NEEDHAM, MA / ACCESSWIRE / October 14, 2024 / According to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, global smartphone shipments increased 4.0% year over year to 316.1 million units in the third quarter of 2024 (3Q24). This marks the fifth consecutive quarter of shipment growth with a strong start into the second half of this year despite macroeconomic concerns.

"Led by strong growth from Chinese vendors like vivo, OPPO, Xiaomi, Lenovo and Huawei, the smartphone market shows resilience despite global economic headwinds"" said Will Wong, senior research manager for AP Client Devices. "Nevertheless, the growth among vendors was uneven - while some companies grappled with elevated Bill-of-Materials (BOM) costs, others benefited from favorable exchange rates in emerging markets like Southeast Asia. vivo's performance was particularly notable, fueled by aggressive product launches and a low comparison base."

"While the growth of the Chinese players in emerging markets has been an ongoing theme this year, Apple also enjoyed a 3.5% YoY growth in shipments this quarter fueled by strong demand from the previous models and the launch of the new iPhone 16 lineup," said Nabila Popal, research director for Worldwide Client Devices. "In Q3 2024, older iPhone models, specifically the iPhone 15, performed exceptionally well due to the heavy promotions and increased marketing activities around Apple Intelligence. Despite the staggered rollout of Apple Intelligence in markets outside the U.S., Apple will continue to grow in the upcoming holiday season as it expects many customers to upgrade from the iPhone 13, iPhone 12 and prior models to a new AI-enabled smartphone, future-proofing their purchases for the long term."

"Samsung retained its market leadership despite a drop in the total number of units shipped. However, the company continues to grow its share in the premium segment as the average prices increased in the quarter driven by a stronger mix of Galaxy AI-enabled models," said Francisco Jeronimo, vice president for EMEA Client Devices. "The company started rolling out Galaxy AI features to other Samsung models and launched the new Galaxy Z Fold6 and Galaxy Z Flip6 foldables with Galaxy AI, which contributed to a better performance in the premium segment."

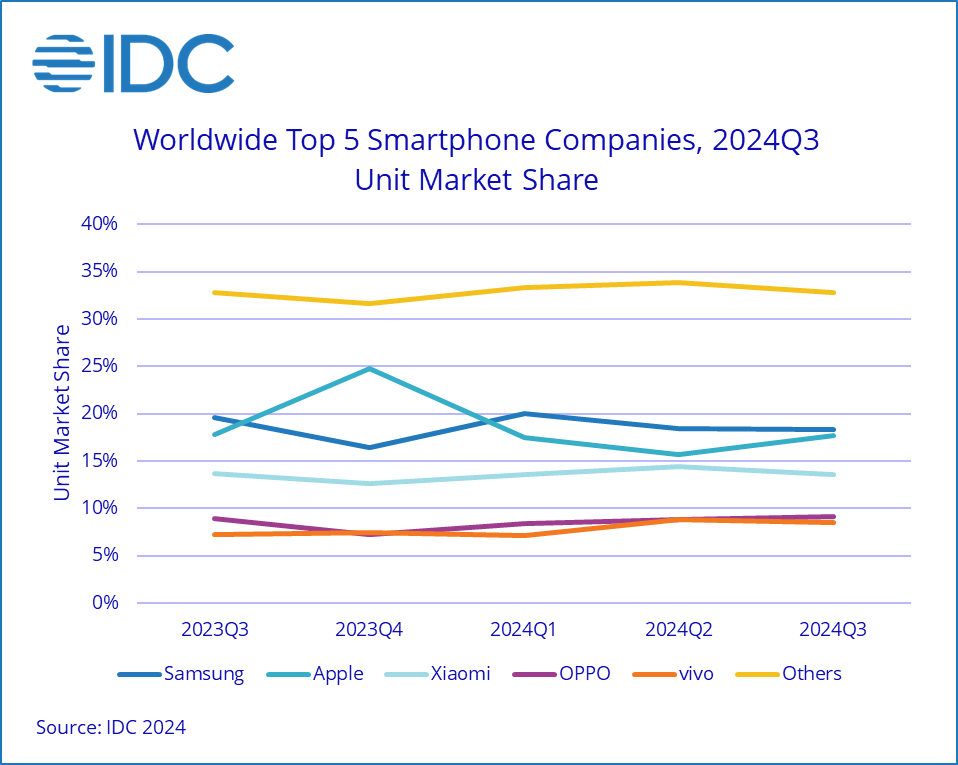

Top 5 Companies, Worldwide Smartphone Shipments, Market Share, and Year-Over-Year Growth, Q3 2024 (Preliminary results, shipments in millions of units) | |||||

Company | 3Q24 Shipments | 3Q24 Market Share | 3Q23 Shipments | 3Q23 Market Share | Year-Over-Year Change |

Samsung | 57.8 | 18.3% | 59.5 | 19.6% | -2.8% |

Apple | 56.0 | 17.7% | 54.1 | 17.8% | 3.5% |

Xiaomi | 42.8 | 13.5% | 41.5 | 13.6% | 3.3% |

OPPO | 28.8 | 9.1% | 27.2 | 8.9% | 5.9% |

vivo | 27.0 | 8.5% | 22.0 | 7.2% | 22.8% |

Others | 103.7 | 32.8% | 99.6 | 32.8% | 4.1% |

Total | 316.1 | 100.0% | 303.9 | 100.0% | 4.0% |

Source: IDC Worldwide Quarterly Mobile Phone Tracker, October 14, 2024 | |||||

Table Notes:

Data are preliminary and subject to change.

Company shipments are branded device shipments and exclude OEM sales for all vendors.

The "Company" represents the current parent company (or holding company) for all brands owned and operated as a subsidiary.

Figures represent new shipments only and exclude refurbished units.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC's Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

For more information about IDC's Worldwide Quarterly Mobile Phone Tracker, please contact Jackie Kliem at 508-988-7984 and jkliem@idc.com.

Click here to learn about IDC's full suite of data products and how you can leverage them to grow your business.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,300 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 110 countries. IDC's analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly owned subsidiary of International Data Group (IDG), the world's leading tech media, data, and marketing services company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC and LinkedIn. Subscribe to the IDC Blog for industry news and insights.

All product and company names may be trademarks or registered trademarks of their respective holders.?

Contacts:

Escalate PR for IDC

jennifer@escalatepr.com

Nabila Popal

npopal@idc.com

+1 508-872-8200

Will Wong

wwong@idc.com

+65 6226 0330

Ryan Reith

rreith@idc.com

+1 508-935-4301

Francisco Jeronimo

fjeronimo@idc.com

+44 77 9630 1919

SOURCE: International Data Corporation

View the original press release on accesswire.com