VANCOUVER, British Columbia, Nov. 14, 2024 (GLOBE NEWSWIRE) -- Cornish Metals Inc. (AIM/TSX-V: CUSN) ("Cornish Metals" or the "Company"), a mineral exploration and development company focused on the advancement and restart of its 100% owned and permitted South Crofty high-grade tin project in Cornwall, United Kingdom, is pleased to announce that it has developed a near mine Exploration Target at South Crofty.

The near mine Exploration Target quantity and grade are conceptual in nature and currently there is insufficient data to classify this as a Mineral Resource. However, Cornish Metals believes the Exploration Target demonstrates the potential to define additional mineralisation, which could expand the current Mineral Resource at the project.

Highlights

- South Crofty is one of the highest-grade tin resources in the world with a tin grade of 1.50% in the Indicated category

- The near mine Exploration Target points to potential additional mineralisation upside of 6Mt to 13Mt, at a tin grade of 0.5% to 1.8%, above the current South Crofty Mineral Resource in the Lower Mine area

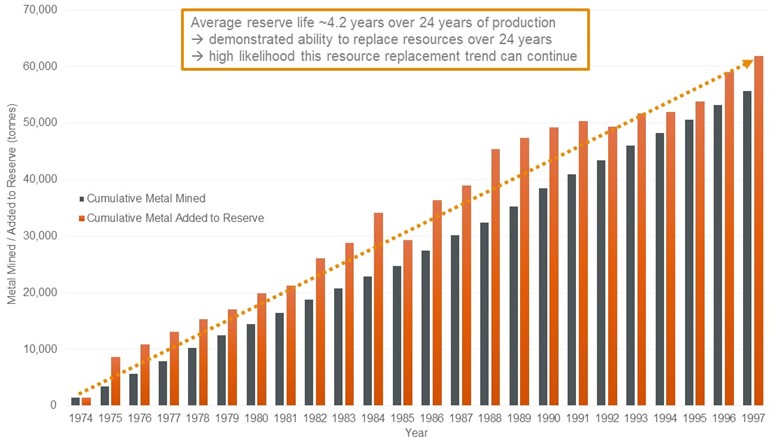

- South Crofty mine has consistently increased its Mineral Resource in line with production each year for over the last 20 years when in operation

- Potential to define additional mineralisation, which could expand the current Mineral Resource at the project

- Further growth opportunities from longer term exploration activities both within the South Crofty mining permission area and within Cornish Metals' extensive mineral rights holdings in Cornwall providing for a multi-generational asset

Don Turvey, CEO and Director of Cornish Metals, stated: "This Exploration Target supports our view that there is a lot more tin at South Crofty waiting to be discovered. South Crofty is a generational asset with a long history of Mineral Resource discovery and conversion, and we expect this trend to continue after the mine restarts production. The PEA results represent a strong foundation for advancing South Crofty to production, but it is only the starting point, and this Exploration Target illustrates the potential for immense upside."

The assessment of the near mine Exploration Target is based on the current understanding of the geological controls on mineralisation at the South Crofty project and the target was generated by extrapolating known structures along strike and down dip, with tonnages estimated by applying assumed minimum and maximum thicknesses.

| South Crofty near mine Exploration Target | ||

| Mass (Mt) | Grade (% Sn) | |

| Upper limit | 13 | 1.8 |

| Lower limit | 6 | 0.5 |

Notes:

- The near mine Exploration Target is reported exclusive of the current South Crofty Mineral Resource.

- No economic parameters, mining dilution or recovery factors have been applied to the assessments of tonnes and average grade.

- The potential quantity and average grade of the near mine Exploration Target is conceptual in nature and is an approximation. There is insufficient data to estimate a Mineral Resource in the area considered and it is uncertain if further exploration will result in the definition of a Mineral Resource.

The near mine Exploration Target was primarily based on extrapolation of known, previously mined structures beyond the limits of the current South Crofty Mineral Resource. The mineralisation around South Crofty remains open along strike and down dip providing further potential beyond the near mine Exploration Target. The Exploration Target does not consider the wider opportunities within the South Crofty mining permission area, which also shows significant potential and includes the Wide Formation exploration project, or within the wider region in Cornwall where Cornish Metals has extensive mineral rights holdings.

