CALGARY, Alberta, Oct. 24, 2024 (GLOBE NEWSWIRE) -- Prospera Energy Inc. ("PEI") (TSX.V: PEI, OTC: GXRFF, FRA: OF6B)

The 2024 Prospera corporate update outlines the company's restructuring efforts since 2021, highlighting key milestones achieved, challenges faced, and the strategic path forward to achieve production stability and profitability.

Preamble:

By the end of 2020 Prospera faced a litany of financial challenges, including low production, high operating costs, and the global impacts of the Covid pandemic. The company's liability was in excess of $24MM ($12MM ARO, $11MM AP arrears, & $1.5MM in Credit Facilities) mainly towards secured mezzanine capital, CRA, mineral royalties, municipality property tax, landowners lease payments, numerous local service providers, and high asset retirement obligations. Adding to the problems, Prospera had in excess of 400+ non-compliance infractions with spills, dysfunctional monitoring devices, and facilities that had been neglected and orphaned. Consequently, Prospera Energy Inc. was in a terminal position. In Q1 2021, the municipality and secured debt holder exercised their rights, taking control of payments from the limited revenue and production that remained. The then-CEO and directors were fleeing from the company's obligations, especially to the CRA.

Towards the end of 2020, PEI's continuing operations had become difficult due to high and long-term liabilities, a situation further amplified by the pandemic and drastic reduction in produced volumes (less than 200 bpd Gross).

At the time, Mr. Samuel David was leading a private company developing medium-light oil around the Brooks area and as a result of his association with the late Burkhart Franz, founder of Prospera Energy Inc. (formerly Georox Resources), Mr. David accepted a role as an advisor to help rescue the company from entering into CCA.

Prospera Energy Restructure:

Prospera Energy Inc's restructuring commenced in Q1, 2021, with the appointment of Mr. David as President, CEO & Director. Mr. David observed legacy heavy (13-17API) oil fields were developed with numerous vertical wells on reduced spacing. These wells were in primary depletion without any patterned pressure support. Produced water was randomly disposed resulting in water recycling. Reserves were estimated on the decline of the small number of low producing wells and their economies were burdened by high surface lease costs and their high number of standing wells. Unprocessed 3-D seismic coverage was available over the entire reservoir of each asset, each of which has a facility processing capacity to handle large volumes of produced fluid, and the wells were tied into these central facilities. Clean oils were trucked out to a nearby terminal. Produced water was reinjected by central pumps at the facility to injectors throughout the field. These infrastructures had previously been neglected and not maintained.

Mr. David recognized the recovery to date was low with respect to volumetric estimation of oil in place, and a significant amount of oil remains within adequate infrastructure. The recovery has been from an under pressured solution gas drive reservoir with low active edge water and exploited by vertical well technology only. However, high AP arrears, ARO and neglected infrastructure were significant obstacles. Overcoming poor technical conduct and neglect required sufficient capital to exploit the remaining reserves effectively and profitably. To rectify these issues, Samuel devised a development plan in phases to capture the significant remaining reserves.

The Prospera development plan is comprised of three phases:

- Phase one was to bring operations to safe operating conditions and optimize low hanging opportunities to increase production.

- Phase two was to transition to horizontal wells and abandon depleted vertical wells along the path. This reduces the environmental footprint and the corresponding fixed operating cost. It would also diversify product mix by adding higher API oil assets.

- The third and final phase is to implement improved and enhanced recovery methods tailored to the reservoir conditions, aiming to reduce decline for sustained long-term production. This approach, combined with a reduced footprint and lower operating costs, is designed to yield higher margins.

At the time, the minimum allowed for a private placement was five cents, while PEI stock was trading at one cent and at risk of being halted. Fortunately, a one-time, two-cents private placement offering opportunity, that was only offered during extraordinary circumstances such as the pandemic, was permitted. Utilizing this opportunity and the proposed engineering solutions, capital was raised with the assistance of Kurt Soost, who played a key role in connecting credible investors such as Peter Lacey, Dave Richardson, and others to the seed capital provided by the management group, which included Mr. David and Jaz Dhaliwal. They participated in the initial and subsequent private placement offerings, helping Prospera secure a financial lifeline.

