9-MONTH REVENUE SHOWING A SLIGHT DECLINE OF 2.0% FOLLOWING 52.3% GROWTH IN 2023

STRONG COMMERCIAL MOMENTUM MITIGATING SHIFT EFFECTS IN SALES

HIGH VISIBILITY AND SOLID ORDER BACKLOG IN AEROSPACE FOR 2025

CONFIRMATION OF A SUSTAINABLE PROFITABILITY MODEL

VALIDATION OF TECHNICAL ADVANCEMENTS IN THE "ENGINE CONTROL" PROGRAM, SUPPORTING THE PROFITABLE GROWTH OBJECTIVES OF THE 4G 2026 PLAN

HEADING TOWARDS 2025!

INVESTOR WEBINAR

MONDAY, OCTOBER 28 AT 6:00 PM

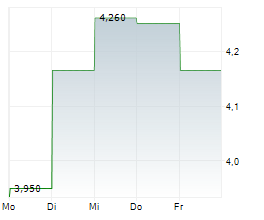

- Quarterly consolidated revenue at EUR 2,626 thousand (vs. EUR 3,011 thousand in Q3 2023)

- 9-month consolidated revenue of EUR 9,901 thousand with a very limited decrease of 2.0%, following a high baseline (52.3% growth as of September 30, 2023)

- Revenue strongly supported by new business offsetting revenue delays from 3 significant customers (4th, 5th and 6th customers in 2023)

- Sustainable profitability model confirmed

- Quarterly adjusted EBITDA1 of EUR 369 thousand (14.0% of consolidated revenue) and EUR 1,778 thousand (18.0% of consolidated revenue) over 9 months

- Quarterly operating profit of EUR 210 thousand (8.0% of consolidated revenue) and EUR 1,109 thousand over 9 months (11.2% of consolidated revenue)

- Group's net profit of EUR 1,170 thousand over 9 months (11.8% of consolidated revenue)

- Significant technical advancements related to the "Engine Control" development and industrialization program

- High visibility in aerospace business for 2025

- The Group remains confident in achieving the profitable growth objectives defined by the 4G Plan by 2026.

- Investor webinar: Monday, October 28 at 6:00 PM

Registration link: https://app.livestorm.co/euroland-corporate/memscap-webinaire-actionnaires?s=de932fe9-2197-4d41-803b-10d138711ecb

Regulatory News:

MEMSCAP (Euronext Paris: MEMS), leading provider of high-accuracy, high-stability pressure sensor solutions for the aerospace and medical markets using MEMS technology (Micro Electro Mechanical Systems), today announced its earnings for the third quarter of 2024 ending September 30, 2024.

Analysis of consolidated revenue

Consolidated revenue from continuing operations (non-audited) for the third quarter of 2024 was EUR 2,626 thousand compared to EUR 3,011 thousand for the third quarter of 2023.

The distribution of consolidated revenue from continuing operations by market segment for the third quarter of 2024 and for the first 9 months of 2024 is as follows:

Market segments Revenue

| Q3 2023 (3 months) | Q3 2023

| Jan.-Sept. 2023 (9 months) | Jan.-Sept. 2023

| Q3 2024

| Q3 2024

| Jan.-Sept. 2024 (9 months) | Jan.-Sept.

|

Aerospace | 1,963 | 65% | 6,478 | 64% | 1,569 | 60% | 6,468 | 65% |

Medical | 814 | 27% | 2,523 | 25% | 769 | 29% | 2,432 | 25% |

Optical communications | 209 | 7% | 1,007 | 10% | 273 | 10% | 940 | 9% |

Others (Royalties from licensed trademarks) | 25 | 1% | 92 | 1% | 16 | 1% | 61 | 1% |

Total revenue from continuing operations | 3,011 | 100% | 10,100 | 100% | 2,626 | 100% | 9,901 | 100% |

(Any apparent discrepancies in totals are due to rounding.)

The 9-month sales reached EUR 9,901 thousand, showing a very limited decrease of 2.0%, despite a particularly challenging baseline, as MEMSCAP achieved revenue growth of 52.3% over the first 9 months of 2023 compared to 2022. This trend of strong growth continued for the majority of MEMSCAP's customers, contributing more than EUR 1,315 thousand in growth (first 9 months of 2024 vs. 2023), except for 3 main customers (the Group's 4th, 5th, and 6th largest customers in 2023) whose revenues were significantly below the normative level due to supply chain pressures. These 3 customers, with a decrease in sales of EUR 1,549 thousand (first 9 months of 2024 vs. 2023), offset the entire growth and resulted in this slight decline.

