Last patient completed pivotal Phase 3 trial in CHB-associated liver fibrosis in the PRC with data expected in Q1 2025

On track to initiate U.S. Phase 2 trial of F351 in MASH-associated liver fibrosis in 2025

Commercial launch of avatrombopag maleate tablets expected by the first half of 2025

Commercial launch of nintedanib expected in 2025

Cash and cash equivalents totaled $15.9 million as of September 30, 2024

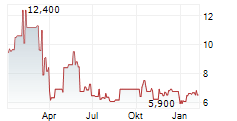

SAN DIEGO, Nov. 13, 2024 (GLOBE NEWSWIRE) -- Gyre Therapeutics ("Gyre") (Nasdaq: GYRE), a self-sustainable, commercial-stage biotechnology company with clinical development programs focusing on a variety of chronic organ diseases, today announced financial results for the third quarter and nine months ended September 30, 2024, and provided a business update.

"Our team has made great progress over the last several months and recently achieved a significant milestone with the final patient completing 52 weeks of study in our pivotal Phase 3 trial for F351 in CHB-associated liver fibrosis. We are encouraged by F351's potential as a novel treatment for this fibrotic disease and are excited to share topline results in the first quarter 2025," said Han Ying, Ph.D., Chief Executive Officer of Gyre Therapeutics. "With several upcoming milestones in 2025, including the commercial launch of two new products in the PRC as well as the anticipated initiation of a U.S. Phase 2 trial of F351 in MASH-associated liver fibrosis, we remain confident in Gyre's ability to deliver in the clinic and the commercial market for patients in need."

Third Quarter 2024 Business Highlights and Upcoming Milestones

Commercial-Stage Updates

- ETUARY (Pirfenidone) sales update: For the quarter ended September 30, 2024, Gyre Pharmaceuticals, Gyre's majority indirectly owned subsidiary in the People's Republic of China ("PRC"), generated $25.3 million in sales of ETUARY.

- Avatrombopag: In June 2024, Gyre Pharmaceuticals received approval from China's National Medical Products Administration ("NMPA") for avatrombopag maleate tablets for the treatment of thrombocytopenia associated with chronic liver disease ("CLD") in adult patients undergoing elective diagnostics procedures or therapy. This approval expands Gyre's rare disease product lines and provides a treatment option for a common and potentially life-threatening hematologic complication in patients with CLD. Gyre anticipates launching avatrombopag in the PRC in the first half of 2025 and plans to leverage its existing extensive sales and marketing platform.

- Nintedanib: Gyre Pharmaceuticals is planning to start commercializing nintedanib, a small-molecule drug for the treatment of idiopathic pulmonary fibrosis ("IPF"), which was acquired from Jiangsu Wangao Pharmaceuticals Co., Ltd., in the PRC in 2025. Nintedanib is the other product approved for the treatment of IPF, which is currently approved globally for the treatment of IPF. Nintedanib is expected to provide patients more choices and benefits, and further enhance Gyre Pharmaceuticals' leading position in the pulmonary fibrosis market.

Clinical Development Updates

F351 (Hydronidone):

- All patients completed 52-week Phase 3 trial evaluating F351 for the treatment of Chronic Hepatitis B ("CHB")-associated liver fibrosis. In October 2024, Gyre Pharmaceuticals announced the final patient had completed the 52-week pivotal Phase 3 trial in patients with CHB-associated liver fibrosis in the PRC. The trial evaluated 248 patients with a primary endpoint of the reduction of the liver fibrosis score (Ishak Scoring System) by at least one stage after taking F351 in combination with Entecavir. Gyre Pharmaceuticals remains on track to report topline data in the first quarter of 2025.

- Plans to initiate a Phase 2 clinical trial in metabolic dysfunction-associated steatohepatitis ("MASH")-associated liver fibrosis in 2025. Pending the results from the PRC Phase 3 trial in CHB-associated liver fibrosis, Gyre intends to initiate a Phase 2 proof-of-concept clinical trial to evaluate F351 for the treatment of MASH-associated liver fibrosis in 2025.

F573:

- Ongoing Phase 2 trial in the PRC. Gyre Pharmaceuticals is conducting a randomized, double-blind, placebo-controlled Phase 2 clinical trial in the PRC to assess the safety and efficacy of F573, a caspase inhibitor for injection in the treatment of acute/acute on-chronic liver failure.

Preclinical Development Updates

- F230: F230 is a selective endothelin receptor agonist for the treatment of pulmonary arterial hypertension ("PAH"). In May 2024, Gyre Pharmaceuticals received NMPA approval for its Investigational New Drug ("IND") application to evaluate for F230 tablets for the treatment of PAH and expects to initiate a Phase 1 trial in 2025.

