HALIFAX, Nova Scotia, Nov. 14, 2024 (GLOBE NEWSWIRE) -- Erdene Resource Development Corp. (TSX:ERD | MSE:ERDN) ("Erdene" or the "Company") is pleased to announce operating and financial results for the three months ended September 30, 2024, and to provide an update on progress at the Bayan Khundii Gold Project ("BK" or "Project"), being developed with Mongolian Mining Corporation ("MMC"). This release should be read in conjunction with the Company's Q3-2024 Condensed Consolidated Interim Financial Statements and MD&A, available on the Company's website and SEDAR+.

Peter Akerley, Erdene's President and CEO stated, "The third quarter of 2024 was another productive period for Erdene as we made significant progress on the construction of the Bayan Khundii Gold Mine and saw exceptional results from expansion drilling peripheral to the planned open pit."

He continued, "At the end of September, the Bayan Khundii process plant, the critical path facility, was approximately 55% complete. All major mechanical equipment is on site, the SAG and ball mills have been installed, and construction of non-process infrastructure is proceeding well, with major progress on the integrated mineral waste facility, 400 person accommodation complex, and 110 kV overhead transmission line during the past quarter bringing the overall project to 45% complete."

Mr. Akerley added, "We expect the process plant and critical non-process infrastructure buildings to be closed over the coming months, allowing for mechanical and electrical works completion in Q1 and commissioning beginning in Q2 2025, as we work toward first gold in mid-2025 and commercial production in Q3 2025. During the fourth quarter, EM management will complete a detailed schedule review and assessment of spending to complete construction. While we anticipate an increase in capex due to weather and logistical delays and modest scope changes, these impacts are forecast to be manageable with available funding."

