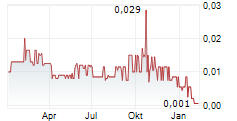

Toronto, Ontario, Oct. 28, 2024 (GLOBE NEWSWIRE) -- Ayurcann Holdings Corp. (CSE: AYUR, OTCQB: AYURF, FSE: 3ZQ0) ("Ayurcann" or the "Company"), a leading Canadian processing and manufacturing company specializing in cannabis 2.0 and 3.0 products, is pleased to announce its financial and operational results for the year ended June 30, 2024, the highlights of which are included in this news release. All figures are reported in Canadian dollars. The Company's full set of consolidated audited financial statements for the years ended June 30, 2024 and 2023 and accompanying management's discussion and analysis can be accessed by visiting the Company's website at www.ayurcann.com and its profile page on SEDAR+ at www.sedarplus.ca.

GROWING MARKET

The recreational cannabis market in Canada continues to thrive, with retail sales reaching $4.4 billion for the twelve-month period ending in July 2024, according to Statistics Canada. Since legalization, the market has shown a clear upward trajectory year after year.

AYURCANN: A LEADING FORCE IN CANADIAN CANNABIS

Ayurcann has firmly established itself as one of the top performers in Canada's cannabis landscape, demonstrating exceptional growth and resilience. Starting in 2020, the Company has rapidly scaled its operations, achieving a remarkable 100% year-over-year growth for the past three years. With just four years in the industry, Ayurcann has proven to have the ability to navigate a highly competitive and regulated industry.

POWERFUL PRESENCE NATIONSWIDE

Ayurcann's reach spans the entire country, with its products available in over 70% of retail cannabis stores across Canada.3 The Company has built a formidable distribution network, ensuring its offerings are available to consumers from coast-to-coast. This expansive footprint has been a major catalyst for the Company's rapid revenue growth and its ability to scale effectively in a competitive marketplace.

LEADING IN ONTARIO: CANADA'S LARGEST MARKET

Ontario, the largest market for cannabis sales in Canada, is where Ayurcann's influence is particularly strong. The Company enjoys over 83% market penetration in the province, with its products carried in more than 1,300 retail stores.3 Ayurcann's strong relationships with provincial boards and retailers, combined with the vast consumer base in Ontario, have enabled the company to capture significant market share and cultivate a loyal customer following.

With a clear strategy and a commitment to excellence, Ayurcann continues to be a dominant force in Canada's cannabis industry, poised for even greater success in the years ahead.

FINANCIAL HIGHLIGHTS FOR THE YEAR ENDED JUNE 30, 2024

- Gross revenue increased to $45,265,235 for the fiscal year ended June 30, 2024 (compared to $22,371,604 in 2023), representing an increase of 100%.

- Grew our product offerings to 80 stock keeping units ("SKUs") across the country.

- Operating company Adjusted EBITDA1 was $1,032,075 for the period (compared to -$1,315,672 an increase of $2,347,748).

- The #1 producer of Vapes in Ontario2, and top 5 pre-roll manufacturer by volume in Ontario2 during the period.

"As the cannabis industry continues to mature in Canada, we are thrilled to witness the steady growth of our revenues across the country. Despite the challenges posed by an increasingly competitive environment and retail price compression, Ayurcann's business-to-consumer focus has enabled us to expand our market share in multiple provinces.

With over 70% penetration in dispensaries and a diverse range of 80 products across vape, concentrate, and flower categories, the success of our in-house brands has been transformative for Ayurcann3. We're proud to have made a lasting impact in the market, continuing to build on our growth trajectory," said Igal Sudman, Chief Executive Officer of Ayurcann.

Operational Highlights for the Year Ended June 30, 2024:

- 30,500 Product Listings across dispensaries in Ontario, New Brunswick, Manitoba, Saskatchewan, Alberta, British Columbia, Newfoundland, and Yukon.

- Continuous innovation and introduction of new product offerings, showcasing Ayurcann's reliability and value.

- Strong demand for Ayurcann's products and brands across Canada.

- Exploration of new national and international opportunities for our brands.

- Building and nurturing strong partnerships, a trusted reputation, and robust industry relationships; and

- Ongoing investment in operations, supply chain optimization, and overall efficiency to fuel future growth.

"With a clear vision and a commitment to innovation, we are excited about the path ahead and look forward to continuing to deliver value to our customers and stakeholders," added Igal Sudman, Chief Executive Officer of Ayurcann.

For further information, please contact:

Igal Sudman, Chairman and Chief Executive Officer

Ayurcann Holdings Corp.