This realigned the PEI board, which requested Mr. David amalgamate his private company assets into Prospera at an equal interest, to avoid any perception of bias towards his assets and to ensure focus on Prospera's asset development going forward. As a result, Prospera acquired a 50% working interest in a medium-light oil property with operatorship from Mr. David on favorable terms, with no upfront cash consideration and delayed consideration on a success basis. These terms were released on December 7th, 2022, and the transaction consideration was based on third-party evaluations, TSX approval, and independent scrutiny and approval resolution by the directors.

Restructuring Efforts Resulted In:

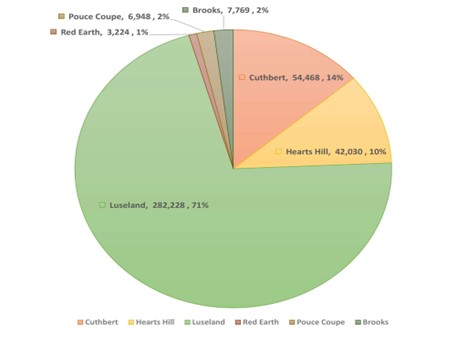

Oil in Place Validated - Prospera Oil in place and remaining reserves were authenticated by geological delineation, well control & production performance, 3D seismic confirmation, and by 3rd party evaluation

- Total OOIP = 396.7 MMbbl

- Produced = 34.2 MMbbl

- Recovered = 8.6%

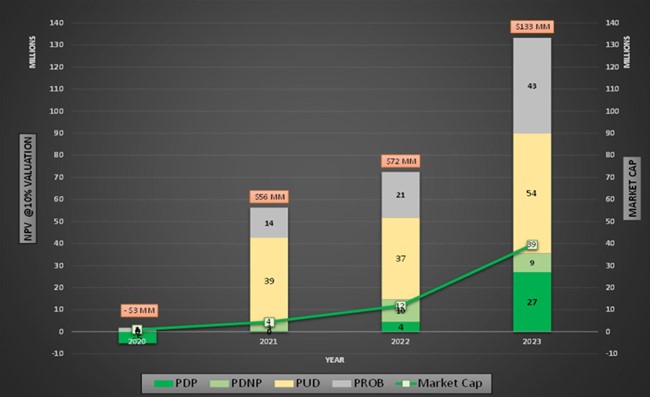

NPV Appreciation - Net Present value of the reserves was steadily substantiated by PEI's optimization and development. As a result:

- Before Tax PDP reserves increased 508% from $4.4MM$ to $27.1MM$ in 2023 at a 10% discount rate

- Before tax 2P reserves increased by $60.8m from $72.5m to $133.3MM$ in 2023 at a 10% discount rate

