TORONTO, ON / ACCESSWIRE / October 31, 2024 / Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) ("Vox" or the "Company"), a returns focused mining royalty company, is pleased to provide recent development and exploration updates from royalty operating partners, Black Cat Syndicate Limited ("Black Cat"), Evolution Mining Limited ("Evolution") and Catalyst Metals Limited ("Catalyst") public disclosures.

Riaan Esterhuizen, Executive Vice President - Australia stated: "We are excited to share that record gold prices of over AUD$4,000/ounce are accelerating numerous Vox gold royalty projects in Western Australia into construction and production stage. We congratulate Myhree's operator, Black Cat, on achieving first gold doré production in September - a remarkable achievement to progress the project from greenfields discovery into a producing gold mine in only six years. Likewise, we are encouraged that the A$250M Mungari mill expansion project is progressing ahead of schedule, with the Castle Hill mining services contract scheduled to commence in November 2024. We look forward to sharing further Australian gold royalty development updates as Vox's portfolio continues to deliver organic growth."

Key Updates

First gold doré produced at Myhree gold project in September 2024 with open pit mining progressing ahead of schedule.

Mining services contract awarded at Castle Hill and Mungari mill expansion ahead of schedule.

Plutonic East mine development on-track, infill drilling scheduled to commence in November 2024 and five year production profile targeted.

Bulong (Production - Western Australia) - First gold doré produced at Myhree in September 2024(1)

Vox holds an uncapped 1% net smelter royalty over key areas of the Bulong Mining Centre, part of the Kal East Gold Project, including the Myhree and Boundary deposits.

On October 4, 2024, Black Cat provided an update on first production at Myhree:

Pre-strip and ore production commenced on July 26, 2024.

The first gold doré from Myhree ore was poured ahead of schedule.

From July 26, 2024 to September 30, 2024, ~78kt of ore produced for the quarter with grade reconciliation to the block model as expected at this stage of the pit.

Vox Management Summary: We congratulate operating partner Black Cat on progressing Myhree from 2018 discovery to 2024 first gold doré production, an accelerated timeline which highlights the merits of the project and the strength of Western Australia as a top-tier mining jurisdiction. We look forward to production ramp-up from Myhree over the coming months.

Figure 1: Myhree open pit 'free dig' mining, no requirement for drill & blast to date

Source: https://api.investi.com.au/api/announcements/bc8/35b86ef8-2f0.pdf

Castle Hill (Development - Western Australia) - Mining services contract awarded at Castle Hill and Mungari mill expansion ahead of schedule(2)

On Castle Hill, Vox holds a A$40/oz Au royalty (payable up to 75koz Au), plus a net milestone payment of A$2M triggered at 140koz Au of cumulative production. Vox also holds an uncapped 2% realised production royalty over the Kunanalling tenure which surrounds Castle Hill, payable post 75koz Au of production from the Castle Hill royalty tenure.

On October 16, 2024, Evolution provided a detailed update on their Mungari mine life extension and mill expansion project:

The Mungari mill expansion project, Mungari 4.2, is slightly ahead of schedule and within budget. Capital spend was ~A$60 million during the September quarter and remains within the approved capital budget of A$250 million.

Construction of the Castle Hill village has commenced, and NRW Holdings Limited was awarded the Castle Hill open pit mining contract on October 8, 2024, a A$360M contract scheduled to commence November 2024 and expected to be completed by mid-2030, employing an average of 150 personnel.

Vox Management Summary: This project update and mining services contract award is trending ahead of Vox management expectations, with the Mungari mill expansion project tracking ahead of schedule and contract mining of the royalty-linked Castle Hill gold deposit still expected in the first half of 2026. Based on a Mining Proposal for the royalty-linked Rayjax satellite deposit approved in March 2024, potential exists for initial revenue from the Castle Hill royalty in late 2024.

