At the end of the third quarter of 2024, Vertiseit's Annual Recurring Revenue (ARR) amounted to 187.2 MSEK (156.6), an increase of 20.9 percent at constant exchange rates compared to the previous year. SaaS revenue (Software as a Service) for the quarter increased by 5.2 MSEK to 47.4 MSEK (42.2), adjusted for divested operations. Sequentially, ARR grew by 4.7 percent at constant exchange rates compared to the previous quarter. Net sales decreased by 14.6 percent to 82.1 MSEK (96.2) due to reduced Systems sales, in line with the strategy for expanded partner collaborations regarding hardware sales. Adjusted EBITDA for the quarter amounted to 23.2 MSEK (20.2), corresponding to an adjusted EBITDA margin of 28.2 percent (21.0). Free cash flow for the quarter amounted to 5.7 MSEK (44.0).

THE QUARTER JANUARY-SEPTEMBER 2024

- At the end of the quarter, Annual Recurring Revenue (ARR) amounted to 187.2 MSEK (156.6), an increase of 20.9 percent compared to the previous year at constant exchange rates. SaaS revenue (Software as a Service) for the quarter increased by 5.2 MSEK to 47.4 MSEK (42.2), adjusted for divested operations.

- Sequentially, ARR grew by 4.7 percent compared to the previous quarter at constant exchange rates, corresponding to an annual organic growth rate of 20.0 percent.

- Net revenue decreased by 14.6 percent to 82.1 MSEK (96.2) due to reduced Systems sales, in line with the strategy for expanded partner collaborations regarding hardware sales. The SaaS and Consulting revenue segments both reported growth compared to the previous year.

- Adjusted EBITDA amounted to 23.2 MSEK (20.2) with an adjusted EBITDA margin of 28.2 percent (21.0). During the quarter, adjustments were made for extraordinary items of 1.5 MSEK related to the acquisition of Visual Art, which was completed in the fourth quarter.

- Profit after tax amounted to 10.9 MSEK (9.4).

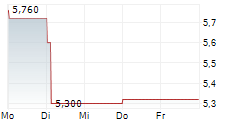

- Free cash flow during the quarter amounted to 5.7 MSEK (44.0). Available liquidity at the end of the period was 45.7 MSEK (59.8).

- Earnings per share, before and after dilution, amounted to 0.48 SEK and 0.43 SEK (0.46 and 0.41) respectively.

EVENTS AFTER THE QUARTER

- On October 2, Vertiseit acquired all outstanding shares in Visual Art Sweden AB. The acquisition valued Visual Art at 457 MSEK, which was financed through bank loan, the issuance of warrants, and a directed share issue.

- At an Extraordinary General Meeting of Vertiseit on October 28, a directed share issue of approximately 250 MSEK was resolved. Approximately 50 MSEK was directed to the selling shareholders of Visual Art, and approximately 200 MSEK to Bonnier Capital AB, making them the largest shareholder in Vertiseit in terms of capital.

INVESTOR EARNINGS CALL

Johan Lind, CEO, and Jonas Lagerqvist, CFO, will present the company's Interim Report for Q3 2024. During the presentation, there will be an opportunity to ask questions. The call will be held in English.

Time: Wednesday, October 30, at 09.00 CET

Participation: To join the call - click here

Links

Link to Vertiseit Investor Relations where the report is available

Contacts

Johan Lind, Vertiseit CEO / Media Contact

johan.lind@vertiseit.com

+46 703 579 154

Jonas Lagerqvist, Vertiseit Deputy CEO / CFO / Investor Relations

jonas.lagerqvist@vertiseit.com

+46 732 036 298

Redeye AB is the company's Certified Adviser

About Vertiseit

Vertiseit is a leading Digital In-store company offering the In-store Experience Management (IXM) SaaS platforms Dise, Grassfish and Visual Art. The platforms enable global brands and leading retailers to strengthen the customer experience by offering seamless customer journeys through connecting the physical and digital meeting. The company has around 270 employees in Sweden, Norway, Denmark, Finland, Austria, Germany, Spain, UK and USA. During the period 2012-2023, Vertiseit performed an average profitable growth of recurring SaaS revenue (ARR) of 53 percent (CAGR). For the full year of 2023, the group's net revenue amounted to SEK 348 million, with an adjusted EBITDA margin of 17 percent. Since 2019, Vertiseit's B-share is listed on Nasdaq First North Growth Market.

VERTISEIT AB (publ)

Phone: +46 340 848 11

E-mail: info@vertiseit.com

Kyrkogatan 7, 432 41 Varberg, Sweden

Org.no: 556753-5272

www.vertiseit.com

This information is information that Vertiseit is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2024-10-30 06:00 CET.