Finanzexperten versuchen immer wieder, die komplexe Welt der Kryptowährungen mit der noch komplexeren Welt der Weltwirtschaft in Einklang zu bringen. Ein häufiges Theorem, das in diesem Zusammenhang genannt wird, ist eine direkte Auswirkung von Inflation auf den Bitcoin Preis - oder zumindest den Einfluss von Inflationsberichten auf die Kursbewegungen des BTC-Tokens.

Genau damit hat sich jetzt eine US-amerikanische Studie beschäftigt, die herausfinden wollte, ob - und wenn ja, wie stark - die Berichte des Consumer Price Index (CPI) die Krypto-Welt tatsächlich beeinflussen. Das jetzt veröffentlichte Ergebnis dürfte einige Krypto-Experten überraschen.

Verbraucherpreisindex hat keinen direkten Einfluss auf den Bitcoin Kurs

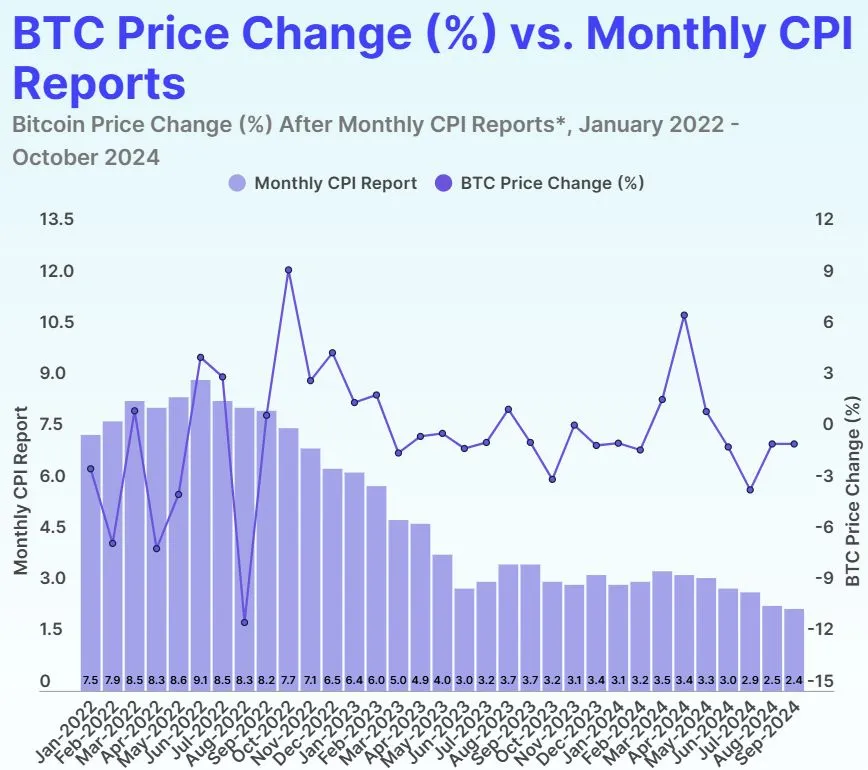

Die neue Studie, die von CoinGecko veröffentlicht wurde, warf einen Blick auf eine etwaige Korrelation zwischen der Veröffentlichung der CPI-Berichte und Veränderungen des BTC-Preises im Zeitraum von Januar 2022 bis zum Oktober 2024.

Das Ergebnis: Innerhalb von 24 Stunden nachdem ein neuer CPI-Bericht herausgekommen war, verhielt sich der Bitcoin Kurs vollkommen unabhängig von den dort verkündeten Ergebnissen. Nachdem zum Beispiel im März und April 2022 ein Rückgang der Inflation von 8,5 auf 8,3 Prozent reduziert wurde, verlor der BTC-Token um 11 Prozent an Wert. Nachdem allerdings die Inflation im September und Oktober 2022 von 8,2 Prozent auf 7,7 Prozent fiel, stieg der Bitcoin um fast 10 Prozent. Das folgende Bild zeigt genau, dass ein direkter Zusammenhang zwischen den CPI-Berichten und dem Bitcoin Kurs äußerst unwahrscheinlich ist.

Weiterhin untersuchte die Studie außerdem, ob ein direkter Zusammenhang zwischen Inflation und dem Bitcoin Kurs festgestellt werden kann. Dabei wird vor allem aufgezeigt, dass die Anpassung des Leitzinses durch die US-Notenbank Federal Reserve einen großen Einfluss hatte, denn die erhöhten Zinssätze sorgten dafür, dass die Kreditaufnahme teurer wurde, was wiederum die Wirtschaft - und auch den Kauf von Bitcoin sowie anderen Kryptowährungen - dämpfte. Gleichzeitig konnte der BTC-Token allerdings laut der Studie davon profitieren, dass er als Absicherung gegen Inflationen immer häufiger in den Medien präsent war und dadurch eine entsprechende Änderung der Wahrnehmung entstanden ist. Davon profitierte Bitcoin letztendlich nachhaltig.

