- Announced additional interim data from ongoing Phase 1 clinical study of ORX750, a novel orexin receptor 2 (OX2R) agonist, in acutely sleep-deprived healthy volunteers that further support best-in-class potential of ORX750 in narcolepsy type 1 (NT1), narcolepsy type 2 (NT2), and idiopathic hypersomnia (IH); Presentation of Phase 1 data planned for medical congress in Q2 2025

- Initiated Phase 2a clinical study of ORX750 in patients with NT1, NT2 and IH; Phase 2a data across all three indications expected in 2025 with first-in-class potential in NT2 and IH

- Advancing ORX142 in IND-enabling studies for treatment of neurological, neurodegenerative, and psychiatric disorders; Clinical data in healthy volunteers planned for 2025

- Nominated ORX489 as third OX2R agonist development candidate; Entering IND-enabling studies for treatment of additional neurological, neurodegenerative, and psychiatric disorders

- Announced strategic decision to discontinue clinical development of SerpinPC; Net savings of approximately $200 million to be reallocated towards expansion of OX2R agonist franchise

BOSTON and LONDON, Nov. 12, 2024(Nasdaq: CNTA), a clinical-stage pharmaceutical company with a mission to discover, develop and ultimately deliver medicines that are transformational for patients, today reported financial results for the third quarter ended September 30, 2024, and provided a business update.

"The totality of data across our OX2R agonist program continues to reinforce the strength of our discovery engine and the therapeutic potential of these assets across a broad spectrum of disorders," said Saurabh Saha MD PhD, Chief Executive Officer of Centessa. "The Phase 1 interim data for ORX750, now updated to include over 70 subjects dosed with ORX750, continue to support its best-in-class potential in NT1, NT2 and IH. Based on the strength of these interim data, we recently initiated a Phase 2a clinical study of ORX750 in patients with NT1, NT2 and IH. Similar to our Phase 1 study, which enabled a move from IND clearance to clinical data in the course of a few months, we expect our Phase 2a study design to generate clinical data for all three indications in 2025 and enable dose selection for future pivotal studies with the potential to be first-in-class in NT2 and IH."

Dr. Saha continued, "In addition to ORX750, we are advancing a growing pipeline of OX2R agonists targeting excessive daytime sleepiness (EDS) in neurological, neurodegenerative, and psychiatric disorders, as well as other potential symptoms including impaired attention, cognitive deficits, and fatigue. ORX142 is currently in IND-enabling studies, and subject to IND clearance, we expect to initiate clinical development and share clinical data in acutely sleep-deprived healthy volunteers in 2025. We're also pleased to be kicking off our next wave of candidates with ORX489, our most potent OX2R agonist to date based on preclinical data, which is entering IND-enabling studies."

Interim Data from Ongoing Phase 1 Clinical Study of ORX750

The additional interim data from the ongoing Phase 1 clinical trial of ORX750 in healthy volunteers includes results from two single-ascending dose (SAD) cohorts at 3.5 mg (n=12: 9 active, 3 placebo) and 5.0 mg (n=12: 9 active, 3 placebo), a cohort of acutely sleep-deprived healthy volunteers within the cross-over assessment at 3.5 mg (n=10) administered as a single oral dose, and two multiple-ascending dose (MAD) cohorts at 2.0 mg (n=10: 8 active, 2 placebo) and 3.0 mg (n=10: 8 active, 2 placebo). The interim data showed:

- Significantly increased wakefulness in acutely sleep-deprived healthy volunteers compared to placebo at all doses tested, with a clear dose dependent response. Treatment with ORX750 resulted in statistically significant (p<0.05) and clinically meaningful increased sleep latency in the Maintenance of Wakefulness Test (MWT) (time to sleep onset over the four sessions performed at ~2, 4, 6, and 8 hours after dosing at 11 p.m., maximum 40 minutes per session) compared to placebo at all doses tested. The 3.5 mg dose was shown to restore normative wakefulness1 with a mean sleep latency of 34 minutes and a placebo-adjusted mean sleep latency of 20 minutes, as measured by the MWT.

