VANCOUVER, British Columbia, Oct. 22, 2024 (GLOBE NEWSWIRE) -- K92 Mining Inc. ("K92" or the "Company") (TSX: KNT; OTCQX: KNTNF) is pleased to announce its third set of drilling results consisting of 19 holes for total results of 30 holes released to date from its maiden surface diamond drill program at Arakompa, located approximately 4.5 km from the Kainantu Gold Mine Process Plant in Papua New Guinea. K92's maiden drill program at Arakompa represents the first drilling on the target in 32 years, with limited historic drilling completed, comprising 18 holes totaling 1.8 km of mostly shallow drilling.

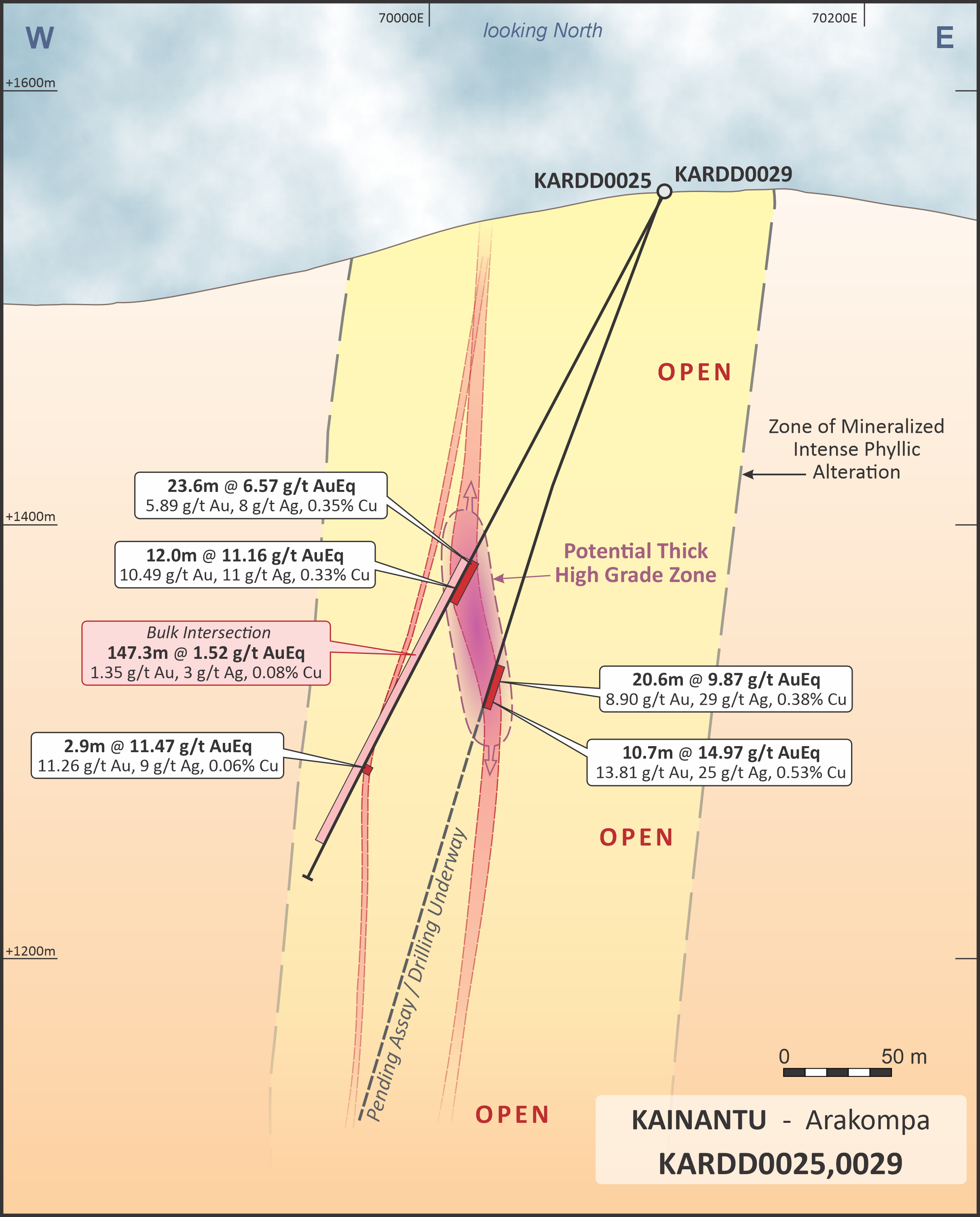

- Potential thick high-grade zone discovered from two holes stepping out 250 metres along strike to the south, encountering both high-grade and bulk mineralized zones (see Figures 1-2 & 4), with:

- KARDD0029 recording 20.60 m at 9.87 g/t gold equivalent ("AuEq")(2) (8.90 g/t Au, 29 g/t Ag, 0.38% Cu), including 10.70 m at 14.97 g/t AuEq (13.81 g/t Au, 25 g/t Ag, 0.53% Cu).

- Located ~60 metres up-dip, KARDD0025 recording 23.60 m at 6.57 g/t AuEq(2) (5.89 g/t Au, 8 g/t Ag, 0.35% Cu) including 12.00 m at 11.16 g/t AuEq (10.49 g/t Au, 11 g/t Ag, 0.33% Cu). A separate vein intersection of 2.90 m at 11.47 g/t AuEq (11.26 g/t Au, 9 g/t Ag, 0.06% Cu) was also recorded.

- Drilling at KARDD0029 is underway for the remainder of hole.

