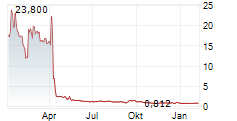

SHANGHAI, Nov. 4, 2024 /PRNewswire/ -- XChange TEC.INC (NASDAQ: XHG) (the "Company") today announced that it plans to change the ratio of the American depositary shares ("ADSs") representing its Class A ordinary shares from one (1) ADS representing six hundred thousand (600,000) Class A ordinary share to one (1) ADS representing twelve million (12,000,000) Class A ordinary shares.

For the ADS holders, the change in the ADS ratio will have the same effect as a one-for-twenty reverse ADS split. There will be no change to the Company's Class A ordinary shares. The effect of the ratio change on the ADS trading price on The Nasdaq Capital Market is expected to take place at the open of trading on November 8, 2024 (U.S. Eastern Time) (the "Effective Date"). Holder of ADSs will be required on a mandatory basis to surrender their old ADSs to the Company's depositary, The Bank of New York Mellon (the "Depositary"), in exchange for every twenty (20) then-held (old) ADSs to receive one (1) new ADS. The ADSs will continue to be traded on The Nasdaq Capital Market under the symbol "XHG."

No fractional new ADSs will be issued in connection with the change in the ADS ratio. Instead, fractional entitlements to new ADSs will be aggregated and sold by the Depositary and the net cash proceeds from the sale of the fractional ADS entitlements (after deduction of fees, taxes and expenses) will be distributed to the applicable ADS holders by the Depositary.

As a result of the change in the ADS ratio, the ADS price is expected to increase proportionally, although the Company can give no assurance that the ADS price after the change in the ADS ratio will be equal to or greater than twenty times the ADS price before the change.

SOURCE XChange TEC.INC