VANCOUVER, BC / ACCESSWIRE / October 16, 2024 / Omega Pacific Resources Inc. (CSE:OMGA)(OTCQB:OMGPF)(FSE:Q0F) ("Omega Pacific" or the "Company") is pleased to provide an overview and update on its recent acquisition of additional claims at the Williams property, located in BC's Golden Horseshoe as previously reported (see Omega Press Release dated May 24, 2024).

Highlights

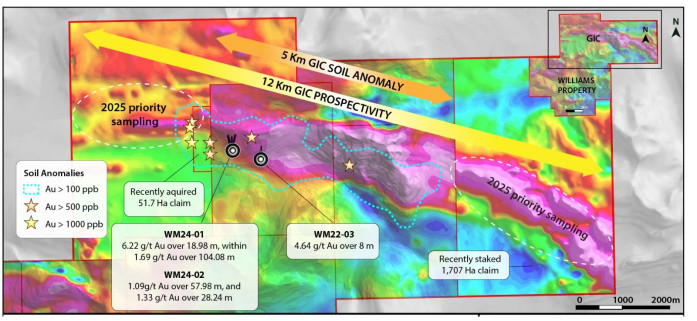

The Company recently acquired a 51.7 Ha claim located 400 m west of Omega's 2024 drilling

Historical soil sampling on the claim returned anomalous copper and gold with assays as high as 12 g/t gold and 0.1% copper

Completes a contiguous land package across the whole GIC Prospect

Newly staked 1,707 Ha claim which adjoins Williams to the east

Geology of the GIC prospect trends directly through the new claim

These acquisitions give Omega an uninterrupted strike length of 5 km of gold-in-soil anomalism and increases GIC's overall strike length GIC to 12 km.

Omega Pacific's CEO Jason Leikam commented, "These new claims significantly expand the opportunity of the GIC gold target. The recently acquired claim was previously a small but important gap of ground directly west of the drill collars from our recent drill program. With this claim now under our control we can trace the complete and expansive geophysical anomaly at GIC. We have already confirmed a robust gold system in our 2024 drill program, and we have a clear vision for the expansion of gold mineralization at GIC in upcoming programs."

New Claims

Omega Pacific has successfully acquired an additional claim (51.7 hectares) from a third party within the Williams Project, providing a contiguous land package for the western extent of the GIC prospect. This newly acquired claim is located within the property's GIC prospect, which has returned strong drill intercepts and notable, untested gold-in-soil anomalies. The GIC prospect currently has a gold- and copper-soil anomaly and coincident magnetics measuring >5 km in length, including this new claim, which remains open at the eastern and western extents. Sampling to extend these anomalies will be a priority for the 2025 exploration work. This acquisition not only increases the scope of ongoing exploration activities but also strengthens the company's ability to focus on highly prospective target zones within its claims.

The Williams Property was extended to the east through staking of an additional 1,707 hectares. This staking covers the eastern extent of the same geology and geophysical signature which comprises the GIC prospect where the Phase 1 2024 drill program was executed. This new area has seen very little historical exploration and will be the focus of some reconnaissance sampling early in the 2025 exploration season.

This acquisition enhances Omega Pacific's footprint in a tier 1 mining and exploration jurisdiction, offering a more robust platform for future development. With the expansion of the targeted zones, the company is well-positioned to capitalize on the region's rich geological setting, further advancing its efforts to unlock the project's mineral potential. This move aligns with Omega Pacific's broader strategy of securing high-value assets in prime mining regions, thereby boosting its long-term growth prospects.

Lekcin Property Option

Omega Pacific also announces, pursuant to an option agreement (the "Lekcin Option") dated August 10, 2022, the Company is proceeding with the second anniversary property payment for the Lekcin Property. Second anniversary payments include $32,000 in cash and 200,000 shares at a deemed value equal to the closing share price of the Company's shares on October 15, 2024. The Lekcin Option Agreement, dated August 10, 2022, outlines a four year term to earn a 100% interest in the Lekcin Property, covering 2,436.93 hectares located in southwestern British Columbia, 120 km east of Vancouver. A Technical Report on the Lekcin Property can be SEDARPlus.ca under the Company's profile.

Qualified Person

Robert L'Heureux (P.Geol.), Director of Omega Pacific Resources, is the "Qualified Person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects and has reviewed, validated and approved the scientific and technical information contained in this news release. Mr. L'Heureux oversees exploration planning and execution at the Williams Property.

About Omega Pacific

Omega Pacific is a mineral exploration company focused on the development of mineral projects containing base and precious metals. The Company is actively exploring its British Columbia located properties and continues to evaluate assets globally for further acquisitions.

For more information, please contact:

Omega Pacific Resources Inc.

Jason Leikam, Chief Executive Officer & Director

Tel: +1 (778) 650 4255

Email: jason@omegapacific.ca

Cautionary Statement

Certain statements contained in this press release constitute forward-looking information under the provisions of Canadian securities laws including statements about the Company's plans. Such statements are necessarily based upon a number of beliefs, assumptions, and opinions of management on the date the statements are made and are subject to numerous risks and uncertainties that could cause actual results and future events to differ materially from those anticipated or projected. The Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors should change, except as required by law.

Neither the CSE nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Contact Information

Jason Leikam

CEO

jason@omegapacific.ca

7788588085

SOURCE: Omega Pacific Resources

View the original press release on accesswire.com