- Total proved and probable reserves increased by 25% from 4,306 to 5,403 Mboe

- Reserve life index increased by 6% from 28.4 to 30.0 years

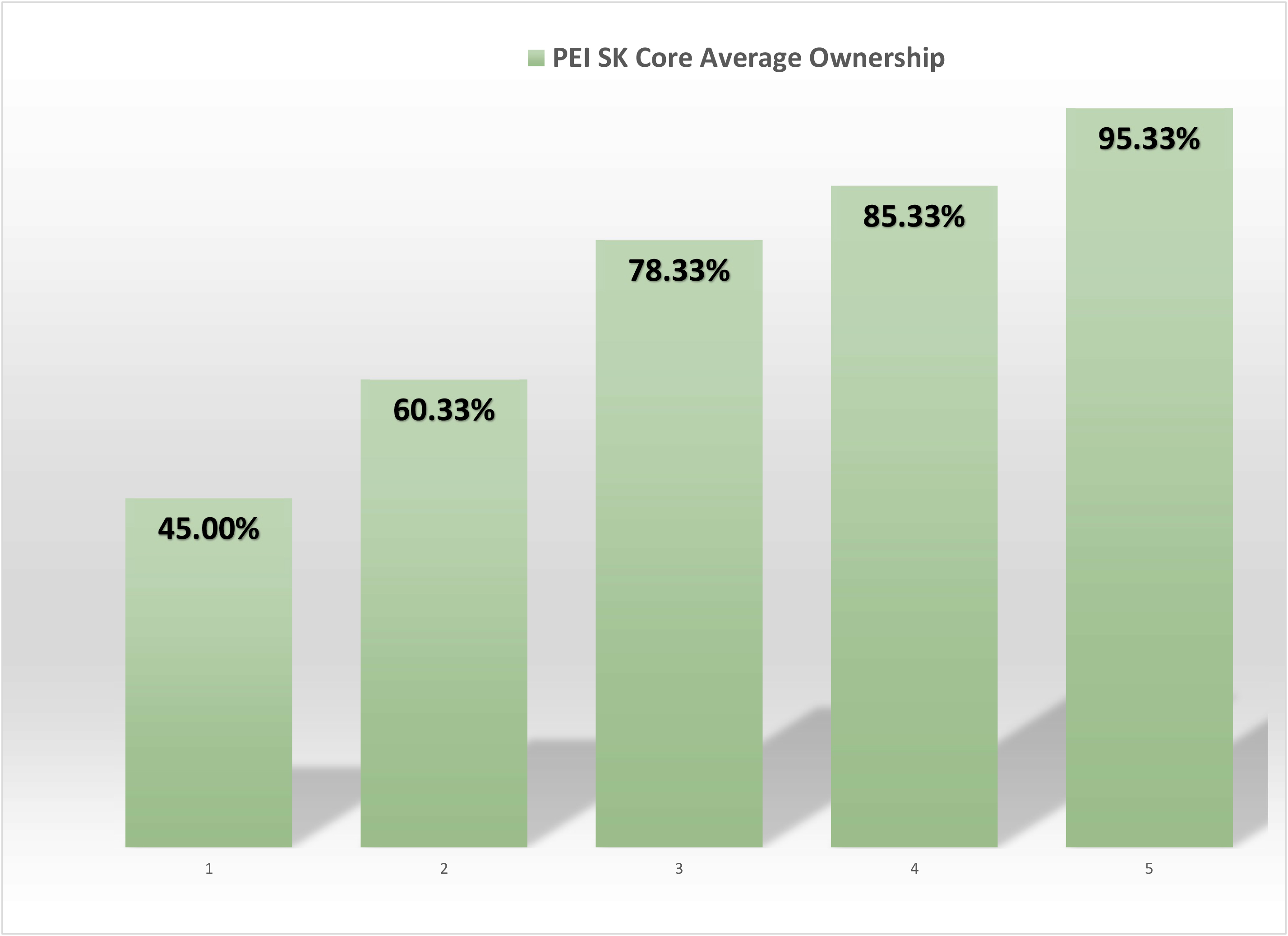

Increased Ownership - In the three core heavy oil properties from an average of 35% to 95% by settling out joint venture receivables.

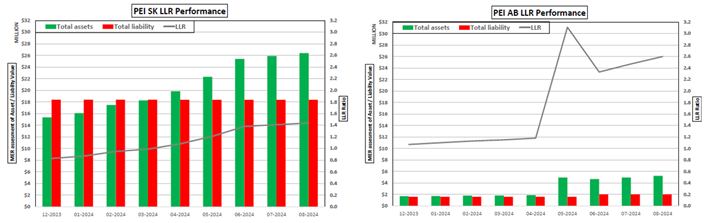

Regulator License Liability Rating - Asset to liability ratio was elevated by PEI restructured efforts

- The Saskatchewan regulator assessed the company's asset value 18MM$ higher due to the changes implemented

- The asset to liability ratio has increased from 0.47 to 1.44 in Saskatchewan

- The asset to liability ratio has increased from 0.90 to 2.60 in Alberta

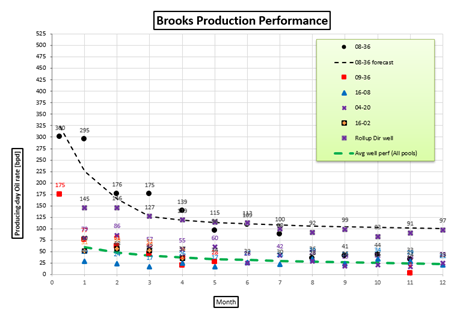

Diversify Production Mix - Acquired a 50% interest in Medium-oil development play and successfully perforated two existing wells with favorable results. In 2023, the first well was drilled, with initial production (IP) rates exceeding expectations. This led to attractive investment returns, with a payout achieved in just seven months.