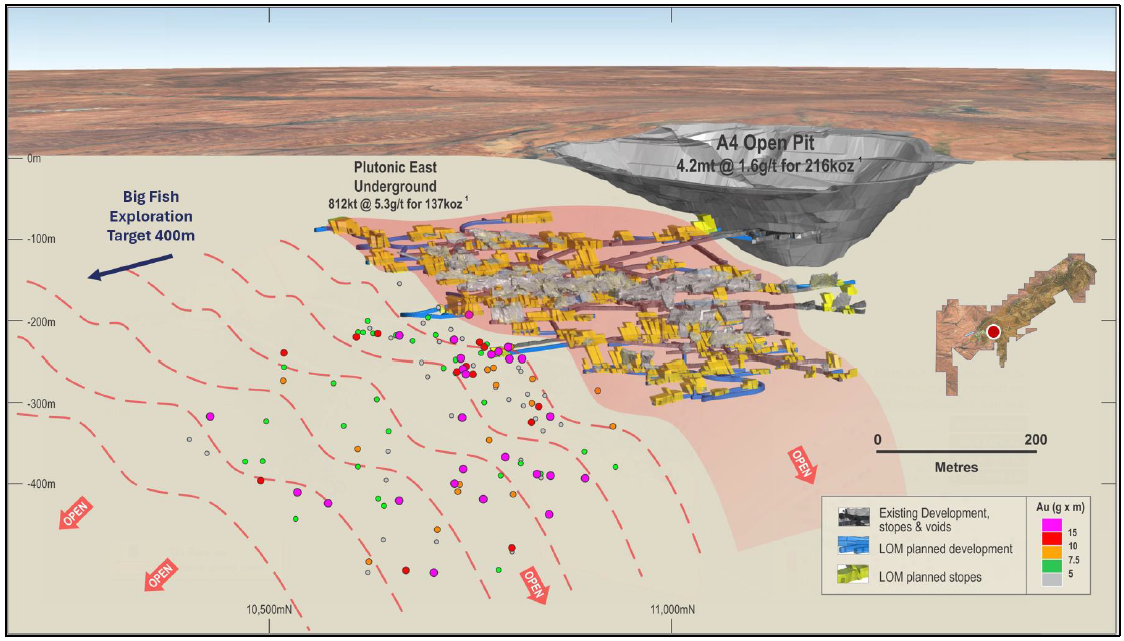

Plutonic East (Development - Western Australia) - Dewatering of underground commenced; first ore expected Q1 2025(3)

Vox holds a sliding-scale grade-linked tonnage royalty over a portion of the Plutonic East Project in Western Australia.

On October 16, 2024, Catalyst announced that:

Dewatering and rehabilitation at Plutonic East continues with underground grade control drilling scheduled to commence in November 2024.

Rehabilitation of the decline to the currently dewatered level has been completed and will continue as dewatering progresses.

Exploration program of A$25m is planned, and underway, for FY25. This includes in-mine exploration to extend the mine life at Plutonic East, and over non-royalty areas Plutonic, K2 and Trident.

As Catalyst commences production at the next two mines - Plutonic East and K2 - in-mine drilling programs are expected to commence, aiming to extend the mine lives of each mine out to five years. This would mean there would be four mines on the Plutonic regional belt, each having expected lifespans of greater than five-years.

Annual gold production at Plutonic East is expected to ramp up to approximately 25,000oz in FY26.

Vox Management Summary: The restart of the Plutonic East underground gold mine by Catalyst is progressing well, and as a brownfields restart benefitting from low capital costs due to the existing decline and underground infrastructure (as well as latent capacity at the Plutonic mill). We look forward to further news flow in relation to the underground rehabilitation and in-mine exploration; ahead of expected first production in Q1 2025.

Figure 2: Plutonic East's mine plan showing mineralisation adjacent to planned work areas.

Source: https://api.investi.com.au/api/announcements/cyl/b30ce80d-0b2.pdf

Qualified Person

Timothy J. Strong, MIMMM, of Kangari Consulting LLC and a "Qualified Person" under NI 43-101, has reviewed and approved the scientific and technical disclosure contained in this press release.

About Vox

Vox is a returns focused mining royalty company with a portfolio of over 60 royalties spanning six jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically focused transactional team and a global sourcing network which has allowed Vox to target the highest returns on royalty acquisitions in the mining royalty sector. Since the beginning of 2020, Vox has announced over 30 separate transactions to acquire over 60 royalties.

Further information on Vox can be found at www.voxroyalty.com.

