New energy storage system supplier rankings to be released at The Battery Show in Detroit, accompanied by lead analyst presentation at conference

SAN FRANCISCO, CA / ACCESSWIRE / October 7, 2024 / PV Tech Research releases the first bankability report for battery energy storage systems (ESS) suppliers, analyzing the leading global companies manufacturing and supplying ESS solutions, with Tesla the only company to be included in the top AAA-Rated band. Understanding the bankability of ESS suppliers, with traceable supply chains and profitable operations, has recently become critical for investors and developers building out new energy storage sites globally.

Insights and trends from the first release of the ESS StorageTech Bankability Ratings Report, will be presented at The Battery Show North America, organized by Informa Markets. (Oct. 7-10, Huntington Place, Detroit). PV Tech Lead analyst, Charlotte Gisbourne, will discuss the current landscape of ESS suppliers and the key developments important for the industry on October 8 at 4:30 PM in the Yellow Room. Media is welcome to attend.

"The ESS market is growing at a rapid pace globally, with the supply of utility scale solutions seeing strong demand for storing energy to feed into national grid networks," notes Charlotte Gisbourne, Research Analyst at PV-Tech Research, Informa Markets. "Understanding supply chains covering the production of battery cells, the assembly of modules and shipping integrated ESS solutions, is critical for investors and developers to assess origin of manufacturing and potential foreign entities of concern."

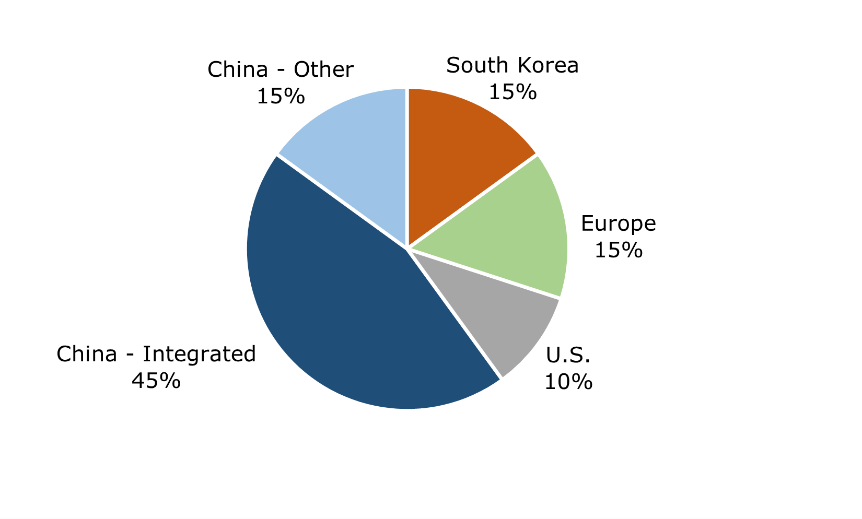

ESS component and integrated solutions manufacturers and suppliers from China account for 60 percent of the top 20 companies, featuring in the first release of the report, with most being backward integrated to the production of the battery cells. Contemporary Amperex Technology Ltd. (CATL) is the highest ranked Chinese company (AA-Rated) that makes cells also, with Sungrow leading those outsourcing the cell production, also AA-Rated.

Among other notable international entrants in the top 20, three are headquartered in South Korea and three are European. Samsung SDI is the top South Korean company (A-Rated), with Wärtsilä, based in Finland, the leading European supplier (BB-Rated). Two of the top 20 are U.S. companies, Tesla and Fluence, with Tesla being the highest ranked, and the only AAA-Rated supplier across the ESS sector globally.

"Tesla's AAA-Rating as an ESS supplier comes from being backward integrated to battery cell production, while reporting record quarterly shipment volumes of integrated ESS products," added Gisbourne. "In addition to its strong manufacturing score in the bankability analysis, Tesla's financial scores are the highest across the top 20 ESS suppliers today."

Figure: Country of ownership for the top 20 energy storage systems suppliers globally

Source: ESS StorageTech Bankability Ratings Report

With many of the backward integrated ESS suppliers focused mainly on storage batteries for electric vehicles (EVs), the top 20 grouping is routinely posting share price highs, corresponding to stock prices at more than three times annual revenue levels for all years apart from the current.

"With onshoring of battery cell production becoming a prerequisite as a supplier to the EV sector, integrated ESS solutions buyers could benefit from new domestic capacity coming online, particularly in Europe and America," added Finlay Colville, Head at PV-Tech Research, Informa Markets. "ESS profits are still a concern as prices decline. However, costs are coming down as manufacturing capacity grows. Together with the incentives on offer for domestic production, this could allow for greater profits to be realized in the future."

You can access the ESS StorageTech Bankability Ratings Report on PV Tech Research.

About PV Tech Research

PV Tech, a part of Informa Markets' Engineering, is the leading source for in-depth research analysis on solar and energy storage supply chains internationally. Founded in 2009, PV Tech's publications reach over 2.5 million visits yearly, along with the distribution of authoritative technical journals, distributed internationally to over 12,500 decision makers. To learn more about PV Tech Research, visit pv-tech.org.

About Informa Markets Engineering

Informa Markets' Engineering portfolio, a subsidiary of Informa plc (LON:INF), is the leading B2B event producer, publisher, and digital media business for the world's $3-trillion advanced, technology-based manufacturing industry. Our print and electronic products deliver trusted information to the engineering market and leverage our proprietary 1.3-million-name database to connect suppliers with buyers and purchase influencers. We produce more than 50 events and conferences in a dozen countries, connecting manufacturing professionals from around the globe. The Engineering portfolio is organized by Informa, the world's leading exhibitions organizer that brings a diverse range of specialist markets to life, unlocking opportunities and helping them to thrive 365 days of the year. For more information, please visit?informamarkets.com.

Media Contact

Informa Markets Engineering PR

EngineeringPR@informa.com

SOURCE: INFORMA MARKETS - ENGINEERING

View the original press release on accesswire.com