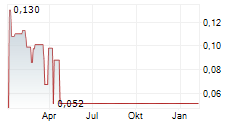

Sequential quarterly growth returns for 2024

New Product Innovations Driving Omni-Channel Expansion

LOUISVILLE, Colo., Nov. 14, 2024 /PRNewswire/ - (TSX: CWEB, OTCQX: CWBHF), Charlotte's Web Holdings, Inc. ("Charlotte's Web" or the "Company"), a market leader in hemp-derived CBD and other botanical wellness products, today reported financial results for the third quarter ended September 30, 2024.

"Our return to quarter-over-quarter growth in 2024 signals that our strategic direction is paying off," said Bill Morachnick, CEO of Charlotte's Web. "We've seen positive impacts from our e-commerce platform upgrades, recent product launches, and additional retailers, highlighted by our new partnership with Walmart that brings our CBD topicals to another 827 stores. The gummies category remains healthy, with notable demand for our CBN 'Stay Asleep' gummy supporting volume growth. Our omni-channel focus across direct-to-consumer, retail, and healthcare channels aims to provide a seamless brand experience that resonates with our consumers."

New Product Innovations

In response to consumer preferences for convenient formats, Charlotte's Web introduced its new Soft Gel Capsule, offering easy-to-swallow gel caps that provide precise, potent dosing of full-spectrum CBD. The new gel caps have received positive consumer feedback for their portability, convenience, and effectiveness.

In the third quarter of 2024, Charlotte's Web expanded beyond hemp wellness with the launch of its latest innovation, a new line of Functional Mushroom Gummies, tapping into the rapidly growing mushroom wellness category. This product line includes three formulations tailored to specific wellness needs:

- Focus (Lion's Mane): Supports cognitive health, focus, and memory.

- Stress Support (Reishi + Ashwagandha): Helps manage daily stress and promotes calm.

- Energy Support (Cordyceps): Enhances energy and endurance.

These gummies leverage Charlotte's Web's botanical expertise, blending mushroom extracts with targeted botanicals for wellness support. The introduction of mushroom gummies marks a key step in diversifying Charlotte's Web's product offerings and broadening its portfolio. This expansion allows the Company to reach new wellness-focused consumers, particularly millennials and Gen X, who prefer alternative, plant-based solutions. With this new product line, Charlotte's Web is positioning to participate in the transition of functional mushroom supplements from niche adoption to mainstream availability. The mushroom gummies have initially rolled out to over 200 retail locations, enabling the Company to capitalize on a growing market with an expected CAGR of over 11% through 2030, according to the Grand View Research "Functional Mushroom Market Report" (July 2024).

"At Charlotte's Web, we believe our dedication to quality and transparent hemp offerings has established us as a wellness thought leader, and we're thrilled to extend that legacy with the launch of our new Functional Mushroom Gummies," said CEO Bill Morachnick. "Drawing on our botanical expertise, we're bringing innovative solutions to curious consumers who prioritize natural wellness. We're expanding our portfolio to lead the way in a mushroom supplements market that demands clarity, helping consumers access effective, transparent wellness solutions across our growing channels."

Omni-Channel Expansion for Broader Consumer Access

As Charlotte's Web diversifies its product portfolio with innovations like gel caps, mushroom gummies, and minor cannabinoid isolate products (CBN Stay Asleep Gummies), it is implementing a robust omni-channel strategy to maximize distribution and accessibility. This approach integrates multiple sales channels, expanding its established brick-and-mortar retail network and its new e-commerce platform to include third-party retail websites and online sales portals of retail partners. With more regulatory clarity around products like cannabinoid isolates and mushroom supplements, Charlotte's Web has access to more channels, allowing for greater flexibility in distribution. Through this omni-channel strategy, Charlotte's Web believes that it is positioned to drive growth, enhance consumer engagement, and strengthen its market presence, allowing each product category to reach its target channels while ensuring operational flexibility.

Canada Gummy Launch with Tilray

Our collaboration with Tilray is a first-of-its-kind agreement for Charlotte's Web, allowing the Company to license its brands, intellectual property, and formulations to a trusted partner. This underscores Charlotte's Web's international expansion strategies through an asset-light model, by partnering to leverage well-established infrastructure, co-production, and route-to-market capabilities.