| Interim Data from Ongoing Phase 1 Clinical Study of ORX750 (as of October 31, 2024 data cutoff date) |

| ORX750 LS Mean (95% CI) Sleep Latency (Minutes) | Placebo LS Mean (95% CI) Sleep Latency (Minutes) | LS Mean Difference Compared to Placebo (95% CI) | p-Value | |

| 1.0 mg (n=8) | 18 (12, 23) | 10 (4, 15) | 8 (0, 16) | p=0.04 |

| 2.5 mg (n=8) | 32 (22, 42) | 17 (7, 27) | 15 (5, 26) | p=0.01 |

| 3.5 mg (n=10) | 34 (27, 40) | 13 (7, 20) | 20 (15, 25) | p<0.0001 |

- A favorable safety and tolerability profile with all observed treatment-emergent adverse events (AEs) being mild and transient with none leading to treatment discontinuation. No cases of hepatotoxicity or visual disturbances were observed. Additionally, there were no clinically significant treatment-emergent changes in hepatic and renal parameters, vital signs, or electrocardiogram (ECG) parameters.

| Interim Safety Data from Ongoing Phase 1 Clinical Study of ORX750 (as of October 31, 2024 data cutoff date) | |||||||||

| SAD Cohorts | MAD Cohorts | ||||||||

| Placebo (n=15) | ORX750 1.0 mg (n=9) | ORX750 2.0 mg (n=9) | ORX750 2.5 mg (n=9) | ORX750 3.5 mg (n=9) | ORX750 5.0 mg (n=9) | Placebo (n=4) | ORX750 2.0 mg (n=8) | ORX750 3.0 mg (n=8) | |

| Any TEAE, n (%) | 4 (27) | 3 (33) | 3 (33) | 1 (11) | 0 | 3 (33) | 2 (50) | 4 (50) | 3 (38) |

| Related | 4 (27) | 0 | 2 (22) | 1 (11) | 0 | 2 (22) | 1 (25) | 4 (50) | 2 (25) |

| Nonrelated | 1 (7) | 3 (33) | 2 (22) | 0 | 0 | 2 (22) | 2 (50) | 2 (25) | 1 (12) |

| Mild | 4 (27) | 3 (33) | 3 (33) | 1(11) | 0 | 3 (33) | 2 (50) | 4 (50) | 3 (38) |

| Moderate | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Severe | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| TEAEs leading to discontinuation, n (%) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Serious TEAEs, n (%) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Frequently reported AEs associated with other OX2R agonists | |||||||||

| Insomnia | 0 | 0 | 0 | 0 | 0 | 0 | 1 (25) | 2 (25) | 0 |

| Urinary frequency/urgency | 1 (7) | 0 | 0 | 0 | 0 | 1 (11) | 0 | 1 (12) | 1 (12) |

| Visual disturbances | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Hepatotoxicity | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Blood pressure increased | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Treatment-emergent adverse event (TEAE). Safety data from Sleep Study Cohorts was consistent with SAD. Nonrelated includes unlikely related and not related. Related includes probably and possibly related. | |||||||||

- An encouraging linear pharmacokinetic (PK) profile that supports the use of ORX750 as a once-daily oral dosing regimen with rapid absorption (plasma concentrations of ORX750 peaked 2h after the first dose). The systemic exposure of ORX750 increased in a dose-proportional manner.

The Phase 1 study is ongoing as dose escalation is continuing in the acutely sleep-deprived cross-over assessment, SAD and MAD portions of the study.