In 2024, four development wells were drilled, encountering pay, structure, and oil shows as anticipated. The first medium-oil horizontal well encountered 800 meters of porous reservoirs with oil shown in the lateral section. The well test demonstrated strong inflow, producing over 50 m³/d of fluid at 50% oil cuts. The oil quality is 26-30-degrees API. This well is now online and delivering consistent rates as it is stabilizing.

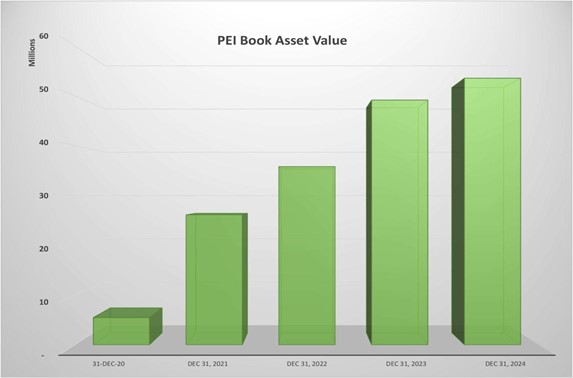

Financial Position Appreciation - Netbook value (Total assets) has increased from $5.5 million in 2020 to approximately $59.0 million by the end of Q3 2024. This growth was driven by capital raised ($35MM) and cash flow from operations ($7MM), both of which were deployed for optimization and development. Additional value appreciation resulted from an impairment reversal, supported by the substantiation of remaining reserve value ($8 million) and the capitalization of a working interest acquisition ($3 million). Since 2021, the total asset value has been appreciated by $53+ million.