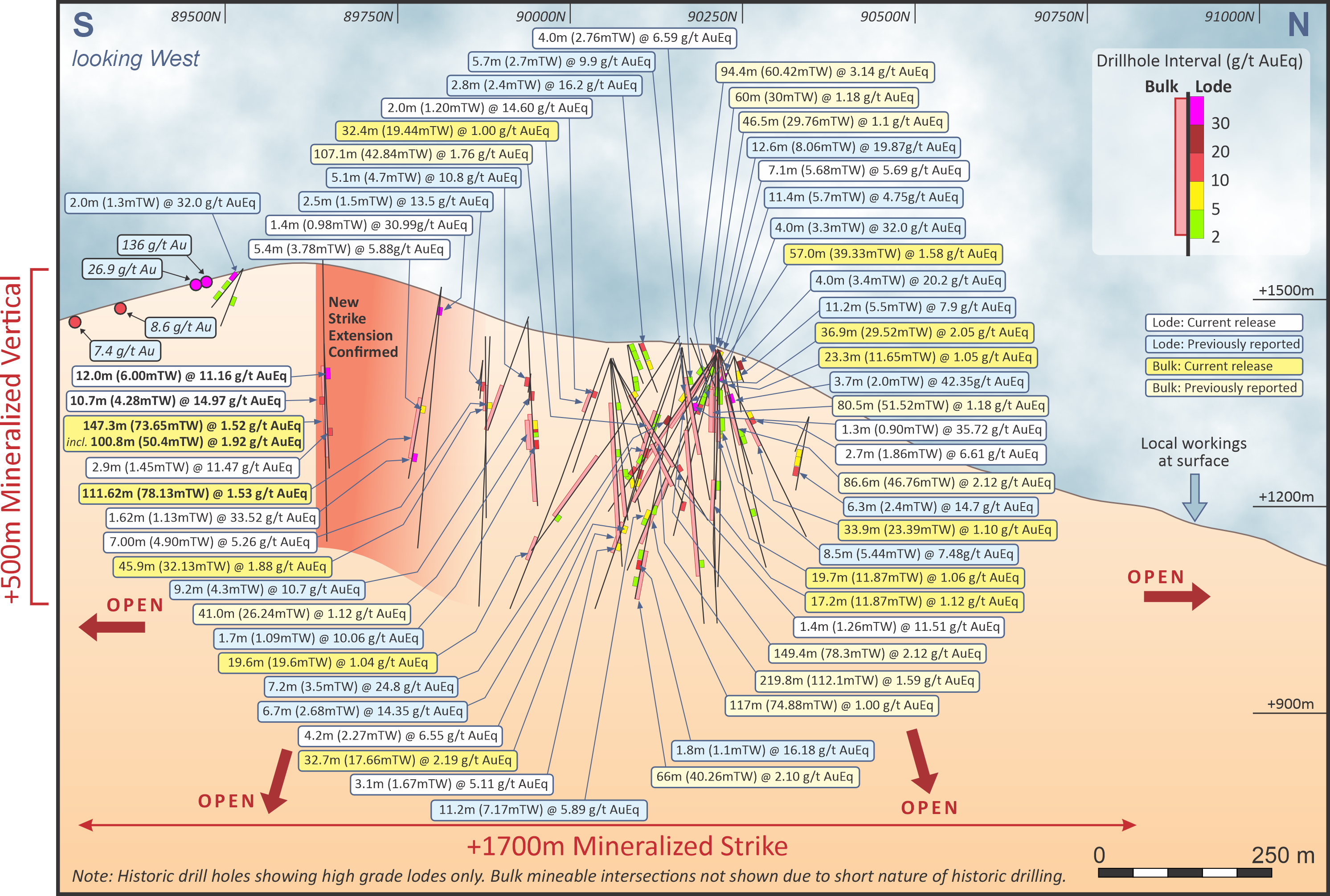

- Significant extension of bulk tonnage strike by ~250 metres to the south to a total interpreted strike now exceeding 750 metres, from long step-out drill holes, with highlights including:

- KARDD0025 (~250 m southern step-out along strike): 100.80 m at 1.92 g/t AuEq (1.71 g/t Au, 3 g/t Ag, 0.10% Cu)

