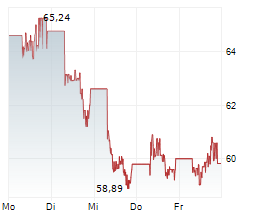

Tencent's stock experienced a significant downturn on the Frankfurt Stock Exchange, with shares plummeting by 9.1% to €51.45 during a recent trading session. This sharp decline comes despite the company's robust financial performance in the last quarter, where earnings per share surged to 5.52 HKD from 3.08 HKD year-over-year. Revenue also saw a healthy increase of 4.38% to 173.92 billion HKD. The stock's volatility is particularly noteworthy given its impressive year-to-date performance, boasting a 41.66% gain and solidifying Tencent's position as a heavyweight in the global technology sector with a market capitalization of 495.0 billion EUR.

Future Prospects and Investor Sentiment

Despite the recent setback, analysts remain optimistic about Tencent's future. Projections for the fiscal year 2024 anticipate earnings of 21.70 CNY per share, with an expected dividend of 3.73 CNY, marking an increase from the previous year's 3.40 HKD. Investors are keenly awaiting the next quarterly report, scheduled for November 13, 2024. While the stock currently trades 8.30% below its 52-week high of €56.58, reached on October 7, 2024, the proximity to this peak suggests potential for recovery. The market's reaction highlights the delicate balance between Tencent's strong fundamentals and broader market sentiment affecting tech stocks.

Ad

Tencent Stock: Buy or Sell? New Tencent Analysis on 09 October Provides the Answer:The latest Tencent figures speak volumes: Urgent action required for Tencent shareholders. Is it worth investing, or should you sell? Find out what to do now in our current free analysis from 09 October.

Tencent: Buy or Sell? Continue reading here ...