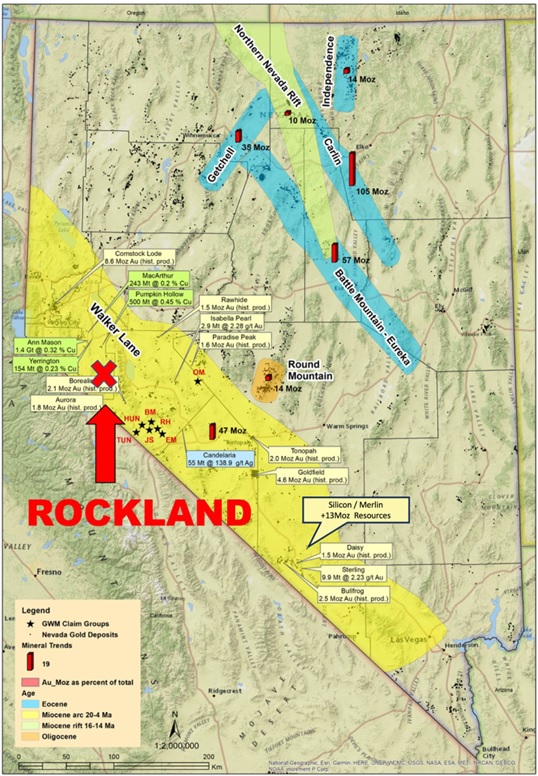

TORONTO, ON / ACCESSWIRE / October 29, 2024 / Wolfden Resources Corporation(WLF.V) ("Wolfden"or the"Company")is pleased to announce that it has executed an option agreement to earn up to a 75% interest in the Rockland Property in the Walker Lane Trend of Nevada USA. Located just south of south of Yerington (Figure 1), the 1,054 hectare property is underlain by a large, robust, low-sulphidation, quartz-adularia epithermal gold-silver system with similar characteristics to the neighbouring high-grade Aurora** (Hecla Mining) and Bodie*** vein deposits. With drill permits in place, and obvious potential below previously drilled well mineralized targets, Wolfden is targeting a larger hydrothermal system similar to the Silicon discovery (Bullfrog District) by AngloGold, that is located further to the southeast along the same trend.

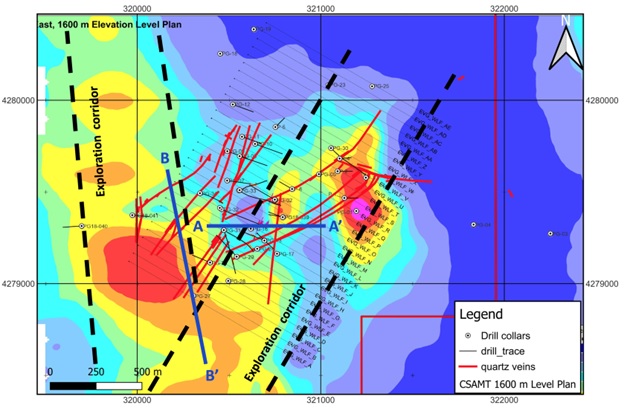

"The Rockland East target in our opinion represents one of the most exciting drill ready exploration targets in the Walker Lane Trend as it consists of 1) gold intercepts that returned to 1.0 g/t AuEq* over 146.4 metres (Figure 3) that ended in mineralization, 2) an historic bonanza-type Au-Ag mine is part of the property package, 3) multi-square kilometre scale, argillic to advanced argillic, rhyolite and basin-margin-debris-hosted alteration zones that are cut by quartz veins enriched in antimony, arsenic and gold, and 4) geophysical data that suggests zones where hydrothermal fluids upwelled and subsequently ponded, creating wide, lower grade gold zones that are interpreted to flank high-grade bonanza-type gold grades at depth, stated Don Dudek, VP Exploration for Wolfden." "These are the typical characteristics exhibited by some of the high quality gold deposits in the Walker Lane Trend. As part of our due diligence four rock and core assay reject (non-oxidized) samples containing from 1.0 g/t Au to 10.4 g/t Au were subjected to a 24-hr bottle roll cyanide leach using Leachwell as a catalyst; resulted in gold recoveries ranging from 85% to 98% and suggest the potential for good conventional gold recoveries. We look forward to being in a position to commence a minimum 5,000 foot core drill program before the end of the year by taking advantage of the previously approved drill program permitting."

As per the terms of the agreement with Evergold Corp (EVER.V), Wolfden must complete US$1.175 million in exploration expenditures, including a minimum of 5,000 feet (~1,500 m) of drilling, and make cash payments of up to US$600,000 over a period of three years to earn a 51% interest in the property by March 2028. Wolfden can elect to earn a 75% interest by completing a Pre-feasibility Study within 5 to 8 years and holds first rights of refusal on the remaining interest and royalties that can be purchased down to a 1.5% net smelter return. The terms of the transaction are subject to regulatory authorities and the TSX Venture exchange.

