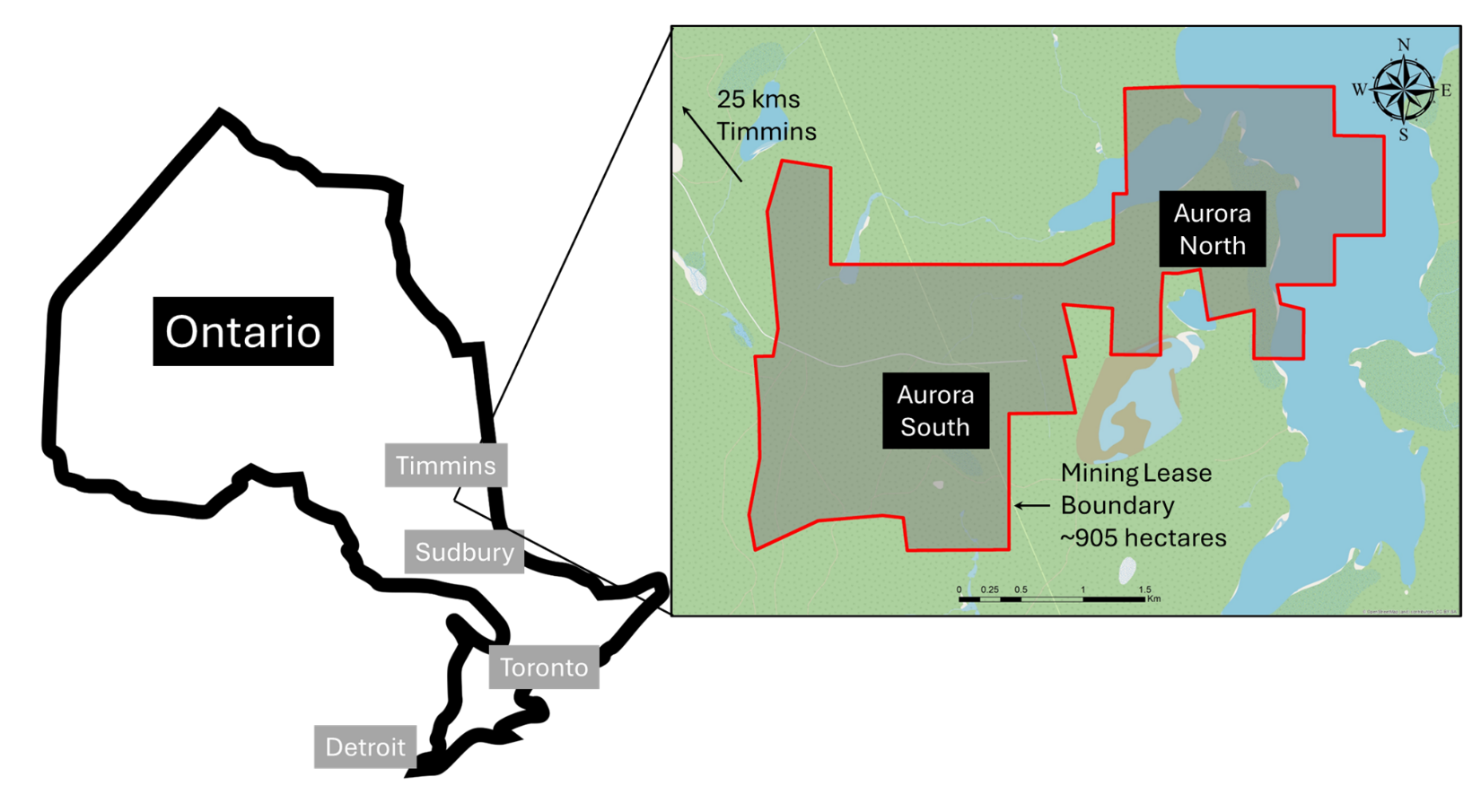

TORONTO, ON / ACCESSWIRE / November 12, 2024 / Clean Energy Transition Inc. (TSXV:TRAN) ("transition.inc" or the "Company") is pleased to announce details of its previously-acquired Aurora Nickel Project, 25 kilometres southeast of Timmins, ON. The Company is now updating the historic mineral resource estimate ("MRE"). Next week, Sean Samson, President, CEO and Director will host a panel and present at Benchmark Week, in California.

"The Aurora Nickel Project has the potential to become a low-carbon production opportunity, like we have prioritized in our strategy," said Sean Samson. "Good grade, near surface nickel mineralization, located just outside Timmins, is the type of opportunity the market has interest in and I look forward to connecting with the CarCos in the USA next week. With the inevitable political change coming to the industry, companies are planning now for how they will prepare for that future and are certainly interested in sourcing nickel from closer to home."

Aurora Nickel Project

Earlier this year transition.inc acquired a mining lease in Ontario (see news release dated July 7, 2024) which hosts the Langmuir North and Langmuir #1 Deposits. The Company has consolidated these assets and will refer to the assets as the Aurora Nickel Project, incorporating the Aurora North and Aurora South Deposits. The Aurora Nickel Project is approximately 25 kilometres southeast of Timmins, Ontario and the mining lease incorporates ~905 hectares.

