Continued progress toward submission of 5th and final module of FDA premarket approval (PMA) application for VenoValve® in Q4

GLP study for enVVe® transcatheter-based replacement venous valve underway; On track to file IDE approval for pivotal trial mid-2025

Ended the quarter with $48.4 million cash and investments on hand sufficient to fund operations beyond expected regulatory approval of the VenoValve and start of the enVVe pivotal trial

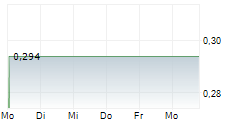

IRVINE, CA / ACCESSWIRE / October 31, 2024 / enVVeno Medical Corporation (NASDAQ:NVNO) ("enVVeno" or the "Company"), a company setting new standards of care for the treatment of venous disease, today reported financial results for the third quarter 2024.

"We are working diligently to collect and analyze the definitive data that we need to complete our PMA application seeking approval from the FDA for the VenoValve and we look forward to releasing that data to the public," commented Robert Berman, CEO of enVVeno Medical. "We are getting closer to seeing the results from all of the time and effort we have spent over the past 6 years, and it is an exciting time for everybody affiliated with our Company."

Clinical Program Highlights

VenoValve: Surgical Replacement Venous Valve

Four (4) out of five (5) modules that comprise the VenoValve PMA application have been submitted, reviewed and approved by the U.S. Food and Drug Administration (FDA).

The Company is on track to file the 5th and final module containing the clinical data from the SAVVE U.S. pivotal trial for the VenoValve in the fourth quarter, completing its PMA application seeking approval from the FDA to market and sell the VenoValve.

Definitive data supporting the PMA application to be released at the VEITHsymposium being held November 19-23, 2024.

enVVe®:Non-surgical Transcatheter Based Replacement Venous Valve

Successfully initiated 6-month pre-clinical GLP study. First wave of implants for the long-term subjects was completed and final wave for the shorter-term subjects is scheduled for December 2024.

The GLP study should be the final step necessary before filing the Investigational Device Exemption (IDE) seeking FDA approval to start the enVVe pivotal study.

The Company expects to be in a position to file for IDE approval for the enVVe pivotal trial mid-next year.

Summary of Financial Results for the Third Quarter 2024

The Company ended the quarter with $48.4 million in cash and investments. On September 30, 2024, the Company closed an offering raising approximately $13.6 million net cash proceeds. Based on management's current expectations, this capital has the potential to fund the Company through several significant milestones, including filing the anticipated FDA pre-market approval of the VenoValve, the beginning of preparations for VenoValve commercialization, and the beginning of the enVVe pivotal trial.

Cash burn for the quarter was $4.3 million, in line with the Company's previous cash burn guidance of approximately $4-5 million per quarter.

The Company reported net losses of $5.6 million and $5.0 million for the three months ended September 30, 2024 and 2023, respectively, representing an increase in net loss of $0.6 million or 12%, due to an increase in operating expenses of $0.8 million, and an increase in other income of $0.2 million.

For the three months ended September 30, 2024, selling, general and administrative expenses increased by $0.7 million or 27%, to $3.3 million from $2.6 million for the three months ended September 30, 2023.

About enVVeno Medical Corporation

enVVeno Medical (NASDAQ:NVNO) is an Irvine, California-based, late clinical-stage medical device Company focused on the advancement of innovative bioprosthetic (tissue-based) solutions to improve the standard of care for the treatment of venous disease. The Company's lead product, the VenoValve®, is a first-in-class surgical replacement venous valve being developed for the treatment of deep venous Chronic Venous Insufficiency (CVI). The Company is also developing a non-surgical, transcatheter based replacement venous valve for the treatment of deep venous CVI called enVVe®. CVI occurs when valves inside of the veins of the leg become damaged, resulting in the backwards flow of blood (reflux), blood pooling in the lower leg, increased pressure in the veins of the leg (venous hypertension) and in severe cases, venous ulcers that are difficult to heal and become chronic. Both the VenoValve and enVVe are designed to act as one-way valves, to help assist in propelling blood up the leg, and back to the heart and lungs. The VenoValve is currently being evaluated in the SAVVE U.S. pivotal study and the company is currently performing the final testing necessary to seek approval for the enVVe pivotal trial.

Cautionary Note on Forward-Looking Statements

Except for historical information contained herein, this press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about the Company's expectations regarding the closing of the offering and timing thereof, expected gross proceeds, and with respect to the underwriters' 30-day option to purchase additional shares. All statements other than statements of historical fact are statements that could be deemed forward-looking statements. These statements are based on management's current expectations and beliefs and are subject to a number of risks, uncertainties and assumptions that could cause actual results to differ materially from those described in the forward-looking statements, including risks and uncertainties related to completion of the public offering on the anticipated terms or at all, market conditions and the satisfaction of customary closing conditions related to the public offering, and those other factors described in our risk factors set forth in our filings with the Securities and Exchange Commission from time to time, including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. We undertake no obligation to update the forward-looking statements contained herein or to reflect events or circumstances occurring after the date hereof, other than as may be required by applicable law.

###

INVESTOR CONTACT:

Jenene Thomas, JTC Team, LLC

NVNO@jtcir.com

908.824.0775

SOURCE: enVVeno Medical Corporation

View the original press release on accesswire.com