Phase 2a Clinical Study of ORX750

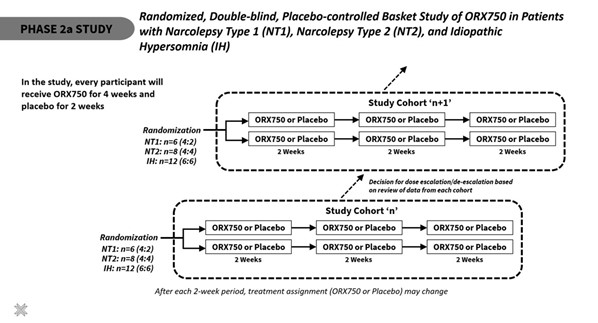

The Phase 2a study is a randomized, double-blind, placebo-controlled, cross-over basket study to evaluate the safety, tolerability, and PK of ORX750 in patients with NT1, NT2, and IH. There will be separate cohorts for each indication. Initial dosing for NT1 will be 1.0 mg and for NT2 and IH will be 2.0 mg with sequential dose escalation/de-escalation between cohorts. Each dosing cohort consists of a 6-week treatment duration with crossover study design. During the 6 weeks of treatment, each participant will be randomized to one of two blinded treatment sequences and receive a total of 4 weeks of treatment with ORX750 and 2 weeks of treatment with placebo. Efficacy assessments will evaluate the effect of ORX750 on excessive daytime sleepiness (using the MWT and Epworth Sleepiness Scale (ESS)), cataplexy (NT1 patients only), and overall symptom improvement (measured by Narcolepsy Severity Scale (NSS) and Idiopathic Hypersomnia Severity Scale (IHSS)). Other exploratory assessments include measures of sleep, cognition, attention, memory, and general health.

"The Phase 2a study of ORX750 is intended to accelerate overall timelines and inform future registrational studies," said Mario Alberto Accardi PhD, President of Centessa's Orexin Program. "This well-powered study leverages highly innovative design elements which we believe have the potential to enable efficient data generation with an optimal number of patients in each indication. With this design, all participating patients will receive ORX750 for at least 4 weeks. We aim to generate data across all three indications in 2025, which could enable ORX750 to be first-in-class in NT2 and IH."

SerpinPC Clinical Program Update

The Company has made a strategic and data-driven decision to discontinue the global clinical development of SerpinPC, a novel inhibitor of activated protein C that was being evaluated for the treatment of hemophilia B. This action was driven by the Company's decision to prioritize capital toward the development of its OX2R agonist program and the outcome of a planned interim analysis of Part 1 of the PRESent-2 study of SerpinPC. Within the interim analysis, SerpinPC was observed to have a favorable safety and tolerability profile; however, the Company determined that additional time and investment would be required to further develop SerpinPC with a more competitive profile for the treatment of hemophilia B in light of the evolving treatment and market landscape for hemophilia B, including the recent FDA approval of a competing product. The Company would like to thank the hemophilia community and all the patients, caregivers and physicians who participated in the SerpinPC clinical trials. The Company is now exploring potential strategic alternatives for SerpinPC.

"Moving forward, we intend to prioritize our resources and reallocate net savings of approximately $200 million associated with the planned commercial launch of SerpinPC towards expanding our potential best-in-class OX2R agonist franchise, where we see significant opportunities to both address unmet patient needs and create shareholder value," stated John Crowley, Chief Financial Officer. "With a cash runway that extends into mid-2027, we believe Centessa is well positioned to support our OX2R agonist franchise through multiple, potential value-creating milestones."

Recent Highlights

- In September, the Company presented preclinical data from non-human primate studies of ORX142 at the 27th Congress of the European Sleep Research Society (Sleep Europe 2024).

- In September, the Company completed an upsized underwritten public offering of 17,542,372 American Depositary Shares (ADSs) in the aggregate, at a price to the public of $14.75 per ADS, resulting in net proceeds of approximately $242.7 million, which included the underwriters' over-allotment option to purchase additional shares.

- In September, the Company announced positive interim data from the ongoing Phase 1 clinical trial of ORX750 in acutely sleep-deprived healthy volunteers as of an August 26, 2024 data cutoff date.

Anticipated Upcoming Program Milestones

- OX2R Agonist Program -

- ORX750: Subject to acceptance, a presentation of Phase 1 clinical data is planned at a medical conference in the second quarter of 2025. The Company expects to share Phase 2a data for NT1, NT2 and IH in 2025.

- ORX142: Advancing through IND-enabling studies. The Company is focused on obtaining IND clearance and initiating clinical development with the goal of sharing clinical data in acutely sleep-deprived healthy volunteers in 2025.

- ORX489: Entering IND-enabling studies.

- OX2R Agonist Pipeline: Progressing additional OX2R agonists as well as research efforts on differentiated pharmacology associated with the activation of the orexin system.

- LockBody Technology Platform - LB101 (PD-L1xCD47 LockBody) is in an ongoing Phase 1/2a first-in-human clinical study for the treatment of solid tumors.

Third Quarter 2024 Financial Results

- Cash, Cash Equivalents and Short-term Investments: $518.4 million as of September 30, 2024. The Company expects its cash, cash equivalents and short-term investments as of September 30, 2024 will fund operations into mid-2027.

