Company Announcement No. 12 - 2024

*Contains inside information*

Revenue

Donkey Republic achieved record revenue of DKK 51.0M in Q3, representing a 25% increase year-over-year. This strong performance was driven by a combination of factors, including a larger fleet, increased fleet utilization, and the successful ramp-up of subsidized operations. In the Antwerp area, for example, where around 2,900 bikes are operated, bike utilization significantly improved, demonstrating the growth and impact potential of subsidized operations.

EBITDA

Q3 EBITDA reached DKK 17.6M, an increase of nearly 60% compared to last year. This means that approximately two-thirds of the revenue increase reached the EBITDA line. Profitability was impacted by increased operating costs associated with ensuring the long-term functionality of the bike fleet. This is reflected in the company's Geneva operation where thanks to these measures the availability of the local fleet of close to 1,500 bikes have increased significantly.

Guidance

With increased visibility on year-end results, Donkey Republic is adjusting its full-year guidance. Revenue guidance is narrowed to DKK 135M-145M and EBITDA guidance to DKK 16M-21M.

EBIT guidance is adjusted to DKK -4M to +1M, reflecting lower than anticipated fleet growth and significant one-time investments to enhance bike quality. These investments, while impacting short-term profitability, support long-term growth and an improved rider experience.

Despite this adjustment, Donkey Republic projects a revenue increase of DKK 20M - 30M compared to 2023, resulting in a year-over-year EBIT improvement of DKK 6.6M to 11.6M.

Donkey Republic revised guidance for 2024:

- Revenue: DKK 135M-145M (growth rate of 17%-26% compared to 2023)

with original guidance being DKK 135M-160M - EBITDA: DKK 16M-21M (growth rate of 68%-142% compared to 2023)

with original guidance being DKK 15M-30M - EBIT: DKK -4M-+1M (growth rate not applicable)

with original guidance being DKK 0M-5M

Fulfillment of the guidance for 2024 depends on the key drivers and assumptions put forth in the 2023 Annual Report.

Forward-looking statements

Statements about the future reflect Donkey Republic's current expectations for future events and financial results. The nature of these statements is affected by risk and uncertainties. Therefore, the company's actual results may differ from the expectations expressed in this company announcement.

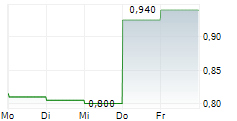

KEY PERFORMANCE INDICATORS Q3-2024 (01 July 2024 - 30 September 2024)

| Metric | Total for Q3-2024 | Compared to Q3-2023 |

| Total Revenue | DKK 51.0M | +25% |

| EBITDA | DKK 17.6M | +60% |

| Monthly revenue per bike | DKK 785 | +15% |

| Riders | 346k | +32% |

| Trips | 3.2M | +28% |

| Fleet size (active bikes) | 21.7k | +9% |

CONTACT INFORMATION

DonkeyRepublic Holding A/S

Skelbækgade 4, trappe B, 4. sal.

1717 København V

www.invest.donkey.bike

Niels Henrik Rasmussen, CEO

investor@donkeyrepublic.com

Subscribe to the company announcements at:

https://invest.donkey.bike/donkey-republic-company-news/

Financial and Certified Adviser:

Certified Adviser

Grant Thornton Denmark,

Direct (+45) 35 27 50 11

About Donkey Republic

Founded in 2014, Donkey Republic is a Danish purpose driven impact company active in the micro mobility industry. Donkey Republic provides a flexible, affordable and more sustainable way of transportation to the citizens by partnering with the cities.

Donkey Republic is a data driven technology company facilitating bike sharing, and we are able to provide cities and citizens a reliable bike sharing service. Sustainably at its core integrates with the city's public transportation system, by pursuing innovation Donkey Republic develops end-to-end products and services that solve city and riders problems. Riders are able to enjoy a more convenient and high quality ride, with our bike and ebike fleet, designed for durability and optimal maintenance through our servicing software platform. This collaborative dedicated software solution together with our bikes, seeks to improve people's health & well-being, the environment, reducing traffic congestion across cities as well as public space optimisation.

Donkey Republic is a publicly traded company listed on the Nasdaq First North Growth Market. The company was listed in 2021 to onboard investors and support its growth and expansion into the European Market, and to continue securing its foothold and developing its market position in the European Micro mobility space. With thousands of Donkey bikes successfully implemented, Donkey Republic aims to grow its business and fulfill its vision of making urban city life quality better through responsible bike sharing.