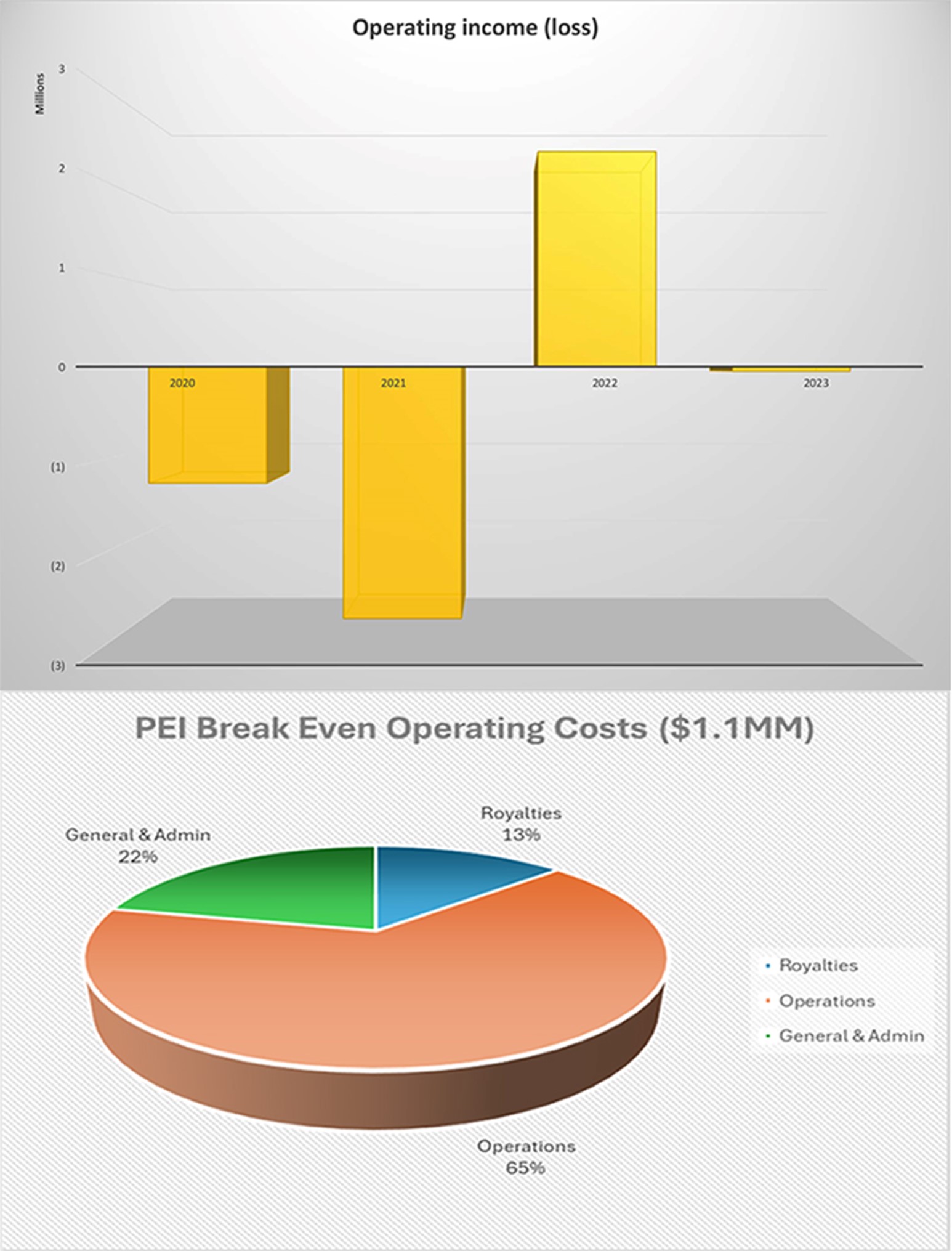

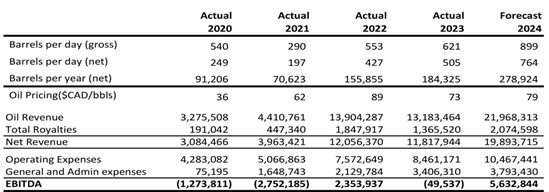

Due to capital deployed for optimization, non-compliance elimination, infrastructure upgrades and development aimed at increasing production and recoveries, the company is beginning to see operational profitability. 2022 saw production increased and, if not for the lower commodity prices in 2023, the company would have been profitable in 2022. Nonetheless, 2022 was a rebound year, generating $2.3 million in operating income compared to a substantial loss the previous year. With ongoing production optimization and development, Prospera has achieved approximately $2.6 million in cash operating income as of Q3, 2024.

The restructuring efforts have transformed the company into cash-flow-positive operation. Prospera's bare bones break-even operating expenses are $1.1 million per month (500 boe/d @ $75/boe CAD). Any cash flow above this break-even amount is allocated to servicing debt, addressing legacy arrears and further funding, optimization and development initiatives.

With current production levels around 900 boe/d, the company has generated $2.6 million year to date Q3, 2024.