At the end of the third quarter, Charlotte's Web gummies were launched in Canada. These gummies are crafted using Charlotte's Web's proprietary hemp genetics, cultivated in the pristine northern Okanagan Valley of British Columbia, Canada, and feature full-spectrum CBD hemp extract combined with functional botanical supplements, designed to provide synergistic support for targeted wellness benefits. The gummies are produced in accordance with Health Canada Processing and under a license by Aphria Inc., a subsidiary of Tilray Brands, Inc. ("Tilray") (Nasdaq: TLRY; TSX: TLRY). They are being distributed through cannabis retailers in select provinces and on the Tilray Medical website. The launch of gummies follows the earlier availability of Charlotte's Web hemp extract oil tinctures and topicals in Canada, expanding Canadian access to trusted, high-quality CBD products.

Regulatory Progress

The Company, in collaboration with One Hemp-a coalition of responsible, industry-leading hemp CBD companies-is proactively engaging with industry and consumer organizations to advance federal and state legislation that protects consumer access to safe, non-intoxicating hemp wellness products. This coalition serves as a resource for crafting regulatory frameworks on the federal and state level that prioritizes public health while protecting the rights of millions of CBD consumers who depend on these rigorously tested, quality-assured products. Federal momentum continues, with Congress making strides toward legislation that would establish a consistent, nationwide framework for CBD under FDA guidance. Charlotte's Web remains encouraged by bipartisan support and is committed to furthering these critical regulatory efforts.

DeFloria LLC ("DeFloria") IND Update

DeFloria is finalizing its Phase 1 trial data for the U.S. Food and Drug Administration (FDA) as part of its investigational new drug (IND) application. The Phase 1 clinical trial determined the dose range that will inform an IND opening Phase 2 clinical trial, which would follow a No Objection letter from the FDA. Updates on DeFloria's progress toward a Phase 2 clinical trial program will be provided accordingly. DeFloria (see April 6, 2023 press release) is a botanical drug development company developing a botanical drug utilizing patented hemp genetics from Charlotte's Web.

Financial Review - Q3 2024

The following table sets forth selected financial information for the periods indicated.

Three Months Ended, September 30, | ||||

U.S. $ millions, except per share data | 2024 | 2023 | ||

Revenue | $12.6 | $14.3 | ||

Cost of goods sold | 5.9 | 6.4 | ||

Gross profit | 6.7 | 7.9 | ||

Selling, general and administrative expenses | 12.7 | 19.9 | ||

Operating loss | (6.0) | (12.0) | ||

Other income (expense), net | (1.2) | 0.8 | ||

Change in fair value of financial instruments | 1.4 | (4.0) | ||

Net loss | ($5.8) | ($15.2) | ||

Net loss per common share, basic and diluted | ($0.04) | ($0.10) | ||

"Expense and cash flow management have been our top priorities this year. The cost reduction initiatives in the first half of the year to reorganize and streamline our operations have delivered a leaner overhead structure, reducing cash burn moving forward," said Erika Lind, Chief Financial Officer of Charlotte's Web. "We will commence initial commercial in-house production for our gummy lines this quarter, improving capacity utilization and fixed cost absorption that will strengthen gross margins over the long term. Gummies are our largest revenue product segment, and this transition will also support innovation and speed to market, aligning with our broader operational goals."

Consolidated net revenue for the third quarter ended September 30, 2024, was $12.6 million compared to $14.3 million in the third quarter of 2023, with retail and e-commerce revenues lower year-over-year. Overall, CBD industry growth in 2024 has been hindered by ongoing headwinds in the category, including regulatory ambiguities at the federal and state levels and associated competitive alternatives causing retailer and consumer confusion.

Gross profit was $6.7 million, or 53.0% of revenue, compared to $7.9 million, or 55.5%, in Q3 2023. The decrease reflects the lower revenue impacting fixed cost absorption in Q3 2024 and the Q1 2024 price reductions implemented on all oil tinctures. Improved production costs partially offset this gross margin decline.