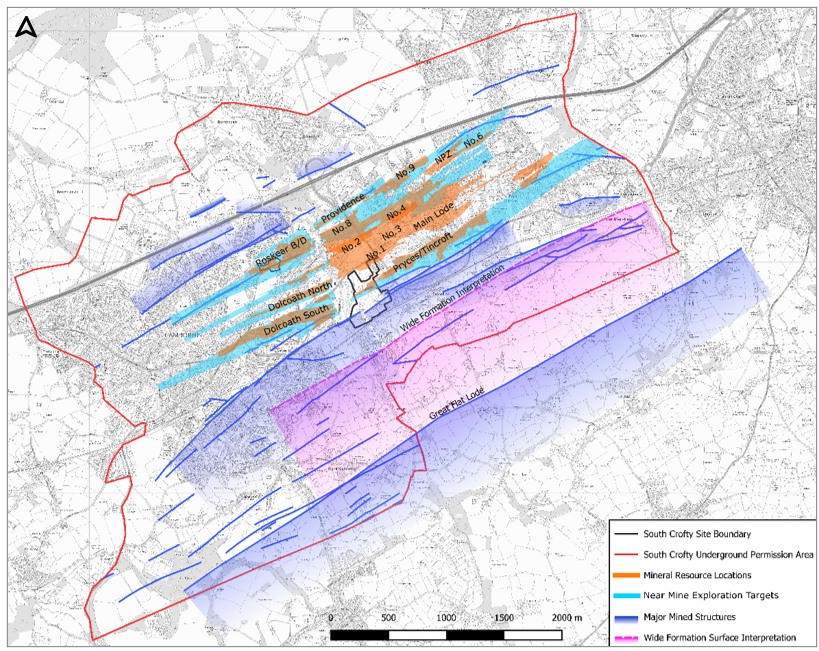

Figure 1: Plan view of existing South Crofty Mineral Resource envelopes (orange), near mine Exploration Targets (light blue) and wider mineralised and mined structures with exploration areas (dark blue, pink) identified within the South Crofty underground permission boundary.

Historic production at South Crofty demonstrates the consistent discovery of new mineralisation and subsequent conversion to Reserves (Figure 2). Cornish Metals plans to test the near mine Exploration Target systematically alongside initial production at South Crofty, targeting an increase of the Mineral Resource Estimate above that depleted by production each year. This is expected to be carried out through targeted development and exploration drilling programmes aimed at extending the existing Mineral Resource both along strike and down dip during approximately the first five years of operation.

Figure 2: South Crofty cumulative metal mined, and metal added to Reserve - 1974 to 1997.

Note: Reserves estimated based on methodologies and classifications used by South Crofty in the period.

GEOLOGY AND MINERALISATION

The geology of Cornwall is dominated by granitic intrusions that are part of the Permian Cornubian batholith, and Devonian metasedimentary and metavolcanics, known locally as "Killas", that form the metamorphic aureole and host rocks of the intrusions. The sedimentary and volcanic package was deformed during the Variscan Orogeny where crustal thickening, followed by subsequent lithospheric extension and crustal subsidence, resulted in anatexis and formation of the Cornubian batholith.

The South Crofty project area lies on the north side of the Permian Carn Brea Granite. The project area is underlain by a series of metasedimentary and metavolcanic rocks and associated hornfels and skarns, that occur in close proximity to the granite contact. At depth, the granite underlies the whole project area dipping towards the north west.

Mineralisation occurs in steeply dipping vein-type structures or "lodes" that generally strike east-northeast, occurring in both the granite and the overlying Killas. Within the granite, the principal mineral of economic significance is cassiterite. The project is split by the Great Crosscourse a late-stage fault which crosscuts and offsets the mineralised structures. The Great Crosscourse transects the project area dividing the mine into two areas, east and west.

The area is host to numerous historic mines which initially exploited copper and subsequently deeper tin. Numerous opportunities exist to test for the continuation of tin below historic copper mines. This precedent is evident both in the South Crofty workings and also at the Dolcoath mine which was continuously mined through the copper mineralisation and into tin mineralisation at depth, demonstrating the vertical zonation.

