Additional Funds to further Build the AGROBODY Platform and Strengthen the Biocontrol Pipeline

Ghent, BELGIUM, Oct. 14, 2024 (GLOBE NEWSWIRE) -- Regulated information - Inside Information

Public announcement in accordance with article 7:97, §4/1 Belgian Companies and Associations Code

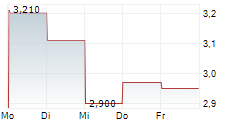

Biotalys NV) (the "Company" or "Biotalys"), an Agricultural Technology (AgTech) company developing protein-based biocontrol solutions for sustainable crop protection, today announced that it has successfully obtained subscription commitments for an amount of EUR 15 million through a private investment in a public equity ("Private Placement"). The transaction involves the issue of 5,300,352 new shares (being approximately 16.5% of the Company's shares outstanding prior to the transaction) at an issue price of EUR 2.83 per share, representing a discount of 10% compared to the volume weighted average price of the Company's share on Euronext Brussels during the period of 30 days from (and including) 11 September 2024 till (and including) 10 October 2024.

Current shareholders, Ackermans & van Haaren NV and Agri Investment Fund BV, participated in the Private Placement, as well as a new investor, the Dutch asset management firm ASR Vermogensbeheer NV.

Ko van Nieuwenhuijzen, Senior Portfolio Manager at ASR Vermogensbeheer, commented: "We were impressed by Biotalys' technology and the team's ability to develop the biofungicide EVOCA which is currently awaiting regulatory approval, while a second product candidate is now being tested in field trials. ASR's participation in Biotalys' capital increase fits with our strategy of investing for the long-term in developments that benefit people and the planet."

Piet Bevernage, Member of the Executive Committee of Ackermans & van Haaren and of the Biotalys Board, said: "We first invested in Biotalys in 2019, further supported the company during the IPO in 2021 and today are pleased to further increase our position in the company. We strongly believe in the AGROBODY technology platform to develop efficacious new biocontrols for growers to protect their crops while reducing the impact on the environment. We are a committed long-term partner and will continue to offer strategic guidance, in addition to our current financial support."

Patrik Haesen, CEO at AIF and permanent representative of AIF on the Biotalys Board of Directors, stated: "With rising resistance and stricter regulatory constraints, growers are in dire need of new solutions to fight crop pests and diseases. We are committed to supporting innovators such as Biotalys, which is developing products with new modes of action to help growers in Belgium and abroad to protect their livelihood and deliver healthy, sustainable produce."

Kevin Helash, Biotalys' CEO, said: "We are proud to welcome ASR Vermogensbeheer as a new investor to our company and are very appreciative of the additional support of our current shareholders, AvH and AIF. We are committed to being good stewards of this investment, maintaining our culture of cost consciousness. We will strategically deploy these funds to advance our R&D pipeline with a target of launching one new project annually, such as the recently announced addition of BioFun-8 for expanded fungal control. The timing of this investment extends our cash runway as we await final regulatory approvals for EVOCA and move toward commercializing EVOCA NG and generating a strong and increasing revenue stream long-term."

Biotalys is developing a strong and diverse pipeline of effective biocontrol products with a favorable safety profile that aim to address key crop pests and diseases across the whole value chain. The pipeline is based on Biotalys' proprietary AGROBODY technology platform, enabling the discovery and development of a variety of solutions against multiple targets such as fungi and harmful insects that cause significant crop losses.

Biotalys intends to use the proceeds of the Private Placement as follows:

- To support the regulatory process for the first product candidate EVOCA and the further development of EVOCA NG and BioFun-6, including field trials and regulatory approvals;

- To further develop and advance the Company's pipeline, including discovery and development, aimed at increasing the number of programs within crop protection and along the food value chain, potentially also through partnerships;

- To fund continuous platform development and intellectual property capture to maintain the Company's competitiveness and increase the efficiency of Biotalys' AGROBODY Foundry platform;

- To support the recruitment and retention of key talent; and

- For general corporate purposes.

The payment and delivery of the new shares is scheduled to take place on Wednesday 16 October 2024. Following such date, the new shares will also be listed on Euronext Brussels. These new shares will have the same rights and benefits as, and rank pari passu in all respects with, the existing and outstanding shares of Biotalys at the time of their issuance.

As a result of the issuance of new shares, the Company's share capital will increase by EUR 783,922 from EUR 4,755,005.78 to EUR 5,538,927.78, and its issued and outstanding shares will increase from 32,157,210 to 37,457,562 shares, representing an increase in the number of shares outstanding of approximately 16.5%.

KBC Securities NV, Belfius Bank NV/SA in cooperation with Kepler Cheuvreux SA, and Coöperatieve Rabobank U.A. are acting as Joint Global Coordinators of the Private Placement.

About Biotalys

Biotalys is an Agricultural Technology.

For further information, please contact:

Toon Musschoot, Head of IR & Communication

T: +32

Additional information

The following information is provided pursuant to Article 7:97 of the Belgian Companies and Associations Code ("BCCA").

The new shares were offered pursuant to a private investment in a public equity, which is expected to be completed on 16 October 2024 by means of a capital increase of the Company by way of contribution in cash under the authorised capital for an amount of EUR 14,999,996.16 (including issue premium) through the issuance of 5,300,352 new shares with cancellation of the statutory preferential right of the existing shareholders of the Company in favour of certain specified persons who are not members of the Company's personnel (the "Capital Increase").