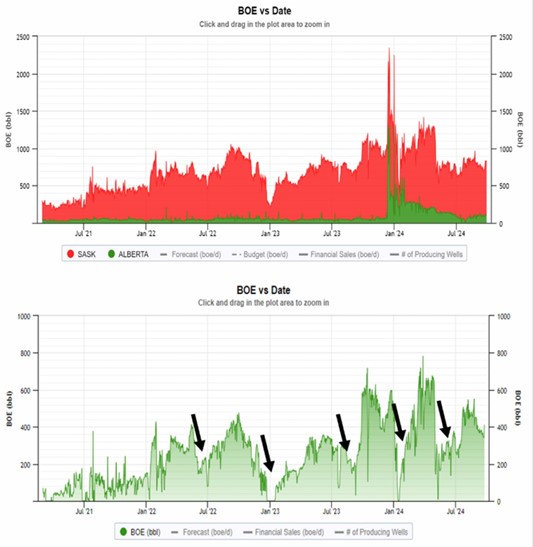

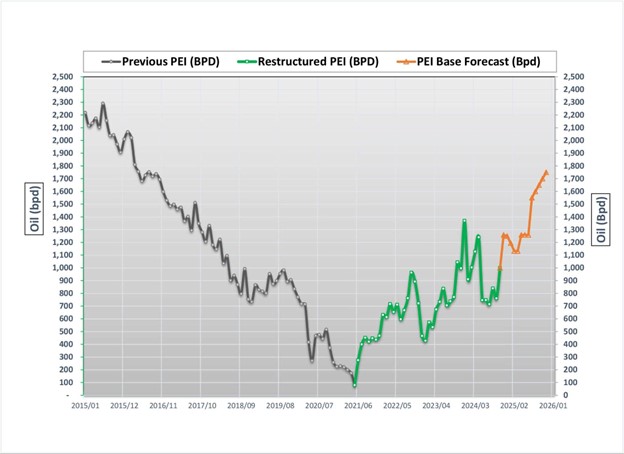

Production Appreciation & Challenges - PEI's restructuring efforts successfully optimized production from 80 boepd to 800 boepd during the phase one execution. By the end of 2023, peak production rates reach 1,800 boepd driven by horizontal development and medium oil development.

While the restructuring yielded positive results, Prospera production progress and forecast were impacted by operational set-back and by severe cold weather conditions. These issues hindered expected production rates, preventing the company from achieving its short-term production and financial targets.

PEI has continually implemented measures to address operational constraints, and restore and maintain peak production rates. These include failure analysis, calibrated equipment, revised operational procedures, and accountability for accurate and timely data to maximize run time with experienced personnel. As a result, Cuthbert operations are starting to stabilize while challenges are being addressed. Approximately 70+ m3/d of production is currently behind pipe at Cuthbert, and PEI is focused on capturing this additional volume.

Revised 2024 Prospera Forecast

Following a challenging recalibration, Prospera has expressed optimism going forward, however, PEI has faced a series of challenges including cold weather conditions, infrastructure breakdown, water recycling issues, legacy arrears, non-participating JV partners, and lower commodity prices. These factors have unexpectedly delayed the company's timeline for attaining the initially projected targets.

The legacy reservoirs are now in the final stages of primary pressure depletion and require additional energy in-situ to increase the mobility of the viscous oil. Enhanced recovery methods suited to the specific reservoir conditions must be applied gradually and methodically to maximize oil recovery, which will take time. PEI has initiated horizontal transformation while testing the recovery methods to be applied to the future horizontal wells while modifying necessary infrastructure adjustments. With the benefit of new information, extensive data, and a revised plan, Prospera has reassessed and incorporated the challenges and setback into the company's updated forecast moving forward.

Prospera has achieved many technical and financial successes, these accomplishments have been overshadowed by production shortfalls set out by optimistic early targets. Moving forward, PEI's primary focus is on efficient operations to ensure sustained, stable production and production growth.

Conclusion

Prospera Energy Inc. has come a long way since the brink of bankruptcy in Q1, 2021. Through a successful restructuring, PEI has eliminated the risk of insolvency, addressed critical regulatory non-compliances, and raised regulator license liability ratings by increasing production through optimization and development. The company has also substantiated the large amount of remaining reserves and substantially increased the proven asset value of the company. By improving cash flow from operations well above break-even, PEI has remained operational while deploying capital to address legacy accounts payable arrears and implement proven technical applications. Additionally, the acquisition of medium-oil assets has reduced dependency on heavy-oil differentials.

In short, Prospera have made significant progress in positioning the company for future growth. However, PEI achievements have been overshadowed by production short fall set out by optimistic targets by optimization and drilling success. Prospera acknowledges these challenges encountered and has incorporated them into the revised 2024 forecast, to allocate sufficient time and resources to improve operational efficiencies, optimize well run times, and implement reservoir management applications while adhering to safety & regulatory guidelines. These proactive measures are being implemented in Q4 2024 and Q1 2025 to stabilize and support robust, sustained growth throughout Q2 and Q3 of 2025.

