Highlights:

Soil Grid Across the Southern Portion of Gran Pilar Returns High-Grade Results:

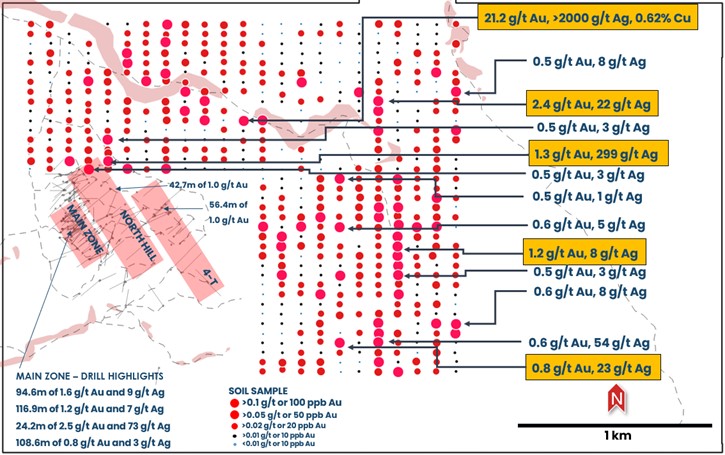

Including 21.2 g/t Au and >2,000 g/t Ag, 1,000 meters northeast of the Main Zone;

2.4 g/t Au and 21.9 g/t Ag, 1,700 meters east, northeast of the Main Zone;

1.3 g/t Au and 299 g/t Ag, 390 meters north, northeast of the Main Zone;

1.2 g/t Au and 8.2 g/t Ag, 1,700 meters east of the Main Zone;

0.8 g/t Au and 23.4 g/t Ag, 1,500 meters southeast of the Main Zone;

0.6 g/t Au and 7.7 g/t Ag, 2,000 meters southeast of the Main Zone.

62 of 541 Sample over 0.1 g/t Au or 100 ppb

350 of 541 Samples over 0.02 g/t Au or 20 ppb, Considered Anomalous for Exploration

Surface Exploration Work Ongoing at Gran Pilar, 184 Rock Samples Pending Analysis