Wolfden is running a process to sell some of its large land holdings in the USA, with an estimated value that could finance the Rockland option drill program and cash payments. The drill program bond will be paid before year end followed by a cash payment to the mineral rights holder in Q1 that totals approximately US$200,000.

Technical Details

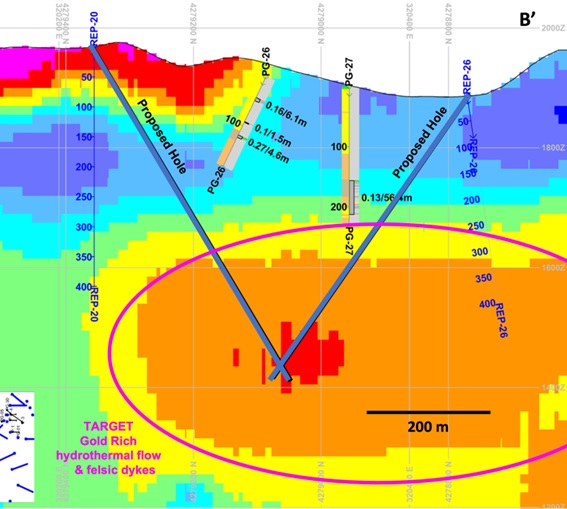

Drilling is planned to test the down-dip extension of a drill hole that returned 146 metres grading 1.0 g/t AuEq in hole 32 (see Figures 2 and 3). The hole 32 intercept lies along the northern edge of an 800 metre long, steep-west-dipping CSAMT anomaly which is interpreted to represent a northeast-trending structure, an area of increased felsic intrusions and an area where hydrothermal fluids upwelled into structural and stratigraphic targets. This interpretation is supported, in part, by a hyperspectral scan of rock chips from hole 32, which indicated an increase in potassium illite content, corresponding with higher temperature alteration, to the end of the hole. It is believed that hole 32 was stopped just above a bonanza-type gold system. The first hole, will be drilled from west to east and designed to intersect the interpreted mineralized system approximately 75 metres below hole 32. Depending on results and validation of the orientation of the mineralized system, another hole may be drilled to test the target area from east to west. This second hole could also determine if the interpreted mineralized system extends upward, closer to surface.

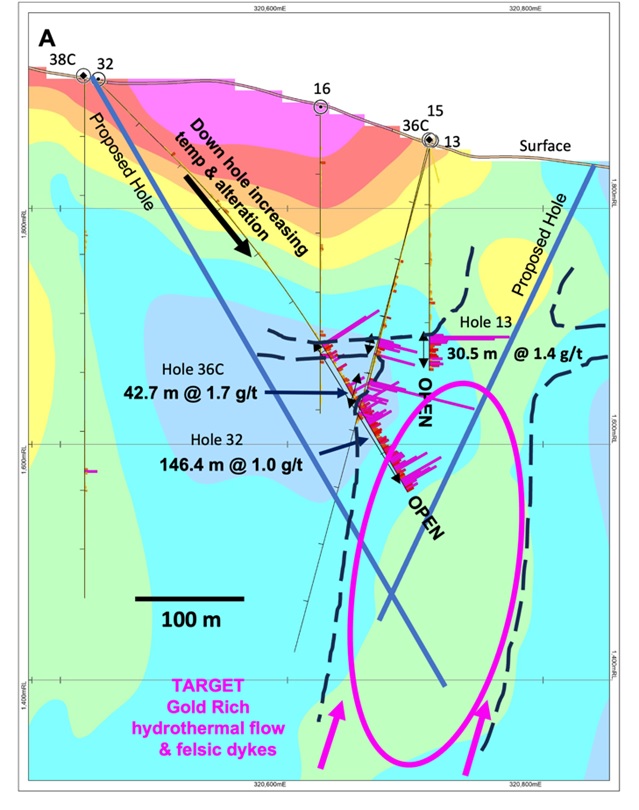

A second hole is proposed to test a large CSAMT anomaly) below an area of outcropping epithermal quartz-adularia veins that returned elevated antimony, arsenic and gold (see Figures 2 and 4). This anomaly has never been tested and is interpreted as a potential area where gold-enriched hydrothermal fluids ponded below silicified rhyolites. This large target area lies near the intersection of northerly- and northeast-trending CSAMT, high resistivity structures.

A third oriented core hole is proposed to test the base of the CSAMT resistivity high in an area of numerous epithermal quartz veins, an intersection area of quartz vein trends, an induced polarization chargeability anomaly and below hole 30 (Figure 2), which intersected 315 metres of anomalous (0.09 g/t average) gold mineralization.