The investors that will subscribe to the new shares are (i) Agri Investment Fund BV, with registered office address at Diestsevest 32 bus 5b, 3000 Leuven, with company number 0893.885.781, RPR Leuven, existing holder of 2,969,606 shares and director of the Company ("A.I.F."), (ii) Ackermans & Van Haaren, with registered office address at Begijnenvest 113, 2000 Antwerpen, with company number 0404.616.494, existing holder of 4,016,281 shares of the Company ("AvH") and (iii) ASR Nederland NV, with registered office address at Archimedeslaan 10, letter box 2072, 3584 BA Utrecht, The Netherlands, with company number 30070695, which currently holds no shares of the Company ("A.S.R.").

As a result of the Capital Increase and the cancellation of the statutory preferential rights, after the Capital Increase, A.I.F. will hold 4,736,390 shares (consisting of 1,766,784 new shares and 2,969,606 current, previously held shares) (12.64%) in the Company, AvH will hold 5,783,065 shares (consisting of 1,766,784 new shares and 4,016,281 current, previously held shares) (15.44%) in the Company after the Capital Increase and A.S.R. will hold 1,766,784 shares (all new shares) (4.72%) in the Company after the Capital Increase.

In this context, the board of directors of the Company (the "Board") applied the related parties procedure of article 7:97 BCCA.

Within the context of the aforementioned procedure, prior to resolving on the Private Placement, a committee of independent directors of the Company (the "Committee") issued an advice to the Board in which the Committee assessed the Capital Increase. In its advice to the Board, the Committee concluded the following: "Based on the information provided, the Committee considers that the proposed Capital Increase is in line with the strategy pursued by the Company, will be done on market terms, and is unlikely to lead to disadvantages for the Company and its shareholders (in terms of dilution) that are not sufficiently compensated by the advantages that the Capital Increase offers the Company and other elements in the Company's policy, or would be manifestly unlawful."

The Board approved the principle of the Private Placement and did not deviate from the Committee's advice. The Company's statutory auditor's assessment of the Committee's advice and the minutes of the meeting of the Board, is as follows: "Based on our review, nothing has come to our attention that causes us to believe that the financial and accounting information included in the report of the ad hoc committee of independent directors and in the minutes of the meeting of the board of directors dated 11 October 2024, justifying the proposed transaction, are not accurate and sufficient in all material respects compared to the information available to us in the context of our mission.

Our mission has been conducted solely within the framework of the provisions of article 7:97 of the Code of companies and associations and our report may therefore not be used in any other context."

Important notices

This announcement is for informational purposes only and is directed only at persons who are located outside the United States. This announcement does not constitute an offer to sell or the solicitation of an offer to buy shares or any other security and shall not constitute an offer, solicitation or sale in the United States or in any jurisdiction in which, or to any persons to whom, such offering, solicitation or sale would be unlawful. The shares have not been, and will not be, registered under the U.S. Securities Act or the securities laws of any state of the United States or any other jurisdiction, and may not be offered or sold within the United States, or to, or for the account or benefit of, U.S. persons, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the U.S. Securities Act and applicable state or local securities laws. Accordingly, the shares are being offered and sold (i) in the United States only to qualified institutional buyers in accordance with Rule 144A under the U.S. Securities Act and (ii) in "offshore transactions" to non-U.S. persons outside the United States in accordance with Regulation S under the U.S. Securities Act. There is no assurance that the offering will be completed or, if completed, as to the terms on which it will be completed.

This announcement has been prepared on the basis that any offer of the shares in any Member State of the European Economic Area (the "EEA") is or will be made pursuant to an exemption under the Prospectus Regulation from the requirement to publish a prospectus for offers of the shares. The expression "Prospectus Regulation" means Regulation (EU) 2017/1129 (as amended or superseded) any implementing measure in each relevant Member State of the EEA.

This announcement is only addressed to and directed at persons in Member States of the EEA who are "qualified investors" within the meaning of Article 2(e) of the Prospectus Regulation, or such other investors as shall not constitute an offer to the public within the meaning of Article 3.1 of the Prospectus Regulation.

The offer, sale and admission to trading of the shares will be made pursuant to an exception under the Prospectus Regulation from the requirement to produce a prospectus for offers or admissions to trading of securities. This press release does not constitute a prospectus within the meaning of the Prospectus Regulation or an offer to the public.

The distribution of this press release into certain jurisdictions may be restricted by law. Persons into whose possession this announcement comes should inform themselves about and observe any such restrictions. Any failure to comply with these restrictions may constitute a violation of the laws of any such jurisdiction.

Biotalys, its business, prospects and financial position remain exposed and subject to risks and uncertainties. A description of and reference to these risks and uncertainties can be found in the annual reporton the consolidated annual accounts published on the company's website.

This announcement contains statements which are "forward-looking statements" or could be considered as such. These forward-looking statements can be identified by the use of forward-looking terminology, including the words 'aim', 'believe', 'estimate', 'anticipate', 'expect', 'intend', 'may', 'will', 'plan', 'continue', 'ongoing', 'possible', 'predict', 'plans', 'target', 'seek', 'would' or 'should', and contain statements made by the company regarding the intended results of its strategy. By their nature, forward-looking statements involve risks and uncertainties and readers are warned that none of these forward-looking statements offers any guarantee of future performance. Biotalys' actual results may differ materially from those predicted by the forward-looking statements. Biotalys makes no undertaking whatsoever to publish updates or adjustments to these forward-looking statements, unless required to do so by law.

Attachments

- Biotalys Press Release Private Placement - 14 October 2024 (https://ml.globenewswire.com/Resource/Download/85cd18eb-b56a-4f28-9e2b-5f944255ff1b)

- Biotalys Persbericht Private Plaatsing - 14 oktober 2024 (https://ml.globenewswire.com/Resource/Download/1a6248eb-2646-4d99-ae5f-87a21b962c83)