Video: Soil Sample Overview

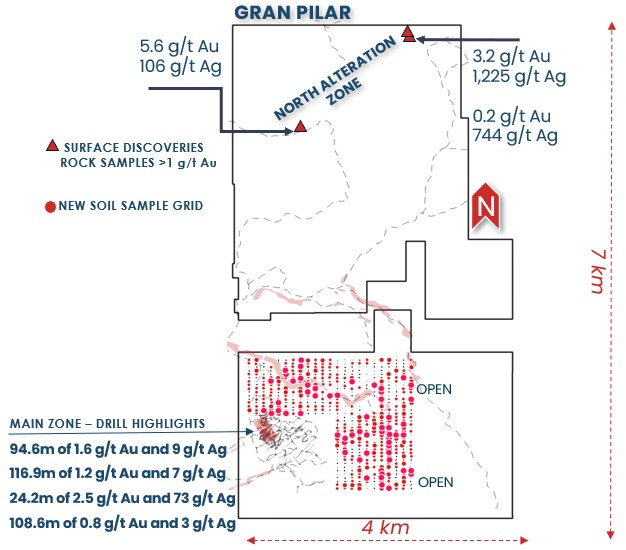

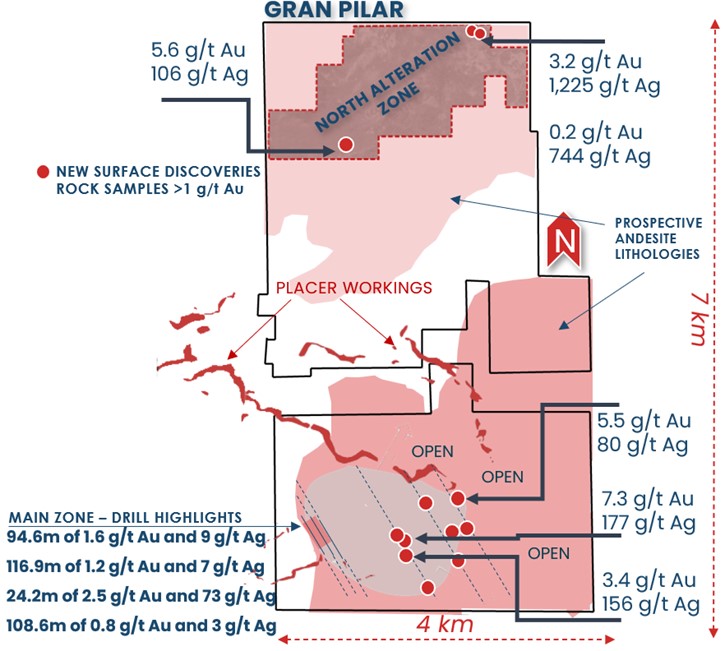

CALGARY, AB / ACCESSWIRE / November 12, 2024 / Tocvan Ventures Corp. (the "Company") (CSE:TOC)(OTCQB:TCVNF)(FSE:TV3), is pleased to provide exploration results from its Gran Pilar gold-silver project in mine-friendly Sonora, Mexico. Surface soil and rock sampling has been ongoing across the Gran Pilar project area with a focus on the northern and eastern extensions of the Main Zone, North Hill and 4-T trends. To date, over 541 soil samples and 184 rock chip samples and counting have been collected by technical staff. Results for 541 soil samples are provided in this release across an area that totals over two-square kilometers within the southern block of Gran Pilar where Tocvan holds 100% interest (see Figure 1). This data builds off of a previous soil grid completed across the original Pilar concessions. The soil grid was completed along north-south orientated lines 100 meters apart with 50-meter sample spacing. Soil material from each site was sieved below 200 mesh or 74 microns, collecting an average sample size of 1.3 kg at each sample location. The southern block remains unsampled 1.4 kilometers east and 400 meters south of the soil grid released today. Another four-square kilometer remains unsampled and open for additional discovery within the southern block alone.

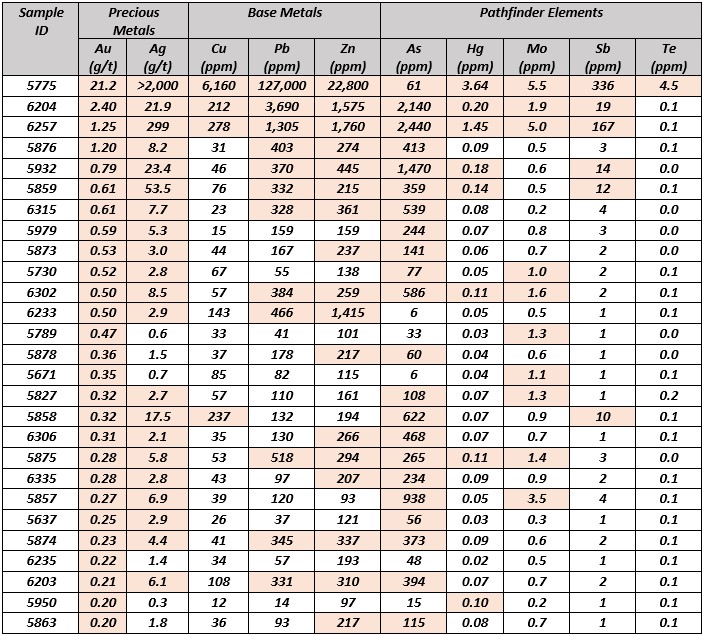

In exploration, soil sampling is a useful tool for locating areas of interest through the geochemical expression of weathered rock. The subtle increase in gold or other pathfinder elements are tracked to outline target areas. Samples returning values greater than 0.02 g/t Au or 20 ppb Au are thought to be anomalous and worthy of closer evaluation. Sample results with values greater than 0.1 g/t Au or 100 ppb Au are thought to be significant and warrant immediate follow-up as near surface mineralization is likely. It is important to note that the soil samples are widely spaced on a 50-meter by 100-meter grid. The results have yielded high-grade gold and silver mineralization across the sample grid with the highest value returning 21.2 g/t Au (21,200 ppb), greater than 2,000 g/t Ag, 0.62% Cu, 12.7% Pb and 2.3% Zn. Follow-up has shown this highly anomalous sample coincides with a nearby historic working concealed in overgrown vegetation. This sample is within a broader zone of anomalous values that extends for over 800-meters long and 500-meters wide. Several other zones of significant and consistently high values of gold have been identified showing several kilometers of prospective trend that remains open to the east for further expansion.