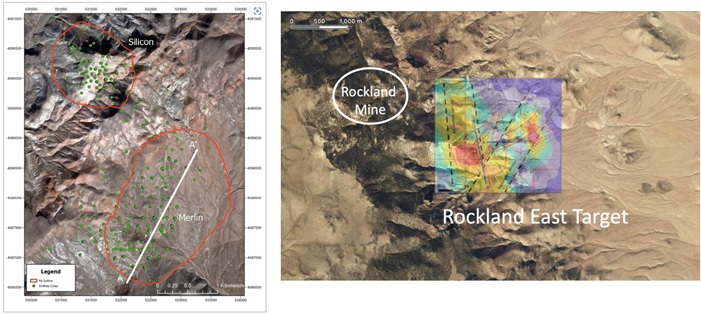

The overall size of the Rockland target area compares favorably with that of Anglo-Gold Ashanti's Silicon-Merlin deposit area located southeast of the property along Nevada's Walker Lane Trend (see Figure 5). Rockland comprises a large area of hydrothermal alteration cut by numerous quartz-adularia veins that display low to bonanza-type gold grades along with enriched arsenic and antimony levels that warrants additional drilling.

QAQC Comment

All grades over drilled length, were calculated from a validated drill database that includes work from several different companies. Holes 13, 15, 26 and 27 were completed in 1995 by a well-known international company and although there is no QAQC documentation available, it is assumed that the work and the laboratory used would have been of good industry standards and practices.

Holes 32 and 36C were drilled in 2006 and 2007 with a complete QAQC program that included reverse circulation samples of 9 kilograms on average, collected at five-foot intervals from a wet splitter. Occasional duplicate samples were taken in the same way. Control samples including standard pulps and crushed marble blanks were inserted into the sample sequence about one every 10 samples. The samples were prepared, and fire assayed for gold, and multi-element analysis by ALS Chemex at their laboratory in Sparks, Nevada. All drill core was HQ in size, photographed, logged, including RQD measurements and recovery prior to sampling. Sample intervals were typically chosen to follow actual core block/run intervals to a maximum of five feet of sample. Control samples including standard pulps and crushed marble blanks were inserted randomly in the sample number sequence to check and verify lab accuracy. The control samples were inserted at least one every tenth sample and more frequently in well mineralized zones.

About Wolfden

Wolfden is a North American exploration and development company focused on high-margin metallic mineral deposits including precious, base, and strategic metals. It has two nickel sulphide deposits in Manitoba one of the highest-grade polymetallic projects in the USA (Zn, Pb, Cu, Ag, Au) that represent significant development projects with the potential to be domestic sources of ethically produced base and critical metals in North America.

For further information please contact Ron Little, President & CEO, or Don Dudek, VP Exploration, at (807) 624-1136.

The information in this news release has been reviewed and approved by Don Dudek, VP Project Exploration, and Ron Little, P.Eng., President and CEO, both who are Qualified Persons under National Instrument 43-101.

* True width unknown. Used gold price of US$ 2000/oz and silver price of US$25/oz to calculate g/t AuEq

** https://www.hecla.com/exploration/nevada-usa

*** https://westernmininghistory.com/mine-detail/10310698/ and /10310374

Cautionary Statement Regarding Forward-Looking Information

This press release contains forward-looking information (within the meaning of applicable Canadian securities legislation) that involves various risks and uncertainties regarding future events, including the potential for projects to be domestic sources of ethically produced base and critical metals for the expansion of renewable energy in North America. Such forward-looking information includes statements based on current expectations involving a number of risks and uncertainties and such forward-looking statements are not guarantees of future performance of the Company, and include, without limitation, metal price assumptions, cash flow forecasts, permitting, land transactions, community and other regulatory approvals, and the timing and completion of exploration programs in the USA, Manitoba, New Brunswick and the respective drill results. There are numerous risks and uncertainties that could cause actual results and the Company's plans and objectives to differ materially from those expressed in the forward-looking information in this news release, including without limitation, the following risks and uncertainties: (i) risks inherent in the mining industry; (ii) regulatory and environmental risks; (iii) results of exploration activities and development of mineral properties; (iv) risks relating to the estimation of mineral resources; (v) stock market volatility and capital market fluctuations; and (vi) general market and industry conditions. Actual results and future events could differ materially from those anticipated in such information. This forward-looking information is based on estimates and opinions of management on the date hereof and is expressly qualified by this notice. Risks and uncertainties about the Company's business are more fully discussed in the Company's disclosure materials filed with the securities regulatory authorities in Canada at www.sedar.com. The Company assumes no obligation to update any forward-looking information or to update the reasons why actual results could differ from such information unless required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Figure 1. Rockland Property Location Map

Figure 2. Rockland East Drill Target Map with proposed holes on Sections A-A' and B-B'

Figure 3. Proposed Drill Holes on Rockland East Target CSAMT Cross Section A-A'

Figure 4. Proposed Drill Holes on Rockland East Target CSMAT Cross Section B-B'

Figure 5. Photo Image Comparison to Size of Silicon - Merlin to Rockland East Targets

SOURCE: Wolfden Resources Corp.

View the original press release on accesswire.com