Three Months Ended | ||||||

Segmented Net Revenue | September 30, | |||||

2024 | 2023 | % Decrease | ||||

Direct-to-consumer ("DTC") net revenue | $8.2 | $9.4 | (13.4) % | |||

Business-to-business ("B2B") net revenue | $4.3 | $4.9 | (10.7) % | |||

Direct-to-consumer net revenue through the Company's web store was $8.2 million, a decrease of $1.2 million compared to $9.4 million in Q3 2023, primarily due to lower year-over-year online traffic and consumer acquisitions. During Q2 2024, the Company migrated to a new e-commerce platform that provides improved software integrations, advanced target marketing tools, and superior customer relationship management capabilities. The new platform offers a more engaging consumer experience, and on a quarter-over-quarter basis, D2C's net revenue increased 4.4% compared to the second quarter of 2024.

Business-to-business retail net revenue was $4.3 million compared to $4.9 million in Q3 2023. The $0.6 million decrease was primarily due to some reductions in retail shelf space allocated to the CBD category between the comparable periods. Inflationary impact on discretionary consumer spending activity and product mix shift away from higher-priced tinctures were additional contributing factors. Despite declines in the overall CBD category this year, according to data from SPINS LLC, Charlotte's Web has been outperforming the category at retail. According to the latest surveys by The Brightfield Group, it holds the leading brand position in trust and loyalty.

On a quarter-over-quarter basis, B2B net revenue was essentially flat compared to the second quarter of 2024, when Charlotte's Web rolled out its new CBD topical isolates to more than 800 Walmart retail locations. The Company's leading gummy lines continue to deliver growth, with third-quarter sales increasing more than 10% year-over-year, further supported by its new CBN 'Stay Asleep' gummies. The distribution improvements in the first half of 2024, combined with CBN Stay Asleep gummy retail placements, increased overall retail Q3 distribution in the Natural channel by more than 20% year-over-year.

SG&A Expenses

Total selling, general, and administrative ("SG&A") expenses in the quarter were $12.7 million, a 36.2% improvement versus $19.9 million in Q3 2023. The improvement reflects actions taken during the first half of 2024 to reduce operating expenses and better align SG&A against revenue levels. Q3 2024 SG&A includes amortizing the MLB license and media rights assets of $1.8 million, compared to $2.9 million in Q3 last year. For the nine months ended September 30, 2024, SG&A expenses were approximately $42.7 million, including $3.8 million related to the MLB partnership. This compares to $57.0 million for the first nine months of 2023, including $6.8 million in MLB expenses. As a result of the operating expense reductions, efficiency improvements, and stringent cost controls, the Company expects operating expenses for 2024 to be more than $20 million lower than 2023.

Net Income and Adjusted EBITDA1

Charlotte's Web reported a net loss of $5.8 million, or ($0.04) per share basic and diluted, for the third quarter of 2024, as compared to a net loss of $15.2 million, or ($0.10) per share basic and diluted, for the third quarter of 2023.

Adjusted EBITDA1 loss for the third quarter of 2024 was $3.9 million, compared to Adjusted EBITDA loss of $6.0 million in the third quarter of 2023.

Cash Flow and Balance Sheet

Net cash used for operations for the three months ended September 30, 2024, was $7.6 million, including $2.5 million in cash paid to MLB regarding license and media rights assets. This is compared to $7.8 million in Q3 2023, which included $2.0 million in cash paid to MLB. There was $0.3 million in capital expenditures during the quarter related to insourcing manufacturing lines for gummy and topical products.

At September 30, 2024, the Company's cash and working capital were $24.6 million and $33.5 million, respectively, compared to $47.8 million and $54.5 million, respectively, at December 31, 2023.

Consolidated Financial Statements and Management's Discussion and Analysis

The Company's unaudited consolidated financial statements and accompanying notes for the three and nine months ended September 30, 2024, and 2023, and related management's discussion and analysis of financial condition and results of operations ("MD&A"), are reported in the Company's 10-Q filing on the Securities and Exchange Commission website at www.sec.gov and on SEDAR+ at www.sedarplus.ca and will be available on the Investor Relations section of the Company's website at https://investors.charlottesweb.com.

Conference Call

Management will not host an earnings conference call this quarter. As part of the Company's expense reduction and operational streamlining initiatives, management intends to host two earnings conference calls per year: in March, following the Company's year-end results report, and in August, following the issuance of the Company's second quarter and six-month results.

Shareholders with questions specific to the Q3 2024 financial results or business operations can contact Charlotte's Web investor relations directly.

Subscribe to Charlotte's Web investor news.

