Montigny Le Bretonneux, November 15, 2024

RECOGNITION OF THE FINAL COMPLETION OF CAPITAL INCREASES

The Chairman and Chief Executive Officer of DOLFINES SA today noted the final completion of the capital increases decided on the basis of resolutions six to eleven of the extraordinary general meeting of DOLFINES SA held on September 16, 2024 and delegating to the Board of Directors, with the option of delegation and subdelegation under the legal conditions, its competence to decide, in the proportions and at the times of its choice, one or more capital increases by the issuance, with cancellation of the shareholders' preferential subscription rights, of ordinary shares of the Company, and the release of which will be effected in cash or by set-off of claims, for the benefit of specific categories of beneficiaries.

It thus noted:

- A capital increase in cash in the amount of €1,146,485.20, through the issuance of 818,918 shares with a nominal value of €1.4 (without issue premium);

- A capital increase by set-off of receivables in the amount of €1,389,574.20, through the issuance of 992,553 shares with a nominal value of €1.4 (without issue premium).

In total, this represents an increase in the share capital of €2,536,059.40, through the issuance of 1,811,471 shares with a nominal value of €1.4 (without issue premium).

The Chairman and Chief Executive Officer notes that following these capital increases, the share capital, which was set at the sum of €828,718.80 and composed of 591,942 shares with a nominal value of €1.4 each, is now set at the sum of €3,364,778.20 and composed of 2,403,413 shares with a nominal value of €1.4 each, fully subscribed and paid up.

Consequently, the Chairman and Chief Executive Officer has decided to amend Article 6 Share Capital as follows: "The share capital is set at the sum of 3,364,778.20 euros. It is divided into 2,403,413 shares with a nominal value of €1.4, fully subscribed and paid up. »

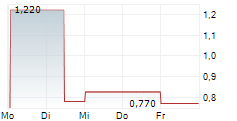

Adrien Bourdon Feniou, Chairman and Chief Executive Officer of DOLFINES SA, said: "I would like to thank the shareholders, old and new, who have enabled DOLFINES along with me to significantly strengthen its equity and cash position. This capital increase, which follows the reverse stock split effective on November 6, marks the end of the period of restructuring of the company's balance sheet. The group's gross financial debt, which was €2.75 million at the end of 2023, is reduced to €1.6 million and gross cash, which stood at €0.8 million at the end of 2023, is increased to €1.63 million.

I now hold nearly 41% of the capital of DOLFINES SA via Thesiger International. In addition, the company's employees and directors account for 15%. DOLFINES SA thus regains a relevant shareholding structure, whose interests are strongly aligned with the group's return to profitable and cash-generating growth. »

About Dolfines: www.dolfines.com

Founded in 2000, DOLFINES is an independent specialist in engineering and services in the renewable and conventional energy industry. Faced with the challenges of decarbonizing the energy sector and capitalizing on its strong expertise, DOLFINES wants to play a key role in this energy transition by designing and providing innovative services and solutions for the exploitation of renewable energy sources onshore and offshore, above and below sea level. Respecting the highest standards of quality and safety, DOLFINES is labelled an innovative company certified ISO 9001 for its technical assistance, auditing, inspection and engineering activities.

Euronext Growth TM

DOLFINES is listed on Euronext GrowthTM - ISIN Code: FR001400SP13- Mnemonic Code: ALDOL - DOLFINES is éligible to PEA-PME

Contacts: Delphine Bardelet Guejo, CFO - delphine.bardelet@dolfines.com

- SECURITY MASTER Key: lJhpZ51uZ5qVym1qksdobZZka2lhx5aVmWLKyGZqZp3GcG9mlWdmaMnGZnFpnWVt

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-88807-dolfines_pr_recognition-of-capital-increases.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free