In this Q&A, Ross Pamphilon and Mark Duffy of Impax Asset Management explore the nuances of the asset class of Impact Bonds and how rigor and expertise can help investors navigate an expanding opportunity set.

Executive Summary

We believe it is worth taking a nuanced view of impact bonds, considering both non-labelled and labelled green, social and sustainability bonds.

Thorough issuer-specific research helps us to understand the environmental and social merits of each bond, assess the impact of financed projects, and maintain flexibility in labelling sustainable securitizations.

Within a portfolio, impact bonds can offer stability, transparency, and diversification alongside attractive risk-adjusted returns.

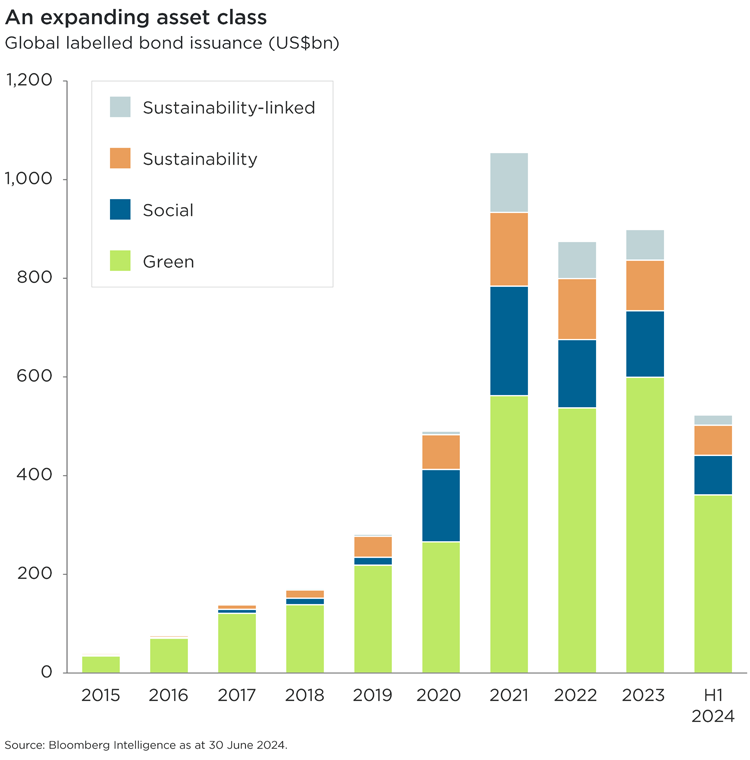

NORTHAMPTON, MA / ACCESSWIRE / October 9, 2024 / Over the last 25 years of investing in impact bonds, we have learned the value of looking beyond labeled green, social and sustainability (GSS) bonds. By broadening the definition of impact bonds, investors can access a wider range of opportunities to generate positive environmental and social outcomes while pursuing attractive risk-adjusted returns. However, navigating this market requires a nuanced understanding of innovative security structures, evolving standards and project-level impact assessment.

In this Q&A, we'll look at how to define the asset class and explain why we look 'off-label', how the global impact bond market has grown, whether impact bonds involve higher credit risks, and the role these instruments can play in an investment portfolio.

Find their useful answers to a variety of questions here - https://greenmoney.com/lifting-the-lid-on-impact-bonds-5-questions-for-investors/

=====

Global Bonds issuance

View additional multimedia and more ESG storytelling from GreenMoney Journal on 3blmedia.com.

Contact Info:

Spokesperson: GreenMoney Journal

Website: https://www.3blmedia.com/profiles/greenmoney-journal

Email: info@3blmedia.com

SOURCE: GreenMoney Journal

View the original press release on accesswire.com