2024 Third Quarter Financial Highlights:

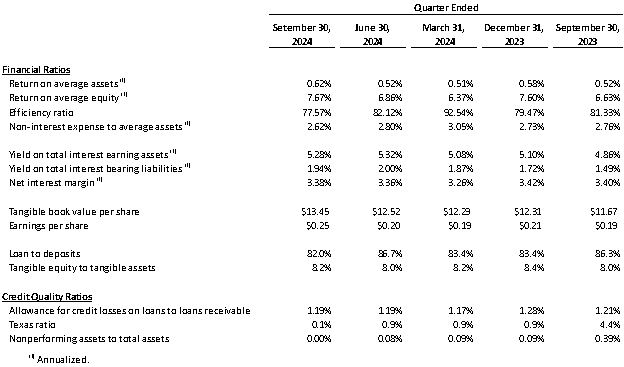

Net income was $959,000 compared to $776,000 for the second quarter of 2024.

Deposits increased $32.7 million, or 6.1%, from the second quarter of 2024. Annualized growth of 9.3%.

Loans receivable increased $1.5 million, or 0.3%, from the second quarter of 2024. Annualized growth of 7.0%.

Nonperforming assets to total assets decreased to 0.00% compared to 0.08% for the second quarter of 2024.

Tangible book value per share increased to $13.45 compared to $12.52 for the second quarter of 2024.

Capital ratios remained well above regulatory requirements.

TACOMA, WA / ACCESSWIRE / November 13, 2024 / Commencement Bancorp, Inc. (OTCQX:CBWA) (the "Company", "we," or "us"), the parent company of Commencement Bank (the "Bank") reported net income of $959,000, or $0.25 per share, for the third quarter of 2024, compared to $776,000, or $0.20 per share, for the second quarter of 2024 and $762,000, or $0.19 per share, for the third quarter of 2023.

"We are very pleased with the Bank's performance in third quarter. In this interest rate environment, it is our deposits that drive our revenues. During the quarter, we had significant growth in our deposits which supported a selling position into overnight, higher-yielding investments, and an improvement in our cost of funds and overall earnings. Although we continue to focus on growth in our deposit portfolio, we look forward to an economy that supports increased borrowings," said John E. Manolides, Chief Executive Officer.

"Our team brought in an impressive 126 new relationships over the course of third quarter, further contributing to our lowered cost of funds. We are well-positioned for this trend to continue as we gain more recognition in our communities and expand our footprint. In addition to relationships, we opened the doors of our permanent branch location in Gig Harbor and have seen a promising amount of traction as a result. We are very pleased with the overall direction of the bank," said Nigel L. English, President and Chief Operating Officer.

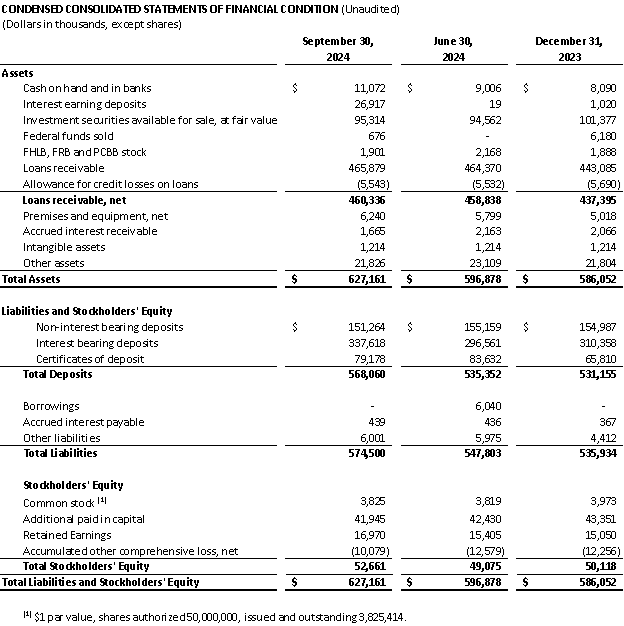

Balance Sheet

Interest earning deposits increased to $26.9 million at September 30, 2024 from $19,000 at June 30, 2024 primarily due to an increase in deposits. The Bank was in a borrowing position at June 30, 2024 in the amount of $6.0 million. All borrowings were repaid during the third quarter of 2024.

Investment securities available for sale increased $752,000, or 0.8%, to $95.3 million at September 30, 2024 from $94.6 million at June 30, 2024 due to a $3.2 million decrease in unrealized losses, offset by $2.4 million in principal payments. The decrease in market rates during the quarter caused the decrease in unrealized losses. The Bank made no investment purchases or sales during the third quarter 2024.

Loans receivable increased $1.5 million, or 0.3%, to $465.9 million at September 30, 2024 from $464.4 million at June 30, 2024 due primarily to funding of prior commitments and new originations, offset by principal payments. The Bank originated $20.8 million in commitments during third quarter of 2024 compared to $27.3 million during the second quarter of 2024 and $12.3 million during the third quarter of 2023.

Total deposits increased $32.7 million, or 6.1%, to $568.1 million at September 30, 2024 from $535.4 million at June 30, 2024 due primarily to a single commercial business relationship which had an increase in activity shortly before quarter end. The Bank expects most of this customer's balance to be distributed during the fourth quarter. Noninterest bearing deposits, as a percentage of total deposits, was 26.6% at September 30, 2024.

Credit Quality

The Bank's nonperforming assets to total assets decreased to 0.00% at September 30, 2024 compared to 0.08% at June 30, 2024 due to the payoff of one nonaccrual loan during the third quarter of 2024. The allowance for credit losses to loan receivable remains strong at 1.19% at September 30, 2024.

