Clarence H. Smith to Retire as CEO; Will Remain as Executive Chairman

Steven G. Burdette to Assume CEO Position and Become Director

ATLANTA, GA / ACCESSWIRE / November 12, 2024 / HAVERTYS (NYSE:HVT)(NYSE:HVTA) today announced that Clarence H. Smith, CEO and chairman of the board, has chosen to retire from his position as CEO and transition to executive chairman of the board, effective January 1, 2025. At that time, Steven G. Burdette, currently president, will succeed Smith as president and CEO of Havertys and will serve as a member of the board of directors.

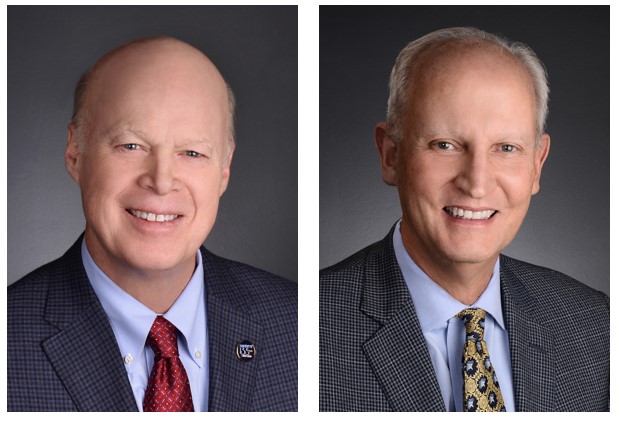

Clarence Smith and Steve Burdette

"Today's announcement follows a planned transition to select the next CEO to lead Havertys," said Smith. "Steve has been an invaluable member of my leadership team, delivering on strategic initiatives and operational excellence during turbulent times. With this transition, Steve becomes only the 7th CEO in the 139-year history of Havertys. His deep knowledge of the industry, passion for the company and its culture, and the respect of an experienced team make Steve the right leader to move the company forward. I am grateful to every team member for their dedication to Havertys' success and their honoring of the legacy of our company's founders."

"The selection of Steve as CEO is the result of an established and thoughtful process to ensure a seamless leadership transition that focuses on strength and growth," commented Tom Hough, lead independent director of Havertys' board of directors. "We are pleased Clarence will assume his role as executive chairman, providing insights to the company's strategic directions from his more than 50 years with Havertys and outstanding leadership as CEO since 2003. Under Clarence's guidance the company weathered two great challenges, the financial crisis which began in late 2007 and the global COVID-19 pandemic. Clarence evolved the company's vision and transformed Havertys from a retailer of other company's merchandise into a specialty branded retailer selling exclusively the Havertys brand of quality furniture."

Burdette said, "I am excited and appreciate the trust and confidence the board has shown in me to lead this great company. We have a remarkable legacy and a strong platform from which to grow. I look forward to continuing Havertys' tradition of serving our customers, suppliers, team members, and shareholders with integrity and accountability."

Burdette, 63, was appointed president in 2021. He began his career with Havertys as a manager trainee in Tampa, Fl in 1983 and has held responsibilities for all aspects of the business including store management, distribution, operations, merchandising, and marketing. He was named executive vice president, stores in 2008 and executive vice president, operations in 2017 prior to his appointment as president. Burdette earned a Bachelor of Business Administration in Finance from the University of Georgia.

About Havertys

Havertys (NYSE:HVT)(NYSE:HVTA), established in 1885, is a full-service home furnishings retailer with 127 showrooms in 17 states in the Southern and Midwestern regions providing its customers with a wide selection of quality merchandise in middle to upper-middle price ranges. Additional information is available on the Company's website at www.havertys.com.

Contact:

Havertys 404-443-2900

Jenny Hill Parker

SVP, finance and

Corporate Secretary

SOURCE: Haverty Furniture Companies, Inc.

View the original press release on accesswire.com