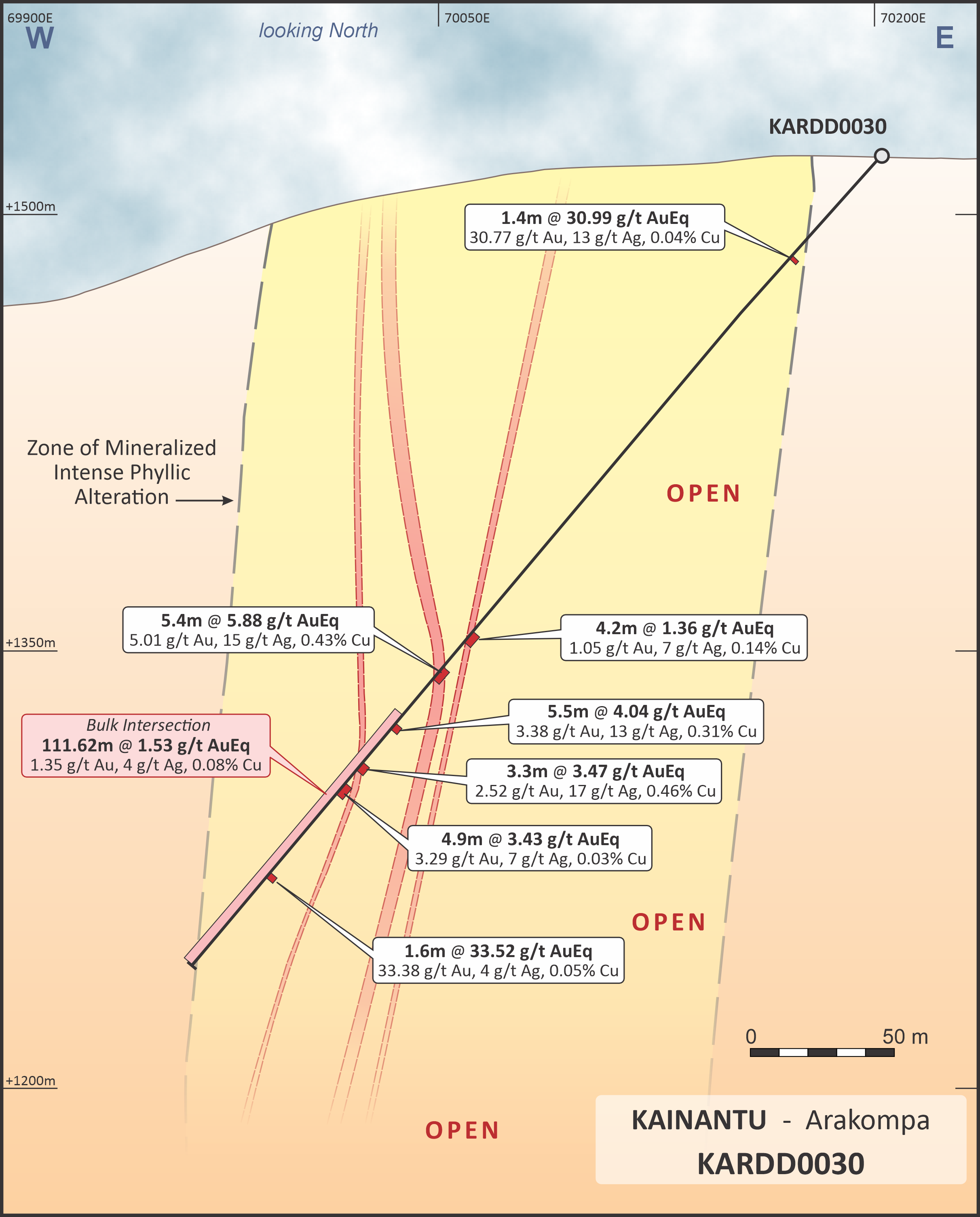

- KARDD0030 (~125 m southern step-out along strike): 111.62 m at 1.53 g/t AuEq (1.35 g/t Au, 4 g/t Ag, 0.08% Cu)

- Multiple high-grade intersections encountered. Drill highlights in addition to the highlights from KARDD0025 and 29 above, include:

- KARDD0018: 1.30 m at 35.72 g/t AuEq (35.29 g/t Au, 17 g/t Ag, 0.14% Cu) and

4.00 m at 6.59 g/t AuEq (6.15 g/t Au, 30 g/t Ag, 0.04% Cu) - KARDD0030: 5.40 m at 5.88 g/t AuEq (5.01 g/t Au, 15 g/t Ag, 0.43% Cu) and

5.53 m at 4.04 g/t AuEq (3.38 g/t Au, 13 g/t Ag, 0.31% Cu) and

1.62 m at 33.52 g/t AuEq (33.38 g/t Au, 4 g/t Ag, 0.05% Cu) and

1.40 m at 30.99 g/t AuEq (30.77 g/t Au, 13 g/t Ag, 0.04% Cu) - KARDD0013: 7.10 m at 5.69 g/t AuEq (5.47 g/t Au, 13 g/t Ag, 0.04% Cu)

- KARDD0028: 7.00 m at 5.26 g/t AuEq (5.04 g/t Au, 10 g/t Ag, 0.06% Cu)

- KARDD0023: 2.00 m at 14.60 g/t AuEq (12.44 g/t Au, 60 g/t Ag, 0.88% Cu)

- KARDD0015: 4.20 m at 6.55 g/t AuEq (6.08 g/t Au, 12 g/t Ag, 0.20% Cu) and

3.10 m at 5.11 g/t AuEq (5.07 g/t Au, 2 g/t Ag, 0.01% Cu) - KARDD0020: 2.70 m at 6.61 g/t AuEq (4.28 g/t Au, 175 g/t Ag, 0.09% Cu)

- KARDD0014: 1.40 m at 11.51 g/t AuEq (11.06 g/t Au, 19 g/t Ag, 0.13% Cu)

- KARDD0018: 1.30 m at 35.72 g/t AuEq (35.29 g/t Au, 17 g/t Ag, 0.14% Cu) and

- K92 has defined a substantial interpreted bulk tonnage zone extending over 750 meters, with bulk tonnage intersections reported to date recording an average true thickness of 56 meters and mineralization reaching a vertical depth of up to 350 meters. In addition to the bulk intersections at KARD0025 and KARDD0030, highlights include:

- KARDD0018: 57.0 m at 1.58 g/t AuEq (1.47 g/t Au, 5 g/t Ag, 0.02% Cu)

- KARDD0028: 45.9 m at 1.88 g/t AuEq (1.72 g/t Au, 5 g/t Ag, 0.06% Cu)

- KARDD0015: 32.7 m at 2.19 g/t AuEq (1.97 g/t Au, 4 g/t Ag, 0.10% Cu)

- KARDD0013: 36.9 m at 1.53 g/t AuEq (1.40 g/t Au, 3 g/t Ag, 0.04% Cu)

- KARDD0020: 33.9 m at 1.10 g/t AuEq (0.73 g/t Au, 22 g/t Ag, 0.06% Cu)

- KARDD0023: 32.4 m at 1.00 g/t AuEq (0.83 g/t Au, 5 g/t Ag, 0.06% Cu) and

19.6 m at 1.04 g/t AuEq (0.72 g/t Au, 8 g/t Ag, 0.14% Cu) - KARDD0027: 23.3 m at 1.05 g/t AuEq (0.98 g/t Au, 2 g/t Ag, 0.02% Cu)

- KARDD0016: 19.7 m at 1.06 g/t AuEq (0.73 g/t Au, 11 g/t Ag, 0.11% Cu)

- KARDD0019: 17.2 m at 1.12 g/t AuEq (0.67 g/t Au, 15 g/t Ag, 0.17% Cu)

