ROUYN NORANDA, Québec, Oct. 23, 2024 (GLOBE NEWSWIRE) -- Granada Gold Mine Inc. (TSXV: GGM) (OTC: GBBFF) (Frankfurt: B6DA.F) (the "Company" or "Granada") announces a comprehensive deep drill program to the north of the current open pit resource in an area known as the Big Claim to define the extent of gold mineralization within the 2 kilometer east-west strike length of the greater 5.5 kilometer defined mineralized gold structure. Gold mineralization is expected to extend beyond 1600-meter vertical depth based on the last drill program.

Drill Program aiming to Support an Updated Gold Resource at Depth

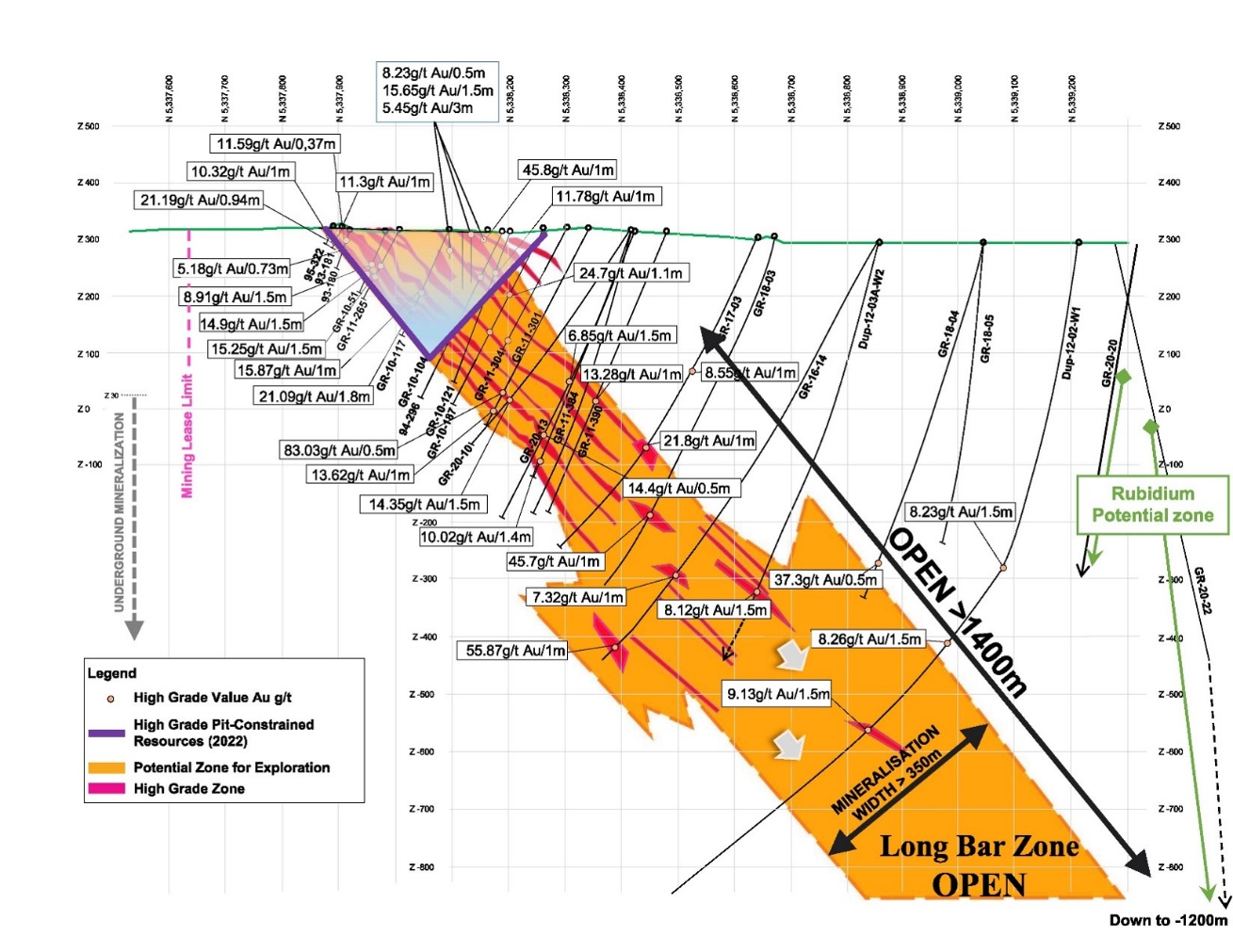

Select deep drilling results on the Big Claim confirming High Grade potential:

- 55.9 g/t gold over 1.00 meters in hole GR-16-14 included in 14.5 g/t gold over 4 meters from 881 to 885 meters.

