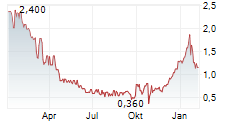

Vancouver, British Columbia--(Newsfile Corp. - October 17, 2024) - Nexus Uranium Corp. (CSE: NEXU) (OTCQB: GIDMF) (FSE: 3H1) (the "Company" or "Nexus") announces the repricing of 2,887,114 common share purchase warrants with an exercise price of $0.60 and an expiry date of June 25, 2026 (the "Repriced Warrants"), to $0.36, effective immediately (the "Warrant Repricing"). Under the policies of the Canadian Securities Exchange (the "CSE"), the Warrant Repricing is subject to the unanimous consent of the registered holders of the outstanding Repriced Warrants.

As the Warrant Repricing will result in an exercise price lower than the market price of the Company's common shares on the date the warrants were issued, CSE policies require that, if following the Warrant Repricing, for any ten consecutive trading days the closing price of the Company's common shares on the CSE exceeds the amended exercise price by more than 25%, the term of the Repriced Warrants must also be amended from June 25, 2026 to 30 days. The amended expiry date will be announced by the Company by press release and the 30-day period will commence seven days from the end of the ten consecutive trading day period referred to above.

About Nexus Uranium Corp.

Nexus Uranium Corp. is a multi-commodity development company focused on advancing the Cree East uranium project in the Athabasca Basin and the Wray Mesa uranium-vanadium project in Utah in addition to its precious metals portfolio that includes the Napoleon gold project in British Columbia, and a package of gold claims in the Yukon. The Cree East project is one of the largest projects within the Athabasca Basin of Saskatchewan spanning 57,752 hectares (142,708 acres) and has seen over $20 million in exploration to date. The Wray Mesa project covers 6,282 acres within the heart of the prolific Uruvan mining district in Utah and has extensive historical drilling of over 500 holes defining multiple mineralized zones. The Napoleon project comprises over 1,000 hectares and prospective for multiple forms of gold mineralization, with exploration in the area dating back to the 1970s with the discovery of high-grade gold. The Yukon gold projects are comprised of almost 8,000 hectares of quartz claims prospective for high-grade gold mineralization with historical grab sampling highlights of 144 g/t gold.

The technical content of this news release has been reviewed and approved by Warren D. Robb, P.Geo. (BC), a Director and VP Exploration of Nexus Uranium Corp. and a Qualified Person under National Instrument 43-101.

FOR FURTHER INFORMATION PLEASE CONTACT:

Jeremy Poirier

Chief Executive Officer

info@nexusuranium.com

This news release includes certain statements and information that may constitute "forward-looking information" within the meaning of applicable Canadian securities laws. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". All statements in this news release, other than statements of historical facts, including statements regarding future estimates, plans, objectives, timing, assumptions or expectations of future performance are forward-looking statements and contain forward-looking information, including, but not limited to, completion of the Warrant Repricing. Forward-looking statements are based on certain material assumptions and analysis made by the Company and the opinions and estimates of management as of the date of this news release, including, but not limited to the assumption that the holders of the Repriced Warrants will consent to the Warrant Repricing. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements or forward-looking information, including, but not limited to the risk that the holders of the Repriced Warrants will not consent to the Repricing, stock market volatility and capital market fluctuations, general market and industry conditions, as well as those risk factors discussed in the Company's most recently filed management's discussion & analysis. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial outlook that are incorporated by reference herein, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/226971

SOURCE: Nexus Uranium Corp.