TECHNICAL INFORMATION

The near mine Exploration Target has been based primarily on extrapolation of known, previously mined structures beyond the data limits of the current South Crofty Mineral Resource. Several smaller structures identified within the historical database that show potential for defining additional mineralisation through further exploration have also been included. An analogue for continuity of mineralised structures is the Dolcoath mine, which sits directly to the south of South Crofty and was mined continuously from surface to over 800m vertical depth with a strike length that is traceable over 2.1km.

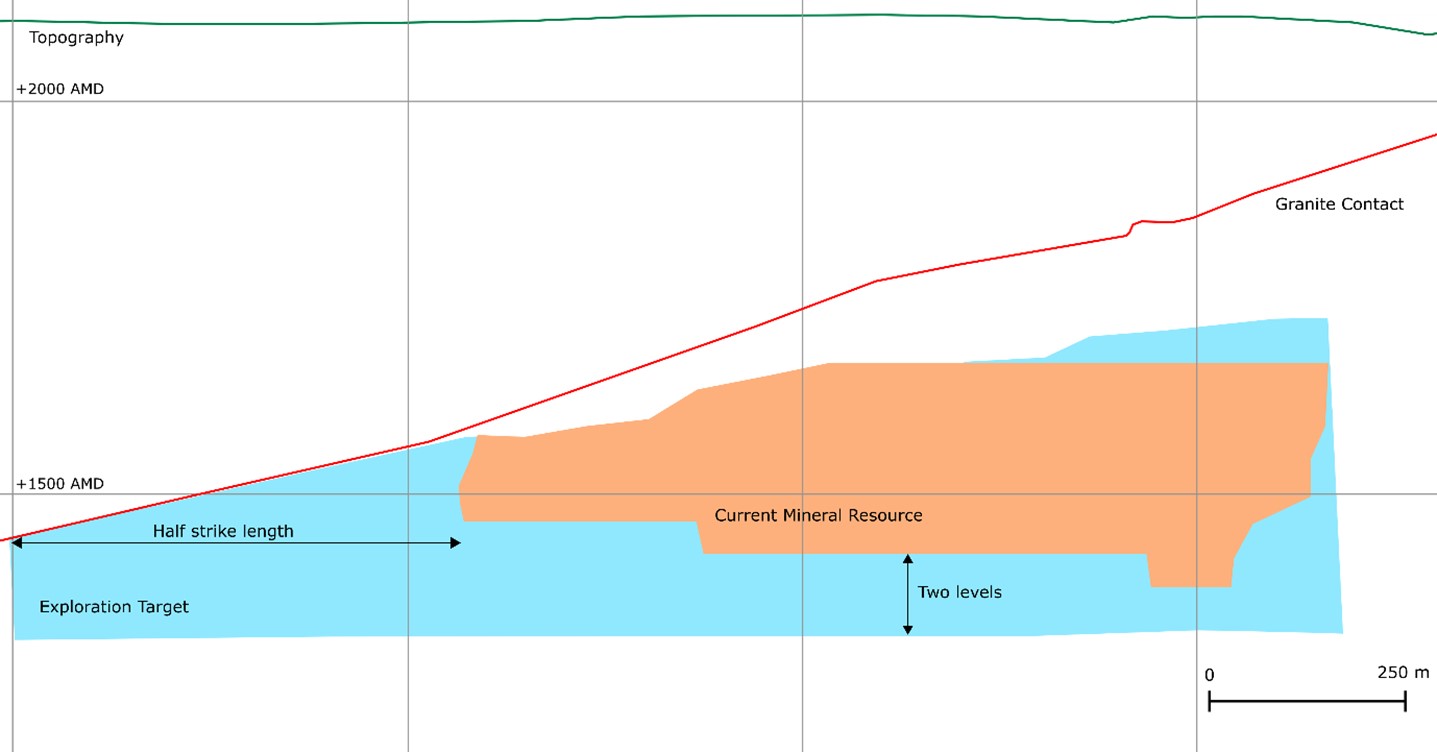

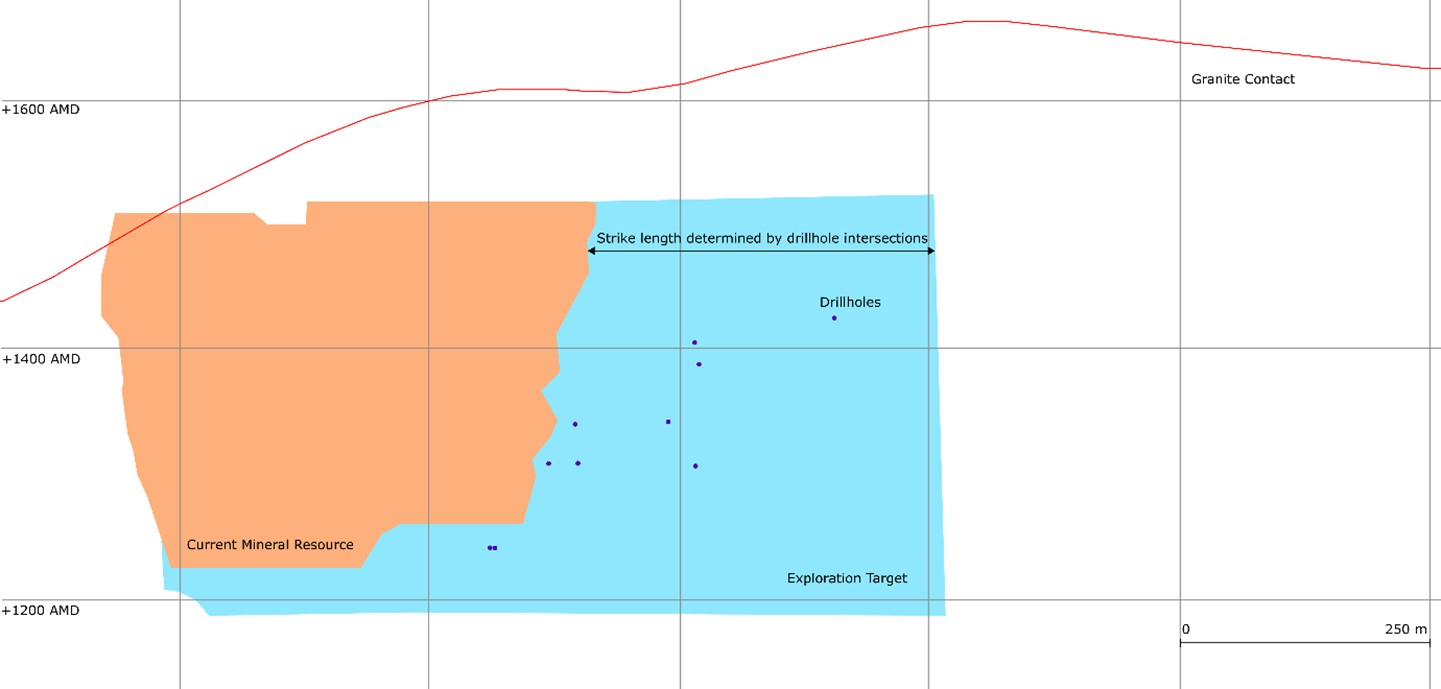

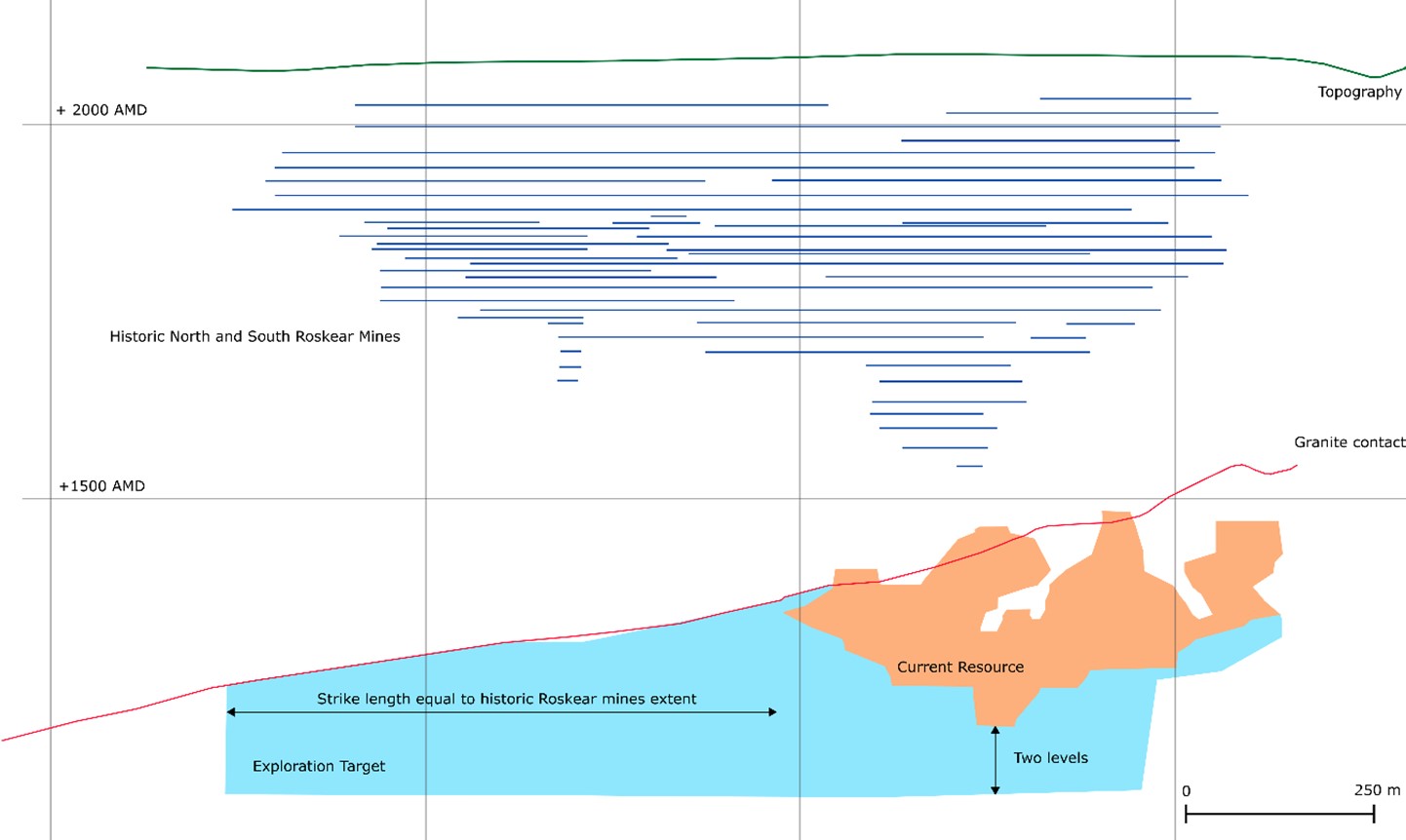

Where structures have been extrapolated beyond known data points, they have been extended half the known strike length of the defined Mineral Resource envelope and extrapolated a further two mine levels (approximately 75m) down dip (Figure 