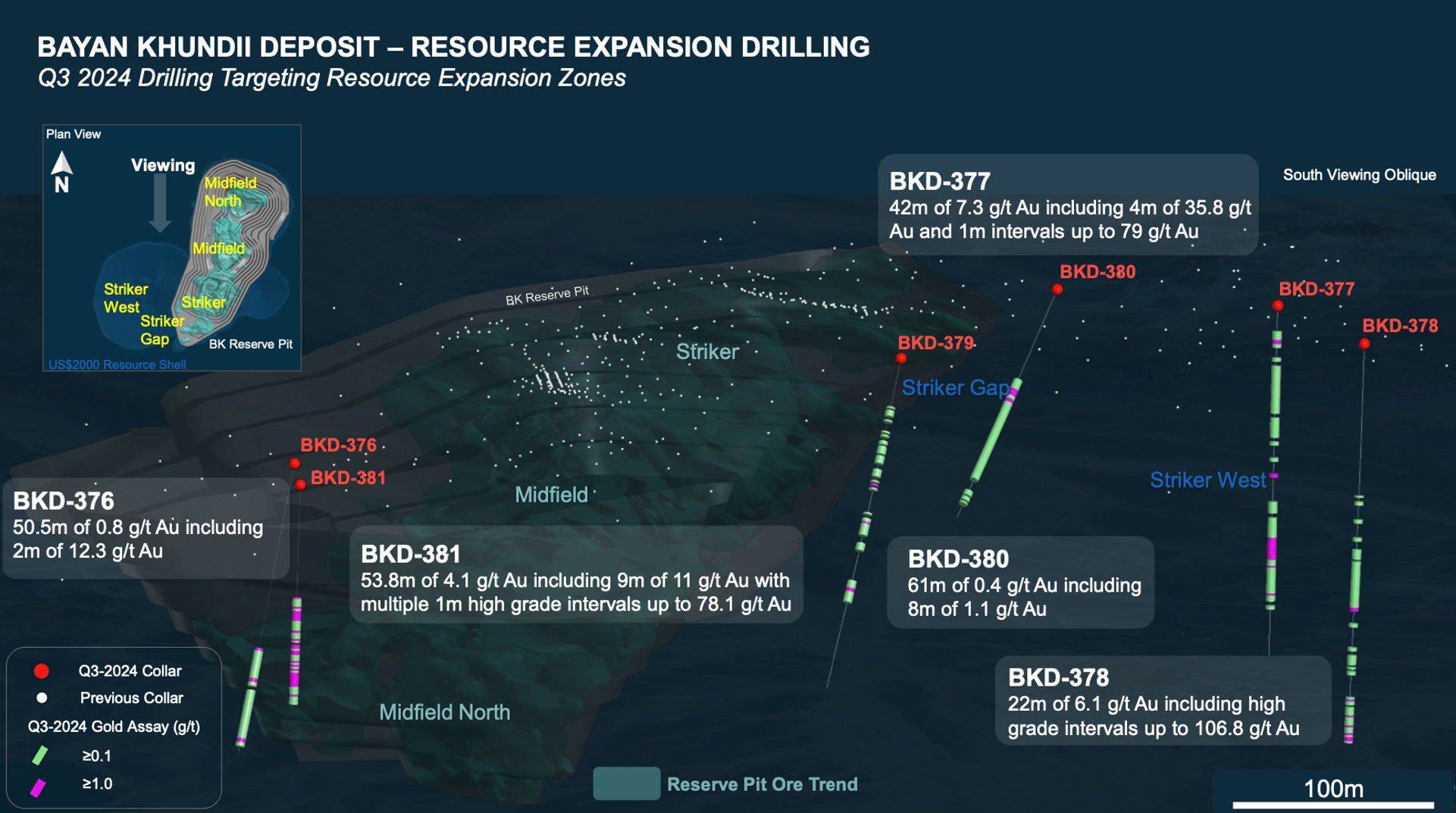

Mr. Akerley concluded, "Expansion drilling in Q3 adjacent to the planned Bayan Khundii open-pit returned the highest grades to date in the area, demonstrating strong growth potential. Additionally, ore control drilling during the past quarter confirmed the high-grade nature of the Bayan Khundii deposit, consistent with the reserve model in near surface zones. These results will be incorporated into an updated Bayan Khundii mine plan in the coming months."

Q3-2024 Highlights and Significant Subsequent Events:

Images: Bayan Khundii Construction Site - Q3 2024

Bayan Khundii Gold Project

- Reached approximately 45% construction progress at Bayan Khundii at September 30, 2024

- Approximately US$70 million of Project expenditures incurred to the end of Q3 2024 - potential cost increases due to logistical and weather delays and minor scope changes are expected to be within available funding

- Process plant, the critical path facility, was ~55% complete at quarter end, with all bulk concrete pours and mechanical equipment installation of the SAG and ball mills complete

- Construction of non-process infrastructure, including camp, 110 kV overhead transmission line, warehouse, workshop, administration building and utilities proceeding well

- Construction expected to be largely complete in Q1 2025 with commissioning in Q2 and first gold production in mid-2025 followed by commercial production in Q3

- Approximately 650 personnel on-site at quarter end achieving ~2,000,000 construction hours without a lost-time or environmental incident

- Advanced community development and local employment stakeholder programs

- Local Cooperation Agreement for 2024 implemented supporting local development programs

- Recruitment and training of Bayan Khundii mine workforce continued with seventh cohort of local residents selected for equipment operator training at MMC's UHG mine, bringing total number of trainees to 140 people to date

- Company supported installation and improvement of three rural water wells to increase water availability for residents

Khundii Minerals District Exploration

- Conducted 1,500 metre Bayan Khundii ore-control drill program

- Drilled 89 shallow holes totaling 1,048 metres focused on high-grade domains, within 15 metres of surface, scheduled to be developed in the first 3-4 months of mining and a further 10 holes totaling 456 metres to assist with future mine planning

- Results confirmed the high-grade domains in the current block model with highlight intersection of 6.61 g/t Au over 12 metres, starting at surface

- Completed 950 metre expansion program on the periphery of the Bayan Khundii planned open pit

- Drilling intersected gold mineralization in all holes, demonstrating the potential for resource growth and pit extension

- Results included the highest-grade drilling results to date in Striker West, adjacent to the Bayan Khundii open-pit, including 7.3 g/t gold over 42 metres, with multiple high-grade metre intersections of 15 to 79 g/t gold (BKD-377)