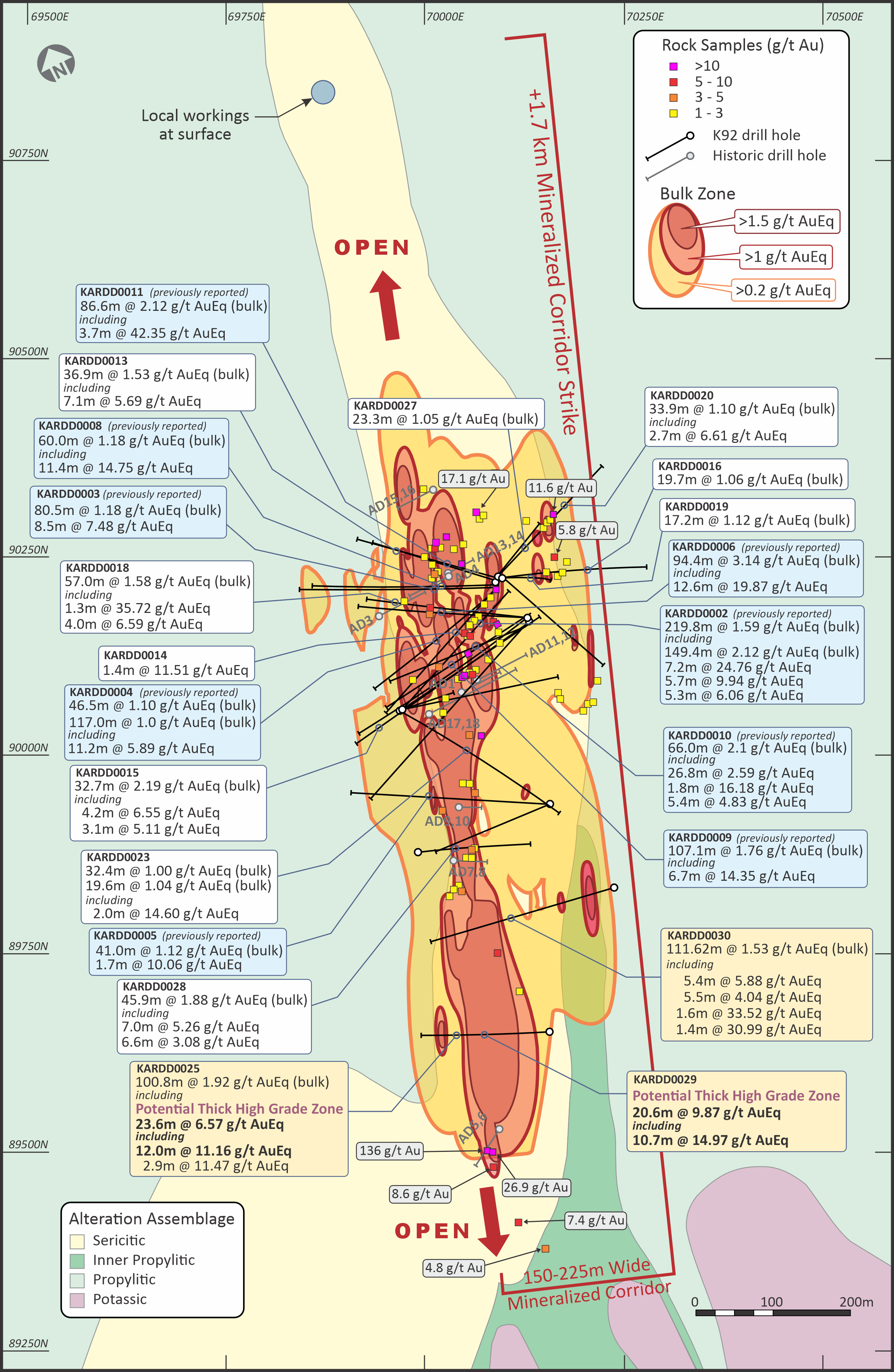

- Exploration expanded from one drill rig at the beginning of 2024, to currently four drill rigs at Arakompa. Mineralization is open along strike, at depth and only approximately 40% of the +1.7 km mineralized corridor strike length has been drill tested to date by K92, defined from rock chips, historic drilling and local workings (see Figure 1).

- K92 is targeting a maiden mineral resource estimate for Arakompa by Q1 2025.

Notes:

(1)Drill highlights presented above are core lengths (not true widths).

(2)Gold equivalent (AuEq) exploration results are calculated using longer-term commodity prices with a copper price of US$4.00/lb, a silver price of US$22.5/oz and a gold price of US$1,750/oz.

John Lewins, K92 Chief Executive Officer and Director, stated, "The significant and rapid progress at Arakompa is a very exciting time for K92, our stakeholders and Papua New Guinea. These latest 19 holes reported extended the known strike length by approximately 50%, discovered a potential thick high-grade zone at the southern limit of K92's drilling to date towards the Tankaunan Porphyry, while also extending the bulk mineralized zone a commensurate amount along strike. With Arakompa open in both directions along strike, we believe that we are still only scratching the surface and this is precisely why we have increased the number of drill rigs from one in Q1 2024 to now four.

Later this month, we are also very excited to be hosting a large group of analysts and investors on site to showcase the significant progress made to date in multiple areas, including at Arakompa, in addition to the mining-friendly jurisdiction of Papua New Guinea."

Chris Muller, K92 Executive Vice President, Exploration, stated, "Progressive drilling at Arakompa has demonstrated continuation of multiple lodes within the already substantial vein system. Drilling so far has tested less than half of the +1.7km strike length of the Arakompa corridor and to a maximum depth of 400m, representing just a small fraction of the presumed expansive set of mineralized veins.

The high grades and appreciable widths, as well as the characteristics and composition, of the Arakompa veins have all the hallmarks of the Kora consolidated veins and are equally as prospective. Four rigs are drilling on a prescribed spacing at Arakompa, on track to define a maiden modern resource estimate early in 2025."

Arakompa Vein System Background

The Arakompa project is interpreted to be an intrusive related gold-copper-silver epithermal vein system with similarities to the producing Kora and Judd vein systems. A significant difference at Arakompa is that it is hosted in tonalite to dioritic rock, whereas Kora and Judd are hosted predominantly in metasediments (phyllite).

Mineralization at Arakompa is in pronounced vein lodes but is also widespread across a very broad envelope, hosted in strongly altered tonalite and diorite. This has been interpreted to have resulted from collapsing argillic and advanced argillic alteration, and the propylitic alteration of the basement tonalite are interpreted to originate from the intrusion of a large magmatic porphyry body. Phyllic alternation appears to be associated with gold mineralization, providing a large halo (at least 100 m wide) around the vein corridor. There has likely been an upwelling of phyllic alteration from the porphyry into the high-grade veins. This has resulted in mineralization between the veins, providing the potential for bulk mining.