3). Where structures have data which could be interpreted as belonging to that structure (Figure 4), or where there is an analogy from an existing structure (for example historical workings above), extrapolations have been expanded to the same extent (Figure 5). In all cases nothing has been extrapolated beyond the mining permission boundary. This approach assumes the continuity of structures beyond the current known data points.

Tonnage assumptions are based on the projected areas of the extrapolated structures. The upper tonnage target is based on the mean width of the known Mineral Resource structure and the lower tonnage target is based on the lower tenth percentile width of the structure. This method acknowledges that although the mineralised structures at South Crofty are extremely persistent, there is significant variability in the width. With the potential volume defined, the mean density of mineralisation at South Crofty of 2.77t/m3 was applied to give an assessment of tonnage.

Average tin grade assumptions were based on the current South Crofty Mineral Resource sample dataset. A range was derived which represents the likely average grade of the global near-mine Exploration Target and equates to the lower 40th and upper 75th percentiles of the existing Mineral Resource sample set. This is believed to give the best indication of expected average grade based on the existing precedent.

Figure 3: Long section view looking north showing the existing Dolcoath South Mineral Resource structure (orange) and the Exploration Target extrapolation (blue).

Figure 4: Long section view looking north showing the existing No. 8a Mineral Resource structure (orange) and the Exploration Target extrapolation (blue).

Figure 5: Long section view looking north showing the existing Roskear B-D Mineral Resource (orange) and the Exploration Target (blue), which has been extrapolated to the length of the historic overlying North Roskear and South Roskear mines.