- Research & Development Expenses: $33.9 million for the third quarter ended September 30, 2024, compared to $28.2 million for the third quarter ended September 30, 2023.

- General & Administrative Expenses: $12.5 million for the third quarter ended September 30, 2024, compared to $12.0 million for the third quarter ended September 30, 2023.

- Net Loss Attributable to Ordinary Shareholders: $42.6 million for the third quarter ended September 30, 2024, compared to $38.6 million for the third quarter ended September 30, 2023.

1. Doghramji K, et al., A normative study of the maintenance of wakefulness test (MWT). Electroencephalogr Clin Neurophysiol 1997; 103:554-62.

About Centessa Pharmaceuticals

Centessa Pharmaceuticals plcis a clinical-stage pharmaceutical company that aims to discover and develop medicines that are transformational for patients. We are developing potential best-in-class orexin receptor 2 (OX2R) agonists intended to be orally administered for the treatment of sleep-wake disorders including narcolepsy type 1 (NT1), narcolepsy type 2 (NT2) and idiopathic hypersomnia (IH), and excessive daytime sleepiness (EDS) in neurological, neurodegenerative, and psychiatric conditions. We also anticipate that our orexin agonists may have utility in treating impaired attention, cognitive deficits, fatigue, and other symptoms. Our lead OX2R agonist, ORX750, is currently being evaluated in Phase 1 and Phase 2 clinical trials for NT1, NT2 and IH. ORX750 has not been approved by the FDA or any other regulatory authority. Centessa's proprietary LockBody technology platform aims to redefine immuno-oncology treatment for patients with cancer. LockBody drug candidates are designed to selectively drive potent effector function activity, such as CD47 or CD3, to the tumor micro-environment (TME) while avoiding systemic toxicity. LB101 has not been approved by the FDA or any other regulatory authority.

Forward Looking Statements

This press release contains forward-looking statements. These statements may be identified by words such as "may," "might," "will," "could," "would," "should," "expect," "intend," "plan," "objective," "anticipate," "believe," "estimate," "predict," "potential," "continue," "ongoing," "aim," "seek," and variations of these words or similar expressions that are intended to identify forward-looking statements. Any such statements in this press release that are not statements of historical fact may be deemed to be forward-looking statements, including statements related to the Company's ability to discover and develop transformational medicines for patients; its expectations for executing on the Company's pipeline; its expectations on its anticipated cash runway; the timing of commencement of new studies or clinical trials or clinical and preclinical data related to ORX750, ORX142, ORX489 and other OX2R agonist molecules, LB101, other LockBody candidates, and the LockBody technology platform; its ability to identify, screen, recruit and maintain a sufficient number of or any subjects in its existing and anticipated studies or clinical trials of ORX750, ORX142, ORX489 and other OX2R agonist molecules, LB101 and any other LockBody candidates; its expectations on executing its research and clinical development plans and the timing thereof; its expectations as to the potential results and impact of each of its clinical programs and trials; the Company's ability to differentiate ORX750, ORX142, ORX489 and other OX2R agonist molecules, LB101, other LockBody candidates from other treatment options; the development, design and therapeutic potential of ORX750, ORX142, ORX489 and other OX2R agonist molecules, LB101, other LockBody candidates and the LockBody technology platform; the anticipated net savings associated with the discontinuation of the SerpinPC program; and regulatory matters, including the timing and likelihood of success of obtaining regulatory clearance, obtaining authorizations to initiate or continue clinical trials. Any forward-looking statements in this press release are based on our current expectations, estimates, assumptions and projections only as of the date of this release and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, risks related to the safety and tolerability profile of our product candidates; our ability to identify, screen and recruit a sufficient number of or any subjects in our existing and anticipated new studies or clinical trials of ORX750, ORX142, ORX489 or LB101 or within anticipated timelines; our expectations relating to the clinical trials of ORX750, including the predicted timing of enrollment, the predicted efficacious doses of ORX750 and our ability to successfully conduct our clinical development of ORX750, our ability to protect and maintain our intellectual property position; business (including commercial viability), regulatory, economic and competitive risks, uncertainties, contingencies and assumptions about the Company; risks inherent in developing product candidates and technologies; future results from our ongoing and planned clinical trials; our ability to obtain adequate financing, including through our financing facility with Oberland, to fund our planned clinical trials and other expenses; trends in the industry; the legal and regulatory framework for the industry, including the receipt and maintenance of clearances to conduct or continue clinical testing; our operating costs and use of cash, including cash runway, cost of development activities and conducting clinical trials, future expenditures risks; the risk that any one or more of our product candidates will not be successfully developed and/or commercialized; the risk that the historical results of preclinical studies or clinical studies will not be predictive of future results in ongoing or future studies; economic risks to the United States and United Kingdom banking systems; and geo-political risks such as the Russia-Ukraine war or the Middle East conflicts. These and other risks concerning our programs and operations are described in additional detail in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and our other reports, which are on file with the U.S. Securities and Exchange Commission (SEC). We explicitly disclaim any obligation to update any forward-looking statements except to the extent required by law.