- F528: F528 is a novel anti-inflammation agent that targets the inhibition of multiple inflammatory cytokines and has the potential to modify the progression of chronic obstructive pulmonary disease ("COPD") with low toxicity in vivo. Gyre Pharmaceuticals is evaluating F528 in preclinical studies as a potential first-line therapy for the treatment of COPD.

Corporate Updates

- In August 2024, Gyre announced the appointment of David M. Epstein, Ph.D., to its Board of Directors. Dr. Epstein has extensive global experience in biotech companies across the United States and Asia. Dr. Epstein is a co-founder of PairX Bio Pte. Ltd., where he currently serves as director, President and Chief Executive Officer. Dr. Epstein co-founded and served as President and Chief Executive Officer of Black Diamond Therapeutics, leading the company through its January 2020 IPO. Prior to Black Diamond, Dr. Epstein was Vice Dean, Innovation & Entrepreneurship and Associate Professor at Duke-NUS Medical School in Singapore.

Financial Results

Cash Position

As of September 30, 2024, Gyre had cash and cash equivalents of $15.9 million. Based on current plans, Gyre anticipates that its cash resources as of September 30, 2024 will enable it to fund operations through at least 12 months following the issuance of the condensed financial statements.

Financial Results for the Three Months Ended September 30, 2024

- Revenues: Revenues for the three months ended September 30, 2024 were $25.5 million, compared to $32.0 million for the same period in 2023. The $6.5 million decrease was primarily driven by a $6.4 million decrease in anti-fibrosis drug sales and a $0.1 million decrease in generic drug sales due to fluctuations in the Chinese economy significantly affecting demand for anti-fibrosis drugs and decreasing healthcare spending generally. To support future revenue growth, we plan to commercially launch new products, such as nintedanib and avatrombopag, in early 2025, which will be supported by our extensive sales and marketing platform across the PRC.

- Cost of Revenues: For the three months ended September 30, 2024, cost of revenues was $1.0 million, compared to $1.2 million for the same period in 2023. The decrease was primarily driven by a $0.1 million factory stoppage loss due to factory renovation in 2023 and a $0.1 million decrease in sales quantity.

- Selling & Marketing Expense: For the three months ended September 30, 2024, selling and marketing expense was $13.7 million, compared to $13.9 million for the same period in 2023. The decrease was primarily driven by a $0.9 million decrease in conference costs due to a decrease in conference activity, a $0.9 million decrease in staff cost as well as a $0.1 million decrease in other expenses, partially offset by a $1.5 million increase in promotional expenses and a $0.2 million increase in travel expense.

- R&D Expense: For the three months ended September 30, 2024, research and development expense was $2.8 million, compared to $3.0 million for the same period in 2023. The decrease was primarily from Gyre Pharmaceuticals, and was driven by a $0.5 million decrease in pre-clinical research expense and a $0.2 million decrease in staff cost due to the decrease in headcount in the research and development department, partially offset by a $0.5 million increase in our clinical trial expense and clinical trial expense from Gyre Pharmaceuticals.

- G&A Expense: For the three months ended September 30, 2024, general and administrative expense was $3.8 million, compared to $1.2 million for the same period in 2023. The increase was primarily driven by costs associated with being a public company, including a $0.9 million increase in functional and administrative department's personnel and stock compensation costs, a $0.6 million increase in miscellaneous expenses, and a $1.2 million increase in professional expense.

- Income from operations: For the three months ended September 30, 2024, income from operations was $4.2 million, compared to $12.8 million for the same period in 2023.

- Net Income: For the three months ended September 30, 2024, net income was $2.9 million, compared to $7.5 million in net income for the same period in 2023.

Financial Results for the Nine Months Ended September 30, 2024

- Revenues: For the nine months ended September 30, 2024, revenue was $77.9 million, compared to $86.3 million for the same period in 2023. The $8.4 million decrease was primarily driven by a $8.0 million decrease in anti-fibrosis drug sales and a $0.4 million decrease in generic drugs due to the same factors mentioned above. If approved by the NMPA for commercial use, we expect that F351 for the treatment of CHB-associated liver fibrosis in the PRC will support revenue growth in the future, which will be supported by our extensive sales and marketing platform across the PRC.