Tel: 905-492-3322

Email: info@ayurcann.com

1 Earnings before interest, taxes, depreciation, and amortization ("EBITDA") and adjusted EBITDA. These measures do not have a standardized meaning prescribed by International Financial Reporting Standards ("IFRS") and are, therefore, unlikely to be comparable to similar measures presented by other issuers. Non-IFRS measures provide investors with a supplemental measure of the Company's operating performance and, therefore, highlight trends in the Company's core business that may not otherwise be apparent when relying solely on IFRS measures. Management uses non-IFRS measures in measuring the financial performance of the Company.

2 Based on Ontario Cannabis Store Data, as of June 30, 2024.

3 Based on Trellis Insights June 30, 2024.

Investor Relations:

Email: ir@ayurcann.com

About Ayurcann:

Ayurcann is a leading post-harvest solution provider with a focus on providing and creating custom processes and pharma grade products for the adult use and medical cannabis industry in Canada. Ayurcann is striving to become a partner of choice for leading Canadian cannabis brands by providing best-in-class, proprietary services including ethanol extraction, formulation, product development and custom manufacturing.

For more information about Ayurcann, please visit www.ayurcann.com and its profile page on SEDAR+ at www.sedarplus.ca.

Neither the Canadian Securities Exchange nor its Regulation Services Provider have reviewed or accept responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of applicable securities laws. All statements contained herein that are not clearly historical in nature may constitute forward-looking statements. Generally, such forward-looking information or forward-looking statements can be identified by the use of forward-looking terminology such as "plans", "strategy", "expects" or "does not expect", "intends", "continues", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or may contain statements that certain actions, events or results "will be taken", "will launch" or "will be launching", "will include", "will allow", "will be made" "will continue", "will occur" or "will be achieved". The forward-looking information and forward-looking statements contained herein include, but are not limited to, statements regarding: the growth trajectory of the Company; the Company continuing to grow its revenue and building on its growth trajectory; the Company achieving greater success in the years ahead; the Company continuing to deliver value to its customers and stakeholders; and the ability of the Company to become the partner of choice for leading Canadian and international cannabis brands.

Forward-looking information in this news release are based on certain assumptions and expected future events, namely: the Company will expand and be able to maintain production capacity; continued approval of the Company's activities by the relevant governmental and regulatory authorities; the continued growth of the Company and Canadian cannabis market; the Company's successful implementation of its strategy to expand market share in cannabis industry; the Company's continuing ability to meet the requirements necessary to remain listed on the Canadian Securities Exchange and alternative exchanges; the Company selling its products in compliance with applicable laws and regulations; the Company successfully distributing the new SKUs; the Company growing its exposure, consumer and retail partnerships and securing additional product listings and market share throughout the country; Ayurcann maintaining a continuous path of growth; the Company's in-house brands having an impact on the future development of Ayurcann; the Company maintaining and creating new relationships with retail distributors; the Company will continue growing its revenue and building on its growth trajectory; the Company will achieve greater success in the years ahead; the Company will continue to deliver value to its customers and stakeholders; and the Company becoming the partner of choice for leading Canadian and international cannabis brands.

These statements involve known and unknown risks, uncertainties and other factors, which may cause actual results, performance or achievements to differ materially from those expressed or implied by such statements, including but not limited to: the Company's inability to expand and/or maintain production capacity; the potential inability of the Company to continue as a going concern; the risks associated with the cannabis industry in general; increased competition in the cannabis extraction market; the potential future unviability of the cannabis market; risks associated with potential governmental and/or regulatory action with respect to the cannabis industry; the Company's inability to obtain continued regulatory approvals; the Company's inability to meet the requirements necessary to remain listed on the Canadian Securities Exchange and alternative exchanges; the Company's inability to sell its cannabis flower products pursuant to applicable laws and regulations; the Company's inability to grow and/or increase sales and/or in-house brands; the Company's inability to secure funds for the integration, development and distribution of new and existing SKUs; the Company's inability to secure additional product listings and grow its market share across the country; the Company's inability to secure additional partnerships; risk that the Company and/or Canadian cannabis market will not continue to grow; the Company will be unable to achieve greater success in the years ahead; the Company will be unable to deliver value to its customers and/or stakeholders; and the Company's inability to become the partner of choice for leading Canadian and international cannabis brands.

Readers are cautioned that the foregoing list is not exhaustive. Readers are further cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the plans, intentions, or expectations upon which they are placed will occur. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated.

Forward-looking statements contained in this news release are expressly qualified by this cautionary statement and reflect the Company's expectations as of the date hereof and are subject to change thereafter. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, estimates or opinions, future events, or results or otherwise or to explain any material difference between subsequent actual events and such forward-looking information, except as required by applicable law.