- Profit from property management for the period amounted to SEK 4,838m (5,009). Profit from property management attributable to the parent company's shareholders amounted to SEK 4,486m (4,683m), corresponding to a decrease per share by 5% to SEK 3.84 (4.06).

- Long term net asset value amounted to SEK 85.60 per share (89.74).

- Rental income amounted to SEK 9,543m (8,855).

- Profit after tax attributable to the parent company's shareholders amounted to SEK -117m (-1,978) corresponding to SEK -0.10 per share (-1.71).

Profit from property management for the period amounted to SEK 4,838m (5,009). Profit from property management attributable to the parent company's shareholders amounted to SEK 4,486m (4,683), corresponding to a decrease per share of 5% to SEK 3.84 (4.06). Profit from property management includes SEK 1,524m (1,425) in respect of associated companies.

Net profit after tax for the period amounted to SEK 192m (-2,486). Profit after tax attributable to the parent company's shareholders amounted to SEK -117m (-1,978), corresponding to SEK -0.10 per share (-1.71). Profit before tax was impacted by unrealised changes in the value of investment properties of SEK -825m (-5,995m), realised changes in the value of investment properties of SEK 5m (6), profit from the sale of development properties SEK 51m (337), changes in value in interest rate derivatives and option component convertible of SEK -1,677m (212) and profit from participations in associated companies of SEK -132m (-989).

"We continue to see a healthy trend in rental income and net operating income, with both increasing by 8% compared to last year, in spite of a minor currency headwind," comments CEO Erik Selin and continues.

"The stable increase in Balder's earning capacity is a consequence of our diversification and our ability to create added value through capital allocation, which is an important cornerstone in the company's strategy. But in times like these, when some segments are a bit more challenging, and the importance of cost control is extremely high, our dedicated coworkers also truly make a difference. I believe this is evident in how we are performing versus the overall market."

Presentation of Balder's Interim report

On 25 October at 08:45 (CET), Balder's CEO Erik Selin, CFO Ewa Wassberg and IR Jonas Erikson will be hosting an online presentation and telephone conference. The presentation will be held in English, and during the telephone conference there will be an opportunity for representatives from the financial market to ask questions.

Follow the webcast at https://ir.financialhearings.com/fastighets-ab-balder-q3-report-2024.

Please register here to be able to ask questions during the conference call. Once you have registered, you will be sent a phone number and a conference ID.

Questions from the media are referred to Media Relations at press@balder.se.

The recorded presentation and telephone conference will subsequently be made available here.

For further information, please contact:

Jonas Erikson, IR, tel. +46 (0)76-765 50 88, jonas.erikson@balder.se

Ewa Wassberg, CFO, tel. +46 (0)31-351 83 99, ewa.wassberg@balder.se

Erik Selin, CEO, tel. +46 (0)31-10 95 92, erik.selin@balder.se

This is information that Fastighets AB Balder (publ) is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 08.00 CET on October 25, 2024.

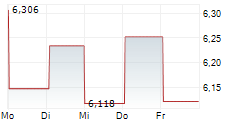

Fastighets AB Balder (publ) is a listed property company that owns, manages and develops residential and commercial properties in Sweden, Denmark, Finland, Norway, Germany and the United Kingdom. The head office is located in Gothenburg. As of 30 September 2024, the property portfolio had a value of SEK 215.3 billion. The Balder share is listed on Nasdaq Stockholm, Large Cap.