VANCOUVER, BC / ACCESSWIRE / November 9, 2024 / Spey Resources Corp. (CSE:SPEY)(OTC:SPEYF)(FRA:2JS) (the "Company" or "Spey") is pleased to announce that it has entered into a share exchange agreement dated November 8, 2024 with Antimony Assets Inc. ("Antimony") and the shareholders of Antimony to acquire 100% of the issued and outstanding common shares of Antimony in consideration for an aggregate of 4,975,000 common shares of the Company at a deemed price of $0.0675 per share (the "Consideration Shares"). Antimony is a privately held arm's length party that holds an interest in two mineral claims covering 3,550 hectares, located in Haida Gwaii, British Columbia (the "Claims").

The proposed transaction remains subject to customary conditions of closing, including the Company completing due diligence to its satisfaction and the approval of the Canadian Securities Exchange (if required), and is expected to complete shortly.

The Consideration Shares will be issued pursuant to an exemption from the prospectus requirements under applicable securities laws pursuant to Section 2.16 of National Instrument 45-106 and are anticipated to be free trading upon issuance. There are no guarantees that the proposed transaction will be completed as contemplated or at all.

Name Change

The Company is also pleased to announce it intends to change its name from "Spey Resources Corp." to "Armory Mining Corp.", effective on or about November 19, 2024. The trading symbol on the CSE will change to "ARMY". An application is pending for a symbol change on the OTC and will be provided once available. The new CUSIP will be 042279109 and the new ISIN will be CA0422791099.

No action will be required to be taken by shareholders with respect to the name or symbol change and the share capital of the Company will remain unchanged. Outstanding share and warrant certificates are not affected by the name change and do not need to be exchanged.

The Claims

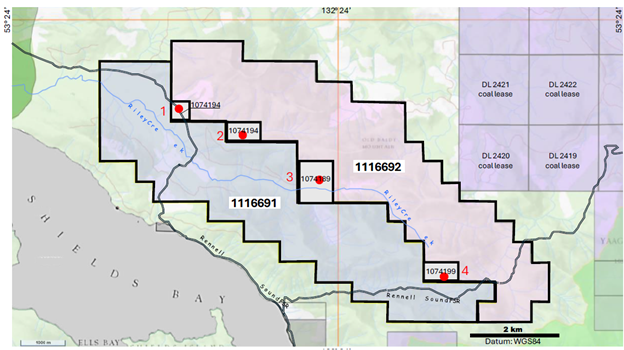

The Claims, known as the Riley Creek Project, are located on the west side of Graham Island, Haida Gwaii in the north coast region of British Columbia. The Riley Creek Project surrounds four small claims owned by an arm's length company that cover four separate gold-antimony occurrences. These four occurrences are described as hydrothermal hot spring deposit types within the Middle Jurassic Yakoun Group pyroclastic andesites, volcanic sediments and argillites. They occur along the regionally significant Rennell-Louscoone northwest trending fault system. No Qualified Person working for the Company has been able to verify the information related to the four occurrences, but the Company believes the proximity to the occurrences supports exploration for new targets in the Riley Creek Project area. The references to these occurrences are not necessarily indicative of mineralization on the Riley Creek Project area. Significant features of the individual mineral occurrences are summarized briefly below:

NEEDLES: - Gold, silver, antimony showing. "A 3.0-metre chip sample of the altered zone assayed 0.93 gram per tonne gold and a 1.0 metre sample assayed 0.96 gram per tonne gold and 0.68 gram per tonne silver (BC Assessment Report 15325)."

SOL (GUMBO ZONE): - Gold, silver antimony showing. "A drill hole intersected a 2 metre section which assayed 3.3 grams per tonne gold and 0.6 grams per tonne silver (BC Assessment Report 8225)."

COURTE: - Antimony, gold silver, lead, zinc showing. "A chip sample of continuous exposure in Sol Creek assayed 1.37 grams per tonne gold and 0.4 per cent antimony over 95 metres (BC Assessment Report 24981, page 8)" Also "A drill hole 425 metres east-southeast from mineralization exposed in Sol Creek assayed 1.37 grams per tonne gold and 0.23 per cent antimony over 10 metres (BC Assessment Report 24981, page 8)." And a "A 2.27 kilogram sample, taken by Luke Watson in 1942, assayed trace gold, 19.2 grams per tonne silver, 0.1 per cent lead, 0.2 per cent zinc and 32.9 per cent antimony (Minister of Mines Annual Report 1942, page 32)"

RUMPLESTILTSKIN: - Gold showing. "Surface samples have returned from 1.25 to 7.8 grams per tonne gold (George Cross Newsletter #94 May 17, 1982)."

Figure 1: The Riley Creek Project and Surrounding Four Small Claims with Gold-Antimony and Silver Showings

Qualified Person

Harrison Cookenboo, Ph.D., P.Geo., is an independent Qualified Person for the purpose of National Instrument 43-101, has reviewed and approved the contents of this news release.

All data in this news release is historical in nature and was not verified by Spey. Referenced nearby occurrences provide geologic context for the Riley Creek Project, but are not necessarily indicative that they hosts similar potential, size or grades of mineralization.

About Spey Resources

Spey Resources Corp. is a Canadian lithium focused mineral exploration company which has an 80% interest in the Candela II lithium brine project located in the Incahuasi Salar, Salta Province, Argentina. Spey also holds a 100% interest in the Kaslo Silver project, west of Kaslo, British Columbia and an option to acquire a 100% interest in certain mineral claims located in Nova Scotia.

FOR FURTHER INFORMATION CONTACT:

Nader Vatanchi

CEO, Director

e: nader@speyresources.cap

p: 778-881-4631

Neither the Canadian Securities Exchange nor its Market Regulator (as the term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy of accuracy of this news release.

Certain information contained herein constitutes "forward-looking information" under Canadian securities legislation. Forward-looking information includes, but is not limited to the Company completing the acquisition of Antimony, the consideration shares being free trading, the receipt of approval by the Canadian Securities Exchange, the name change and symbol change and anticipated timing thereof. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "anticipates", "anticipated" "expected" "intends" "will" or variations of such words and phrases or statements that certain actions, events or results "will" occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are from those expressed or implied by such forward-looking statements or forward-looking information subject to known and unknown risks, uncertainties and other factors that may cause the actual results to be materially different, including receipt of all necessary regulatory approvals. Although management of the Company have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. The Company will not update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws.

SOURCE: Spey Resources Corp.

View the original press release on accesswire.com