NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, HONG KONG, JAPAN, CANADA, NEW ZEALAND, SWITZERLAND, SINGAPORE, SOUTH AFRICA, SOUTH KOREA, RUSSIA, BELARUS OR IN ANY OTHER JURISDICTION IN WHICH THE RELEASE, DISTRIBUTION OR PUBLICATION OF THIS PRESS RELEASE WOULD BE UNLAWFUL, REQUIRE REGISTRATION OR ANY OTHER MEASURES THAN THOSE REQUIRED BY SWEDISH LAW. SEE ALSO THE SECTION "IMPORTANT INFORMATION" BELOW.

The Board of Directors of Ziccum AB (publ) ("Ziccum" or the "Company") announces today its intention to carry out a new issue of shares and warrants ("Units") with pre-emption rights for the Company's shareholders (the"Rights Issue"). The Board of Directors intends to publish a notice to an extraordinary general meeting planned to be held on 8 November 2024, to grant the Board of Directors an authorization to resolve on the Rights Issue and for the adoption of new articles of association. Each Unit consists of one (1) share and one (1) warrant free of charge of series TO 6 ("Warrants"). Upon full subscription in the Rights issue, the Company will initially receive approximately SEK 30 million in issue proceeds before issue costs. In connection with the Rights Issue, the Company has received subscription and guarantee undertakings amounting up to a total of approximately SEK 11.6 million, corresponding up to approximately 39 percent of the Rights Issue. The issue proceeds will primarily be used to further the technological development of LaminarPace®. To secure the Company's liquidity needs until the completion of the Rights Issue, the Company has secured a SEK 6.5 million bridge loan from VIFC Nordic AB and Dariush Hosseinian.

Jonas Ekblom, Chairman of Ziccum says:

"A concentrated effort in technology and business advancement has brought Ziccum to this gateway. It is important to recognize that the attractive value potential of Ziccum depends on further investments into our platform. In this regard, we feel confident about our continued ability to advance the LaminarPace® technology. After careful evaluation of the company's prospective capital needs and capital structure, Ziccum's board has concluded that it is in the shareholders' best interest to secure additional financing for such efforts. Although there is a financing agreement with American investor GCF, there is a strong preference of GCF to not exceed a 10% ownership threshold in Ziccum, motivating this capital raise."

The Rights Issue in brief

- The Rights Issue is comprised of Units and will initially, if fully subscribed, provide Ziccum with approximately SEK 30 million before issue costs. Each Unit will consist of one (1) share and one (1) Warrant. The Warrants are intended to be admitted to trading on Nasdaq First North Growth Market.

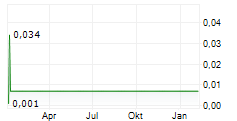

- The Board of Directors' resolution on the Rights Issue, including the subscription price, increase of the share capital and number of shares and warrants issued, is intended to be announced no later than 14 November 2024. The subscription price is intended to be set based on a discount to TERP (theoretical share price after separation of unit rights) of approximately 30 percent based on the volume-weighted average share price of the Company's share on Nasdaq First North Growth Market during the period from and including 1 November 2024 up to and including 14 November 2024 (the "Subscription Price"), however not less than the quota value of the share.

- Provided that the authorization is granted by the extraordinary general meeting on 8 November 2024, the record date for the Rights Issue is expected to be 22 November 2024 and the subscription period is expected to run from and including 26 November 2024 up to and including 10 December 2024.

- A number of the Company's existing shareholders, including all members of the Company's Board of Directors and management, have undertaken to subscribe for Units amounting to approximately SEK 0.3 million, which corresponds to approximately 1 percent of the Rights Issue. In addition, the Company has received guarantee undertakings from a consortium of external investors amounting to a total of approximately SEK 11.3 million, corresponding to approximately 38 percent of the Rights Issue. The Rights Issue is thus covered by subscription and guarantee undertakings amounting up to approximately 39 percent of the Rights Issue.

- One (1) Warrant entitles the holder, during the exercise period from and including 4 February 2025 up to and including 18 February 2025, to subscribe for one (1) new share in the Company at a subscription price per share amounting to 70 percent of the volume-weighted average price of the Company's share on Nasdaq First North Growth Market during the period from and including 17 January 2025 up to and including 30 January 2025, however, not less than the quota value of the share and not more than 125 percent of the Subscription Price in the Rights Issue. Thus, the Company may receive additional proceeds in February 2025 if the Warrants are exercised for subscription of new shares.

