Highlights:

- First gold pour is on track for Q4 2025, key long lead items procured

- Project Development team appointed, led by Chief Development Officer Dimitrios Felekis

- Engineering for doubling plant capacity to 6Mtpa was awarded to Primero Engineering and is currently 24% complete

- Additional Ball Mill awarded and scheduled for shipment in May 2025, SAG Mill on track for Q1 2025

- Power station awarded with delivery from May 2025

- Tailings Storage Facility (TSF) expanded design commenced with Knight Piésold

- Civils contracts awarded, and concrete work has recommenced on site

- Earthworks Fleet for TSF and infrastructure arrived in Guinea

- Electrical and instrumentation awarded to ECG Engineering

- Inferred resource drilling program for Mansounia nearing completion with more than 32,000 metres of RC and more than 2,600 meters of DD completed

- Updated Feasibility Study for Kiniero on track for Q1 2025, led by AMC.

QUEBEC CITY, Oct. 08, 2024 (GLOBE NEWSWIRE) -- West African gold producer and developer Robex Resources Inc ("Robex" or the "Company") (TSXV: RBX) is pleased to provide a project development update for Kiniero Gold Project in Guinea. The project is on track for first gold in Q4 2025.

Robex Managing Director Matthew Wilcox said: "I am very pleased to provide shareholders with our first project development update for Kiniero with the expanded project, nearly doubling the previous plant size.

With our recent capital raise, we have been able to advance the schedule to leverage Kiniero's potential to be one of the largest and lowest cost gold producing mines in Guinea.

We will provide regular updates as we track towards first gold by the end of Q4 CY25 as construction advances the Kiniero Gold Project to become West Africa's next gold mine."

DEVELOPMENT TEAM APPOINTMENTS

Dimitrios Felekis - Chief Development Officer

Dimitrios has joined the Robex team as Chief Development Officer from Primero Engineering after serving as Project and Design manager on Tietto Minerals' Abujar project in Côte d'Ivoire. He has more than 25 years of experience primarily in the design and development of West African gold projects, including 17 years with Lycopodium Engineering. Dimitrios has worked on multiple West African gold projects including his role as Design Manager and Lead Field engineer on Nordgold's Bissa and Bouly Project in Burkina Faso.

Daniel Kotzee - Construction Manager

Daniel joins the team from Tietto Minerals where he was most recently the Construction Manager of the 5Mtpa Abujar gold project. Daniel has more than 15 years' experience in gold project development, including roles as construction manager of the Sanbrado gold project in Burkina Faso for West African Resources, Nordgold's Gross project in Southern Yakutia, as well as roles in both the Bissa and Bouly projects in Burkina Faso. Daniel also spent more than 12 months at Nordgold's Lefa Gold Operation in Guinea as project superintendent.

Hesbon Okwayo - Commercial Manager

Hesbon joins the team from Tietto Minerals where he was most recently the Commercial Manager of the 5Mtpa Abujar gold project. Hesbon has more than 15 years' experience in gold project development, including roles as commercial manager of the Sanbrado gold project in Burkina Faso for West African Resources, as well as roles in both the Bissa and Bouly projects in Burkina Faso. Hesbon also spent 12 months in Guinea as contracts manager for the Lefa Gold Operation.

Guillaume Hubert - Earthworks Manager

Guillaume joins the team from Tietto Minerals where he was most recently the Earthworks Manager of the 5Mtpa Abujar gold project. Guillaume has more than 30 years' experience in earthworks, including roles as earthworks manager of the Sanbrado gold project in Burkina Faso for West African Resources, Nordgold's Gross project in Southern Yakutia, as well as roles in both the Bissa and Bouly projects in Burkina Faso for Nordgold and construction roles for Endeavor Mining in West Africa.

KEY LONG LEAD ITEM PROCUREMENT

Comminution

The SAG mill is ready to ship after being awarded to New Concept Projects in 2023 as part of the 3Mtpa project previously commenced before the addition of the 900koz Mansounia deposit currently been drilled. The comminution modelling was updated to achieve an increased milling throughput of 6Mtpa by adding a ball mill to the previous circuit. This mill was awarded to New Concept Project in July 2024. The ball mill is currently scheduled to ship to site in May 2025.

Power Station

The power station for the Kiniero operation has been awarded Hyundai Heavy Industries. This power station consists of eight (8) sets of Hyundai HiMSEN 9H32/40 model generator with 11kv alternators. The current delivery plan starts from May 2025.