Corporate

- Recorded net loss of $1,687,580 for the three months ended September 30, 2024, compared to a net loss of $1,200,099 for three months ended September 30, 2023

- Exploration and evaluation expenses totaled $215,903 for the three months ended September 30, 2024, compared to $219,670 for the same quarter in 2023, as increased activity compared to the prior year and an increase in non-capitalized Mongolian office costs following the close of the Strategic Alliance was more than offset by a reduction in stock based compensation due to the timing of annual performance stock option grants

- Corporate and administrative expenses totaled $582,089 for the three months ended September 30, 2024, compared to $600,595 for three months ended September 30, 2023, with the decrease from the prior year comparative quarter primarily due to the timing of annual staff performance DSU grants, which were incurred in the Q2 2024 compared to Q3 2023, partially offset by increased marketing spend related to an investor site visit

- Loss from investment in associate of $918,649 for the three months ended September 30, 2024, compared to $445,493 for the three months ended September 30, 2023, with the period over period change primarily due to an increase in non-capitalized interest expenditures by EM following the February 2024 financing partially offset by Erdene's change in ownership following the close of the Strategic Alliance in Q1 2024

Qualified Person

Peter Dalton, P.Geo. (Nova Scotia), Senior Geologist for Erdene, is the Qualified Person as that term is defined in National Instrument 43-101 and has reviewed and approved the technical information contained in this news release.

About Erdene

Erdene Resource Development Corp. is a Canada-based resource company focused on the acquisition, exploration, and development of precious and base metals in underexplored and highly prospective Mongolia. The Company has interests in three mining licenses and an exploration license in Southwest Mongolia, where exploration success has led to the discovery and definition of the Khundii Gold District. Erdene Resource Development Corp. is listed on the Toronto and the Mongolian stock exchanges. Further information is available at www.erdene.com. Important information may be disseminated exclusively via the website; investors should consult the site to access this information.

Forward-Looking Statements

Certain information regarding Erdene contained herein may constitute forward-looking statements within the meaning of applicable securities laws. Forward-looking statements may include estimates, plans, expectations, opinions, forecasts, projections, guidance, or other statements that are not statements of fact. Although Erdene believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. Erdene cautions that actual performance will be affected by a number of factors, most of which are beyond its control, and that future events and results may vary substantially from what Erdene currently foresees. Factors that could cause actual results to differ materially from those in forward-looking statements include the ability to obtain required third party approvals, market prices, exploitation, and exploration results, continued availability of capital and financing and general economic, market or business conditions. The forward-looking statements are expressly qualified in their entirety by this cautionary statement. The information contained herein is stated as of the current date and is subject to change after that date. The Company does not assume the obligation to revise or update these forward-looking statements, except as may be required under applicable securities laws.

NO REGULATORY AUTHORITY HAS APPROVED OR DISAPPROVED THE CONTENTS OF THIS RELEASE

Erdene Contact Information

Peter C. Akerley, President and CEO, or

Robert Jenkins, CFO

| Phone: Email: Twitter: Facebook: LinkedIn: | (902) 423-6419 info@erdene.com https://twitter.com/ErdeneRes https://www.facebook.com/ErdeneResource https://www.linkedin.com/company/erdene-resource-development-corp-/ |

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/78a4a538-28ac-4507-bde2-a4d4551d82ab

https://www.globenewswire.com/NewsRoom/AttachmentNg/b5ee279a-3672-4ac7-8e8f-a8c42d4afbdc

https://www.globenewswire.com/NewsRoom/AttachmentNg/494accf1-ee0f-4d95-85d3-721dd2731360

https://www.globenewswire.com/NewsRoom/AttachmentNg/2f9cfeed-0e9e-4757-a570-42fe79686ce2

https://www.globenewswire.com/NewsRoom/AttachmentNg/f0b1977b-9501-4cc3-b444-07e376a48f78

https://www.globenewswire.com/NewsRoom/AttachmentNg/ad414833-58b4-4c56-88ba-7894dbd08d8c

https://www.globenewswire.com/NewsRoom/AttachmentNg/68ad597f-4f05-45d4-ad49-8cc7e5180bc8