Multi-stage mineralizing events with several phases of quartz-sulphide development are apparent within the veins themselves. The sequence of early quartz deposited from a mesothermal dilute fluid followed by pyrite-copper-gold ± Bi-Te-Pb-Zn-Sn mineralization at Arakompa has many similarities to the same events encountered at Kora and Judd.

The main sulphides are pyrite, chalcopyrite, bornite and bismuthinite. As at Kora, chalcopyrite forms late, overprinting early phases of pyrite. Gold is documented in petrological reports and shown in photomicrographs as occurring in quartz, or often as inclusions overgrown by chalcopyrite.

Porphyry evidence is widespread at Arakompa. Localized, high-level B veins (quartz with centreline pyrite) are present, typical of the upper parts of a porphyry system. Magnetite-epidote alteration represents classic prograde porphyry assemblages, indicative of the inner propylitic shell. Chalcocite is also locally present, suggesting an underlying copper-enriched body.

The maiden drill program by K92 is the first drilling completed on the target in 32 years, with limited and shallow drilling completed historically (18 holes, 1,766 m drilled). Of the 18 holes drilled historically, there were 15 intersections above 5 g/t AuEq, 8 intersections above 10 g/t AuEq and 3 intersections above 20 g/t AuEq, with highlights including:

004DA92 - 4.00 m at 32.03 g/t AuEq (3.32 m true thickness)

013AD92 - 4.00 m at 20.21 g/t AuEq (3.40 m true thickness)

001AD92 - 2.80 m at 16.18 g/t AuEq (2.41 m true thickness)

005AD92 - 2.00 m at 32.01 g/t AuEq (1.26 m true thickness)

016AD92 - 6.30 m at 14.96 g/t AuEq (2.39 m true thickness)

010AD92 - 9.20 m at 10.67 g/t AuEq (4.32 m true thickness)

Surface field work completed historically and by K92 has demonstrated that the target size of Arakompa is significant, with mineralization observed from drill holes, rock samples and surface workings for at least 1.7 km of strike, hosted within an approximately 150- to 225-m-wide mineralized intense phyllic altered package, and a vertical extent of over 500 m.

Figures

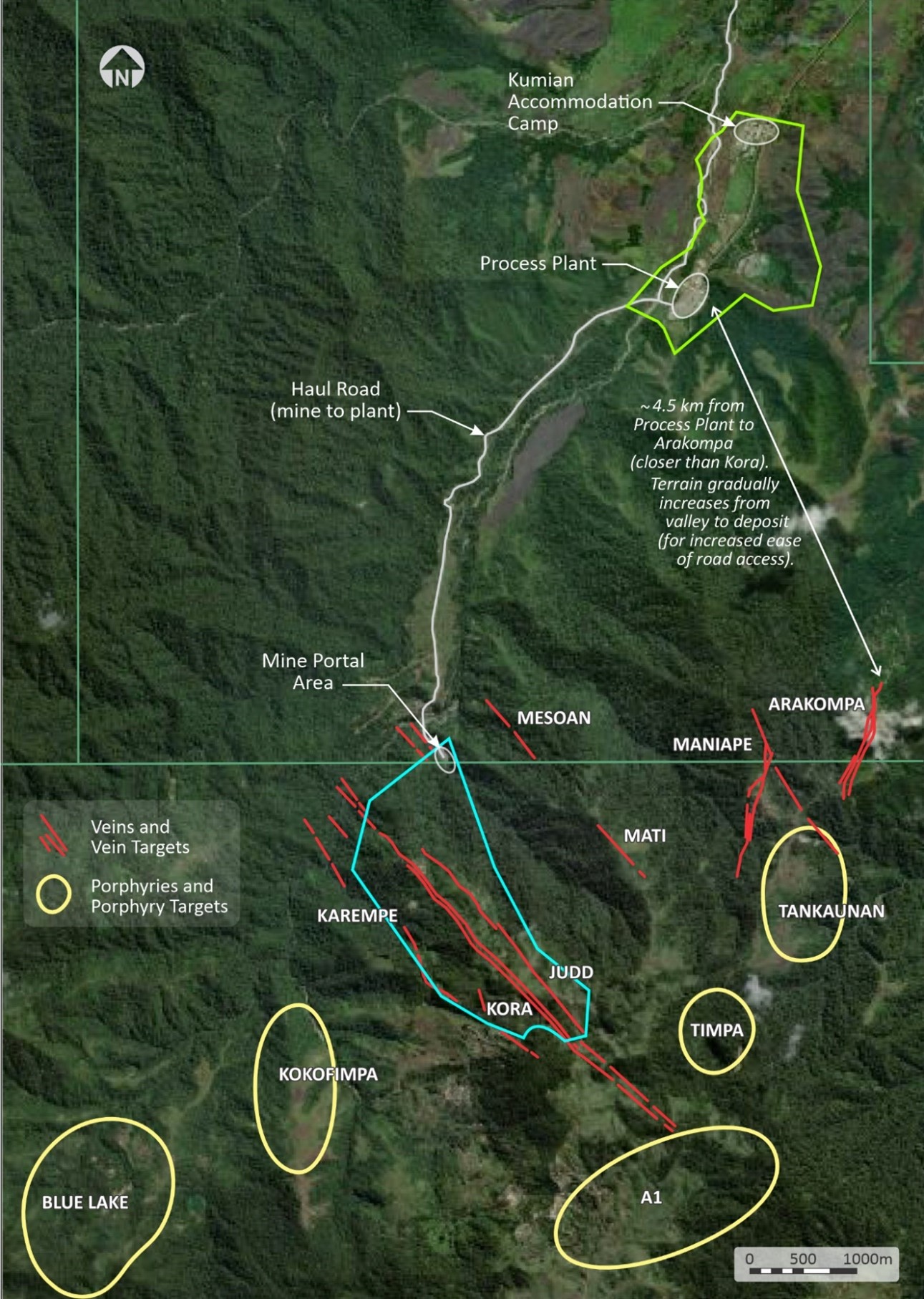

A plan map for Arakompa is provided in Figure 1.

A cross section showing KARDD0025 and KARDD0029 at Arakompa is provided in Figure 2.