Earthworks Fleet

The earthworks fleet consisting of ten (10) SANY off highway rigid body 60-ton dump trucks, three (3) Komatsu excavators, three (3) Komatsu Dozers, two (2) Komatsu Graders, and various other support equipment has been procured and is either on site or in Conakry awaiting delivery to site.

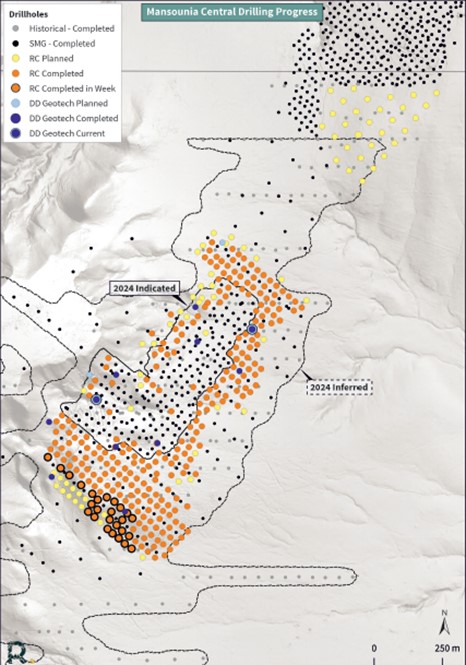

MANSOUNIA DRILLING CAMPAIGN UPDATE

The Phase 1 Mansounia resource drilling campaign is nearing completion with 32,000 metres of RC drilling and 2,600 metres of DD with the aim to convert Inferred resources to Indicated to enable their inclusion in the upcoming Ore Reserve estimate for Kiniero's updated Feasibility Study.

Figure 1: Mansounia drilling campaign as of 2 October 2024

FEASIBILITY STUDY UPDATE - Q1 2025

The resource model update is in progress by AMC Consultants to include the updated Mansounia drilling database.

Kiniero mine planning update is ongoing in line with AMC receiving updated modifying parameters for Geotech (mainly Mansounia) and preliminary operating cost inputs for processing (Primero) and mining (AMC/Robex) and Mansounia model by end of Q4 2024.

The updated feasibility study is planned to be published in Q1 2025.

CONSTRUCTION AND PROCUREMENT

Kiniero's upgraded access road to site is completed. Earthworks and concrete have commenced on the site of the process plant. Concrete for the CIL and Crushing areas is expected to commence this month.

All major mechanical equipment has now been issued for tender. Structural steel and platework fabrication packages have also been tendered.

GOVERNMENT AND PERMITTING

Robex continues to deliver milestones during 2024. The Company is negotiating the final regulatory step, the Kiniero Mining Convention, with the Guinean Government, having already secured all mining and environmental approvals for the current project layout.

NEXT MILESTONES - DELIVERING ON OUR STRATEGIC PLAN

Board / Management / Construction team appointment - Complete

Robex has delivered on its June strategic plan with the successful C$125.6m upsized equity raise and the concurrent appointment of the board and the management team. In addition, Robex has appointed the key construction team in-line with refocussing the company towards Kiniero's development.

Financing - US$130m debt package

The Company, advised by TerraFranca, is in advanced negotiations with multiple financiers to procure up to US$130 million of debt facility, with due diligence to commence shortly.

Mali - Divestment ongoing

As previously disclosed, Robex has settled with the Mali government to derisk its assets in Mali. Robex continues to engage with potential acquirers in the context of the contemplated sale of all the Company's assets in Mali.

ASX Listing - Q1 2025

In line with its strategic plan, Robex is planning to list onto the Australian Securities Exchange (ASX) by early Q1, 2025.

First Gold - Q4 2025

Robex's owner's team is focused on engineering to double capacity of previous DFS while constructing the process plant and associated infrastructure. Robex has commenced activities to ensure an expedited route to gold production at Kiniero and the maximisation of our current and potential resources.

Robex is very well positioned to achieve first gold for Kiniero Gold Project in Q4 2025.

