VANCOUVER, BC / ACCESSWIRE / October 24, 2024 / SILVER X MINING CORP. (TSXV:AGX)(OTCQB:AGXPF)(F:AGX) ("Silver X" or the "Company"), a growing silver producer and developer in Central Peru, is pleased to announce its operating results for the third quarter ending September 30, 2024 ("Q3 2024") at the Company's Nueva Recuperada Project (the "Project") in Peru.

Q3 2024 Production Highlights

YTD production results demonstrate sustained growth compared to the first nine months of 2023:

30% more AgEq produced

52% more ore mined and 42% more processed

Grades holding steady

Steady production continued during Q3 2024.

Q3 2024 is not comparable to Q3 2023 due to the Operational Reset last year with operations being paused for 8 weeks.

Underground development continues, enabling new phases for both production and resource development.

"Our wholly owned Nueva Recuperada Project is producing as expected. We are pleased with the steady growth of the operation and are excited about the future of this Project. Our dedicated team continues to work hard to realize the potential of this promising silver district high in the Andes," said Silver X CEO Jose M. Garcia.

"Financial results for the third quarter are expected to be announced in the next few weeks. Metals prices, particularly silver, continue to be a wind in our sails."

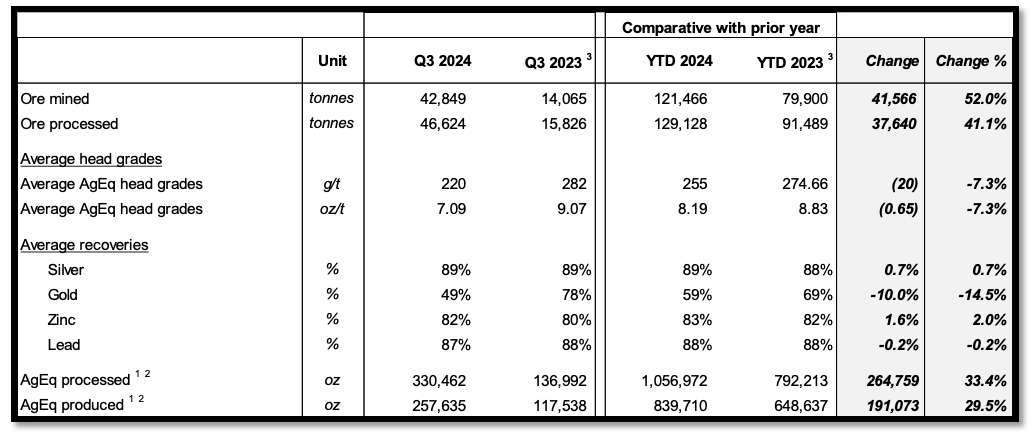

Nueva Recuperada Project Production

Quarter and nine month ending September 30, 2024, compared to September 30, 20233

Notes

(1) Measure of performance with no prescribed definition under IFRS. Refer to the "Non-IFRS Measures" section of this press release.

(2) AgEq ounces produced were calculated based on all metals produced using the average sales prices of each metal for each month during the period. Revenues from concentrate sales does not consider metallurgical recoveries in the calculations as the metal recoveries are built into the sales amounts. In Q3 2024, AgEq was calculated using metal prices of U.S. $29.29 per oz Ag, U.S. $2,462 per oz Au, U.S. $0.93 per lb of Pb and US$1.25 per lb of Zn.

(3) During the three months ended September 30, 2023, the Company completed its operational hold from July 26, 2023, to September 19, 2023, to implement a strategic operational reset. During this brief pause, operational upgrades were successfully completed and are expected to enhance efficiency and profitability, including investment in equipment upgrades, workforce training, and safety measures.

Please see "Cautionary Note regarding Production without Mineral Reserves" at the end of this news release.

Board Change

Silver X also announces that Sebastian Wahl has resigned as a director of the Company, effective today.

"Sebastian has been a valuable member of Silver X's Board since inception, and we are grateful for his leadership and contributions during his tenure," stated Silver X CEO Jose M. Garcia. "We wish him the very best in his future endeavors."

Qualified Person

Mr. A. David Heyl, B.Sc., C.P.G who is a qualified person under NI 43-101, has reviewed and approved the technical content of this news release for Silver X. Heyl is a consultant for Silver X.

Cautionary Note regarding Production without Mineral Reserves

The decision to commence production at the Nueva Recuperada Project and the Company's ongoing mining operations as referenced herein (the "Production Decision and Operations") are based on economic models prepared by the Company in conjunction with management's knowledge of the property and the existing estimate of mineral resources on the property. The Production Decision and Operations are not based on a preliminary economic assessment, a pre-feasibility study or a feasibility study of mineral reserves demonstrating economic and technical viability. Accordingly, there is increased uncertainty and economic and technical risks of failure associated with the Production Decision and Operations, in particular: the risk that mineral grades will be lower than expected; the risk that additional construction or ongoing mining operations are more difficult or more expensive than expected; and production and economic variables may vary considerably, due to the absence of a detailed economic and technical analysis in accordance with NI 43-101.

About Silver X

Silver X is a rapidly expanding silver developer and producer. The Company owns the 20,000-hectare Nueva Recuperada Silver District in Central Peru and produces silver, gold, lead and zinc from its Tangana Project. We are building a premier silver company that aims to deliver outstanding value to all stakeholders, consolidating and developing undervalued assets, adding resources and increasing production while aspiring to social and environmental excellence. For more information visit our website at www.silverxmining.com.

ON BEHALF OF THE BOARD

José M. Garcia, CEO and Director

For further information, please contact:

Susan Xu

Investor Relations

ir@silverxmining.com

+1 778 323 0959

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding "Forward-Looking" Information

This press release contains forward-looking information within the meaning of applicable Canadian securities legislation ("forward-looking information"). Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain acts, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". All information contained in this press release, other than statements of current and historical fact, is forward looking information. Forward- looking information contained in this press release may include, without limitation, exploration plans, results of operations, expected performance at the Project, the Company's belief that the Tangana system will provide considerable resource expansion potential, that the Company will be able to mine the Tangana Mining Unit in an economic manner, and the expected financial performance of the Company.

The following are some of the assumptions upon which forward-looking information is based: that general business and economic conditions will not change in a material adverse manner; demand for, and stable or improving price for the commodities we produce; receipt of regulatory and governmental approvals, permits and renewals in a timely manner; that the Company will not experience any material accident, labour dispute or failure of plant or equipment or other material disruption in the Company's operations at the Project and Nueva Recuperada Plant; the availability of financing for operations and development; the Company's ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; that the estimates of the resources at the Project and the geological, operational and price assumptions on which these and the Company's operations are based are within reasonable bounds of accuracy (including with respect to size, grade and recovery); the Company's ability to attract and retain skilled personnel and directors; and the ability of management to execute strategic goals.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information, including but not limited to those risks described in the Company's annual and interim MD&As and in its public documents filed on www.sedarplus.ca from time to time. Forward- looking statements are based on the opinions and estimates of management as of the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

SOURCE: Silver X Mining Corp.

View the original press release on accesswire.com