While the company is revising the year-end production target down to 1,250 barrels, it is important to emphasize that the fundamentals of Prospera Energy's assets remain strong. The significant recovery potential remains within reach, and PEI continues to execute on our long-term development plan to capitalize on these opportunities. The reduction in short-term targets does not diminish the company's confidence in the strategic path forward. Prospera remains focused on optimizing production, improving efficiency, and unlocking the full value of PEI's resources. As Prospera moves ahead, the company is committed to increasing production through optimization, horizontal transformation, and enhanced oil recovery.

About Prospera

Prospera is a publicly traded energy company based in Western Canada, specializing in the exploration, development, and production of crude oil and natural gas. Prospera is primarily focused on optimizing hydrocarbon recovery from legacy fields through environmentally safe and efficient reservoir development methods and production practices. Prospera was restructured in the first quarter of 2021 to become profitable and in compliance with regulatory, environmental, municipal, landowner, and service stakeholders.

The company is in the midst of a three-stage restructuring process aimed at prioritizing cost effective operations while appreciating production capacity and reducing liabilities. Prospera has completed the first phase by optimizing low hanging opportunities, attaining free cash flow, while bringing operation to safe operating condition, all while remaining compliant. Currently, Prospera is executing phase II of the restructuring process, the horizontal transformation intended to accelerate growth and capture the significant oil in place (400 million bbls). These horizontal wells allow PEI to reduce its environmental and surface footprint by eliminating the numerous vertical well leases along the lateral path. Phase III of Prospera's corporate redevelopment strategy is to optimize recovery through EOR applications. Furthermore, Prospera will pursue its acquisition strategy to diversify its product mix and expand its core area. Its goal is to attain 50% light oil, 40% heavy oil and 10% gas.

The Corporation continues to apply efforts to minimize its environmental footprint. Also, efforts to reduce and eventually eliminate emissions, alongside pursuing innovative ESG methods to enhance API quality, thereby achieving higher margins and eliminating the need for diluents.

For Further Information:

Shawn Mehler, PR

Email: investors@prosperaenergy.com

Website: www.prosperaenergy.com

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements relating to the future operations of the Corporation and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "will," "may," "should," "anticipate," "expects" and similar expressions. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding future plans and objectives of the Corporation, are forward-looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements.

Although Prospera believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because Prospera can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, risks associated with the oil and gas industry in general (e.g., operational risks in development, exploration and production; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses, and health, safety and environmental risks), commodity price and exchange rate fluctuations and uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital expenditures.

The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of Prospera. As a result, Prospera cannot guarantee that any forward-looking statement will materialize, and the reader is cautioned not to place undue reliance on any forward- looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release, and Prospera does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by Canadian securities law.

Neither TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/0b193b58-7798-4139-b69d-1f8aec58a8f7

https://www.globenewswire.com/NewsRoom/AttachmentNg/46e266dc-9f3f-43b1-a3f7-1f71bb526cce

https://www.globenewswire.com/NewsRoom/AttachmentNg/2d404ae6-c38e-40c3-910a-403f9376549f

https://www.globenewswire.com/NewsRoom/AttachmentNg/506b134d-3ce3-4639-9a61-f0caa42b633e

https://www.globenewswire.com/NewsRoom/AttachmentNg/b0ac6d1d-5ea5-4c86-b5b4-d49a72936f7b

https://www.globenewswire.com/NewsRoom/AttachmentNg/e14fb81b-462a-456d-99fa-e4a54a549e7d

https://www.globenewswire.com/NewsRoom/AttachmentNg/100176cb-60ba-45e8-9311-e94604dcd117

https://www.globenewswire.com/NewsRoom/AttachmentNg/8fc83e60-6686-4b8f-93e8-84598ec586a0

https://www.globenewswire.com/NewsRoom/AttachmentNg/6c20cd2d-ef07-41b7-9149-5d80f7288b16

https://www.globenewswire.com/NewsRoom/AttachmentNg/fb37dc99-2c7f-4db1-bcab-a3807af55016