First Tranche: €6.3 million to be issued in two installments of €3.15 million each, intended for immediate working capital needs to fulfill Q4 2024 and Q1 2025 orders

Structured Financing: A maximum gross financing* amount of €50 million with a 36-month term, providing Metavisio optimal flexibility and control to manage its growth independently.

SAFE Structure: The financing is structured as a SAFE ("Simple Agreement for Future Equity"), allowing Metavisio to exclusively control its deployment. Metavisio has the option to repay issued convertible bonds in new shares or cash, while the investor can request repayment in new shares issued at a 5% premium over the Volume Weighted Average Price (VWAP**).

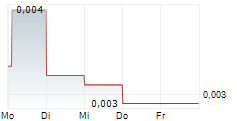

Regulated Share Sales: Any sale of shares on the market by the investor (i) can only take place if the prevailing market price exceeds the previous day's closing price, ensuring an upward trend, and (ii) cannot exceed 25% of daily trading volume.

Flexibility and Control: Metavisio retains control over the drawdown of financing tranches.

Repayment Rights Above Market Price: Metavisio reserves the option to repay the convertible bonds at 110% of their nominal value, at its discretion.

Commitment Against Discounted Private Placements: The company commits to refraining from private placements at a discount.

Enhanced Dividend for Loyal Shareholders: The company plans to hold an upcoming general meeting to introduce a provision in its statutes for a loyalty dividend to reward long-term shareholders.

* Convertible bonds allow the company to choose the repayment method, either in shares or cash, at its discretion.

** VWAP: The lowest volume-weighted average price over a 15-day trading period immediately preceding a request for repayment in new shares.

PARIS, FRANCE / ACCESSWIRE / October 31, 2024 / METAVISIO (THOMSON Computing) (FR00140066X4; ticker symbol:ALTHO), a French company, based in Greater Paris - Dammarie-les-Lys city - France, specializing in the design, production, and marketing of laptops, announces the signing of a bond issuance agreement (the "Issuance Agreement") providing for the issuance of bonds with a maximum nominal gross amount of €50,000,000 over 36 months, based on the Company's needs. This is accomplished through the issuance of subscription warrants (the "Subscription Warrants"), which grant access to equity-redeemable bonds with attached Warrants, subscribed by AMERICAN AI AND HARDWARE INVESTMENTS LTD (the "Investor").

The first tranche, with a total gross amount of €6,300,000, will meet the company's immediate cash flow needs, specifically to fulfill orders for the fourth quarter of 2024 (Q4) and the first quarter of 2025 (Q1) during key commercial periods, including Christmas, Black Friday, and Winter Sales. The Company retains full control over the timing and terms of each tranche.

« This financing, aligned with the company's interests, provides us with the flexibility needed to support our international expansion and technological advancements while protecting shareholder interests and maintaining control over drawdowns. With this exclusive control, we can confidently fulfill our Q4 2024 and Q1 2025 orders, periods that account for nearly 70% of our commercial performance, particularly during the Christmas, Black Friday, and Winter Sales seasons. This financing will also help accelerate our international sales and diversify our distribution channels. Furthermore, we are reinforcing our commitment to our shareholders by introducing a loyalty dividend provision, to be voted on at the general meeting in December 2024, maintaining full control over drawdowns and restricting share sales to cases where the price exceeds the previous day's closing price,"said Stephan Français, Chairman and CEO of Metavisio - Thomson Computing.

Terms and Conditions of the Financing

The General Meeting of the Company held on May 16, 2024, granted the Board of Directors a delegation of authority, under its 19th resolution, to increase the share capital by waiving shareholders' preferential subscription rights in favor of specific categories of persons, in accordance with Article L. 225-138 of the French Commercial Code.

At its meeting on October 29, 2024, the Company's Board of Directors, exercising this delegated authority and the aforementioned authorization, approved the signing of the Issuance Agreement and granted full authority to the CEO to carry out the operations provided therein.