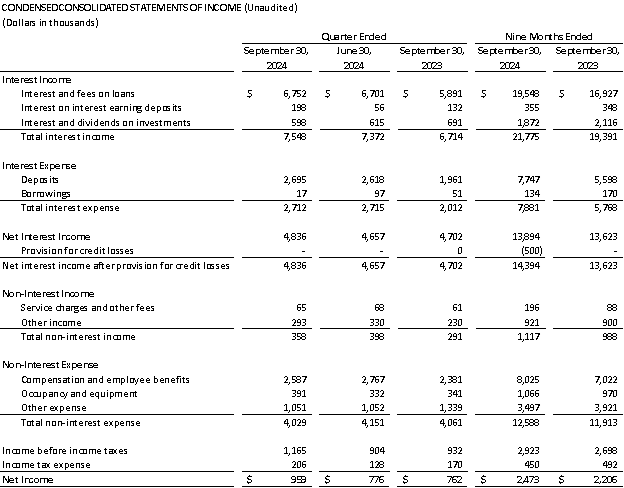

Income Statement

Net interest income increased $179,000, or 3.8%, during the third quarter of 2024 compared to the second quarter of 2024 due to the increase in interest income of $176,000 and the decrease in interest expense of $3,000. Net interest margin increased two basis points (bps) to 3.38% during the third quarter of 2024 from 3.36% during the second quarter of 2024. Net interest margin increased two bps to 3.34% for the nine months ended September 30, 2024 compared to 3.32% for the nine months ended September 30, 2023.

Interest on cash and cash equivalents increased $142,000 during third quarter of 2024 compared to second quarter 2024 due to an increase in the average balance of interest earning deposits of $11.0 million during the third quarter 2024. Yield on interest earning deposits is generally 10 bps less than the short-term Federal Funds rate.

Interest income on loans increased $51,000 during the third quarter of 2024 compared to the second quarter of 2024 due to an increase in average balances of $2.3 million, offset by a five bps decrease in yield to 5.87% for the third quarter of 2024 from 5.92% for the second quarter of 2024. Loan yield decreased four bps during the third quarter of 2024 due to the recognition of a deferred cost true-up. Loan yield increased 53 bps to 5.81% for the nine months ended September 30, 2024 compared to 5.28% for the nine months ended September 30, 2023.

Interest expense on deposits increased $77,000 during the third quarter of 2024 compared to the second quarter of 2024 due to an increase of average balance of $11.0 million, offset by a three bps decrease in the cost of interest-bearing deposits. Total cost of deposits decreased three bps to 1.93% for the third quarter of 2024 compared to 1.96% for the second quarter of 2024 due to the mix of deposits. Total cost of deposits increased 50 bps to 1.92% for the nine months ended September 30, 2024 compared to 1.41% for the nine months ended September 30, 2023 due primarily to deposit exception pricing and the transfer of customer funds to higher cost products.

The Bank recorded $17,000 of interest expense on borrowings during the third quarter of 2024 compared to $97,000 for the second quarter of 2024 due to the repayment of all outstanding borrowings early in the third quarter.

Total non-interest income decreased $40,000, or 10.1%, during the third quarter of 2024 compared to the second quarter of 2024 due to a change in the merchant service vendor and program.

Total non-interest expense decreased $122,000, or 6.5%, during the third quarter of 2024 compared to the second quarter of 2024 due to a decrease in compensation and employee benefits of $180,000 primarily related to the reversal of inactive employee deferred benefits and a reduction in incentive compensation accrual. Occupancy and equipment increased $59,000 during the third quarter of 2024 compared to the second quarter of 2024 due to the new Gig Harbor location.

###

About Commencement Bancorp, Inc.

Commencement Bancorp, Inc. is the holding company for Commencement Bank, headquartered in Tacoma, Washington. Commencement Bank was formed in 2006 to provide traditional, reliable, and sustainable banking in Pierce, King, and Thurston counties and the surrounding areas. Their team of experienced banking experts focuses on personal attention, flexible service, and building strong relationships with customers through state-of-the-art technology as well as traditional delivery systems. As a local bank, Commencement Bank is deeply committed to the community. For more information, please visit www.commencementbank.com. For information related to the trading of CBWA, please visit www.otcmarkets.com.

For further discussion, please contact the following:

John E. Manolides,Chief Executive Officer | 253-284-1802

Nigel L. English, President & Chief Operating Officer | 253-284-1801

Brandi Parker, Executive Vice President & Chief Financial Officer | 253-284-1803

Forward-Looking Statement Safe Harbor: This news release contains comments or information that constitutes forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) that are based on current expectations that involve a number of risks and uncertainties. Forward-looking statements describe Commencement Bancorp, Inc.'s projections, estimates, plans and expectations of future results and can be identified by words such as "believe," "intend," "estimate," "likely," "anticipate," "expect," "looking forward," and other similar expressions. They are not guarantees of future performance. Actual results may differ materially from the results expressed in these forward-looking statements, which because of their forward-looking nature, are difficult to predict. Investors should not place undue reliance on any forward-looking statement, and should consider factors that might cause differences including but not limited to the degree of competition by traditional and nontraditional competitors, declines in real estate markets, an increase in unemployment or sustained high levels of unemployment; changes in interest rates; greater than expected costs to integrate acquisitions, adverse changes in local, national and international economies; changes in the Federal Reserve's actions that affect monetary and fiscal policies; changes in legislative or regulatory actions or reform, including without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act; demand for products and services; changes to the quality of the loan portfolio and our ability to succeed in our problem-asset resolution efforts; the impact of technological advances; changes in tax laws; and other risk factors. Commencement Bancorp, Inc.undertakes no obligation to publicly update or clarify any forward-looking statement to reflect the impact of events or circumstances that may arise after the date of this release.

SOURCE: Commencement Bank

View the original press release on accesswire.com