PAREF CONTINUES TO SET NEW MILESTONES IN ITS STRATEGY

AS A EUROPEAN PLAYER

PAREF Group's consolidated revenue amounted to €21.4 million as at September 30, 2024, down -19% compared to the same period in 2023. This is mainly due to:

- Gross rental income almost stable, -2% compared to the same period in 2023, despite the temporary vacancy on the Franklin Tower

- Management commissions up +9% compared to the same period in 2023, reaching €12.4 million over three quarters, driven in particular by the new management mandate of the Fondo Broggi in Italy;

- Subscription commissions amounted to €2.4 million, down -71% compared to the same period last year, reflecting the overall trend in the declining real estate fund distribution market.

| Revenues (in €Mn) | Sep YTD 2023 | Sep YTD 2024 | Variation in % |

| Gross rental income[1] | 6.7 | 6.6 | -2% |

| Commissions | 19.8 | 14.8 | -25% |

| - o.w. management commissions | 11.4 | 12.4 | 9% |

| - o.w. subscription commissions | 8.4 | 2.4 | -71% |

| Total | 26.5 | 21.4 | -19% |

Main events of the third quarter 2024

- The fund management activity was initiated in Italy with the appointment of the Italian branch of PAREF Gestion as the fund manager of Fondo Broggi, owner of The Medelan in Milan, one of the most attractive addresses in Europe. This mandate strengthens the Group's footprint in Europe and highlights its expertise and ability to enter the market in a differentiated way through its full spectrum of services.

- On the French retail fund business, PAREF Gestion continues its strategic repositioning and maintains rigorous operational monitoring. Proposed and adopted at the Annual General Meetings in June and July 2024, the renewal of the SCPI range offers a repositioning of funds to adapt to the new real estate cycle and thus gain in agility, while maintaining the share prices for all its vehicles and the pay-out ratio target. PAREF Prima is the result of merger-absorption of Novapierre Allemagne 2 by Novapierre Allemagne, PAREF Hexa succeeded Interpierre France by broadening its investment strategy and Interpierre Europe Central became PAREF Evo, the new Pan-European SCPI with the diversified investment strategy in Europe (except France) and in all commercial real estate sectors. At the same time, PAREF Prima was awarded TOP D'OR in the "Under 10 years old - Retail" category by ToutSurMesFinances (TSMF), and Novapierre 1 received a Bronze Victory in the "SCPI invested in retail" category, awarded by Le Particulier.

- PAREF is once again rewarded by EPRA for the quality of its reporting. Thanks to the constant commitment of its teams, it has won, for the 6th consecutive year, a BPR Gold Award, the highest level of distinction attesting to its excellence in financial communication. PAREF also received Silver level sBPR Award, in recognition of its alignment with the highest standards in its extra-financial reporting.

- SOLIA Paref, launched in June 2024 and dedicated to Property Management, has entered the Décideurs Magazine ranking with the obtention of the "High Reputation" distinction in 2 categories: Real Estate - Property Management and Commercial Real Estate.

Post September 30, 2024, events

- PAREF has been awarded 5 stars and a score of 97/100 in the GRESB 2024 ranking, a global benchmark for ESG performance in real estate, for its TEMPO project. This achievement reflects the in-house know-how and highlights its ongoing commitment to sustainability and responsible practices in its projects.

"PAREF Group is demonstrating the relevance of its strategy in a still challenging market environment. We are indeed driven by solid fundamentals, built over several decades, and by a distinct vision through our ONE-STOP-SHOP offer to investors, in France and Europe. This quarter's accomplishments and awards are strong signs that we consider as valuable milestones to embrace the future with confidence."

Antoine Castro - Chairman & CEO of PAREF

"PAREF Group continues to capitalize on the complementarity and the diversification of its capabilities, and PAREF Gestion confirms its agility in proposing a coherent offer, in line with the new real estate paradigm through the renewal of its SCPI range. Firmly focused on client satisfaction, we are maintaining an optimal fund management momentum and are convinced that these new key milestones will bear fruit in the coming quarters and in the longer term."

Anne Schwartz - Deputy CEO of PAREF and CEO of PAREF Gestion

Financial Agenda

February 27, 2025: 2024 Annual Results

About PAREF Group

PAREF is a leading European player in real estate management, with over 30 years of experience and the aim of being one of the market leaders in real estate management based on its proven expertise.

Today, the Group operates in France, Germany, Italy, and Switzerland and provides services across the entire value chain of real estate investment: investment, fund management, renovation and development project management, asset management, and property management. This 360° approach enables it to offer integrated and tailor-made services to institutional and retail investors.

The Group is committed to creating more value and sustainable growth and has put CSR concerns at the heart of its strategy.

As at June 30, 2024, PAREF Group manages over €3 billion AUM.

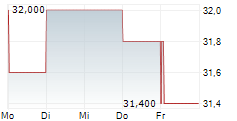

PAREF is a company listed on Euronext Paris, Compartment C, under ISIN FR0010263202 - Ticker PAR.

More information on www.paref.com

Press contacts

| PAREF Group Samira Kadhi +33(7) 60 00 59 52 samira.kadhi@paref.com | Shan Alexandre Daudin / Aliénor Kuentz +33(6) 34 92 46 15 / +33(6) 28 81 30 83 paref@shan.fr |

[1] Excluding recovered charges

- SECURITY MASTER Key: nJptZpZnZ2eWm52eaMtqbGWYb5mVk5aam5fIlGmZlMzHcGyRmJxhmcmXZnFpmmZo

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-88512-paref-financial-information-q3-2024.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free