- The full terms and conditions of the Rights Issue, along with information about the Company, will be presented in a prospectus which is expected to be published on or around 20 November 2024.

- To secure the Company's liquidity needs until the completion of the Rights Issue, the Company has secured a SEK 6.5 million bridge loan from VIFC Nordic AB and Dariush Hosseinian.

Background and purpose

Ziccum is a Swedish pharmaceutical technology platform company. Ziccum develops LaminarPace®, a unique technology for formulating and drying biological drugs and vaccines at room temperature. The method is based on mass transfer instead of heat transfer. By reducing the stress that the active substance is exposed to during drying with traditional methods, LaminarPace® offers an opportunity to produce thermostable biological drugs with particle technology in a robust dry powder preparation meeting high pharmaceutical quality specifications. The conversion to robust, dry powder forms enables significant cost savings in all phases of development, manufacturing, handling, transport and administration of the pharmaceutical product. The dry pharmaceutical forms are ideally suited to new dosage forms. The technology has been successfully applied to mRNA, peptides, proteins, antibodies, lipids and enzymes, as well as excipients and adjuvants, and is well suited for industrial applications.

Application of LaminarPace® offers an important possibility for particle engineering, to generate drug product particles with precise, desired properties, unlike other existing drying technologies. The powder can be engineered for adequate drug inhalation properties. This particle engineering possibility has been proven also for mRNA/LNP material, generally considered near impossible to engineer for inhalation. Inhalable mRNA/LNP offers increased storage stability compared to liquid formulations and simplified and preferred patient administration avoiding injections. Inhalable mRNA/LNP therapies are not available on the market today. In August 2024, the Company also published results from Ziccum's internal development where a special effect has been discovered for certain lipid compositions, where the mRNA activity of the drug product is not only preserved but significantly increased after LaminarPace® treatment. The effect is being studied by measuring protein expression in live cells treated with mRNA.

Following the appointment of the new CEO Ann Gidner in May 2022, a new focused business strategy was implemented, which is based on a technology licensing business model. Following the implementation of the new strategy, a broad pipeline of customer dialogues has been created with revenue generation through paid feasibility studies. Four feasibility studies were signed in 2023/H1 2024, demonstrating progress and delivery under the new business model.

It is the Company's assessment that the existing working capital is not sufficient for the current needs during the coming twelve-month period. The Company believes that the capital raised through the Rights Issue will enable continued progress for the Company through the completion of ongoing projects, the establishment of new projects (through continued industry dialogues), the generation of additional milestone data through studies and collaborative projects and the strengthening of intellectual property rights and, ultimately, work for licensing agreements.

Upon full subscription in the Rights Issue, the Company will raise approximately SEK 30 million before issue costs. The costs related to the Rights Issue are estimated to amount to a maximum of SEK 4 million upon full subscription, of which approximately SEK 1.5 million is attributable to guarantee compensation. The expected net proceeds from the Rights Issue, upon full subscription, are thus estimated to amount to approximately SEK 26 million. The net proceeds, after repayment of the bridge loans, are intended to be used for the following purposes, listed in order of priority and with an approximate share indicated in brackets:

- Technology development of LaminarPace® to commercial scale and GMP production and expansion of current capacity (80 percent)

- A prerequisite for being an attractive licence partner is to be able to offer an industrial version of LaminarPace® suitable for commercial scale and GMP production. Ziccum is running two projects for this purpose. The first is the LaminarPace® Master plan, an internal technology development project that refines and optimises LaminarPace® and its capabilities. The second project is LaPaSim, where Ziccum is using leading expertise from the ICP Institute of computational physics at the Zurich University of Technology (ZHAW). The 3D modelling is performed to build a complete digital model of the LaminarPace® process, optimise design and process parameters, explore optimal capacity loads and create a digital twin ready for tech transfer to licensees.