- Cost of Revenues: For the nine months ended September 30, 2024, cost of revenues was $2.7 million, compared to $3.4 million for the same period in 2023. The decrease was primarily driven by a $0.4 million factory stoppage loss due to factory renovation in 2023, and a $0.4 million decrease in generic drug cost due to the decrease of sales, offset by a $0.1 million increase of the staff cost and new equipment depreciation.

- Selling & Marketing Expense: For the nine months ended September 30, 2024, selling and marketing expense was $40.7 million, compared to $44.7 million for the same period in 2023. The decrease was primarily driven by a $5.3 million decrease in conference costs due to a decrease in conference activity, partially offset by a $1.0 million increase in promotional expenses, a $0.2 million increase in staff costs due to an increase in staff headcount, and a $0.1 million increase in other expenses.

- R&D Expense: For the nine months ended September 30, 2024, research and development expense was $8.3 million, compared to $9.2 million for the same period in 2023. The $1.5 million decrease from Gyre Pharmaceuticals was primarily driven by a $1.0 million decrease in pre-clinical research expenses, a $0.3 million decrease in materials and utilities, and a $0.2 million decrease in staff cost due to the decrease in headcount in the research and development department. These decreases were offset by a $0.6 million increase in our clinical trial costs and research and development consulting costs.

- G&A Expense: For the nine months ended September 30, 2024, general and administrative expense was $10.6 million, compared to $4.6 million for the same period in 2023. The increase was primarily driven by costs associated with being a public company, including a $2.9 million increase in functional and administrative department's personnel and stock compensation costs, a $1.8 million increase in miscellaneous expenses, and a $1.3 million increase in professional expense.

- Income from operations: For the nine months ended September 30, 2024, income from operations was $15.6 million, compared to $24.4 million for the same period in 2023.

- Net Income: For the nine months ended September 30, 2024, net income was $17.3 million, compared to $15.5 million for the same period in 2023.

Use of Non-GAAP Financial Measures by Gyre Therapeutics, Inc.

Gyre reports financial results in accordance with accounting principles generally accepted in the United States ("GAAP"). This release presents the financial measure "adjusted net income," which is not calculated in accordance with GAAP. The most directly comparable GAAP measure for this non-GAAP financial measure is "net income." Adjusted net income presents Gyre's results of operations after excluding gain from change in fair value of warrants, stock-based compensation, and provision for income taxes. This is meant to supplement, and not substitute, Gyre's financial information presented in accordance with GAAP. Adjusted net income as defined by Gyre may not be comparable to similar non-GAAP measures presented by other companies. Management believes that presenting adjusted net income provides investors with additional useful information in evaluating the Gyre's performance and valuation. See the reconciliation of adjusted net income to net income in the section titled "Reconciliation of GAAP to Non-GAAP Financial Measures" below.

About Hydronidone (F351)

F351 is a structural analogue of the approved anti-fibrotic (IPF) drug Pirfenidone and has been shown to inhibit in vitro both p38? kinase activity and TGF-ß1-induced excessive collagen synthesis in hepatic stellate cells ("HSCs"), which are recognized as critical event in the development and progression of fibrosis in the liver. This is further supported by its anti-proliferative effects on the HSCs in the liver. In vitro anti-fibrotic effects of F351 were also confirmed in several established in vivo models of liver fibrosis such as CCI4-induced liver fibrosis mouse model, DMN-induced liver fibrosis rat model, and HSA-induced liver rat model, as well as mouse model of MASH fibrosis (CCI4+Western High Fat Diet).

About Gyre Pharmaceuticals

Gyre Pharmaceuticals is a commercial-stage biopharmaceutical company committed to the research, development, manufacturing and commercialization of innovative drugs for organ fibrosis. Its flagship product, ETUARY® (Pirfenidone capsule), was the first approved treatment for IPF in the PRC in 2011 and has maintained a prominent market share (2023 net sales of $112.1 million). In addition, Gyre Pharmaceuticals is evaluating F351 in a Phase 3 clinical trial in CHB-associated liver fibrosis in the PRC, which is expected to readout topline data by early 2025. F351 received Breakthrough Therapy designation by the NMPA Center for Drug Evaluation in March 2021. Gyre Pharmaceuticals is also developing treatments for COPD, PAH and ALF/ACLF. In October 2023, Gyre Therapeutics acquired an indirect majority interest in Gyre Pharmaceuticals (also known as Beijing Continent Pharmaceuticals Co., Ltd.).

About Gyre Therapeutics

Gyre Therapeutics is a biopharmaceutical company headquartered in San Diego, CA, with a primary focus on the development and commercialization of F351 (Hydronidone) for the treatment of MASH-associated fibrosis in the U.S. Gyre's development strategy for F351 in MASH is based on the company's experience in MASH rodent model mechanistic studies and CHB-induced liver fibrosis clinical studies. Gyre is also advancing a diverse pipeline in the PRC through its indirect controlling interest in Gyre Pharmaceuticals, including ETUARY therapeutic expansions, F573, F528, and F230.

Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, which statements are subject to substantial risks and uncertainties and are based on estimates and assumptions. All statements, other than statements of historical facts included in this press release, are forward-looking statements, including statements concerning: the expectations regarding Gyre's research and development efforts, timing of expected clinical readouts, including timing of topline data from Gyre Pharmaceuticals' Phase 3 clinical trial evaluating F351 for the treatment of CHB-associated liver fibrosis in the PRC, the U.S. IND submission of F351 in MASH-associated liver fibrosis, initiation of Gyre's Phase 2 trial and comprehensive Phase 2/3 clinical program in the U.S. for F351, timing of topline results from Phase 2 clinical trial in the PRC of F573 for acute/acute on-chronic liver failure and initiation of Phase 1 trial of F230 for the treatment of PAH, the expectations regarding generic drug nintedanib, the anticipated commercial launch of avatrombopag maleate tablets, interactions with regulators, expectations regarding future product sales, and Gyre's financial position and cash resources. In some cases, you can identify forward-looking statements by terms such as "may," "might," "will," "objective," "intend," "should," "could," "can," "would," "expect," "believe," "design," "estimate," "predict," "potential," "plan" or the negative of these terms, and similar expressions intended to identify forward-looking statements. These statements reflect our plans, estimates, and expectations, as of the date of this press release. These statements involve known and unknown risks, uncertainties and other factors that could cause our actual results to differ materially from the forward-looking statements expressed or implied in this press release. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation: Gyre's ability to execute on its clinical development strategies; positive results from a clinical trial may not necessarily be predictive of the results of future or ongoing clinical trials; the timing or likelihood of regulatory filings and approvals; competition from competing products; the impact of general economic, health, industrial or political conditions in the United States or internationally; the sufficiency of Gyre's capital resources and its ability to raise additional capital. Additional risks and factors are identified under "Risk Factors" in Gyre's Annual Report on Form 10-K for the year ended December 31, 2023 filed on March 27, 2024 and in other filings with the Securities and Exchange Commission.

Gyre expressly disclaims any obligation to update any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

For Investors:

Stephen Jasper

stephen@gilmartinir.com

| Gyre Therapeutics, Inc. Condensed Consolidated Statements of Operations (In thousands, except share and per share amounts) (Unaudited) | ||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenues | $ | 25,488 | $ | 32,042 | $ | 77,885 | $ | 86,302 | ||||||||

| Operating expenses: | ||||||||||||||||

| Cost of revenues | 958 | 1,184 | 2,707 | 3,386 | ||||||||||||

| Selling and marketing | 13,699 | 13,928 | 40,655 | 44,695 | ||||||||||||

| Research and development | 2,775 | 3,009 | 8,312 | 9,212 | ||||||||||||

| General and administrative | 3,823 | 1,157 | 10,645 | 4,607 | ||||||||||||

| Total operating expenses | 21,255 | 19,278 | 62,319 | 61,900 | ||||||||||||

| Income from operations | 4,233 | 12,764 | 15,566 | 24,402 | ||||||||||||

| Other income (expense), net: | ||||||||||||||||

| Interest income, net | 523 | 283 | 1,201 | 718 | ||||||||||||

| Other expense, net | (598 | ) | (1,333 | ) | (1,226 | ) | (1,281 | ) | ||||||||

| Change in fair value of warrant liability | (228 | ) | - | 6,973 | - | |||||||||||

| Loss on disposal of assets, net | - | (526 | ) | (68 | ) | (526 | ) | |||||||||

| Income before income taxes | 3,930 | 11,188 | 22,446 | 23,313 | ||||||||||||

| Provision for income taxes | (1,074 | ) | (3,678 | ) | (5,117 | ) | (7,816 | ) | ||||||||

| Net income | 2,856 | 7,510 | 17,329 | 15,497 | ||||||||||||

| Net income attributable to noncontrolling interest | 1,732 | 3,534 | 5,145 | 7,424 | ||||||||||||

| Net income attributable to common stockholders | $ | 1,124 | $ | 3,976 | $ | 12,184 | $ | 8,073 | ||||||||

