Not for distribution to the US news wire services or for dissemination in the US

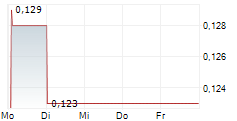

VANCOUVER, BC / ACCESSWIRE / November 11, 2024 / Storm Exploration Inc. (TSX-V:STRM) (the "Company") is pleased to announce that it has closed a first tranche of the Company's non-brokered private placement (the "Offering"), for aggregate gross proceeds of $402,500. The closing is subject to final acceptance of the TSX Venture Exchange.

The Offering, previously announced on September 16, 2024, consists of units (the "Units") at a price of $0.05 per Unit, and flow-through units (the "FT Units") at a price of $0.06 per FT Unit. Each Unit will consist of one common share of the Company and one warrant (a "Unit Warrant") entitling the holder thereof to acquire an additional common share (the "Warrant Share") of the Company at an exercise price of $0.10 per Warrant Share for a period of 24 months from the date of issuance. The FT Units will consist of one flow-through common share of the Company and one warrant (a "FT Unit Warrant") entitling the holder thereof to acquire a (non-flow through) common share (the "Warrant Share") of the Company at an exercise price of $0.12 per Warrant Share for a period of 24 months from the date of issuance.

In connection with the closing of the first tranche of the Offering, the Company has issued 8,050,000 Units at a price of $0.05 per Unit. The Company paid aggregate cash finders' fees of $14,400 to arm's length finders, representing 6% of the proceeds raised from subscriptions by certain placees introduced by the finders. The Company has also issued to the finders 288,000 non-transferable share purchase warrants (the "Finder's Warrants") entitling the purchase of an aggregate 288,000 common shares, on the same terms as the Unit Warrants.

The shares acquired by the placees under the Offering, and any shares which may be acquired upon the exercise of the Unit Warrants and the Finder's Warrants, are subject to a hold period of four months and one day, in accordance with applicable Canadian securities legislation.

The proceeds from the Offering will be used to advance the Company's gold and base metal properties in northern Ontario and for general working capital purposes.

One related party (as such term is defined in Multilateral Instrument 61-101 -Protection of Minority Security Holders in Special Transactions ("MI 61-101")) participated in the Offering and acquired an aggregate of 250,000 Units. This portion of the Offering constituted a related party transaction for the purposes of TSX Venture Exchange Policy 5.9 and MI 61-101. The Company relied on Section 5.5(a) of MI 61-101 for an exemption from the formal valuation requirement and Section 5.7(1)(a) of MI 61-101 for an exemption from the minority shareholder approval requirement of MI 61-101 as the fair market value of the transaction insofar as the transaction involved interested parties did not exceed 25% of the Company's market capitalization.

The Company advises that Units and FT Units of the Offering remain available, and the Company expects to close the financing on or about November 29, 2024.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) has reviewed or accepts responsibility for the adequacy or accuracy of this release.

About Storm Exploration Inc.

Storm Exploration is a Canadian mineral exploration company focused on the discovery and development of economic precious and base metal deposits on four district-scale projects in northwest Ontario: Miminiska, Keezhik, Attwood and Gold Standard.

Forward Looking Information

This news release includes certain information that may constitute "forward-looking information" under applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, completion of the Offering. Forward-looking information is necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information, including the approval of the TSX Venture Exchange of the Offering. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. All forward-looking information contained in this press release is given as of the date hereof and is based upon the opinions and estimates of management and information available to management as at the date hereof. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law.

For further information, please contact:

Storm Exploration Inc.

+1 (604) 506-2804

info@stormex.ca

SOURCE: Storm Exploration Inc.

View the original press release on accesswire.com