A cross section showing KARDD0030 at Arakompa is provided in Figure 3.

A long section showing Arakompa drilling to date is provided in Figure 4.

A location map is provided in Figure 5.

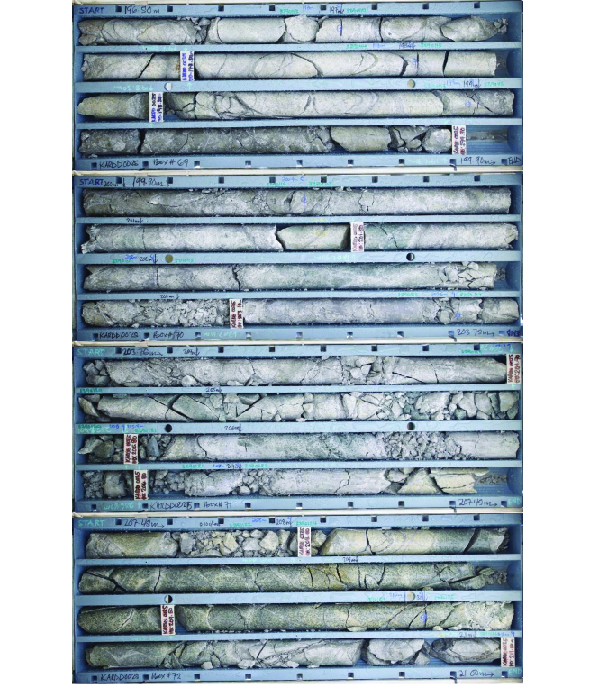

Core photographs of drill hole KARDD0025 are provided in Figure 6.

Table 1

Kainantu Gold Mine - Significant Intercepts from Arakompa Diamond Drilling

| Hole ID | From (m) | To (m) | Interval (m) | True width (m) | Gold g/t | Silver g/t | Copper % | Gold Eq | Vein |

| KARDD0012 | 246.80 | 370.20 | 123.40 | 66.64 | 0.25 | 1 | 0.03 | 0.32 | Bulk Intersection |

| KARDD0013 | 0.00 | 36.90 | 36.90 | 29.52 | 1.40 | 3 | 0.04 | 1.53 | Bulk Intersection |

| KARDD0013 | 12.90 | 20.00 | 7.10 | 5.68 | 5.47 | 13 | 0.04 | 5.69 | |

| KARDD0014 | 74.20 | 225.50 | 151.30 | 136.17 | 0.32 | 2 | 0.03 | 0.40 | Bulk Intersection |

| KARDD0014 | 74.20 | 75.50 | 1.30 | 1.17 | 2.36 | 50 | 1.37 | 5.19 | |

| KARDD0014 | 218.00 | 219.40 | 1.40 | 1.26 | 11.06 | 19 | 0.13 | 11.51 | |

| KARDD0014 | 225.00 | 225.50 | 0.50 | 0.45 | 5.54 | 35 | 0.25 | 6.38 | |

| KARDD0015 | 312.50 | 345.20 | 32.70 | 17.66 | 1.97 | 4 | 0.10 | 2.19 | Bulk Intersection |

| KARDD0015 | 318.20 | 322.40 | 4.20 | 2.27 | 6.08 | 12 | 0.20 | 6.55 | |

| KARDD0015 | 340.00 | 343.10 | 3.10 | 1.67 | 5.07 | 2 | 0.01 | 5.11 | |

| KARDD0016 | 101.50 | 121.20 | 19.70 | 12.02 | 0.73 | 11 | 0.11 | 1.06 | Bulk Intersection |

| KARDD0016 | 112.00 | 116.30 | 4.30 | 2.62 | 2.22 | 18 | 0.18 | 2.73 | |

| KARDD0017 | 229.50 | 307.60 | 78.10 | 70.29 | 0.21 | 2 | 0.02 | 0.26 | Bulk Intersection |

| KARDD0018 | 66.80 | 123.80 | 57.00 | 39.33 | 1.47 | 5 | 0.02 | 1.58 | Bulk Intersection |

| KARDD0018 | 66.80 | 70.80 | 4.00 | 2.76 | 6.15 | 30 | 0.04 | 6.59 | |

| KARDD0018 | 122.50 | 123.80 | 1.30 | 0.90 | 35.29 | 17 | 0.14 | 35.72 | |

| KARDD0019 | 255.70 | 272.90 | 17.20 | 11.87 | 0.67 | 15 | 0.17 | 1.12 | Bulk Intersection |

| KARDD0020 | 116.10 | 150.00 | 33.90 | 23.39 | 0.73 | 22 | 0.06 | 1.10 | Bulk Intersection |

| KARDD0020 | 105.90 | 106.60 | 0.70 | 0.48 | 4.95 | 47 | 0.04 | 5.60 | |

| KARDD0020 | 116.10 | 116.90 | 0.80 | 0.55 | 9.14 | 43 | 0.28 | 10.12 | |

| KARDD0020 | 148.30 | 151.00 | 2.70 | 1.86 | 4.28 | 175 | 0.09 | 6.61 | |

| KARDD0021 | 72.30 | 280.20 | 207.90 | 143.45 | 0.20 | 1 | 0.02 | 0.25 | Bulk Intersection |

| KARDD0022 | 127.80 | 376.40 | 248.60 | 124.30 | 0.15 | 2 | 0.02 | 0.20 | Bulk Intersection |

| KARDD0023 | 78.00 | 110.40 | 32.40 | 19.44 | 0.83 | 5 | 0.06 | 1.00 | Bulk Intersection |

| KARDD0023 | 328.00 | 347.60 | 19.60 | 11.76 | 0.72 | 8 | 0.14 | 1.04 | Bulk Intersection |

| KARDD0023 | 78.00 | 78.80 | 2.00 | 1.20 | 12.44 | 60 | 0.88 | 14.60 | |

| KARDD0023 | 346.50 | 349.00 | 2.50 | 1.50 | 2.11 | 29 | 0.68 | 3.57 | |

| KARDD0024 | 190.60 | 276.30 | 85.70 | 51.36 | 0.20 | 2 | 0.03 | 0.29 | Bulk Intersection |