In der Zwischenzeit konnten obendrein Meme-Coins besonders stark davon profitieren, dass sowohl die Federal Reserve als auch die Europäische Zentralbank den Leitzins in den letzten Monaten stark gesenkt hatten. Auch Presale-Projekte wie Flockerz ($FLOCK) wurden dadurch immer populärer und konnten starke Zuflüsse verzeichnen.

Der 'Meme-Coin des Volkes': Flockerz mit über 1 Million US-Dollar gesammelten Kapital

Einer der Hauptgründe dafür, warum Flockerz derzeit vor allem in den sozialen Medien heiß diskutiert wird, dürfte das sogenannte FlockTopia sein, bei dem es sich um das DAO-System dieses Krypto-Projekts handelt. Hierfür wurde ein eigenes Vote-to-Earn-Konzept (VTE) entwickelt, über das die Anleger an allen Abstimmungen teilnehmen und dafür sogar Bonuszahlungen in Form des $FLOCKERZ-Tokens erhalten.

Regelmäßige Abstimmungen werden dabei zur Projektentwicklung, etwaigen Expansionsplänen, neuen Features, der Marketing-Strategie, der Token-Verbrennung und weiteren Aspekten durchgeführt. Dies soll garantieren, dass die eigene Community eng an der Entwicklung von Flockerz beteiligt ist und gleichzeitig die Dezentralisierung fördert. Deshalb werden alle wichtigen Entscheidungen über das Konsensverfahren von der Community getroffen.

Besuche jetzt den Vorverkauf von Flockerz!

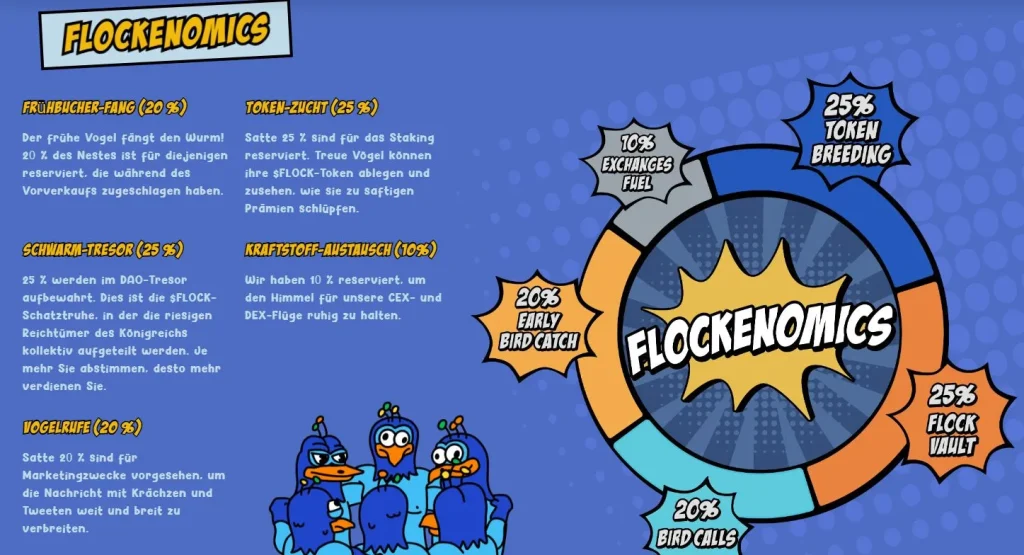

Derzeit befindet sich der $FLOCK-Token noch im Vorverkauf, doch wurden innerhalb der ersten Wochen bereits über 1,15 Millionen US-Dollar an Startkapital durch Anleger gesammelt. Dies dürfte unter anderem auch darauf zurückzuführen sein, dass ein erstes Presale-Staking-Angebot vorhanden ist, das derzeit eine jährliche prozentuale Rendite (APY) von 1.458 Prozent bietet. Hier werden innerhalb der ersten zwei Jahre ganze 25 Prozent aller 12,6 Milliarden $FLOCK-Token ausgegeben, um das Netzwerk stabil und sicher zu halten.

Außerdem interessant: Für das VTE-System sollen weitere 25 Prozent aller Flockerz Coins ausbezahlt werden, um dadurch regelmäßige Teilnahmen an den Community-Abstimmungen lukrativ zu halten. Es könnte sich also lohnen, noch heute einen Blick auf das junge Projekt zu werfen und in Flockerz zu investieren.

Kaufe jetzt $FLOCK-Token zu günstigen Presale-Preisen!

Hinweis: Investieren ist spekulativ. Bei der Anlage ist Ihr Kapital in Gefahr. Diese Website ist nicht für die Verwendung in Rechtsordnungen vorgesehen, in denen der beschriebene Handel oder die beschriebenen Investitionen verboten sind, und sollte nur von Personen und auf gesetzlich zulässige Weise verwendet werden. Ihre Investition ist in Ihrem Land oder Wohnsitzstaat möglicherweise nicht für den Anlegerschutz geeignet. Führen Sie daher Ihre eigene Due Diligence durch. Diese Website steht Ihnen kostenlos zur Verfügung, wir erhalten jedoch möglicherweise Provisionen von den Unternehmen, die wir auf dieser Website anbieten.