As part of the announced fund raise Divio is releasing preliminary financial numbers for the financial quarter ending 30th September 2024 (Q3).

Net sales grew by 8% year over year driven by deeper engagement of existing clients and new client subscriptions. MRR (monthly recurring revenues) increased by 39% over the same period primarily driven by the signing of a major Swiss Healthcare Company as announced on the 9th of September 2024. The consultancy engagement of the new contract, with ca 59 KUSD in additional monthly revenue, has not been included in the MRR KPI as it is classified as professional service revenue and operates with a low margin. As the project started at the end of the quarter, no material revenue has yet been recognized during the period.

Costs have been adjusted and remain stable compared to the same period last year, which is a result of keeping control over staffing and other external costs. The goal is to achieve additional cost reductions moving forward. This led to an EBITDA improvement of approximately 19% from -2.1 MSEK to -1.7 MSEK. EBIT improved from -3.6 MSEK (-3.3).

The total result for the period was -0.3 MSEK (-4.4) which was all attributed to improved FX gains on balance sheet items.

Cash position amounted to 1.2 MSEK awaiting some payments from customers, especially the first payment from the Swiss Healthcare Company as described above. The cash position includes 2.0 MSEK drawn under the loan facility entered with Levin Invest AB on the 9th of September 2024.

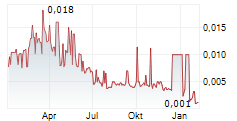

Divio recently announced a 100% guaranteed rights issue of MSEK 15.5 before issuance costs. The subscription price is SEK 0.12 per share and the subscription period is 29th October to 12th November 2024. This capital raise will strengthen the company's equity, providing funding until the next payment from Fidelity and positioning the company to reach cash flow positivity.

| Third quarter (3M) | Year to date (9M) | |||||||

| MSEK | 2024 | 2023 | % | 2024 | 2023 | % | ||

| Key Financials | ||||||||

| Subscription revenue | 5.3 | 4.8 | 10% | 15.1 | 13.6 | 11% | ||

| Professional services revenue | 0.1 | 0.1 | 0% | 0.6 | 1.1 | -45% | ||

| Net sales | 5.4 | 5.0 | 8% | 15.6 | 14.7 | 6% | ||

| Total revenue | 7.2 | 6.8 | 6% | 20.9 | 19.1 | 9% | ||

| Costs | -8.9 | -8.9 | 0% | -29.5 | -25.0 | -18% | ||

| EBITDA | -1.7 | -2.1 | 19% | -8.5 | -5.9 | -44% | ||

| Dep / Am | -1.6 | -1.5 | -7% | -4.7 | -4.5 | -4% | ||

| EBIT | -3.3 | -3.6 | 8% | -13.3 | -10.4 | -28% | ||

| Profit for the period | -0.3 | -4.4 | 93% | -12.8 | -9.8 | -31% | ||

| EPS before dilution (SEK) | -0.00 | -0.03 | - | -0.07 | -0.06 | - | ||

| MRR (KUSD) | 210 | 151 | 39% | |||||

| Cash position | 1.2 | 20.8 | -94% | |||||

Jon Levin, CEO of Divio, commented: "We are pleased to share our preliminary Q3 2024 numbers, which are in line with our expectations, showing an 39% increase in MRR. Our new enterprise customer lays the foundation for the next phase of Divio's growth and further validates the strength of our service offering."

The full Q3 quarterly report is scheduled to be released on 29th November 2024.

Press enquiries

For further information about Divio Technologies, please visit divio.com or contact CEO Jon Levin (ir@divio.com)

The company's Certified Adviser is FNCA Sweden AB.

About Divio Technologies

Divio Technologies AB (Publ) is the PaaS and Cloud Management Software development group behind the Divio platform, which simplifies cloud hosting, deployment and development via a PaaS solution. The platform allows enterprises to reduce costs, time to market and the burden on employees, as well as decreasing dependency on cloud vendors.

This information is information that Divio Technologies is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2024-10-28 23:05 CET.