About Charlotte's Web Holdings, Inc.

Charlotte's Web Holdings, Inc., a Certified B Corporation headquartered in Louisville, Colorado, is the market leader in innovative hemp extract wellness products that include Charlotte's Web whole-plant full-spectrum CBD extracts as well as broad-spectrum CBD certified NSF for Sport®. Charlotte's Web is the official CBD of Major League Baseball© and the Premier Lacrosse League. Charlotte's Web branded premium quality products start with proprietary hemp genetics that are North American farm-grown using organic and regenerative cultivation practices. The Company's hemp extracts have naturally occurring botanical compounds including cannabidiol ("CBD"), CBN, CBC, CBG, terpenes, flavonoids, and other beneficial compounds. Charlotte's Web product categories include CBD oil tinctures (liquid products), CBD gummies (sleep, calming, exercise recovery, immunity), CBN gummies, CBD capsules, CBD topical creams, and lotions, as well as CBD pet products for dogs. Through its substantially vertically integrated business model, Charlotte's Web maintains stringent control over product quality and consistency with analytic testing from soil to shelf for quality assurance. Charlotte's Web products are distributed to retailers and healthcare practitioners throughout the U.S.A. and online through the Company's website at www.charlottesweb.com.

© Major League Baseball trademarks and copyrights are used with permission of Major League Baseball. Visit MLB.com.

Forward-Looking Information

Certain information provided herein constitutes forward-looking statements or information (collectively, "forward-looking statements") within the meaning of applicable securities laws. Forward-looking statements are typically identified by words such as "may", "will", "should", "could", "anticipate", "expect", "project", "estimate", "forecast", "plan", "intend", "target", "believe" and similar words suggesting future outcomes or statements regarding an outlook. Forward-looking statements are not guarantees of future performance and readers are cautioned against placing undue reliance on forward-looking statements. This press release includes forward-looking statements. By their nature, these statements involve a variety of assumptions, known and unknown risks and uncertainties, and other factors which may cause actual results, levels of activity, and achievements to differ materially from those expressed or implied by such statements. The forward-looking statements contained in this press release are based on certain assumptions and analysis by management of the Company in light of its experience and perception of historical trends, current conditions and expected future development and other factors that it believes are appropriate and reasonable.

Specifically, this press release contains forward-looking statements relating to, but not limited to: organizational changes, marketing plans and operational platform upgrades, and the impact of these initiatives, operational efficiencies, cash flow,? revenue and e-commerce monetization; expectations relating to IT upgrades, marketing optimization and operational integrations; product expansion activities and the corresponding ?results thereof; sales volume and gross margin expectations; anticipated timing for, and business impact of, in-house manufacturing of topical ?and gummy products; ?the impact of the Company's product innovations on product development; regulatory developments and the impact of developments on both consumer action and the Company's opportunities and operations; activities relating to, and sponsorship of, legislation to advance regulatory framework; the impact of insourcing on operating margins, capital expenditures and R&D; anticipated consumer trends and corresponding product innovation; anticipated future financial results, including expectations regarding targeted reduction in SG&A costs; improvements in cash flow; sufficient working capital; the impact of the Company's partnership with the MLB on the Company's exposure and sales; the Company's ability to increase online traffic and demographic exposure through new products and marketing; and the impact of certain activities on the Company's business and financial condition and anticipated trajectory.

The material factors and assumptions used to develop the forward-looking statements herein include, but are not limited to: regulatory regime changes; anticipated product development and sales; the success of sales and marketing activities; product development and production expectations; outcomes from R&D activities; the Company's ability to deal with adverse growing conditions in a timely and cost-effective manner; the availability of qualified and cost-effective human resources; compliance with contractual and regulatory obligations and requirements; availability of adequate liquidity and capital to support operations and business plans; and expectations around consumer product demand. In addition, the forward-looking statements are subject to risks and uncertainties pertaining to, among other things: supply and distribution chains; the market for the Company's products; revenue fluctuations; regulatory changes; loss of customers and retail partners; retention and availability of talent; competing products; share price volatility; loss of proprietary information; product acceptance; internet and system infrastructure functionality; information technology security; available capital to fund operations and business plans; crop risk; economic and political considerations; and including but not limited to those risks and uncertainties discussed under the heading "Risk Factors" in the Company's Annual Report on Form 10-K for the year ending December 31, 2023, and other risk factors contained in other filings with the Securities and Exchange Commission available on www.sec.gov and filings with Canadian securities regulatory authorities available on www.sedarplus.ca. The impact of any one risk, uncertainty, or factor on a particular forward-looking statement is not determinable with certainty as these are interdependent, and the Company's future course of action depends on management's assessment of all information available at the relevant time.

