Interim report January - September 2024

Net asset value was SEK 350.3 per share compared to SEK 257.9 at the beginning of the year, corresponding to an increase of 35.8 per cent.

Bure's net asset value was SEK 25,976M compared to SEK 19,123M at the beginning of the year.

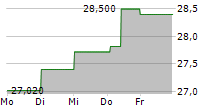

Total return on the Bure share was 45.1 per cent; the SIX Return Index rose 15.2 per cent in the same period.

Group earnings after tax amounted to SEK 7,025M (1,776). Earnings per share were SEK 94.8 (23.9).

Interim report July - September 2024

Net asset value was SEK 350.3 per share compared to SEK 319.6 at the beginning of the quarter, corresponding to an increase of 9.6 per cent.

Bure acquired 14.5 per cent of Mentimeter for SEK 531M.

Atle signed an agreement to acquire 66 percent of FIRST Fondene AS in Norway. FIRST manages approx. NOK 11 billion in equity and fixed income funds. The transaction was completed in October.

Atle signed an agreement to become a partner in Amaron Holding AB through a directed share issue. Amaron is a manager of alternative investment funds with a focus on real estate.

Events after the end of the period

Net asset value amounted to SEKM 347.6 per share on November 7, 2024, corresponding to an increase of 34.8 per cent since the beginning of the year.

Atle acquired shares in HealthInvest Partners, increasing its holding to 100 per cent.

Comments from the CEO

Bure's net asset value per share achieved a new record high at the end of the quarter of SEK 350.30. This corresponds to an increase of 9.6 per cent on the quarter and 35.8 per cent for the first nine months of the year. The Six Return Index rose by 4.2 per cent in the third quarter. This robust increase was primarily driven by the share price performance of Vitrolife, Xvivo and Yubico. These three companies reported quarterly results for the second quarter that exceeded market expectations. Vitrolife jumped 46.5 per cent and Xvivo 23.0 per cent. Yubico increased 10.4 per cent in the quarter, although had peaked at 25 per cent up in August following the release of a very strong Q2 report.

To date, half of the listed portfolio companies have published third quarter reports. They continue to perform strongly. According to Mycronic's CEO, Anders Lindkvist, operating profit for the first nine months of the year of SEK 1,494M exceeds full-year results for 2023 of SEK 1,235M by some margin, which itself was Mycronic's best ever year. Growth for Vitrolife increased to 7 per cent in the quarter. The Consumables business area grew the most, at 13 per cent, and it was notable that the company's Genetics business area grew by 5.5 per cent.

In July, Atle acquired a majority stake in Norwegian asset management company

FIRST Fondene, which manages approximately NOK 11 billion in equity and bond funds. Atle also became a partner in Amaron Holding AB, which manages alternative investment funds primarily focused on property.

In hard-to-assess environments and challenging market conditions that currently prevail in Europe and the US, the portfolio companies' improved performance is both impressive and reassuring. A clear and long-term focus on profitable growth provides a fertile ground for the portfolio companies to be able to execute on their strategic objectives.

For more information, contact

Henrik Blomquist, CEO

henrik.blomquist@bure.se

Telephone: +46 (0) 8-614 00 20

This information is information that Bure Equity AB is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2024-11-08 08:30 CET.