| KARDD0025 | 191.00 | 299.80 | 100.80 | 50.40 | 1.71 | 3 | 0.10 | 1.92 | Bulk Intersection |

| KARDD0025 | 191.00 | 214.60 | 23.60 | 11.80 | 5.89 | 8 | 0.35 | 6.57 | Potential Southern HG Zone |

| KARDD0025 | 199.00 | 211.00 | 12.00 | 6.00 | 10.49 | 11 | 0.33 | 11.16 | Potential Southern HG Zone |

| KARDD0025 | 199.00 | 200.40 | 1.40 | 0.70 | 65.62 | 64 | 1.01 | 68.05 | |

| KARDD0025 | 296.90 | 299.80 | 2.90 | 1.45 | 11.26 | 9 | 0.06 | 11.47 | |

| KARDD0025 | 334.40 | 338.30 | 3.90 | 1.95 | 3.15 | 4 | 0.04 | 3.27 | |

| KARDD0026 | 180.50 | 280.70 | 100.20 | 70.14 | 0.18 | 2 | 0.01 | 0.22 | Bulk Intersection |

| KARDD0027 | 0.00 | 23.30 | 23.30 | 11.65 | 0.98 | 2 | 0.02 | 1.05 | Bulk Intersection |

| KARDD0028 | 83.00 | 128.90 | 45.90 | 32.13 | 1.72 | 5 | 0.06 | 1.88 | Bulk Intersection |

| KARDD0028 | 101.20 | 107.80 | 6.60 | 4.62 | 2.95 | 3 | 0.05 | 3.08 | |

| KARDD0028 | 113.00 | 120.00 | 7.00 | 4.90 | 5.04 | 10 | 0.06 | 5.26 | |

| KARDD0028 | 123.60 | 128.90 | 5.30 | 3.71 | 2.83 | 19 | 0.21 | 3.40 | |

| KARDD0029 | 240.60 | 261.20 | 20.60 | 8.24 | 8.90 | 29 | 0.38 | 9.87 | Potential Southern HG Zone |

| KARDD0029 | 240.60 | 251.30 | 10.70 | 4.28 | 13.81 | 25 | 0.53 | 14.97 | Potential Southern HG Zone |

| KARDD0030 | 216.50 | 328.12 | 111.62 | 78.13 | 1.35 | 4 | 0.08 | 1.53 | Bulk Intersection |

| KARDD0030 | 30.00 | 30.90 | 0.90 | 0.63 | 3.61 | 2 | 0.02 | 3.66 | |

| KARDD0030 | 46.50 | 47.90 | 1.40 | 0.98 | 30.77 | 13 | 0.04 | 30.99 | |

| KARDD0030 | 101.70 | 104.00 | 2.30 | 1.61 | 3.49 | 10 | 0.02 | 3.64 | |

| KARDD0030 | 233.10 | 238.50 | 5.40 | 3.78 | 5.01 | 15 | 0.43 | 5.88 | |

| KARDD0030 | 241.30 | 241.70 | 0.40 | 0.28 | 3.93 | 15 | 0.21 | 4.45 | |

| KARDD0030 | 255.57 | 261.10 | 5.53 | 3.87 | 3.38 | 13 | 0.31 | 4.04 | |

| KARDD0030 | 276.20 | 279.50 | 3.30 | 2.31 | 2.52 | 17 | 0.46 | 3.47 | |

| KARDD0030 | 285.73 | 290.60 | 4.87 | 3.41 | 3.29 | 7 | 0.03 | 3.43 | |

| KARDD0030 | 326.50 | 328.12 | 1.62 | 1.13 | 33.38 | 4 | 0.05 | 33.52 |

Table 2

Kainantu Gold Mine - Collar Locations for Arakompa Surface Drilling

| Hole ID | Collar location | Collar orientation | ||||

| Local North | Local East | mRL | Dip | Local azimuth | EOH depth (m) | |

| KARDD0012 | 70125 | 90159 | 1449 | -46 | 228 | 424 |

| KARDD0013 | 70094 | 90216 | 1424 | -60 | 287 | 362 |

| KARDD0014 | 69953 | 90053 | 1415 | -44 | 47 | 312 |

| KARDD0015 | 70119 | 90162 | 1433 | -58 | 237 | 362 |

| KARDD0016 | 70088 | 90216 | 1415 | -61 | 89 | 385 |

| KARDD0017 | 69949 | 90059 | 1419 | -46 | 83 | 315 |

| KARDD0018 | 70123 | 90163 | 1434 | -46 | 280 | 301 |

| KARDD0019 | 70089 | 90215 | 1415 | -75 | 88 | 286 |

| KARDD0020 | 70090 | 90215 | 1415 | -75 | 83 | 314 |

| KARDD0021 | 69949 | 90060 | 1419 | -75 | 74 | 314 |

| KARDD0022 | 70125 | 90162 | 1434 | -60 | 273 | 455 |

| KARDD0023 | 69957 | 90057 | 1419 | -58 | 121 | 445 |

| KARDD0024 | 70098 | 90214 | 1427 | -51 | 135 | 276 |

| KARDD0025 | 70110 | 89642 | 1573 | -62 | 267 | 357 |

| KARDD0026 | 69949 | 90060 | 1419 | -44 | 58 | 308 |

| KARDD0027 | 70088 | 90217 | 1428 | -71 | 41 | 295 |

| KARDD0028 | 69963 | 89879 | 1447 | -60 | 89 | 300 |

| KARDD0029 | 70107 | 89642 | 1577 | -71 | 271 | 450 |

| KARDD0030 | 70204 | 89814 | 1519 | -47 | 260 | 368 |

Drill Hole Sampling Methodology, QA/QC and Qualified Person

The diamond drill hole is first logged to determine the sampling intervals, which range from a minimum of 0.1 metres to generally 1 metre. The drill core is sawn half core cut along a reference line, with the remainder of the core returned to the core tray. Core samples are then placed in numbered calico and plastic bags, with a numbered sample ticket for dispatch to the assay laboratory. Samples are separately assayed for gold, copper and silver. K92's procedure includes the insertion standards, blanks and duplicates. Gold assays are by the fire assay method. Copper and silver assays are by three-acid-digestion method (nitric, perchloric and hydrochloric mix).