The Board of Directors subsequently approved the issuance of 630 convertible bonds with attached Warrants, subscribed by the Investor, representing gross proceeds of €3,150,000.

As of the date of this press release, no convertible bonds have been redeemed.

New shares issued upon redemption of the convertible bonds and exercise of the Warrants will carry immediate dividend rights. They will have the same rights as those attached to the Company's existing ordinary shares and will be listed on the Euronext Growth Paris market on the same trading line as the existing shares.

No compensation is owed by the Company in the event of termination of the Issuance Agreement at its own initiative.

Details of the terms and conditions of this financing and the objectives of the issuance

The detailed terms and conditions of this financing and the objectives of the issuance can be found on the Company's website and in the French press release published on October 30 at 8:30 CET .

Impact of the Financing on Liquidity Risk Management and Funding Horizon

The Company estimates that the funds potentially generated from the issuance of convertible bonds and the exercise of Warrants, if applicable, will enable it to finance its objectives over a period of at least 36 months, assuming all tranches are drawn (see above, "Risk of Non-Completion of All Tranches").

Conflict of Interest

There are no factors that could create a conflict of interest related to the implementation of the Financing Agreement.

Warnings

In accordance with Article 1(4) of Regulation (EU) 2017/1129 of the European Parliament and of the Council of June 14, 2017, the issuance of convertible bonds with attached Warrants, if applicable, will not require the publication of a Prospectus subject to approval by the French Financial Markets Authority (AMF).

This press release therefore does not constitute a prospectus under Regulation (EU) 2017/1129 of the European Parliament and of the Council of June 14, 2017, as amended, nor does it constitute a public offering.

Information for Shareholders

Metavisio will regularly communicate information related to the drawdown of tranches, the redemption of convertible bonds, and the exercise of Warrants. A summary table of tranche drawdowns, bond redemptions, and warrant exercises will be available on the Company's website ( www.metavisio.com ).

About METAVISIO - THOMSON Computing

METAVISIO - THOMSON Computing (FR00140066X4; Ticker:ALTHO), is a French company specializing in the research, design, and marketing of laptops under the THOMSON Computing brand. Founded in 2013, METAVISIO - THOMSON Computing offers a range of products featuring "the latest technology at the best price."

METAVISIO is eligible for the PEA-PME investment plan (a French tax-efficient investment plan for small and medium-sized enterprises) and holds the Innovative Company qualification (FCPI). More information is available at: www.metavisio.eu

Contact for Investor and media Inquiries

Gabriel Rafaty

metavisio@aimpact.net

www.aimpact.net

Disclaimer on Securities and Investment Information

This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities in the United States or in any other jurisdiction. The securities mentioned in this press release have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "Securities Act"). They may not be offered or sold in the United States without registration or an applicable exemption from registration requirements under the Securities Act. Any public offering of securities in the United States would be made by means of a prospectus containing detailed information about the issuer, its business, financial condition, and financial statements.

Risk Factor Information

Prospective investors should be aware that this investment carries certain risks. The Company makes no assurance as to the future performance of the securities issued, and there is a risk that financial objectives may not be met. This press release includes forward-looking statements which may involve uncertainties and risks, including those related to market fluctuations and international economic conditions. The Company undertakes no obligation to publicly update forward-looking statements except as required by law.

Regulation S Specific Clauses

The securities mentioned herein are intended solely for persons outside the United States (including its territories and possessions) in accordance with Regulation S under the Securities Act. These securities may only be resold in the United States pursuant to securities laws, including Regulation S and Rule 144A, or another applicable exemption.

Liability Disclaimer

The Company disclaims any responsibility for the accuracy or completeness of the information provided in this press release. Any investment decision should be based solely on information contained in the Company's financial disclosures or other investment-related documents.

Contact for Investor and media Inquiries

Gabriel Rafaty

metavisio@aimpact.net

SOURCE: METAVISIO (THOMSON COMPUTING)

View the original press release on accesswire.com