Any forward-looking statement in this press release is based only on information currently available to the Company and speaks only as of the date on which it is made. Except as required by applicable law, the Company assumes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise. All forward-looking statements, whether written or oral, attributable to the Company or persons acting on the Company's behalf, are expressly qualified in their entirety by these cautionary statements.

(1) | Non-GAAP Measures: The press release contains non-GAAP measures, including EBITDA and Adjusted EBITDA. Please refer to the section in the tables captioned "Non-GAAP Measures" below for additional information and a reconciliation to GAAP for all Non-GAAP metrics. |

CHARLOTTE'S WEB HOLDINGS, INC. | |||

CONSOLIDATED BALANCE SHEETS | |||

(in thousands of U.S. dollars, except share and per share amounts) | |||

September 30, | December 31, | ||

2024 (unaudited) | 2023 | ||

ASSETS | |||

Current assets: | |||

Cash and cash equivalents | $ 24,620 | $ 47,820 | |

Accounts receivable, net | 1,605 | 1,950 | |

Inventories, net | 19,532 | 21,538 | |

Prepaid expenses and other current assets | 4,236 | 6,864 | |

Total current assets | 49,993 | 78,172 | |

Property and equipment, net | 27,102 | 27,513 | |

License and media rights | 14,816 | 17,070 | |

Operating lease right-of-use assets, net | 13,275 | 14,601 | |

Investment in unconsolidated entity | 11,400 | 11,000 | |

SBH purchase option and other derivative assets | 1,328 | 2,602 | |

Intangible assets, net | 1,082 | 887 | |

Other long-term assets | 648 | 703 | |

Total assets | $ 119,644 | $ 152,548 | |

LIABILITIES AND SHAREHOLDERS' EQUITY | |||

Current liabilities: | |||

Accounts payable | $ 3,357 | $ 2,860 | |

Accrued and other current liabilities | 5,601 | 8,682 | |

Lease obligations - current | 2,316 | 2,252 | |

License and media rights payable - current | 5,209 | 9,852 | |

Total current liabilities | 16,483 | 23,646 | |

Convertible debenture | 45,170 | 42,528 | |

Lease obligations | 13,937 | 15,655 | |

License and media rights payable | 11,636 | 11,338 | |

Derivatives and other long-term liabilities | 2,175 | 3,823 | |

Total liabilities | 89,401 | 96,990 | |

Commitments and contingencies | |||

Shareholders' equity: | |||

Common shares, nil par value; unlimited shares authorized; 157,495,042 and 154,332,366 shares issued and outstanding as of September 30, 2024 and December 31, 2023 | 1 | 1 | |

Additional paid-in capital | 328,443 | 327,280 | |

Accumulated deficit | (298,201) | (271,723) | |

Total shareholders' equity | 30,243 | 55,558 | |

Total liabilities and shareholders' equity | $ 119,644 | $ 152,548 | |

CHARLOTTE'S WEB HOLDINGS, INC. | |||||||

CONSOLIDATED STATEMENTS OF OPERATIONS | |||||||

(in thousands of U.S. dollars, except share and per share amounts) | |||||||

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||

2024 | 2023 | 2024 | 2023 | ||||

Revenue | $ 12,587 | $ 14,294 | $ 37,000 | $ 47,310 | |||

Cost of goods sold | 5,914 | 6,365 | 20,834 | 20,546 | |||

Gross profit | 6,673 | 7,929 | 16,166 | 26,764 | |||

Selling, general and administrative expenses | 12,693 | 19,889 | 42,700 | 57,029 | |||

Operating loss | (6,020) | (11,960) | (26,534) | (30,265) | |||

Gain on initial investment in unconsolidated entity | - | - | - | 10,700 | |||

Change in fair value of financial instruments | 1,422 | (4,024) | 702 | 5,588 | |||