Contact:

Kristen K. Sheppard, Esq.

SVP of Investor Relations

investors@centessa.com

| Centessa Pharmaceuticals plc Consolidated Statements of Operations and Comprehensive Loss (unaudited) (amounts in thousands except share and per share data) | |||||||||||||||

| Three Months Ended September 30, 2024 | Three Months Ended September 30, 2023 | Nine Months Ended September 30, 2024 | Nine Months Ended September 30, 2023 | ||||||||||||

| Operating expenses: | |||||||||||||||

| Research and development | $ | 33,903 | $ | 28,190 | $ | 89,370 | $ | 94,689 | |||||||

| General and administrative | 12,502 | 12,019 | 37,105 | 41,416 | |||||||||||

| Loss from operations | (46,405 | ) | (40,209 | ) | (126,475 | ) | (136,105 | ) | |||||||

| Interest income | 3,340 | 2,953 | 9,171 | 7,543 | |||||||||||

| Interest expense | (2,557 | ) | (2,541 | ) | (7,611 | ) | (7,336 | ) | |||||||

| Other income (expense), net | 3,664 | (1,677 | ) | 2,281 | (4,550 | ) | |||||||||

| Loss before income taxes | (41,958 | ) | (41,474 | ) | (122,634 | ) | (140,448 | ) | |||||||

| Income tax expense (benefit) | 608 | (2,826 | ) | 1,794 | (26,200 | ) | |||||||||

| Net loss | (42,566 | ) | (38,648 | ) | (124,428 | ) | (114,248 | ) | |||||||

| Other comprehensive income (loss): | |||||||||||||||

| Foreign currency translation adjustment | (412 | ) | (419 | ) | (498 | ) | 1,241 | ||||||||

| Unrealized gain on available for sale securities, net of tax | 912 | 252 | 1,100 | 1,035 | |||||||||||

| Other comprehensive income (loss) | 500 | (167 | ) | 602 | 2,276 | ||||||||||

| Total comprehensive loss | $ | (42,066 | ) | $ | (38,815 | ) | $ | (123,826 | ) | $ | (111,972 | ) | |||

| Net loss per ordinary share - basic and diluted | $ | (0.37 | ) | $ | (0.40 | ) | $ | (1.15 | ) | $ | (1.20 | ) | |||

| Weighted average ordinary shares outstanding - basic and diluted | 116,253,902 | 96,648,110 | 108,571,742 | 95,589,181 | |||||||||||

| Centessa Pharmaceuticals plc Condensed Consolidated Balance Sheets (unaudited) (amounts in thousands) | |||||||

| September 30, 2024 | December 31, 2023 | ||||||

| Total assets: | |||||||

| Cash and cash equivalents | $ | 395,026 | $ | 128,030 | |||

| Short-term investments | 123,423 | 128,519 | |||||

| Other assets | 91,266 | 103,697 | |||||

| Total assets | $ | 609,715 | $ | 360,246 | |||

| Total liabilities | |||||||

| Other liabilities | $ | 34,878 | $ | 48,302 | |||

| Long term debt | 75,700 | 75,700 | |||||

| Total liabilities | 110,578 | 124,002 | |||||

| Total shareholders' equity | 499,137 | 236,244 | |||||

| Total liabilities and shareholders' equity | $ | 609,715 | $ | 360,246 | |||

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/46d719f5-271c-4504-9151-9da45a7837e8