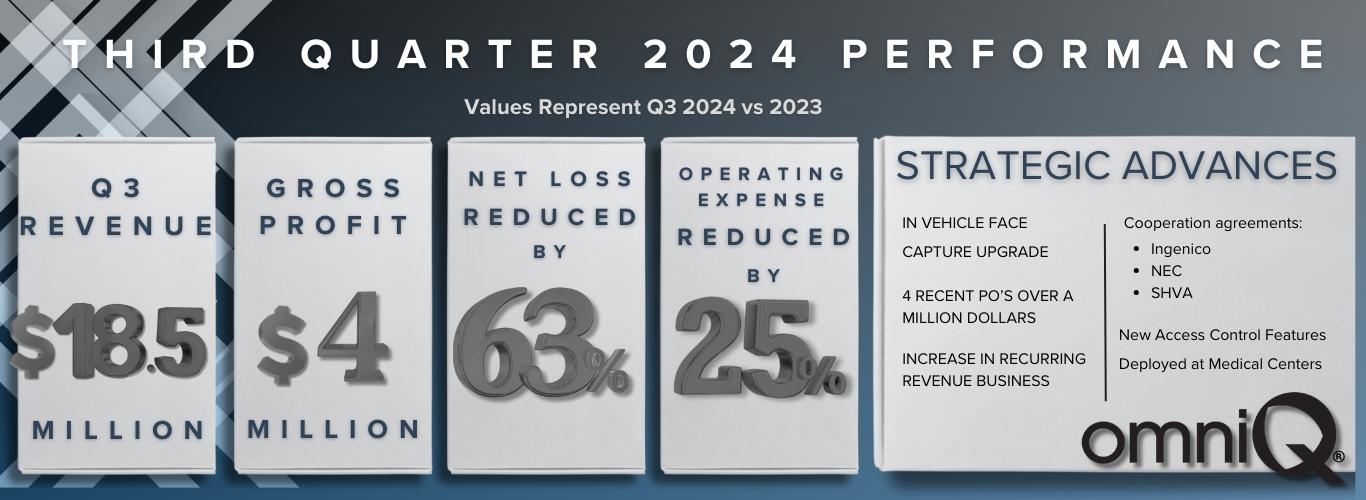

SALT LAKE CITY, Nov. 14, 2024 (GLOBE NEWSWIRE) -- omniQ Corporation (OTCMKTS: OMQS) ("omniQ" or "the Company"), reports third quarter 2024 revenue of $18.5 million, signifying 7.57% YoY growth, as well as significant decreases in operational expenses and net loss.

FINANCIAL HIGHLIGHTS:

- Revenue: OMNIQ reported revenue of $18,549,000 for Q3 2024, a modest increase from $17,244,000 in Q3 2023, marking a 7.57% year-over-year growth.

- Operating Expenses: Decreased significantly to $4,934,000 in Q3 2024 from $6,631,000 in Q3 2023, showing effective cost management resulting in a 25.58% reduction.

- Net Loss: The Company reported a net loss of $1,599,000 in Q3 2024, significantly reduced from a net loss of $4,305,000 in Q3 2023, resulting in a reduction in losses by 62.86%.

THIRD QUARTER 2024 FINANCIAL RESULTS

For the three months ended September 30, 2024 and 2023, the Company generated net revenues in the amount of $18.5 million and $17 million, respectively. The increase between the three-month periods was attributable to the increase in demand.

Total operating expenses for the three months ended September 30, 2024 and 2023 recognized was $5 million and $6.6 million, respectively, representing a 25% decrease. The decreases are related to the cost reduction plan put in place by management.

Selling, general and administrative expenses for the three months ended September 30, 2024 and 2023 totaled $4.4 million and $5.6 million, respectively, representing a 21% decrease. The decreases are related to the cost reduction plan put in place by management.

Operating Activities: Generated a modest net cash of $230,000 in the nine months ending September 2024, showing an improvement from a net use of $2,651,000 in the same period of 2023.