This Exploration Target was reviewed and approved by Mr. Nicholas Szebor (MCSM, BSc, MSc, CGeol, EurGeol, FGS), Regional Manager and Principal Geologist at AMC Consultants (UK) Limited, a Qualified Person under National Instrument 43-101 (NI 43-101) and AIM Rules for Companies and a Competent Person as defined under the JORC Code (2012). Mr. Szebor has reviewed the technical content of this news release as it relates to the Exploration Target and has approved its dissemination.

This news release has been reviewed and approved by Mr. Owen Mihalop, MCSM, BSc (Hons), MSc, FGS, MIMMM, CEng, Chief Operating Officer for Cornish Metals Inc. who is the designated Qualified Person under NI 43-101 and the AIM Rules for Companies and a Competent Person as defined under the JORC Code (2012). Mr. Mihalop consents to the inclusion in this announcement of the matters based on his information in the form and context in which it appears.

ABOUT CORNISH METALS

Cornish Metals is a dual-listed mineral exploration and development company (AIM and TSX-V: CUSN) that is advancing the South Crofty tin project towards production. South Crofty:

- Is a historical, high-grade, underground tin mine located in Cornwall, United Kingdom and benefits from existing mine infrastructure including multiple shafts that can be used for future operations;

- Is fully permitted to commence underground mining (valid to 2071), construct new processing facilities and for all necessary site infrastructure;

- Has a 2024 Preliminary Economic Assessment that validates the Project's potential (see news release dated April 30, 2024 and the Technical Report entitled "South Crofty PEA"):

- US$201 million after-tax NPV8% and 29.8% IRR

- 3-year after-tax payback

- 4,700 tonnes average annual tin production in years two through six

- Life of mine all-in sustaining cost of US$13,660 /tonne of payable tin

- Total after-tax cash flow of US$626 million from start of production

- Would be the only primary producer of tin in Europe or North America. Tin is a Critical Mineral as defined by the UK, American, and Canadian governments as it is used in almost all electronic devices and electrical infrastructure. Approximately two-thirds of the tin mined today comes from China, Myanmar and Indonesia;

- Benefits from strong local community, regional and national government support with a growing team of skilled people, local to Cornwall, and could generate up to 320 direct jobs.

The 2024 Preliminary Economic Assessment for South Crofty is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorised as Mineral Reserves. There is no certainty that the 2024 Preliminary Economic Assessment will be realised. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

ON BEHALF OF THE BOARD OF DIRECTORS

"Don Turvey"

Don Turvey

Engage with us directly at our investor hub. Sign up at: https://investors.cornishmetals.com/link/lPdoKr

For additional information please contact:

| Cornish Metals | Fawzi Hanano Irene Dorsman | investors@cornishmetals.com info@cornishmetals.com |

| Tel: +1 (604) 200 6664 | ||

| SP Angel Corporate Finance LLP (Nominated Adviser & Joint Broker) | Richard Morrison Charlie Bouverat Grant Barker | Tel: +44 203 470 0470 |

| Cavendish Capital Markets Limited (Joint Broker) | Derrick Lee Neil McDonald | Tel: +44 131 220 6939 |

| Hannam & Partners (Financial Adviser) | Matthew Hasson Andrew Chubb Jay Ashfield | cornish@hannam.partners Tel: +44 207 907 8500 |

| BlytheRay (Financial PR) | Tim Blythe Megan Ray | cornishmetals@blytheray.com Tel: +44 207 138 3204 |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Caution regarding forward looking statements

This news release contains certain "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements"). Forward-looking statements include predictions, projections, outlook, guidance, estimates and forecasts and other statements regarding future plans and operations, the realisation, cost, timing and extent of mineral resource or mineral reserve estimates, estimation of commodity prices, currency exchange rate fluctuations, estimated future exploration expenditures, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, requirements for additional capital and the Company's ability to obtain financing when required and on terms acceptable to the Company, future or estimated mine life and other activities or achievements of Cornish Metals, including but not limited to: the expected use of proceeds from the secured credit facility with Vision Blue; the balance of the cash consideration due to Cornish in respect of the sale of the Mactung and Cantung royalty interests; mineralisation at South Crofty, mine dewatering and construction requirements; the development, operational and economic results of the preliminary economic assessment, including cash flows, capital expenditures, development costs, extraction rates, recovery rates, mining cost estimates and returns; estimation of mineral resources; statements about the estimate of mineral resources and production of minerals; magnitude or quality of mineral deposits; anticipated advancement of the South Crofty project mine plan; exploration potential and project growth opportunities for the South Crofty tin project and other Cornwall mineral properties, the Company's ability to evaluate and develop the South Crofty tin project and other Cornwall mineral properties, strategic vision of Cornish Metals and expectations regarding the South Crofty mine, timing and results of projects mentioned. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "estimate", "forecast", "expect", "potential", "project", "target", "schedule", "budget" and "intend" and statements that an event or result "may", "will", "should", "could", "would" or "might" occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this news release, are forward-looking statements that involve various risks and uncertainties and there can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements.