Other income (expense), net | (1,189) | 841 | (584) | (1,234) | |||

Loss before provision for income taxes | (5,787) | (15,143) | (26,416) | (15,211) | |||

Income tax expense | - | - | (62) | - | |||

Net loss | $ (5,787) | $ (15,143) | $ (26,478) | $ (15,211) | |||

Per common share amounts | |||||||

Net loss per common share, basic and diluted | $ (0.04) | $ (0.10) | $ (0.17) | $ (0.10) | |||

CHARLOTTE'S WEB HOLDINGS, INC. | |||||||||

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY | |||||||||

(in thousands of U.S. dollars, except share amounts) | |||||||||

Common Shares | Additional | Accumulated Deficit | Total | ||||||

Shares | Amount | ||||||||

Balance-December 31, 2023 | 154,332,366 | $ 1 | $ 327,280 | $ (271,723) | $ 55,558 | ||||

Common shares issued upon vesting of restricted share units, net of withholding | 2,895,489 | - | (98) | - | (98) | ||||

Share-based compensation | - | - | 842 | - | 842 | ||||

Net income (loss) | - | (9,634) | (9,634) | ||||||

Balance- March 31, 2024 | 157,227,855 | $ 1 | $ 328,024 | $ (281,357) | $ 46,668 | ||||

Common shares issued upon vesting of restricted share units, net of withholding | 267,187 | - | (20) | - | (20) | ||||

Share-based compensation | - | - | 237 | - | 237 | ||||

Net income (loss) | - | - | - | (11,057) | (11,057) | ||||

Balance-June 30, 2024 | 157,495,042 | $ 1 | $ 328,241 | $ (292,414) | $ 35,828 | ||||

Common shares issued upon vesting of restricted share units, net of withholding | 267,187 | - | (15) | - | (15) | ||||

Share-based compensation | - | - | 217 | - | 217 | ||||

Net income (loss) | - | - | - | (5,787) | (5,787) | ||||

Balance-September 30, 2024 | 157,762,229 | $ 1 | $ 328,443 | $ (298,201) | $ 30,243 | ||||

Balance-December 31, 2022 | 152,135,026 | $ 1 | $ 325,431 | $ (247,927) | $ 77,505 | ||||

Common shares issued upon vesting of restricted share units, net of withholding | 297,888 | - | (69) | - | (69) | ||||

Share-based compensation | - | - | 375 | - | 375 | ||||

Net income (loss) | - | - | - | (2,912) | (2,912) | ||||

Balance-March 31, 2023 | 152,432,914 | $ 1 | $ 325,737 | $ (250,839) | $ 74,899 | ||||

Common shares issued upon vesting of restricted share units, net of withholding | 392,204 | - | (6) | - | (6) | ||||

Share-based compensation | - | - | 624 | - | 624 | ||||

Net income (loss) | - | - | - | 2,844 | 2,844 | ||||

Balance-June 30, 2023 | 152,825,118 | $ 1 | $ 326,355 | $ (247,995) | $ 78,361 | ||||

Common shares issued upon vesting of restricted share units, net of withholding | 954,738 | - | (127) | - | (127) | ||||

Share-based compensation | - | - | 647 | - | 647 | ||||

Net income (loss) | - | - | - | (15,143) | (15,143) | ||||

Balance-September 30, 2023 | 153,779,856 | $ 1 | $ 326,875 | $ (263,138) | $ 63,738 | ||||

CHARLOTTE'S WEB HOLDINGS, INC. | |||

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | |||

(in thousands of U.S. dollars) | |||

Nine Months Ended September 30, | |||

2024 | 2023 | ||

Cash flows from operating activities: | |||

Net loss | $ (26,478) | $ (15,211) | |

Adjustments to reconcile net loss to net cash used in operating activities: | |||