Gross Profit: Slightly decreased to $3,950,000 in Q3 2024 from $4,009,000 in Q3 2023, reflecting a slight reduction of 1.45%.

Earnings per Share (EPS): Basic loss per share improved to -$0.15 in Q3 2024 from -$0.55 in Q3 2023.

ADDITIONAL Q3 AND RECENT EVENTS

- Uplisting to the OTCQB Market: enhancing visibility and trading conditions for investors.

- Two major medical center deployments with increased technology capabilities.

- Strategic alliances with Ingenico and SHVA: enhancing fintech capabilities and increasing market reach.

- New purchase orders received: $2.5, $1, $1.4, and $3.4 million.

- Cooperation Agreement with NEC: broadens technology integration capabilities and brings new projects.

ADVANCES IN FINTECH:

OMNIQ continues to make significant strides in the fintech sector through strategic partnerships and product innovations, working alongside SHVA and Ingenico to enhance secure transaction solutions. These collaborations are focused on bringing robust, AI-driven financial technologies to market, further positioning OMNIQ as a key player in the fintech landscape.

STRATEGIC EXPANSION IN PUBLIC SAFETY

OMNIQ was selected to collaborate with NEC, leveraging OMNIQ's advanced in-vehicle face capture technology with NEC's cutting-edge facial recognition capabilities. This partnership has progressed to an active pilot phase and is set to scale into larger projects planned for 2025, underlining OMNIQ's growing impact in high-security solutions. Additionally, OMNIQ has introduced new functionalities to its access control SaaS, now implemented in two prominent medical centers in Ohio and Texas, enhancing secure access protocols in critical healthcare environments.

STRONG IOT BUSINESS PERFORMANCE

OMNIQ realized several significant purchase orders during the third quarter, particularly notable for including recurring revenue components such as software subscriptions and service contracts, contributing to more consistent revenue streams. This momentum is extending into early Q4, underscoring sustained demand for OMNIQ's IoT solutions across sectors including retail, supply chain, and public safety, where these capabilities are meeting critical customer needs.

SHAREHOLDER UPDATE

As OMNIQ continues to advance its strategic priorities, the Company has placed particular emphasis on expanding recurring revenue streams by refining our business model to focus on high-margin SaaS and service offerings. Supported by enhanced marketing and sales efforts, this strategic shift has driven increased adoption of these solutions across our customer base. By strengthening predictable revenue streams, OMNIQ is well-positioned to make ongoing investments in innovative product development, aligning with current market demand.

OMNIQ has prioritized the expansion of its recurring revenue base by optimizing our business model to emphasize high-margin SaaS and service offerings. Supported by enhanced marketing and sales efforts, this strategic shift has driven increased adoption of these solutions across our customer base. By strengthening predictable revenue streams, OMNIQ is well-positioned to make ongoing investments in innovative product development, aligning with current market demand.

In addition, OMNIQ is focused on expanding its presence within high-growth sectors including fintech, manufacturing and logistics, smart city solutions, public safety, retail, healthcare, and education. Our targeted partnerships in each of these areas enhance brand recognition, secure new contracts, and expand the value-added offerings available to existing clients. By leveraging these partnerships, OMNIQ believes that it can effectively reduce upfront investment and lower the costs associated with launching new solutions, establishing an efficient pathway for scalable and sustainable growth within these competitive markets.

Finally, OMNIQ is addressing the complexities of its expansion through a balanced approach, combining internal investments with strategic acquisitions aligned with the Company's core objectives. This dual strategy strengthens OMNIQ's operational capacity and market reach while ensuring that each acquisition complements our commitment to sustainable, scalable growth. Together, these efforts position OMNIQ to drive long-term value for our shareholders.

ABOUT OMNIQ:

OMNIQ Corp. (OTCQB: OMQS) provides computerized and machine vision image processing solutions that use patented and proprietary AI technology to deliver real time object identification, tracking, surveillance, and monitoring for the Supply Chain Management, Public Safety, and Traffic Management applications. The technology and services provided by the Company help clients move people, and objects and manage big data safely and securely through airports, warehouses, schools, and national borders and in many other applications and environments.