- Pipeline expansion, adding additional projects and partners to the project portfolio. Project development, continued work and progress on existing projects, and data generation in the form of data from ongoing and future projects with partners (20 percent)

- Ongoing external feasibility studies, as well as ongoing internal data generation, are crucial for the continued quality, pace and volume of business development. It is of great importance to ensure continued strong efforts to build up data proving the applicability of the LaminarPace® technology. The commercialisation of the valuable LaminarPace® offering has been successfully launched and according to the Company has received global attention. The primary data generation will consist of factorial experiments with LaminarPace® runs to select optimal process parameters, followed by animal experiments with selected materials to investigate further typical preclinical parameters.

In February 2025, the Company may receive additional proceeds if the Warrants issued in the Rights Issue are exercised for subscription of shares. The proceeds from the exercise of Warrants are intended to be used with a corresponding allocation as for the proceeds in the Rights Issue.

Terms and conditions of the Rights Issue

The Board of Directors has today resolved on the intention to carry out the Rights Issue. Through the Rights Issue, Ziccum may receive initial issue proceeds of approximately SEK 30 million, excluding the additional proceeds that may be received upon exercise of the Warrants that are issued in the Rights Issue. Those who are registered as shareholders in the Company on the record date 22 November 2024 are expected to be entitled to subscribe for units with pre-emption rights.

The Board of Directors' resolution on the Rights Issue, including the subscription price, increase of the share capital and number of shares and warrants issued, is intended to be announced no later than 14 November 2024. Each Unit will consist of one (1) share and one (1) Warrant. The subscription price is intended to be set based on a discount to TERP (theoretical share price after separation of unit rights) of approximately 30 percent based on the volume-weighted average share price of the Company's share on Nasdaq First North Growth Market during the period from and including 1 November 2024 up to and including 14 November 2024, however, not less than the quota value of the share.

Provided that the authorization is granted by the extraordinary general meeting on 8 November, the record date for the Rights Issue is expected to be 22 November 2024 and the subscription period is expected to run from and including 26 November 2024 up to and including 10 December 2024.

One (1) Warrant entitles the holder, during the exercise period from and including 4 February 2025 up to and including 18 February 2025, to subscribe for one (1) new share in the Company at a subscription price per share amounting to 70 percent of the volume-weighted average price of the Company's share on Nasdaq First North Growth Market during the period from and including 17 January 2025 up to and including 30 January 2025, however, not less than the quota value of the share and not more than 125 percent of the Subscription Price in the Rights Issue. Thus, the Company may receive additional proceeds in February 2025 if the Warrants are exercised for subscription of new shares. The Warrants are intended to be admitted to trading on Nasdaq First North Growth Market.

Allocation principles

In the event that not all Units are subscribed for with unit rights, the Board of Directors shall, within the limits of the maximum amount of the Rights Issue, resolve on allotment of Units subscribed for without unit rights. Allotment shall then be made in accordance with the following allocation principles.

- Firstly, allotment shall be made to those who have subscribed for Units with the support of unit rights, regardless of whether the subscriber was a shareholder on the record date or not, pro rata in relation to the number of unit rights exercised for subscription and, to the extent this cannot be done, by drawing lots.

- Secondarily, allocation shall be made to others who have applied for subscription without unit rights. In the event that these cannot receive full allotment, allotment shall be made pro rata in relation to the number of shares for which each person has applied for subscription and, to the extent this cannot be done, by drawing lots.

- Thirdly and finally, any remaining shares shall be allocated to the parties that have undertaken to guarantee the Rights Issue, in proportion to the guarantee undertakings made.

Subscription and guarantee undertakings

A number of the Company's existing shareholders, including all members of the Company's Board of Directors and management, have undertaken to subscribe for Units amounting to approximately SEK 0.3 million, which corresponds to approximately 1 percent of the Rights Issue. In addition, the Company has received guarantee undertakings from a consortium of external investors amounting to a total of approximately SEK 11.3 million, corresponding to approximately 38 percent of the Rights Issue. The Rights Issue is thus covered by subscription and guarantee undertakings amounting up to approximately 39 percent of the Rights Issue.

No compensation is paid for the subscription undertakings. Compensation for the guarantee undertakings is paid with thirteen (13) percent of the guaranteed amount in cash or fifteen (15) percent of the guaranteed amount in the form of newly issued units in the Company, with the same terms and conditions as for Units in the Rights Issue, however, the subscription price per unit shall correspond to the Subscription Price in the Rights Issue. The subscription and guarantee undertakings are not secured through bank guarantees, restricted funds, pledged assets or similar arrangements.