For reference, historically the highest soil sample across the Main Zone returned 8.1 g/t Au and 12 g/t Ag with most values ranging as low as 0.04 g/t Au or 40 ppb Au. Results from the recent soil survey are summarized in Figure 1 and Table 1.

"The results from the soil survey are simply incredible with samples exceeding the analysis overlimits two to three times; outlining the much larger potential for significant mineralization at Gran Pilar" commented Brodie Sutherland, CEO. "The consistently high values across the area is telling of the overall potential, this area also coincides with early reconnaissance sampling that has returned significant gold and silver values released earlier this year. It is fantastic to see several values in excess of 1 gram per tonne in the soil results and immediate follow-up has proven the values are directly related to mineralized structures tied to historic workings. This proves the soil sampling method is extremely effective in discovering new areas of interest. As surface work and drill preparation continues, we look forward to refining these targets for future drill programs. It is important to note that the entire area has never seen systematic and modern exploration, these areas are completely new and we are beginning to outline the larger mineralized system that remains untested. This is just one portion of the southern block of Gran Pilar with even larger untested sections of the property extending to the north. More results are to come as we unlock the full potential of Gran Pilar."

Table 1. Summary of Soil sample results and the related pathfinder elements for gold values greater than 200 ppb or 0.2 g/t Au.

About the Pilar Property

The Pilar Gold-Silver property has returned some of the regions best drill results. Coupled with encouraging gold and silver recovery results from metallurgical test work, Pilar is primed to be a potential near-term producer. Pilar is interpreted as a structurally controlled low-sulphidation epithermal system hosted in andesite rocks. Initially three primary zones of mineralization were identified on the original property from historic surface work and drilling and are referred to as the Main Zone, North Hill and 4-T. Each trend remains open to the southeast and north and new parallel zones have been discovered. Structural features and zones of mineralization within the structures follow an overall NW-SE trend of mineralization. Mineralization extends along a 1.2-km trend, only half of that trend has been drill tested so far. The Company has now expanded its interest in the area by consolidating 22 square-kilometers of highly prospective ground where it has already made significant surface discoveries.

Pilar Drill Highlights:

2022 Phase III Diamond Drilling Highlights include (all lengths are drilled thicknesses):

116.9m @ 1.2 g/t Au, including 10.2m @ 12 g/t Au and 23 g/t Ag

108.9m @ 0.8 g/t Au, including 9.4m @ 7.6 g/t Au and 5 g/t Ag

63.4m @ 0.6 g/t Au and 11 g/t Ag, including 29.9m @ 0.9 g/t Au and 18 g/t Ag

2021 Phase II RC Drilling Highlights include (all lengths are drilled thicknesses):

39.7m @ 1.0 g/t Au, including 1.5m @ 14.6 g/t Au

47.7m @ 0.7 g/t Au including 3m @ 5.6 g/t Au and 22 g/t Ag

29m @ 0.7 g/t Au

35.1m @ 0.7 g/t Au

2020 Phase I RC Drilling Highlights include (all lengths are drilled thicknesses):

94.6m @ 1.6 g/t Au, including 9.2m @ 10.8 g/t Au and 38 g/t Ag;

41.2m @ 1.1 g/t Au, including 3.1m @ 6.0 g/t Au and 12 g/t Ag ;

24.4m @ 2.5 g/t Au and 73 g/t Ag, including 1.5m @ 33.4 g/t Au and 1,090 g/t Ag

15,000m of Historic Core & RC drilling. Highlights include:

61.0m @ 0.8 g/t Au

21.0m @ 38.3 g/t Au and 38 g/t Ag

13.0m @ 9.6 g/t Au

9.0m @ 10.2 g/t Au and 46 g/t Ag

Pilar Bulk Sample Summary:

62% Recovery of Gold Achieved Over 46-day Leaching Period

Head Grade Calculated at 1.9 g/t Au and 7 g/t Ag; Extracted Grade Calculated at 1.2 g/t Au and 3 g/t Ag

Bulk Sample Only Included Coarse Fraction of Material (+3/4" to +1/8")

Fine Fraction (-1/8") Indicates Rapid Recovery with Agitated Leach

Agitated Bottle Roll Test Returned Rapid and High Recovery Results: 80% Recovery of Gold and 94% Recovery of Silver after Rapid 24-hour Retention Time

Additional Metallurgical Studies:

Gravity Recovery with Agitated Leach Results of Five Composite Samples Returned

95 to 99% Recovery of Gold

73 to 97% Recovery of Silver

Includes the Recovery of 99% Au and 73% Ag from Drill Core Composite at 120-meter depth.

Based on management's strong belief in the project's potential, the Company is outlining a permitting and operations strategy for a pilot facility at Pilar. The facility would underpin a robust test mine scenario with aims to process up to 50,000 tonnes of material. Timelines and budget are being prepared with the aim of moving forward with the development early in 2025. With gold prices hitting all-time highs, the Company believes the onsite test mine will provide key economic parameters and showcase the mineral potential of the area. In 2023, the Company completed an offsite bulk sample that produced important data showcasing the potential to recover both gold and silver through a variety of methods including heap leach, gravity and agitated leach (see August 22, 2023, news release for more details).

About Tocvan Ventures Corp.

Tocvan's advancing gold-silver projects are located in the mine-friendly jurisdiction of Sonora, Mexico. Through ongoing exploration programs, Company is unveiling the high-potential at its Gran Pilar Gold-Silver Project where it holds 100% interests in over 21 square kilometers of prospective area and a majority ownership (51%) in a one square kilometer area shared with Colibri Resources. The Company also holds 100% interest in the Picacho Gold-Silver project in the Caborca Trend of northern Sonora, a trend host to some of the major gold deposits of the region. Management feels both projects represent tremendous opportunity to create shareholder value.

Tocvan has approximately 51 million shares outstanding.

Quality Assurance / Quality Control

Samples were shipped for sample preparation to ALS Limited in Hermosillo, Sonora, Mexico and for analysis at the ALS laboratory in North Vancouver. The ALS Hermosillo and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Gold and multi-element analysis of soils was completed by aqua regia digestion and ICP-MS finish using a 50-gram nominal weight. Over limit gold values greater than 1 g/t were re-assayed with a more robust aqua regia digestion ad ICP-MS finish. Over limit analyses for silver (>100 g/t) were re-assayed using an ore-grade four-acid digestion with ICP-AES finish. Control samples comprising blank samples and certified reference materials were systematically inserted into the sample stream and analyzed as part of the Company's robust quality assurance / quality control protocol.

Brodie A. Sutherland, CEO for Tocvan Ventures Corp. and a qualified person ("QP") as defined by Canadian National Instrument 43-101, has reviewed and approved the technical information contained in this release.

Cautionary Statement Regarding Forward-Looking Statements

Neither the Canadian Securities Exchange nor its regulation services provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains "forward-looking information" which may include, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future. Forward-looking information in this news release includes statements regarding the use of proceeds from the Offering. Such forward-looking information is often, but not always, identified by the use of words and phrases such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. Management believes that these assumptions are reasonable. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others, risks related to the speculative nature of the Company's business, the Company's formative stage of development and the Company's financial position. Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws.

There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

For more information, please contact:

TOCVAN VENTURES CORP.

Brodie A. Sutherland, CEO

1150, 707 - 7 Ave SW

Calgary, Alberta T2P 3H6

+1-403-829-9877

bsutherland@tocvan.ca

The Howard Group

Jeff Walker

VP Howard Group Inc.

+1-403-221-0915

jeff@howardgroupinc.com

SOURCE: Tocvan Ventures Corp

View the original press release on accesswire.com