- 45.7 g/t gold over 1.00 meters in hole GR-18-03 included in 8.39 g/t gold over 6 meters from 572 to 578 meters.

- 107.9 g/t gold over 4.00 meters in hole GR-20-21 from 617.4 to 621.4 meters

Figure 1: Granada Gold High-Grade Intersections

Showing Pit, High-Grade Intercepts and Prospective Zone for Future Exploration

Composite Section as of July 2023

The drill program is a continuation of a planned 120,000-meter drill program of which 20,000 meters has been completed.

Frank J. Basa, President and CEO, commented, "The drill program will assess the potential for higher-grade underground resources in line with historical production, which averaged between 9 and 10 grams per tonne gold. This aligns with our strategy to systematically evaluate the property's high-grade potential at depth."

Qualified person

The technical information in this news release was reviewed and approved by Matthew Halliday, P.Geo., Director of Granada Gold Mine Inc., and member of the Ordre des Géologues du Québec, who is a Qualified Person in accordance with National Instrument 43-101.

Mineral Resource Estimate

On August 22, 2022 the Company filed an updated NI 43-101 technical report supporting the resource estimate update for the Granada Gold project (Please see July 6, 2022 news release) reporting that the Granada deposit contains an updated mineral resource, at a base case cut-off grade of 0.55 g/t Au for pit constrained mineral resources within a conceptual pit shell and at a base case cut-off grade of 2.5 g/t for underground mineral resources within reasonably mineable volumes, of 543,000 ounces of gold (8,220,000 tonnes at an average grade of 2.05 g/t Au) in the Measured and Indicated category, and 456,000 ounces of gold (3,010,000 tonnes at an average grade of 4.71 g/t Au) in the Inferred category. Please see Table 1 below for full details. Report reference: Granada Gold Project Mineral Resource Estimate Update, Rouyn-Noranda, Quebec, Canada authored by Yann Camus, P.Eng. and Maxime Dupéré, B.Sc, P.Geo., SGS Canada Inc. dated August 20th, 2022 and with an effective date of June 23rd, 2022.

Table 1: Mineral Resource Estimate Showing Tonnes, Average Grade, and Gold Ounces

| Cut-Off (g/t Au) | Classification | Type | Tonnes | Au (g/t) | Gold Ounces |

| 0.55 / 2.5 | Measured1 | InPit+UG | 4,900,000 | 1.70 | 269,000 |

| Indicated | InPit+UG | 3,320,000 | 2.57 | 274,000 | |

| Measured & Indicated | InPit+UG | 8,220,000 | 2.05 | 543,000 | |

| Inferred | InPit+UG | 3,010,000 | 4.71 | 456,000 |

About Granada Gold Mine Inc.

Granada Gold Mine Inc. continues to develop and explore its 100% owned Granada Gold Property near Rouyn-Noranda, Quebec, and is adjacent to the prolific Cadillac Break. The Company owns 14.73 square kilometers of land in a combination of mining leases and claims. The Company is currently undergoing a large drill program with 20,000m out of 120,000m complete. The drills are currently paused to provide the technical team with the necessary time to evaluate, assimilate existing data and wait for improved market conditions.

The Granada Shear Zone and the South Shear Zone contain, based on historical detailed mapping as well as from current and historical drilling, up to twenty-two mineralized structures trending east-west over five and a half kilometers. Three of these structures were mined historically from four shafts and three open pits. Historical underground grades were 8 to 10 grams per tonne gold from two shafts down to 236 m and 498 m with open pit grades from 3.5 to 5 grams per tonne gold.

The property includes the former Granada Gold underground mine which produced more than 50,000 ounces of gold at 10 grams per tonne gold in the 1930's from two shafts before a fire destroyed the surface buildings. In the 1990s, Granada Resources extracted a bulk sample (Pit #1) of 87,311 tonnes grading 5.17 g/t Au. They also extracted a bulk sample (Pit # 2) of 22,095 tonnes grading 3.46 g/t Au. More information at https://granadagoldmine.com/

For further information, Contact:

Frank J. Basa, P.Eng. member of Professional Engineers Ontario

Chief Executive Officer

P: 416-625-2342

Or:

Wayne Cheveldayoff,

Corporate Communications

P: 416-710-2410

E: waynecheveldayoff@gmail.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements which include, but are not limited to, comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, availability of funds, and others are forward-looking. Forward-looking statements are not guarantees of future performance and actual results may vary materially from those statements. General business conditions are factors that could cause actual results to vary materially from forward-looking statements. The Company does not undertake to update any forward-looking information in this news release or other communications unless required by law.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/859fc2a1-7977-4abb-ac21-2ac08a294185