K92 maintains an industry-standard analytical quality assurance and quality control (QA/QC) and data verification program to monitor laboratory performance and ensure high quality assays. Results from this program confirm reliability of the assay results. All sampling and analytical work for the mine exploration program is performed by Intertek Testing Services (PNG) Ltd, an independent accredited laboratory that is located on site. External check assays for QA/QC purposes are performed at SGS Australia Pty Ltd in Townsville, Queensland, Australia.

K92 Executive Vice President, Exploration, Mr. Chris Muller, PGeo, and K92 Mine Geology Manager and Mine Exploration Manager, Andrew Kohler, MAIG, both Qualified Persons under the meaning of National Instrument 43-101 - Standards of Disclosure for Mineral Projects, have reviewed and are responsible for the technical content of this news release. In addition to the analytical QA/QC program outlined above, data verification also includes significant time onsite reviewing drill core, soil and outcrop sampling, artisanal workings, as well as discussing work programs and results with geology personnel and external consultants.

About K92

K92 Mining Inc. is engaged in the production of gold, copper and silver at the Kainantu Gold Mine in the Eastern Highlands province of Papua New Guinea, as well as exploration and development of mineral deposits in the immediate vicinity of the mine. The Company declared commercial production from Kainantu in February 2018, is in a strong financial position, and is working to become a Tier 1 mid-tier producer through ongoing plant expansions. A maiden resource estimate on the Blue Lake copper-gold porphyry project was completed in August 2022. K92 is operated by a team of mining company professionals with extensive international mine-building and operational experience.

On Behalf of the Company,

John Lewins, Chief Executive Officer and Director

For further information, please contact David Medilek, P.Eng., CFA, President and Chief Operating Officer at +1-604-416-4445

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Such forward-looking statements include, without limitation: (i) the results of the Kainantu Mine Definitive Feasibility Study, and the Kainantu 2022 Preliminary Economic Assessment, including the Stage 3 Expansion, a new standalone 1.2 mtpa process plant and supporting infrastructure; (ii) statements regarding the expansion of the mine and development of any of the deposits; (iii) the Kainantu Stage 4 Expansion, operating two standalone process plants, larger surface infrastructure and mining throughputs; and (iv) the potential extended life of the Kainantu Mine.

All statements in this news release that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as "expect", "plan", "anticipate", "project", "target", "potential", "schedule", "forecast", "budget", "estimate", "intend" or "believe" and similar expressions or their negative connotations, or that events or conditions "will", "would", "may", "could", "should" or "might" occur. All such forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Forward-looking statements are necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors, many of which are beyond our ability to control, that may cause our actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. Such factors include, without limitation, Public Health Crises, including the COVID-19 virus; changes in the price of gold, silver, copper and other metals in the world markets; fluctuations in the price and availability of infrastructure and energy and other commodities; fluctuations in foreign currency exchange rates; volatility in price of our common shares; inherent risks associated with the mining industry, including problems related to weather and climate in remote areas in which certain of the Company's operations are located; failure to achieve production, cost and other estimates; risks and uncertainties associated with exploration and development; uncertainties relating to estimates of mineral resources including uncertainty that mineral resources may never be converted into mineral reserves; the Company's ability to carry on current and future operations, including development and exploration activities; the timing, extent, duration and economic viability of such operations, including any mineral resources or reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company's ability to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the availability and costs of achieving the Stage 3 Expansion or the Stage 4 Expansion; the ability of the Company to achieve the inputs the price and market for outputs, including gold, silver and copper; failures of information systems or information security threats; political, economic and other risks associated with the Company's foreign operations; geopolitical events and other uncertainties, such as the conflicts in Ukraine, Israel and Palestine; compliance with various laws and regulatory requirements to which the Company is subject to, including taxation; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions, including relationship with the communities in Papua New Guinea and other jurisdictions it operates; other assumptions and factors generally associated with the mining industry; and the risks, uncertainties and other factors referred to in the Company's Annual Information Form under the heading "Risk Factors".

Estimates of mineral resources are also forward-looking statements because they constitute projections, based on certain estimates and assumptions, regarding the amount of minerals that may be encountered in the future and/or the anticipated economics of production. The estimation of mineral resources and mineral reserves is inherently uncertain and involves subjective judgments about many relevant factors. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, Forward-looking statements are not a guarantee of future performance, and actual results and future events could materially differ from those anticipated in such statements. Although we have attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking statements, there may be other factors that cause actual results to differ materially from those that are anticipated, estimated, or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Figure 1 - Arakompa Plan Map

Figure 2 - Arakompa Cross-Section - Showing KARDD0025 and KARDD0029

Figure 3 - Arakompa Cross-Section - Showing KARDD0030

Figure 4 - Arakompa Long Section

Figure 5 - Site Map and Location of Arakompa, located near infrastructure (~4.5km from the Process Plant).

Figure 6 - KARDD0025 Core Photograph, 196.5 - 211.0m - from 199.0 to 211.0 m is 12.0 m at 11.16 g/t AuEq intersection, within a broader 23.6 m at 6.57 g/t AuEq intersection.

Figures accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/7e6aedaf-fe93-47e2-a90b-415bcf7a1197

https://www.globenewswire.com/NewsRoom/AttachmentNg/2f917076-acc4-44e6-bec4-6401a248fc6f

https://www.globenewswire.com/NewsRoom/AttachmentNg/c69d2370-cab2-475c-a85c-7ccbd523c186

https://www.globenewswire.com/NewsRoom/AttachmentNg/b8bd25d4-27eb-4db7-b5b2-8f1cda308ae7

https://www.globenewswire.com/NewsRoom/AttachmentNg/f993c8f3-7e51-49b4-b1a9-17a6650b2590

https://www.globenewswire.com/NewsRoom/AttachmentNg/04bbccf0-4e53-49f7-8d6d-eb0df09cbcd8