VANCOUVER, British Columbia, Nov. 08, 2024 (GLOBE NEWSWIRE) -- GoldHaven Resources Corp. ("GoldHaven" or the "Company") (CSE: GOH) (OTCQB: GHVNF) (FSE: 4QS0) announces that, further to its news release of November 1, 2024 announcing the definitive securities exchange agreement dated October 31, 2024 with Copper Peak Metals Inc. ("Copper Peak") and each of the shareholders of Copper Peak, pursuant to which the Company agreed to acquire all of the issued and outstanding shares of Copper Peak, the Company has completed acquisition of all of the issued and outstanding shares and warrants of Copper Peak from the shareholders of Copper Peak in exchange for:

| (a) | 3,990,000 common shares of the Company (the "Consideration Shares") at a deemed price of $0.09 per Consideration Share for total deemed consideration of $359,100, | |

| (b) | 500,000 common share purchase warrants, each exercisable at $0.10 per warrant to acquire one common share of the Company until September 16, 2027, and | |

| (c) | 500,000 common share purchase warrants, each exercisable at $0.10 per warrant to acquire one common share of the Company until August 22, 2027 (collectively referred to as, the "Transaction"). | |

Out of the 3,990,000 Consideration Shares, 2,990,000 Consideration Shares shall be subject to a pooling arrangement where 10% of such shares shall be released on Closing and the balance shall be released in six tranches of 15% every six months. The future obligations under this acquisition agreement include the payment of $93,334 to the underlying property optionor, Gerry Diakow by January 29, 2025.

Copper Peak is the beneficial and registered owner of a 100% undivided interest in and to the mineral properties, known as the Magno Property, located in the Liard Mining District in British Columbia, comprised of twenty-four (24) mineral tenures, and the Three Guardsmen property. For further information pertaining to the Magno Property please see the NI 43-101 technical report available on the Company's website.

The Company also wishes to announce that Gerry Diakow has been appointed to the Board of Directors of GoldHaven. Mr. Diakow has worked in the Cassiar regional area since 1973, beginning as a crew member with Union Carbide's regional helicopter silt sampling program targeting tungsten mineralization. Having worked in the Traditional territory of the Kaska nation and with many members of the Kaska community Gerry is familiar with and has consulted with band members for years.

Mr. Smith further announced, "the successful completion of this acquisition marks a pivotal milestone for the Company. Our newly acquired assets put us in a well-known and historic district in BC with two district scale properties. We are eager to commence phase 1 exploration on the Magno property in an effort to confirm a link to the known and nearby porphyry systems in BC."

About Copper Peak: The Magno & Three Guardsmen Properties

Copper Peak holds 100% ownership of the Magno and Three Guardsmen mineral properties in British Columbia. British Columbia is a premier mining jurisdiction, hosting 16 of Canada's 31 critical minerals and standing as the nation's largest copper producer. It also holds vast gold resources, with an estimated 280 million ounces of in-ground gold, primarily within polymetallic porphyry deposits.

Northwestern British Columbia is a globally significant mining district, home to some of the richest porphyry copper and gold deposits in the world. This region's Late Triassic to Early Jurassic tectono-magmatic activity created high-grade, large-scale deposits, positioning it as a major source of copper and precious metals.

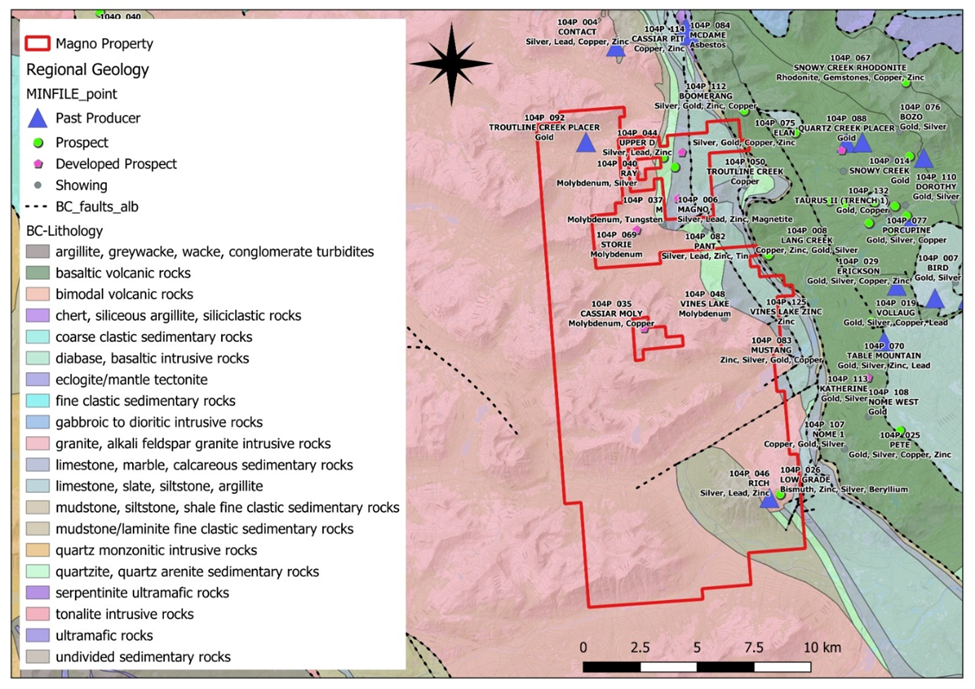

The Magno property is a district-scale, polymetallic property with 24 mineral tenures located in the Liard Mining Division, adjacent to the historic Cassiar mining district, in Cassiar BC, Canada.