Aurora Nickel Project Historical Mineral Resource Estimate

Micon International Limited ("Micon") previously completed an MRE for the Aurora Nickel Project (ref. Sedar+ filed report titled "Technical Report on the Initial MRE for the Langmuir North and Langmuir #1 Nickel Deposits, Langmuir Township, Ontario, Canada", issued January 6, 2010, revised June 4, 2015) and this MRE (see Table 1) is considered historical in nature. Although the resource estimate was prepared and disclosed in accordance with disclosure requirements for mineral resources set out in the Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and the classification of the historical resource as a Measured, Indicated and Inferred resource is consistent with the 2014 CIM Definition Standards - For Mineral Resources and Mineral Reserves, a qualified person has not done sufficient work to classify the historical resource estimate as a current mineral resource in view of the recent (November 2019) CIM Best Practice guidelines on the estimation of Mineral Resources/Reserves and the CIM Environmental, Social and Governance Guidelines (September 2023); hence, the Company is not treating the historical resource estimate as a current mineral resource.

Table 1- Aurora Nickel Project Summary of Historical Mineral Resource Estimate (June 4, 2015)

Deposit | Mining | Category | Tonnes | Grade Ni% | Strip Ratio |

Aurora North | Open pit | Indicated | 8,324,000 | 0.40 | 2.93 |

Aurora South | Open pit | Indicated | 1,733,000 | 0.51 | 12.5 |

Combined | 10,057,000 | 0.42 |

| ||

It is emphasized that a qualified person has not done sufficient work to classify the historical estimates referenced herein as current mineral resources and the Company is not treating the historical estimate as current mineral resources or mineral reserves.

For context- equivalent number of Electric Vehicles in the Historic MRE's Contained Nickel

It is estimated that the average electric vehicle battery requires ~145 pounds of nickel (Bloomberg New Energy Finance ("BNEF") estimate, for a 100kWh battery*) and based on this, the Contained Nickel in the Aurora Nickel Project's Historical MRE represents the equivalent nickel which would be used in more than 642K electric vehicles. For context, this is ~3.5x the total 2023 new Battery EV registrations in Canada**.

* Company estimates, based on BNEF calculations https://tinyurl.com/3xswdn8k.

** Company estimates, based on 139,501 Battery EVs registered in Canada (StatsCan) https://tinyurl.com/3z8penz7.

Benchmark Week Presentation

This week in California, Sean Samson will speak at Benchmark Week 2024. Since 2016, Benchmark Week has been the leading gathering for the world's lithium-ion battery supply chain and the wider energy transition. Mr Samson has been asked to present on the Company's assets, including the Aurora Nickel Project.

About Clean Energy Transition Inc.

Transition.inc is focused on opportunities to generate positive cash flow across the energy transition. The Company includes a Quartz division, focused on advancing its silica/Quartz business with the Snow White Project in Ontario and the Silicon Ridge Project in Québec. The silica in high-quality Quartz can be used to make silicon metal, a key component in solar energy panels. In addition to Quartz, transition.inc is looking for low-carbon production opportunities in critical minerals and additional opportunities developing with the rapid change underway.

Qualified Person

The Qualified Person for this News Release as defined by NI 43-101, is Mr. Charley Murahwi, M.Sc., P.Geo., Pr. Sci. Nat., FAusIMM and Senior Economic Geologist at Micon International Limited. Mr. Murahwi has reviewed and approved the technical information in this press release, related to the Aurora Project Historical Resource. There are no known factors that could materially affect the reliability of the information verified by Mr. Murahwi.

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking information. Such forward-looking statements or information are provided to inform the Shareholders and potential investors about management's current expectations and plans relating to the future. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Any such forward-looking information may be identified by words such as "anticipate", "proposed", "estimates", "would", "expects", "intends", "plans", "may", "will", and similar expressions.

More particularly and without limitation, the forward-looking statements in this news release include (i) expectations regarding approvals by the TSXV and Shareholders; (ii) expectations regarding the timing and receipt thereof; and (iii) expectations concerning the Company's business plans and operations. Forward-looking statements or information are based on a number of factors and assumptions that have been used to develop such statements and information, but which may prove to be incorrect. Although the Company believes that the expectations reflected in such forward-looking statements or information are reasonable, undue reliance should not be placed on forward-looking statements because the Company can give no assurance that such expectations will prove to be correct. The forward-looking information in this news release reflects the current expectations, assumptions and/or beliefs of the Company based on information currently available to the Company. Any forward-looking information speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or expressly qualified by this cautionary statement.

Contact Information

For further information, visit www.transition.inc

Or contact: Sean Samson, President, CEO, and Director at:

Clean Energy Transition Inc.

200 - 150 King St. W.

Toronto, ON M5H 1J9

info@transition.inc

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy of this release.

SOURCE: Clean Energy Transition Inc.

View the original press release on accesswire.com