For further information contact:

Riaan Esterhuizen | Kyle Floyd |

EVP - Australia | Chief Executive Officer |

riaan@voxroyalty.com +1-345-815-3939 | info@voxroyalty.com +1-345-815-3939 |

Cautionary Statements to U.S. Securityholders

This press release and the documents incorporated by reference herein, as applicable, have been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources,", "indicated mineral resources," "measured mineral resources" and "mineral resources" used or referenced herein and the documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Definition Standards").

For U.S. reporting purposes, the U.S. Securities and Exchange Commission (the "SEC") has adopted amendments to its disclosure rules (the "SEC Modernization Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934, as amended, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC's disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed by companies domiciled in the U.S. subject to U.S. federal securities laws and the rules and regulations thereunder.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further, "inferred mineral resources" have a greater amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are "substantially similar" to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of SEC Industry Guide 7.

Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information

This press release contains "forward-looking statements", within the meaning of the U.S. Securities Act of 1933, as amended, the U.S. Securities Exchange Act of 1934, as amended, the Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate" "plans", "estimates" or "intends" or stating that certain actions, events or results " may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be "forward-looking statements". Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements.

The forward-looking statements and information in this press release include, but are not limited to, summaries of operator updates provided by management and the potential impact on the Company of such operator updates, statements regarding expectations for the timing of commencement of development, construction at and/or resource production from various mining projects, expectations regarding the size, quality and exploitability of the resources at various mining projects, future operations and work programs of Vox's mining operator partners, the receipt of expected and potential royalty payments derived from various royalty assets of Vox, anticipated future cash flows and future financial reporting by Vox, and requirements for and operator ability to receive regulatory approvals.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements, including but not limited to: the impact of general business and economic conditions; the absence of control over mining operations from which Vox will purchase precious metals or from which it will receive royalty or stream payments, and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined; problems related to the ability to market precious metals or other metals; industry conditions, including commodity price fluctuations, interest and exchange rate fluctuations; interpretation by government entities of tax laws or the implementation of new tax laws; the volatility of the stock market; competition; risks related to Vox's dividend policy; epidemics, pandemics or other public health crises, including the global outbreak of the novel coronavirus, geopolitical events and other uncertainties, such as the conflict in Ukraine, as well as those factors discussed in the section entitled "Risk Factors" in Vox's annual information form for the financial year ended December 31, 2023 available at www.sedarplus.ca and the SEC's website at www.sec.gov (as part of Vox's Form 40-F).

Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or statement prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Vox cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

Vox has assumed that the material factors referred to in the previous paragraph will not cause such forward looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forward-looking information contained in this press release represents the expectations of Vox as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While Vox may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

None of the TSX, its Regulation Services Provider (as that term is defined in policies of the TSX) or The Nasdaq Stock Market LLC accepts responsibility for the adequacy or accuracy of this press release.

Technical and Third-Party Information

Except where otherwise stated, the disclosure in this press release is based on information publicly disclosed by project operators based on the information/data available in the public domain as at the date hereof and none of this information has been independently verified by Vox. Specifically, as a royalty investor, Vox has limited, if any, access to the royalty operations. Although Vox does not have any knowledge that such information may not be accurate, there can be no assurance that such information from the project operators is complete or accurate. Some information publicly reported by the project operators may relate to a larger property than the area covered by Vox's royalty interests. Vox's royalty interests often cover less than 100% and sometimes only a portion of the publicly reported mineral reserves, mineral resources and production from a property.

References & Notes:

(1) Black Cat Syndicate - Kal East - First Gold Doré from Myhree - dated 4 October 2024:

https://api.investi.com.au/api/announcements/bc8/35b86ef8-2f0.pdf

(2) Evolution Mining - Quarterly Report | September 2024 - dated 16 October 2024:

https://evolutionmining.com.au/storage/2024/10/2794376-September-2024-Quarterly-Report.pdf

(3) Catalyst Metals Ltd - September 2024 Quarterly Report - dated 16 October 2024:

https://api.investi.com.au/api/announcements/cyl/b30ce80d-0b2.pdf

SOURCE: Vox Royalty Corp.

View the original press release on accesswire.com