Depreciation and amortization | 7,505 | 11,509 | |

Inventory provision | 3,926 | 730 | |

Convertible debenture and other accrued interest | 2,836 | 2,916 | |

Share-based compensation | 1,296 | 1,646 | |

Changes in right-of-use assets | 1,373 | 1,453 | |

Allowance for credit losses | 138 | 1,187 | |

Change in fair value of financial instruments | (702) | (5,588) | |

Gain on initial investment in unconsolidated entity | - | (10,700) | |

Gain on foreign currency transaction | (870) | (63) | |

Other | 524 | 1,657 | |

Changes in operating assets and liabilities: | |||

Accounts receivable, net | (167) | (1,151) | |

Inventories, net | (1,884) | 3,593 | |

Prepaid expenses and other current assets | 1,305 | (589) | |

Accounts payable, accrued and other liabilities | (1,266) | (328) | |

Operating lease obligations | (1,701) | (1,722) | |

License and media rights | (5,000) | (6,000) | |

Income taxes receivable | - | 4,261 | |

Other operating assets and liabilities, net | (304) | (449) | |

Net cash used in operating activities | (19,469) | (12,849) | |

Cash flows from investing activities: | |||

Purchases of property and equipment and intangible assets | (3,631) | (3,015) | |

Proceeds from sale of assets | 33 | 119 | |

Net cash used in investing activities | (3,598) | (2,896) | |

Cash flows from financing activities: | |||

Other financing activities | (133) | (202) | |

Net cash used in financing activities | (133) | (202) | |

Net decrease in cash and cash equivalents | (23,200) | (15,947) | |

Cash and cash equivalents -beginning of period | 47,820 | 66,963 | |

Cash and cash equivalents -end of period | $ 24,620 | $ 51,016 | |

Non-cash activities: | |||

Non-cash purchase of property and equipment and intangible assets | (8) | (81) | |

Non-cash issuance of note receivable | - | (142) | |

(1) Non-GAAP Measures - Adjusted EBITDA

Earnings before interest, taxes, depreciation, and amortization ("EBITDA") is not a recognized performance measure under U.S. GAAP. The term EBITDA consists of net income (loss) and excludes interest, taxes, depreciation, and amortization. Adjusted EBITDA also excludes other non-cash items such as changes in fair value of financial instruments (Mark-to-Market), Share-based compensation, and impairment of assets. These non-GAAP financial measures should be considered supplemental to, and not a substitute for, our reported financial results prepared in accordance with GAAP. The non-GAAP financial measures do not have a standardized meaning prescribed under U.S. GAAP and therefore may not be comparable to similar measures presented by other issuers. The primary purpose of using non-GAAP financial measures is to provide supplemental information that we believe may be useful to investors and to enable investors to evaluate our results in the same way we do. We also present the non-GAAP financial measures because we believe they assist investors in comparing our performance across reporting periods on a consistent basis, as well as comparing our results against the results of other companies, by excluding items that we do not believe are indicative of our core operating performance. Specifically, we use these non-GAAP measures as measures of operating performance; to prepare our annual operating budget; to allocate resources to enhance the financial performance of our business; to evaluate the effectiveness of our business strategies; to provide consistency and comparability with past financial performance; to facilitate a comparison of our results with those of other companies, many of which use similar non-GAAP financial measures to supplement their GAAP results; and in communications with our board of directors concerning our financial performance. Investors should be aware, however, that not all companies define these non-GAAP measures consistently.

(1) | Adjusted EBITDA is a non-GAAP financial measure with reconciliations provided in the table below. |

Adjusted EBITDA for the three and nine months ended September 30, 2024, and 2023 is as follows:

Charlotte's Web Holdings, Inc. | ||||||

Statement of Adjusted EBITDA | ||||||

(In Thousands) | ||||||

Three Months Ended | Nine Months Ended | |||||

September 30, | September 30, | |||||

(unaudited) | (unaudited) | |||||

U.S. $ Thousands | 2024 | 2023 | 2024 | 2023 | ||

Net income (loss) | $ (5,787) | $ (15,143) | $ (26,478) | $ (15,211) | ||

Depreciation of property and equipment and amortization of intangibles | 2,523 | 3,741 | 7,505 | 11,509 | ||

Interest expense | 577 | 289 | 1,557 | 1,436 | ||

Income tax expense | - | - | 62 | - | ||

EBITDA | (2,687) | (11,113) | (17,354) | (2,266) | ||

Stock Comp | 217 | 647 | 1,296 | 1,646 | ||

Mark-to-market financial instruments | (1,422) | 4,024 | (702) | (5,588) | ||

Inventory Provision | - | 410 | 3,926 | 730 | ||

Adjusted EBITDA | $ (3,892) | $ (6,032) | $ (12,834) | $ (5,478) | ||

SOURCE Charlotte's Web Holdings, Inc.