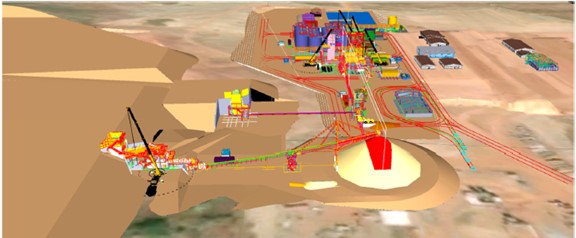

SITE PICTURES AND ENGINEERING

Figure 2: Primero current stage design (24% complete)

Figure 3: CIL Ring Beams

Figure 4: Steel frames for reagent shed

For more information

ROBEX RESOURCES INC.

Matthew Wilcox, Chief Executive Officer

Alain William, Chief Financial Officer

+1 581 741-7421

Email: investor@robexgold.com

www.robexgold.com

FORWARD-LOOKING INFORMATION AND FORWARD-LOOKING STATEMENTS

Certain information set forth in this news release contains "forward-looking statements" and "forward-looking information" within the meaning of applicable Canadian securities legislation (referred to herein as "forward-looking statements"). Forward-looking statements are included to provide information about Management's current expectations and plans that allows investors and others to have a better understanding of the Company's business plans and financial performance and condition.

Statements made in this news release that describe the Company's or Management's estimates, expectations, forecasts, objectives, predictions, projections of the future or strategies may be "forward-looking statements", and can be identified by the use of the conditional or forward-looking terminology such as "aim", "anticipate", "assume", "believe", "can", "contemplate", "continue", "could", "estimate", "expect", "forecast", "future", "guidance", "guide", "indication", "intend", "intention", "likely", "may", "might", "objective", "opportunity", "outlook", "plan", "potential", "should", "strategy", "target", "will" or "would" or the negative thereof or other variations thereon. Forward-looking statements also include any other statements that do not refer to historical facts. Such statements may include, but are not limited to, statements regarding: the perceived merit and further potential of the Company's properties; the Company's estimate of mineral resources and mineral reserves (within the meaning ascribed to such expressions in the Definition Standards on Mineral Resources and Mineral Reserves adopted by the Canadian Institute of Mining Metallurgy and Petroleum ("CIM Definition Standards") and incorporated into National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101")); capital expenditures and requirements; the Company's access to financing; preliminary economic assessments (within the meaning ascribed to such expressions in NI 43-101) and other development study results; exploration results at the Company's properties; budgets; strategic plans; market price of precious metals; the Company's ability to successfully advance the Kiniero Gold Project on the basis of the results of the feasibility study (within the meaning ascribed to such expression in the CIM Definition Standards incorporated into NI 43-101) with respect thereto, as the same may be updated, the whole in accordance with the revised timeline previously disclosed by the Company; the potential development and exploitation of the Kiniero Gold Project and the Company's existing mineral properties and business plan, including the completion of feasibility studies or the making of production decisions in respect thereof; work programs; permitting or other timelines; government regulations and relations; optimization of the Company's mine plan; the future financial or operating performance of the Company and the Kiniero Gold Project; exploration potential and opportunities at the Company's existing properties; costs and timing of future exploration and development of new deposits; the Company's ability to enter into definitive documentation in respect of the USD115 million project finance facility for the Kiniero Gold Project (including a USD15 million cost overrun facility, the "Facilities"), including the Company's ability to restructure the Taurus USD35 million bridge loan and adjust the mandate to accommodate for the revised timeline of the enlarged project; timing of entering into definitive documentation for the Facilities; if final documentation is entered into in respect of the Facilities, the drawdown of the proceeds of the Facilities, including the timing thereof; and the Company's ability to reach an agreement with the Malian authorities to establish a sustainable new tax framework for the Company, and for the sustainable continuation of the Company's activities and further exploration investments at Nampala.

Forward-looking statements and forward-looking information are made based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performance or achievements of the Company to be materially different from future results, performance or achievements expressed or implied by such statements or information. There can be no assurance that such statements or information will prove to be accurate. Such statements and information are based on numerous assumptions, including: the ability to execute the Company's plans relating to the Kiniero Gold Project as set out in the feasibility study with respect thereto, as the same may be updated, the whole in accordance with the revised timeline previously disclosed by the Company; the Company's ability to reach an agreement with the Malian authorities to establish a sustainable new tax framework for the Company, and for the sustainable continuation of the Company's activities and further exploration investments at Nampala; the Company's ability to complete its planned exploration and development programs; the absence of adverse conditions at the Kiniero Gold Project; the absence of unforeseen operational delays; the absence of material delays in obtaining necessary permits; the price of gold remaining at levels that render the Kiniero Gold Project profitable; the Company's ability to continue raising necessary capital to finance its operations; the Company's ability to restructure the Taurus USD35 million bridge loan and adjust the mandate to accommodate for the revised timeline of the enlarged project; the Company's ability to enter into definitive documentation for the Facilities on acceptable terms or at all, and to satisfy the conditions precedent to closing and advances thereunder (including satisfaction of remaining customary due diligence and other conditions and approvals); the ability to realize on the mineral resource and mineral reserve estimates; and assumptions regarding present and future business strategies, local and global geopolitical and economic conditions and the environment in which the Company operates and will operate in the future.