The average 9-month growth rate over the 2022-2024 period is over 22%.

Considering the 2025 order backlog in aerospace, and particularly from one of these 3 clients, this delay impact is considered temporary.

Sales levels in the optical communications and royalties from licensed trademarks segments remained stable. Revenue distribution by segment for the first 9 months of 2024 were in line with the previous period.

Analysis of consolidated income statement

MEMSCAP's consolidated earnings for the third quarter of 2024 and the first 9 months of 2024 are given within the following table:

In thousands of euros Non-audited | Q3 2023

| Jan.-Sept. 2023

| Q3 2024

| Jan.-Sept. 2024

|

Revenue from continuing operations | 3,011 | 10,100 | 2,626 | 9,901 |

Cost of revenue | (1,723) | (5,754) | (1,489) | (5,828) |

Gross margin | 1,288 | 4,346 | 1,138 | 4,073 |

% of revenue | 42.8% | 43.0% | 43.3% | 41.1% |

Operating expenses | (787) | (2,688) | (927) | (2,965) |

Operating profit (loss) | 500 | 1,659 | 210 | 1,109 |

Financial profit (loss) | (196) | (172) | (27) | 84 |

Income tax expense | (1) | (49) | (6) | (23) |

Net profit (loss) | 304 | 1,437 | 178 | 1,170 |

* Net of research development grants.

(Any apparent discrepancies in totals are due to rounding.)

The gross margin rate, representing 43.3% of consolidated revenue compared to 42.8% in the third quarter of 2023, increased by 0.5 percentage point. The gross margin thus amounted to EUR 1,138 thousand compared to EUR 1,288 thousand for the third quarter of 2023.

Operating expenses, net of research and development grants, amounted to EUR 927 thousand compared to an amount of EUR 787 thousand for the third quarter of 2023.

For the third quarter of 2024, the Group posted an operating profit from continuing operations of EUR 210 thousand (8.0% of consolidated revenue) compared to an operating profit of EUR 500 thousand (16.6% of consolidated revenue) for the third quarter of 2023.

The net financial loss for the third quarter of 2024 was EUR 27 thousand compared to EUR 196 thousand for the third quarter of 2023 which was mainly affected by an unfavourable exchange rate effect. The tax expense recognized over the third quarters of 2024 and 2023 corresponded to the change in deferred tax assets. This tax expense is a non-cash item.

The Group therefore reported a net profit EUR 178 thousand in the third quarter of 2024 (6,8% of consolidated revenue) compared to a net profit of EUR 304 thousand in the third quarter of 2023 (10.1% of consolidated revenue).

MEMSCAP posted an adjusted EBITDA1 of EUR 369 thousand for the third quarter of 2024 (14.0% of consolidated revenue) and EUR 1,778 thousand for the first 9 months of 2024, representing 18.0% of consolidated revenue (EUR 616 thousand for the third quarter of 2023 and EUR 2,293 thousand for the first 9 months of 2023, representing 22.7% of consolidated revenue). It is noted that research and development costs were fully recognized as expenses during this 9-month period and were not capitalized in the Group's balance sheet.

1 Adjusted EBITDA means operating profit before depreciation, amortisation, and share-based payment charge (IFRS 2) and including foreign exchange gains/losses related to ordinary activities.

The current 9-month period demonstrates the strength of MEMSCAP's business model, whose foundations ensure a significant and sustainable level of profitability.

Perspectives

In this quarter, the Group validated major technical advancements in the "Engine Control" development and industrialization program, marking a major milestone in implementing an important growth driver.

This significant progress, combined with very encouraging business prospects, strengthens MEMSCAP's confidence in achieving its profitable growth objectives outlined in the 4G Plan by 2026.

Shareholders and investors video conference Monday, October 28, 2024 at 06:00 p.m.

Thank you for registering and sending your questions in advance using the following link:

https://memscap.com/fr/visio/

Q4 2024 revenue and earnings: January 27, 2025.

About MEMSCAP

MEMSCAP is a leading provider MEMS based pressure sensors, best-in-class in term of precision and stability (very low drift) for two market segments: aerospace and medical.

MEMSCAP also provides variable optical attenuators (VOA) for the optical communications market.

For more information, visit our website at:

www.memscap.com

MEMSCAP is listed on Euronext Paris (Euronext Paris Memscap ISIN code: FR0010298620 Ticker symbol: MEMS)

View source version on businesswire.com: https://www.businesswire.com/news/home/20241028398863/en/

Contacts:

Yann Cousinet

Chief Financial Officer

Ph.: +33 (0) 4 76 92 85 00

yann.cousinet@memscap.com