A subscription of units in the Rights Issue (other than by exercising pre-emption rights) which result in an investor acquiring a shareholding corresponding to or exceeding a threshold of ten (10) percent or more of the total number of votes in the Company following the completion of the Rights Issue, must prior to the investment be filed with the Inspectorate of Strategic Products (Sw. Inspektionen för strategiska produkter). To the extent any guarantors' fulfilment of their guarantee commitment entails that the investment must be approved by the Inspectorate of Strategic Products in accordance with the Swedish Screening of Foreign Direct Investments Act (Sw. lag (2023:560) om granskning av utländska direktinvesteringar), such part of the guarantee is conditional upon notification that the application of the transaction is left without action or that approval has been obtained from the Inspectorate of Strategic Products.

Indicative timetable for the Rights Issue

| 20 November 2024 | Expected date for the publication of the prospectus |

| 20 November 2024 | Last day of trading in the share including the right to receive unit rights |

| 21 November 2024 | First day of trading in the share excluding the right to receive unit rights |

| 22 November 2024 | Record date for participation in the Rights Issue |

| 26 November - 5 December 2024 | Trading in unit rights |

| 26 November - 10 December 2024 | Subscription period |

| 26 November - around 31 December 2024 | Trading in BTUs (paid subscribed units) |

Lock-up agreements

In connection with the Rights Issue, all shareholding members of the Board of Directors and management in Ziccum have undertaken towards Vator Securities AB, subject to customary exceptions, not to sell or carry out other transactions with a similar effect as a sale unless, in each individual case, first having obtained written approval from Vator Securities AB. Decisions to give such written consent are resolved upon by Vator Securities AB and an assessment is made in each individual case. Consent may depend on both individual and business reasons. The lock-up undertakings only cover the shares held prior to the Rights Issue and the lock-up period lasts for 180 days after the announcement of the Rights Issue.

Extraordinary General Meeting

The Board of Directors' resolution on the Rights Issue is subject to an extraordinary general meeting resolving to grant the Board of Directors an authorization to issue shares and warrants and to adopt new articles of association. The extraordinary general meeting is planned to be held on 8 November 2024 and the notice will be published through a separate press release.

Bridge loans

To secure the Company's liquidity needs until the completion of the Rights Issue, the Company has entered into agreements on bridge loans from VIFC Nordic AB and Dariush Hosseinian of a total of approximately SEK 6.5 million. The bridge loans have an arrangement fee of 5 percent of the loan amount and carries an interest rate of initially 1.25 percent per month and shall be repaid with the proceeds from the Rights Issue.

Prospectus

The full terms and conditions of the Rights Issue, along with information about the Company, will be presented in a prospectus (available in Swedish only), which is expected to be published on the Company's website on or around 20 November 2024.

Advisors

Vator Securities AB is acting as financial advisor and issuing agent and Fredersen Advokatbyrå AB is acting as legal advisor to Ziccum in connection with the Rights Issue.

Important information

The information in this press release does not contain or constitute an offer to acquire, subscribe or otherwise trade in units, shares, warrants or other securities in Ziccum. No action has been taken and measures will not be taken to permit a public offering in any jurisdictions other than Sweden. Any invitation to the persons concerned to subscribe for units, shares or warrants in Ziccum will only be made through the prospectus that Ziccum estimates to publish on or around 20 November 2024 on Ziccum's website. The upcoming approval of the prospectus by the Swedish Financial Supervisory Authority shall not be regarded as an approval of the Company's shares, warrants or any other securities. This press release is not a prospectus in accordance with the definition in the Prospectus Regulation (EU) 2017/1129 ("Prospectus Regulation") and has not need approved by any regulatory authority in any jurisdiction. This announcement does not identify or suggest, or purport to identify or suggest, the risks (direct or indirect) that may be associated with an investment in shares, warrants or other securities in Ziccum. In order for investors to fully understand the potential risks and benefits associated with a decision to participate in the Rights Issue, any investment decision should only be made based on the information in the Prospectus. Thus, investors are encouraged to review the Prospectus in its entirety.

