On 11 November S&P announced that they confirm Balder's credit rating BBB and changes the rating outlook from negative to stable.

A stable investment grade rating is important considering Balder's strategy of having a broad funding base at a favourable cost. The company has a long track record in building a real estate business with a size and diversification, that is very well suited for both bond financing and secured bank loans.

"It is pleasing that we can now sum up this interest rate cycle with an unchanged rating, and an earnings capacity which, even after interest costs, is higher than before the interest rate hikes. It provides predictability for our bond investors which we believe is valuable," says Balder's CFO Ewa Wassberg.

Balder will continue to strengthen the balance sheet somewhat, in line with the target regarding Net debt/EBITDA of 11 times that was introduced in 2023. As valuation yields now have stabilised, Balder's strong cash flow gives the company the ability to combine a continued debt reduction with fairly material investments.

For further information, please contact:

Erik Selin, CEO, tel. +46 (0)31-10 95 92, erik.selin@balder.se

Ewa Wassberg, CFO, tel. +46 (0)31-351 83 99, ewa.wassberg@balder.se

Jonas Erikson, IR, tel. +46 (0)76-765 50 88, jonas.erikson@balder.se

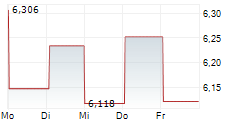

Fastighets AB Balder (publ) is a listed property company that owns, manages and develops residential and commercial properties in Sweden, Denmark, Finland, Norway, Germany and the United Kingdom. The head office is located in Gothenburg. As of 30 September 2024, the property portfolio had a value of SEK 215.3 billion. The Balder share is listed on Nasdaq Stockholm, Large Cap.