Forward-looking statements are subject to risks and uncertainties that may cause actual results to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to receipt of regulatory approvals, risks related to general economic and market conditions; risks related to the availability of financing; the timing and content of upcoming work programmes; actual results of proposed exploration activities; possible variations in Mineral Resources or grade; outcome of any future studies; projected dates to commence mining operations; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; changes in national and local government regulation of mining operations, tax rules and regulations. The list is not exhaustive of the factors that may affect Cornish's forward-looking statements.

Cornish Metals' forward-looking statements are based on the opinions and estimates of management and reflect their current expectations regarding future events and operating performance and speak only as of the date such statements are made. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward- looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that forward-looking statements will prove to be accurate and accordingly readers are cautioned not to place undue reliance on forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements. Cornish Metals does not assume any obligation to update forward-looking statements if circumstances or management's beliefs, expectations or opinions should change other than as required by applicable law.

Caution regarding non-IFRS measures

This news release contains certain terms or performance measures commonly used in the mining industry that are not defined under International Financial Reporting Standards ("IFRS"), including "all-in sustaining costs". Non-IFRS measures do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar measures employed by other companies. The data presented is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS and should be read in conjunction with Cornish Metals' consolidated financial statements and Management Discussion and Analysis, available on its website and on SEDAR+ at www.sedarplus.ca.

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by the Company to constitute inside information pursuant to Article 7 of EU Regulation 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 as amended.

Appendix

"cassiterite" means a tin oxide mineral which is the principal source for tin metal

"Exploration Target" is a statement or estimate of the exploration potential of a mineral deposit in a defined geological setting where the statement or estimate, quoted as a range of tonnes and a range of grade (or quality) relates to mineralisation for which there has been insufficient exploration to estimate a Mineral Resource. Any such information must be expressed so that it cannot be misrepresented or misconstrued as an estimate of a Mineral Resource or Ore Reserve. There has been insufficient exploration to estimate a Mineral Resource and that it is uncertain if further exploration will result in the estimation of a Mineral Resource.

"grade(s)" means the quantity of ore or metal in a specified quantity of rock

"Indicated Mineral Resource" is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. An Indicated Mineral Resource has a lower level of confidence than that applying to a Measured Mineral Resource and may only be converted to a probable mineral reserve.

"Inferred Mineral Resource" is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a mineral reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. An Inferred Mineral Resource is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

"JORC Code" means the 2012 edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves prepared by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia. The JORC Code is an acceptable foreign code for purposes of NI 43-101.

"Lodes" means a vein of metal ore in the earth

"MRE" means Mineral Resource Estimate

"km" means kilometres

"kt" means thousand tonnes

"m" means metres

"Mt" means million tonnes

"NI 43-101" means National Instrument 43-101 - Standards of Disclosure for Mineral Projects issued by the Canadian Securities Administrators, which provides standards of disclosure of scientific and technical information regarding mineral projects

"Sn" means Tin

"t" means tonnes

"t/m3" means tonnes per cubic metre

"tourmaline" means the crystalline silicate mineral group that occurs as prismatic crystals in granitic and other rocks

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/12015dc9-3c1c-4091-8697-2677f2a0b7b8

https://www.globenewswire.com/NewsRoom/AttachmentNg/ada95822-2866-4494-bfa9-eca474579adb

https://www.globenewswire.com/NewsRoom/AttachmentNg/8687b987-cd52-44ef-bc78-ee7966bed693

https://www.globenewswire.com/NewsRoom/AttachmentNg/234a3046-5ed2-4e62-b1b6-cd2f403c67ff

https://www.globenewswire.com/NewsRoom/AttachmentNg/47dc6f93-b036-43c9-aa8c-aa258e6912b9