Topic: Yesterday, FWAG reported traffic results for September 2024, which finished off the company's third and seasonaly most important quarter. In detail:

For the September month, group passenger numbers rose by 7% yoy to 4.06m (eNuW: 4.03m) , driven by a solid development at the group's main airport (Vienna: +5.4% yoy to 3.08m) but also by strong growth at Malta (0.90m, +10% yoy) and Kosice (0.08m, + 22% yoy).

This led to a Q3 passenger volume of 12.9m, which is not only 8% above the old record of Q3'19, but also up 8% yoy and 16% qoq. Seasonally, Q3 is the most busy quarter as it comprises the main travel season during the summer holidays. Therefore, we regard the strong passenger growth, especially in comparison to last year's strong Q3, as outstanding and it highlights the current balance of high demand meeting the capacity increases of the airlines during the summer season.

For the first nine months, group passenger numbers stand a solid 9% above 9M'23, showing that FWAG could benefit from much better passengers development than previously anticipated at the start of '24.

FWAG is due to report Q3'24e results on 14th November '24, but we already expect a new top line record. Thanks to the statutory increase of airport charges at Vienna (c. 40% of group sales) by 9.7% per 1st January '24 coupled with Q3' passenger growth of 8%, group sales look set to grow 12% yoy to € 306m in Q3'24e (eNuW).

Nex to passenger numbers, which is the main earnings driver, FWAG has presented some strong cargo figures. Here, cargo volume in Vienna is up 26% yoy (+24% yoy in Q3; +20% yoy per 9M), driven by a shift from shipping to air cargo due the current situation in the Red Sea. While cargo is not a major revenue driven (c. 5% of sales), it nevertheless shows a positive contribution for FWAG.

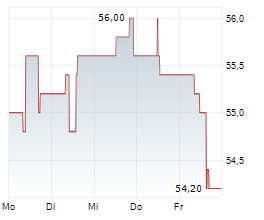

Furthermore, we precised our FY'24e and '25e passengers estimates and also now include the statutory price increase of airport charges by 4.5% for FY'25e (prev. eNuW: 4%), effective as of 1st January '25, in our model. Consequently, our DCF-based PT increases to € 61.00 (old: € 59.00), however, the shares remain a HOLD with only 13% upside.

ISIN: AT00000VIE62