The publication, announcement or distribution of this press release may, in certain jurisdictions, be subject to legal restrictions and persons in the jurisdictions where this press release has been published or distributed should inform themselves about and observe such legal restrictions. The recipient of this press release is responsible for using this press release and the information contained herein in accordance with the applicable rules in each jurisdiction. This press release does not constitute an offer or an invitation to acquire or subscribe for any securities in Ziccum in any jurisdiction, neither from Ziccum nor from anyone else.

This press release does not constitute an offer or invitation to purchase or subscribe for securities in the United States. The securities referred to herein may not be sold in the United States absent registration or an exemption from registration under the U.S. Securities Act of 1933, as amended (the "Securities Act"), and may not be offered or sold in the United States absent registration or an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. There is no intention to register any securities referred to herein in the United States or to make a public offering of such securities in the United States. The information contained in this press release may not be announced, published, copied, reproduced or distributed, directly or indirectly, in whole or in part, in or into the United States, Australia, Hong Kong, Japan, Canada, New Zealand, Switzerland, Singapore, South Africa, South Korea, Russia, Belarus or any other jurisdiction where such announcement, publication or distribution of this information would be contrary to applicable law or where such action is subject to legal restrictions or would require additional registration or other measures than those required by Swedish law. Actions in contravention of this guidance may constitute a breach of applicable securities laws.

The Company considers that it carries out protection-worthy activities under the Swedish Screening of Foreign Direct Investments Act (Sw. lag (2023:560) om granskning av utländska direktinvesteringar) (the "FDI Act"). According to the FDI Act, the Company must inform presumptive investors that the Company's activities may fall under the regulation and that the investment may be subject to mandatory filing. If an investment is subject to mandatory filing, it must prior to its completion, be filed with the Inspectorate of Strategic Products (the ISP). investor should consult an independent legal adviser on the possible application of the Swedish FDI Act in relation to the participation in the Rights Issue by the individual investor.

Forward-looking statements

This press release contains forward-looking statements that reflect the Company's intentions, beliefs or expectations regarding the Company's future results of operations, financial condition, liquidity, performance, prospects, anticipated growth, strategies and opportunities and the markets in which the Company operates. Forward-looking statements are statements that do not relate to historical facts and can be identified by the fact that they contain expressions such as "believes", "expects", "anticipates", "intends", "estimates", "will", "may", "assumes", "should", "could" and, in each case, negatives thereof, or similar expressions. The forward-looking statements in this press release are based on various assumptions, many of which are based on additional assumptions. Although the Company believes that the assumptions reflected in these forward-looking statements are reasonable, there can be no assurance that they will materialise or that they are accurate. Because these assumptions are based on assumptions or estimates and are subject to risks and uncertainties, the actual results or outcomes may differ materially from those in the forward-looking statements for a variety of reasons. Such risks, uncertainties, contingencies and other important factors could cause actual events to differ materially from the expectations expressed or implied by the forward-looking statements in this press release. The Company does not guarantee that the assumptions underlying the forward-looking statements in this press release are correct and any reader of this press release should not place undue reliance on the forward-looking statements in this press release. The information, opinions and forward-looking statements expressed or implied herein speak only as of the date of this press release and are subject to change. Neither the Company nor anyone else undertakes to review, update, confirm or publicly announce any revision to any forward-looking statement to reflect events that occur or circumstances that arise in relation to the content of this press release, unless required by law or applicable listing rules.

For more information about Ziccum, please contact:

Ann Gidner

CEO, Ziccum AB

Mail: gidner@ziccum.com

Mobile: +46 722140141

Jonas Ekblom

Chairman of the Board, Ziccum AB

Mail: ekblom@ziccum.com

Mobile: +46 736777540

Ziccum's Certified Adviser is

Vator Securities AB

About Ziccum

Ziccum is developing LaminarPace®, a unique drying method for biopharmaceuticals and vaccines based on mass transfer, not heat transfer. The technology is offered by licensing to vaccine and biologics developers and manufacturers in the global pharmaceutical industry. By reducing drying stress to the active ingredient, LaminarPace® uniquely enables particle-engineered, thermostable dry powder biopharmaceuticals which can be easily handled and transported and are highly suitable for novel administration routes. The technology has been successfully applied to mRNA, peptides, proteins, antibodies, lipids and enzymes as well as excipients and adjuvants, and is well suited for industrial application. Ziccum is listed on the Nasdaq First North Growth Market.

This information is information that Ziccum is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2024-10-10 08:55 CEST.