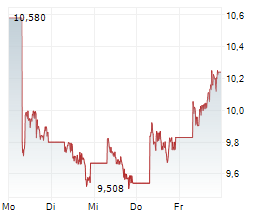

BYD, the Chinese electric vehicle powerhouse, continues its impressive market performance with a notable 20% gain over the past ten trading days. This surge brings the stock's year-to-date increase to a remarkable 40%. The company's robust growth is further exemplified by its recent expansion into the Polish market, where it introduced the Seal U DM-i plug-in hybrid vehicle on October 10, 2024. This strategic move underscores BYD's commitment to strengthening its presence in Europe and diversifying its New Energy Vehicle portfolio.

Analysts Eye Potential All-Time High

Despite a recent setback, market experts view the current stock price as an attractive entry point for investors. With a market capitalization of 38.2 billion euros and a projected price-earnings ratio of 21.68 for 2024, BYD remains a compelling option in the electric mobility sector. Analysts are now speculating on the possibility of the stock reaching a new all-time high in the near future, fueled by the company's strong market position and ongoing global expansion efforts. However, challenges persist, as evidenced by regulatory hurdles in India that have temporarily halted plans for a new manufacturing facility.

Ad

BYD Stock: Buy or Sell? New BYD Analysis on 12 October Provides the Answer:The latest BYD figures speak volumes: Urgent action required for BYD shareholders. Is it worth investing, or should you sell? Find out what to do now in our current free analysis from 12 October.

BYD: Buy or Sell? Continue reading here ...