"Leveraging the Strength of Our Franchises"

Third quarter 2024

- Net sales amounted to SEK 42.7 million (494.4).

- PAYDAY 2 accounted for SEK 11.5 million (51.6).

- PAYDAY 3 accounted for SEK 22.9 million (440.8).

- Third-party publishing accounted for SEK 6.2 million (0.8).

- EBITDA* amounted to SEK 21.4 million (441.8).

- Cash flow from operating activities amounted to SEK -15.9 million (11.1).

- Depreciation, amortization and impairment amounted to SEK 76.5 million (142.0).

- Profit/loss before taxes amounted to SEK -58.5 million (299.8).

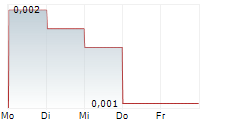

- Basic and diluted earnings per share amounted to SEK -0.04 (0.21).

January-September 2024

- Net sales amounted to SEK 139.5 million (564.3).

- PAYDAY 2 accounted for SEK 31.6 million (120.8).

- PAYDAY 3 accounted for SEK 68.2 million (440.8).

- Third-party publishing accounted for SEK 32.3 million (0.8).

- EBITDA* amounted to SEK 78.0 million (460.0), including items affecting comparability of SEK 20.9 million.

- Cash flow from operating activities amounted to SEK 65.2 million (51.9).

- Depreciation, amortization and impairment amounted to SEK 227.2 million (174.7).

- Profit/loss before taxes amounted to SEK -150.1 million (299.2).

- Basic and diluted earnings per share amounted to SEK -0.10 (0.31).

- Cash and cash equivalents amounted to SEK 249.3 million (312.9).

Significant events during the quarter

- August 14, a content update was released for Roboquest with new content, functionality, and improvements. Read more here.

- August 19, a free heist - "Diamond District" - was released for PAYDAY 3. Read more here.

- August 19, third DLC was released for PAYDAY 3: "Chapter III: Houston Breakout". Read more here.

- September 16, fourth DLC was released for PAYDAY 3: "Chapter IV: Fear & Greed". Read more here.

CEO's message

"Leveraging the Strength of Our Franchises"

This time last year we had just launched PAYDAY 3 - a milestone for us as a studio, and a commercial success, but also a launch marred by a series of technical issues. Since then, we have worked tirelessly to improve the game and expand the amount of content and features. By the end of the quarter, we had launched four major DLCs as well as a large amount of updates to both functionality and content for all of our players. At the end of October, one of our biggest updates since launch was launched, with a brand new user interface, server browser, VoIP and much more. We continue to see great improvements in ratings, sentiment and engagement from our players - important milestones on the way to increasing PAYDAY 3's sales. As a brand, PAYDAY continues to be very strong and a key part of our strategy is to further build value in our franchise, both through our own productions and what we can do together with partners. An example of successful collaboration is the one we carried out with French giant Ubisoft, where two of PAYDAY's central characters - Dallas and Chains - made a guest appearance in the game "Tom Clancy's Rainbow Six Siege".

Meanwhile, our Dungeons & Dragons® project - Baxter - continues at full speed. During the quarter, we were able to show the first images from production to give an indication of the game's direction and feel. Internally, we have weekly playtests of Baxter, and active discussions with a number of industry-leading players regarding potential collaborations around Baxter's development and launch.

During the quarter we had our largest investment in our own game development to date, a combination of both major updates for PAYDAY 3 but also for production of Project Baxter and payment of licensing fees to Wizards of the Coast. In the coming months, the level of investment will be lower as we round off "Operation Medic Bag" for PAYDAY and therefore enter Year 2 with a smaller team focused on continuously updating the game with new content.

RESULTS AND FINANCIAL POSITION

Starbreeze remains financially strong, with a healthy balance sheet almost free of debt and a cash position to execute our strategy. Sales of PAYDAY 3 still have great potential to improve, which is offset somewhat by continued relatively stable sales of PAYDAY 2 and third-party publishing of, among other things, Roboquest. During the same period last year, we booked the revenue attributable to PAYDAY 3's launch, which makes the revenue in the comparison period uniquely high.

PAYDAY 3

During the quarter, both the third and fourth DLCs for PAYDAY 3 - "Chapter III: Houston Breakout" and "Chapter IV: Fear & Greed" were released. In conjunction with both launches, a lot of free content was also released to all players, including a new free heist. Both DLCs received a very positive reception from the player base and the game's rating on Steam, among others, has taken significant steps upwards. The game's MAU (monthly active players) is holding steady considering that we in September left Xbox GamePass. The level of investment during PAYDAY 3's first year on the market, both through launched DLCs and "Operation Medic Bag", has been at an elevated level. Ahead of year two, we are confident in being able to continue delivering amounts of value to our players with a significantly lower level of investment.

PROJECT BAXTER - DUNGEONS & DRAGONS®

As mentioned, production of Baxter continues at full speed. Starbreeze will be the publisher of the game, but we are also looking to give the game the best possible commercial conditions. We continue to have continuous dialogue with a number of industry leading players to ensure the game is a success.

THIRD-PARTY PUBLISHING

During the quarter, additional content updates for Roboquest were launched, and we announced that the game will be coming to PlayStation®4 and 5 in the first half of 2025. The game is unanimously praised on the platforms it is on today - Steam and Xbox. Of course, we see great sales potential in the fact that the game will soon be available on two additional large platforms.

ORGANIZATION

We continue to hire specific skills, primarily within Project Baxter, as well as a number of leading roles within the development organization. We also work actively to streamline the organization to ensure long-term sustainability and competitiveness. At the end of the quarter, the number of employees amounted to 191, with the majority employed at our head office in Stockholm.

CLOSING WORDS

Our strategy is to become a true multi-title studio, with a balanced risk profile. To get there, our strategy is based on several pillars: we develop and refine our own brands, license strong brands for new games, and take on projects that help us optimize our resources and use our broad expertise within the company. With a stable financial foundation, strong cash and prominent projects both in development and on the market, we have the prerequisites to build an even stronger Starbreeze in the long term.

MATS JUHL, acting CEO

Presentation

The company will hold a webcast at 10 AM CET, November 14, 2024. To join the presentation - click here.

Contacts

Mats Juhl, acting CEO and CFO

Telephone: +46 (0) 8-209 208

E-mail: ir@starbreeze.com

This information is information that Starbreeze is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2024-11-14 06:45 CET.