Certain important factors could cause the Company's actual results, performance or achievements to differ materially from those in the forward-looking statements including, but not limited to: geopolitical risks and security challenges associated with its operations in West Africa, including the Company's inability to assert its rights and the possibility of civil unrest and civil disobedience; fluctuations in the price of gold; limitations as to the Company's estimates of mineral reserves and mineral resources; the speculative nature of mineral exploration and development; the replacement of the Company's depleted mineral reserves; the Company's limited number of projects; the risk that the Kiniero Gold Project will never reach the production stage (including due to a lack of financing); the Company's capital requirements and access to funding; changes in legislation, regulations and accounting standards to which the Company is subject, including environmental, health and safety standards, and the impact of such legislation, regulations and standards on the Company's activities; equity interests and royalty payments payable to third parties; price volatility and availability of commodities; instability in the global financial system; the effects of high inflation, such as higher commodity prices; fluctuations in currency exchange rates; the risk of any pending or future litigation against the Company; limitations on transactions between the Company and its foreign subsidiaries; volatility in the market price of the Company's shares; tax risks, including changes in taxation laws or assessments on the Company; the Company's inability to successfully defend its positions in negotiations with the Malian authorities to establish a new tax framework for the Company, including with respect to the current tax contingencies in Mali; the Company obtaining and maintaining titles to property as well as the permits and licenses required for the Company's ongoing operations; changes in project parameters and/or economic assessments as plans continue to be refined; the risk that actual costs may exceed estimated costs; geological, mining and exploration technical problems; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; the effects of public health crises, such as the COVID-19 pandemic, on the Company's activities; the Company's relations with its employees and other stakeholders, including local governments and communities in the countries in which it operates; the risk of any violations of applicable anticorruption laws, export control regulations, economic sanction programs and related laws by the Company or its agents; the risk that the Company encounters conflicts with small-scale miners; competition with other mining companies; the Company's dependence on third-party contractors; the Company's reliance on key executives and highly skilled personnel; the Company's access to adequate infrastructure; the risks associated with the Company's potential liabilities regarding its tailings storage facilities; supply chain disruptions; hazards and risks normally associated with mineral exploration and gold mining development and production operations; problems related to weather and climate; the risk of information technology system failures and cybersecurity threats; and the risk that the Company may not be able to insure against all the potential risks associated with its operations.

Although the Company believes its expectations are based upon reasonable assumptions and has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. These factors are not intended to represent a complete and exhaustive list of the factors that could affect the Company; however, they should be considered carefully. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information.

The Company undertakes no obligation to update forward-looking information if circumstances or Management's estimates, assumptions or opinions should change, except as required by applicable law. The reader is cautioned not to place undue reliance on forward-looking information. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company's expected financial and operational performance and results as at and for the periods ended on the dates presented in the Company's plans and objectives, and may not be appropriate for other purposes.

See also the "Risk Factors" section of the Company's Annual Information Form for the year ended December 31, 2023, available under the Company's profile on SEDAR+ at www.sedarplus.caor on the Company's website at www.robexgold.com, for additional information on risk factors that could cause results to differ materially from forward-looking statements. All forward-looking statements contained in this news release are expressly qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/747b745f-6cd4-4563-8341-e7f3d0bf55d0

https://www.globenewswire.com/NewsRoom/AttachmentNg/fa003e78-8fbf-4a93-88de-9c4499971da8

https://www.globenewswire.com/NewsRoom/AttachmentNg/b3a54883-de1b-475d-86fd-2c88c09a2ca5

https://www.globenewswire.com/NewsRoom/AttachmentNg/54465a0f-44ca-4f35-a5bd-6b20e7b5e17a