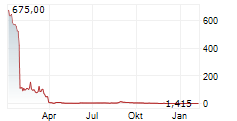

NEW YORK, Oct. 14, 2024 (GLOBE NEWSWIRE) -- Sharps Technology, Inc. (NASDAQ: "STSS" and "STSSW") ("Sharps"), an innovative medical device and pharmaceutical packaging company offering patented, best-in-class syringe products, today announced that it will effect a one-for-22 reverse stock split (the "reverse split") of its common stock, par value $0.0001 per share (the "Common Stock"), that will become effective on October 15, 2024 at 11:59 PM Eastern Time, before the opening of trading on The Nasdaq Capital Market ("Nasdaq"). Sharps has requested that its Common Stock begin trading on October 16, 2024, on a post-reverse split basis on the Nasdaq under the existing symbol "STSS".

The reverse split is primarily intended to bring Sharps into compliance with the minimum bid price requirement for maintaining its listing on the Nasdaq. The new CUSIP number for the Common Stock following the reverse split will be 82003F200.

At Sharps' special meeting of stockholders on October 7, 2024 (the "Special Meeting"), Sharps' stockholders approved the proposal to authorize Sharps' Board of Directors (the "Board"), in its sole and absolute discretion, to file a certificate of amendment (the "Amendment") to Sharps' amended and restated certificate of incorporation to effect the reverse split at a ratio to be determined by the Board, not to exceed a 1-for-22 reverse split. On August 19, 2024, the Board approved the reverse split at a ratio of one-for-8 up to 1-for-22, and the Amendment has been filed with the Secretary of State of the State of Nevada, which will become effective on October 15, 2024, at 11:59 PM Eastern Time, before the opening of trading on the Nasdaq.

The reverse split will affect all issued and outstanding shares of Common Stock. All outstanding options, restricted stock awards, warrants and other securities entitling their holders to purchase or otherwise receive shares of Common Stock will be adjusted as a result of the reverse split, as required by the terms of each security. The number of shares available to be awarded under Sharps' 2023 Equity Incentive Plan, will also be appropriately adjusted. Following the reverse split, the par value of the Common Stock will remain unchanged at $0.0001 per share. The reverse split will not change the authorized number of shares of Common Stock or preferred stock. No fractional shares of Common Stock shall be issued as a result of the Reverse Split, and stockholders who otherwise would be entitled to receive fractional shares of New Common Stock shall be entitled to receive the number of shares of New Common Stock rounded up to the next whole number. The reverse split will affect all stockholders uniformly and will not alter any stockholder's percentage interest in Sharps' equity (other than as a result of the rounding of fractional shares, as set forth above).

The reverse split will reduce the number of shares of Common Stock issued and outstanding from approximately 39.5 million shares to approximately 1.8 million shares.

About Sharps Technology:

Sharps Technology is an innovative medical device and pharmaceutical packaging company offering patented, best-in-class smart-safety syringe products to the healthcare industry. The Company's product lines focus on providing ultra-low waste capabilities, that incorporate syringe technologies that use both passive and active safety features. Sharps also offers products that are designed with specialized copolymer technology to support the prefillable syringe market segment. The Company has a manufacturing facility in Hungary and has partnered with Nephron Pharmaceuticals to expand its manufacturing capacity in the U.S. For additional information, please visit www.sharpstechnology.com.

Forward-Looking Statements:

This press release contains "forward-looking statements". Forward-looking statements reflect our current view about future events. When used in this press release, the words "anticipate," "believe," "estimate," "expect," "future," "intend," "plan," "poised" or the negative of these terms and similar expressions, as they relate to us or our management, identify forward-looking statements. Such statements, include, but are not limited to, statements contained in this press release relating to our business strategy, our future operating results and liquidity, and capital resources outlook. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees of assurance of future performance. We caution you therefore against relying on any of these forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation, our ability to raise capital to fund continuing operations; our ability to protect our intellectual property rights; the impact of any infringement actions or other litigation brought against us; competition from other providers and products; our ability to develop and commercialize products and services; changes in government regulation; our ability to complete capital raising transactions; and other factors relating to our industry, our operations and results of operations. Actual results may differ significantly from those anticipated, believed, estimated, expected, intended, or planned. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee future results, levels of activity, performance, or achievements. The Company assumes no obligation to update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this release.

Investor Relations:

Dave Gentry

RedChip Companies, Inc.

1-800-RED-CHIP (733-2447)

Or 407-644-4256

STSS@redchip.com