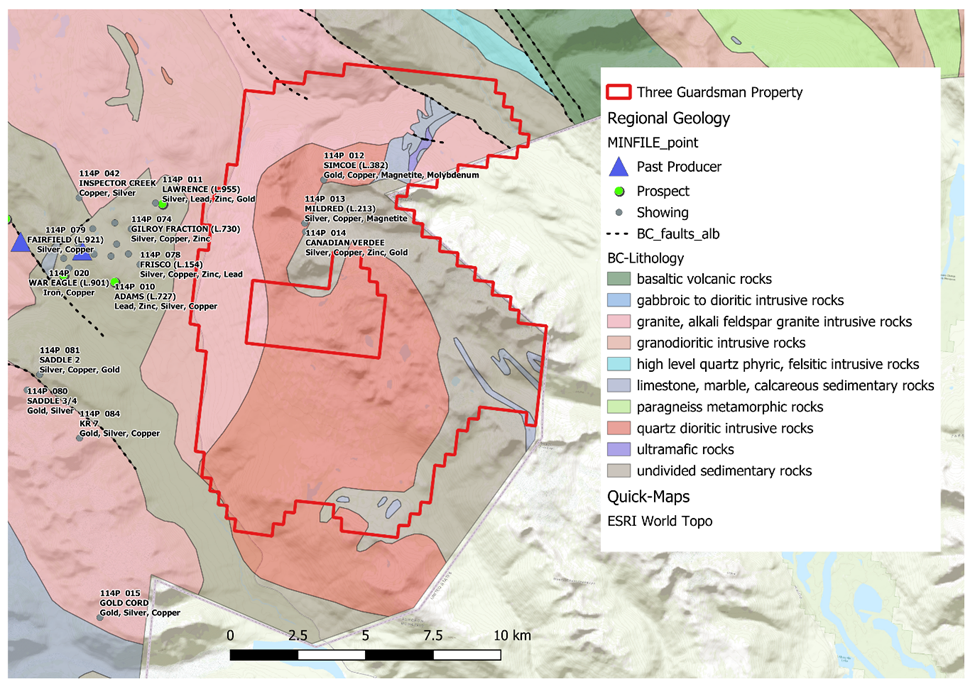

Located in the northwest corner of BC near Haines Junction, the Three Guardsmen Property contains 12 mineral tenures with historical findings of Gold, Copper, Molybdenum, Silver, Zinc, and Magnetite. Two past producers sit within 4km to the West of the Three Guardsmen with multiple other showings in the area.

Both projects focus on the late Cretaceous terranes, known to host significant porphyry deposits like those at Casino and Red Mountain. The exploration team will target granitic bodies beneath promising skarn deposits, aiming to identify the source of mineralized fluids linked to these skarns. The focus will be on extensive geochemical and geophysical exploration to identify potential porphyry sources.

Magno property with BC regional geology highlighting historical work and present showings

Three Guardsmen property with BC regional geology highlighting historical work and present showings

R.J. (Bob) Johnston, P.Geo from Engineers & Geoscientists British Columbia is the qualified person for the Company has reviewed and approved the scientific and technical information in this news release.

About GoldHaven Resources Corp.

GoldHaven Resources Corp. is a Canadian junior metals exploration Company focused on acquiring and exploring highly prospective land packages in North America.

On Behalf of the Board of Directors

Bonn Smith, Chief Executive Officer

For further information, please contact:

Bonn Smith, CEO

www.GoldHavenresources.com

bsmith@goldhavenresources.com

Office Direct: (604) 629-8254

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE- Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

This news release contains forward-looking statements and forward-looking information (collectively, "forward looking statements") within the meaning of applicable Canadian and U.S. securities legislation, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein including, without limitation,, the possible acquisition of the future projects, the Company's expectation that it will be successful in enacting its business plans, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: "believes", "will", "expects", "anticipates", "intends", "estimates", "plans", "may", "should", "potential", "scheduled", or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, that there will be investor interest in future financings, market fundamentals will result in sustained precious metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future exploration and development of any future projects in a timely manner, the availability of financing on suitable terms for exploration and development of future projects and the Company's ability to comply with environmental, health and safety laws.

The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, operating and technical difficulties in connection with mineral exploration and development activities, actual results of exploration activities, the estimation or realization of mineral reserves and mineral resources, the inability of the Company to obtain the necessary financing required to conduct its business and affairs, as currently contemplated,, the inability of the Company to enter into definitive agreements in respect of possible Letters of Intent, the timing and amount of estimated future production, the costs of production, capital expenditures, the costs and timing of the development of new deposits, requirements for additional capital, future prices of precious metals, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, lack of investor interest in future financings, accidents, labour disputes and other risks of the mining industry, delays in obtaining governmental approvals, permits or financing or in the completion of development or construction activities, changes in laws, regulations and policies affecting mining operations, title disputes, the inability of the Company to obtain any necessary permits, consents, approvals or authorizations, including by the Exchange, the timing and possible outcome of any pending litigation, environmental issues and liabilities, and risks related to joint venture operations, and other risks and uncertainties disclosed in the Company's latest interim Management's Discussion and Analysis and filed with certain securities commissions in Canada. All of the Company's Canadian public disclosure filings may be accessed via www.sedarplus.ca and readers are urged to review these materials.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements in this news release or incorporated by reference herein, except as otherwise required by law.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/496b11ba-4f34-4d5f-9fca-bc32176d269c

https://www.globenewswire.com/NewsRoom/AttachmentNg/1d0c5b67-0778-45c5-9ac8-6ab97026ff82