, address matters that are, to different degrees, uncertain. Although the Company believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that the expectations will be attained or that any deviation will not be material. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. The Company undertakes no obligation to update or revise any forward-looking statements.

Forward-looking statements involve a number of risks and uncertainties, and actual results or events may differ materially from those projected or implied in those statements. Factors that could cause actual results or events to differ materially from these forward-looking statements include, but are not limited to:

- the Company's ability to comply with the continued listing standards of the Nasdaq Capital Market;

- risks from social and natural catastrophic events;

- external economic forces and conditions that could have a material adverse impact on the Company's advertising revenues and results of operations;

- the ability of the Company's stations to compete effectively in their respective markets for advertising revenues;

- the ability of the Company to develop compelling and differentiated digital content, products and services;

- audience acceptance of the Company's content, particularly its audio programs;

- the ability of the Company to respond to changes in technology, standards and services that affect the audio industry;

- the Company's dependence on federally issued licenses subject to extensive federal regulation;

- actions by the FCC or new legislation affecting the audio industry;

- increases to royalties the Company pays to copyright owners or the adoption of legislation requiring royalties to be paid to record labels and recording artists;

- the Company's dependence on selected market clusters of stations for a material portion of its net revenue;

- credit risk on the Company's accounts receivable;

- the risk that the Company's FCC licenses and/or goodwill could become impaired;

- the Company's substantial debt levels and the potential effect of restrictive debt covenants on the Company's operational flexibility and ability to pay dividends;

- risks related to the Exchange Notes and the New Notes;

- the Company's ability to comply with debt covenants and service its debt;

- impacts to the value of collateral assets;

- the Company's ability to consummate the Offers;

- the potential effects of hurricanes on the Company's corporate offices and stations;

- the failure or destruction of the internet, satellite systems and transmitter facilities that the Company depends upon to distribute its programming;

- disruptions or security breaches of the Company's information technology infrastructure and information systems;

- the loss of key personnel;

- the Company's ability to integrate acquired businesses and achieve fully the strategic and financial objectives related thereto and their impact on the Company's financial condition and results of operations;

- the fact that the Company is controlled by the Beasley family, which creates difficulties for any attempt to gain control of the Company; and

- other economic, business, competitive, and regulatory factors affecting the businesses of the Company, as discussed in more detail in the Company's filings with the SEC.

Although the Company believes the expectations reflected in any of its forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of its forward-looking statements. The Company does not intend, and undertake no obligation, to update any forward-looking statement.

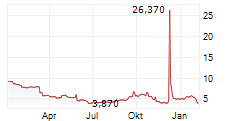

(1) On September 13, 2024, the Company's Board of Directors approved a reverse stock split of its Class A and Class B Common Stock at a ratio of 1-for-20, allowing for the Company to remain in compliance with Nasdaq Capital Market's $1.00 bid minimum bid price requirement. The reverse stock split became effective on September 23, 2024. Shares of the Company's Class A Common Stock began trading on a split-adjusted basis on Nasdaq on September 24, 2024. For more information on the reverse stock split, please refer to the Company's definitive information statement filed with the U.S. Securities and Exchange Commission on September 3, 2024, or the Company's Current Report on Form 8-K filed on September 19, 2024.