| Net income per share attributable to common stockholders: | ||||||||||||||||

| Basic | $ | 0.01 | $ | 0.06 | $ | 0.14 | $ | 0.13 | ||||||||

| Diluted | $ | 0.01 | $ | 0.05 | $ | 0.05 | $ | 0.10 | ||||||||

| Weighted average shares used in calculating net income per share attributable to common stockholders: | ||||||||||||||||

| Basic | 85,643,646 | 63,588,119 | 84,807,041 | 63,588,119 | ||||||||||||

| Diluted | 102,640,373 | 78,904,324 | 102,505,585 | 78,907,695 | ||||||||||||

| Gyre Therapeutics, Inc. Condensed Consolidated Balance Sheets (In thousands, except share and per share amounts) (Unaudited) | ||||||||

| September 30, 2024 | December 31, 2023 | |||||||

| (Unaudited) | ||||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 15,866 | $ | 33,509 | ||||

| Short-term bank deposits | 9,226 | - | ||||||

| Accounts and note receivables, net | 19,487 | 15,552 | ||||||

| Other receivables from GNI | 1,287 | 1,287 | ||||||

| Inventories, net | 6,379 | 4,281 | ||||||

| Prepaid assets | 1,051 | 1,547 | ||||||

| Other current assets | 1,513 | 1,045 | ||||||

| Total current assets | 54,809 | 57,221 | ||||||

| Property and equipment, net | 24,442 | 23,288 | ||||||

| Long-term receivable from GCBP | 4,900 | 4,722 | ||||||

| Intangible assets, net | 184 | 205 | ||||||

| Right-of-use assets | 1,984 | 489 | ||||||

| Land use rights, net | 1,479 | 1,493 | ||||||

| Deferred tax assets | 5,161 | 4,695 | ||||||

| Long-term certificates of deposit | 29,515 | 23,431 | ||||||

| Other assets, noncurrent | 2,766 | 995 | ||||||

| Total assets | $ | 125,240 | $ | 116,539 | ||||

| Liabilities, convertible preferred stock, and equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 303 | $ | 355 | ||||

| Deferred revenue | 36 | 39 | ||||||

| Due to related parties | 1,288 | 1,369 | ||||||

| CVR excess closing cash payable | - | 1,085 | ||||||

| Accrued expenses and other current liabilities | 9,553 | 11,935 | ||||||

| Income tax payable | 2,842 | 5,054 | ||||||

| Operating lease liabilities, current | 694 | 210 | ||||||

| Total current liabilities | 14,716 | 20,047 | ||||||

| Operating lease liabilities, noncurrent | 1,101 | 199 | ||||||

| Deferred government grants | 185 | 213 | ||||||

| CVR derivative liability, noncurrent | 4,900 | 4,722 | ||||||

| Warrant liability, noncurrent | 5,862 | 12,835 | ||||||

| Other noncurrent liabilities | 2 | 49 | ||||||

| Total liabilities | 26,766 | 38,065 | ||||||

| Convertible Preferred Stock, $0.001 par value, 5,000,000 shares authorized; nil shares and 13,151 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | - | 64,525 | ||||||

| Stockholders' equity: | ||||||||

| Common stock, $0.001 par value, 400,000,000 shares authorized; 85,769,526 shares and 76,595,616 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | 85 | 77 | ||||||

| Additional paid-in capital | 134,296 | 68,179 | ||||||

| Statutory reserve | 3,098 | 3,098 | ||||||

| Accumulated deficit | (73,354 | ) | (85,538 | ) | ||||

| Accumulated other comprehensive loss | (946 | ) | (1,644 | ) | ||||

| Total Gyre stockholders' equity (deficit) | 63,179 | (15,828 | ) | |||||

| Noncontrolling interest | 35,295 | 29,777 | ||||||

| Total equity | 98,474 | 13,949 | ||||||

| Total liabilities, convertible preferred stock, and equity | $ | 125,240 | $ | 116,539 | ||||

| Gyre Therapeutics, Inc. Reconciliation of GAAP to Non-GAAP Financial Measures (In thousands) (Unaudited) | |||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Net income | $ | 2,856 | $ | 7,510 | $ | 17,329 | $ | 15,497 | |||||||

| Loss (gain) from change in fair value of warrants (1) | 228 | - | (6,973 | ) | - | ||||||||||

| Stock-based compensation | 237 | - | 264 | - | |||||||||||

| Provision for income taxes | 1,074 | 3,678 | 5,117 | 7,816 | |||||||||||

| Non-GAAP adjusted net income | $ | 4,395 | $ | 11,188 | $ | 15,737 | $ | 23,313 | |||||||

| (1) Reflects adjustments for fair value of warrants based on the Black-Scholes option pricing model. | |||||||||||||||