OMNIQ's customers include government agencies and leading Fortune 500 companies from several sectors, including manufacturing, retail, distribution, food and beverage, transportation and logistics, healthcare, and oil, gas, and chemicals. Since 2014, annual revenues have more than doubled, reaching $81 million in 2023, from clients in more than 40 countries.

The Company currently addresses several billion-dollar markets with double-digit growth, including the Global Smart City & Public Safety markets.

INFORMATION ABOUT FORWARD-LOOKING STATEMENTS

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995. Statements in this press release relating to plans, strategies, economic performance and trends, projections of results of specific activities or investments, and other statements that are not descriptions of historical facts may be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

This release contains "forward-looking statements" that include information relating to future events and future financial and operating performance. The words "anticipate," "may," "would," "will," "expect," "estimate," "can," "believe," "potential" and similar expressions and variations thereof are intended to identify forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which that performance or those results will be achieved. Forward-looking statements are based on information available at the time they are made and/or management's good faith belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements.

Examples of forward-looking statements include, among others, statements made in this press release regarding the closing of the private placement and the use of proceeds received in the private placement. Important factors that could cause these differences include, but are not limited to: fluctuations in demand for the Company's products particularly during the current health crisis, the introduction of new products, the Company's ability to maintain customer and strategic business relationships, the impact of competitive products and pricing, growth in targeted markets, the adequacy of the Company's liquidity and financial strength to support its growth, the Company's ability to manage credit and debt structures from vendors, debt holders and secured lenders, the Company's ability to successfully integrate its acquisitions, and other information that may be detailed from time-to-time in OMNIQ Corp.'s filings with the United States Securities and Exchange Commission. Examples of such forward-looking statements in this release include, among others, statements regarding revenue growth, driving sales, operational and financial initiatives, cost reduction and profitability, and simplification of operations. For a more detailed description of the risk factors and uncertainties affecting OMNIQ Corp., please refer to the Company's recent Securities and Exchange Commission filings, which are available at SEC.gov. OMNIQ Corp. undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, unless otherwise required by law.

Contact

IR@omniq.com

| OMNIQ CORP. CONDENSED CONSOLIDATED BALANCE SHEETS | ||||||||

| (In thousands, except share and per share data) | As of | |||||||

| September 30, 2024 | December 31, 2023 | |||||||

| (UNAUDITED) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 1,234 | $ | 1,678 | ||||

| Accounts receivable, net | 17,512 | 18,654 | ||||||

| Inventory | 5,651 | 6,028 | ||||||

| Prepaid expenses | 1,054 | 969 | ||||||

| Other current assets | 40 | 25 | ||||||

| Total current assets | 25,491 | 27,354 | ||||||

| Property and equipment, net of accumulated depreciation of $1,851 and $1,166 respectively | 843 | 1,066 | ||||||

| Goodwill, net of accumulated impairment of $0 and $14,868, respectively | 2,869 | 1,788 | ||||||

| Trade name, net of accumulated amortization of $4,974 and $4,850, respectively | 1,212 | 1,377 | ||||||

| Customer relationships, net of accumulated amortization of $12,256 and $11,814, respectively | 3,234 | 3,777 | ||||||

| Other intangibles, net of accumulated amortization of $1,711 and $1,669, respectively | 430 | 504 | ||||||

| Right of use lease asset | 1,293 | 1,862 | ||||||

| Other assets | 1,821 | 1,758 | ||||||

| Total Assets | $ | 37,193 | $ | 39,486 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Current liabilities | ||||||||

| Accounts payable and accrued liabilities | $ | 61,020 | $ | 56,741 | ||||

| Line of credit | 562 | 240 | ||||||

| Accrued payroll and sales tax | 2,392 | 1,537 | ||||||

| Notes payable - current portion | 8,651 | 10,196 | ||||||

| Lease liability - current portion | 745 | 885 | ||||||

| Other current liabilities | 2,420 | 3,106 | ||||||

| Total current liabilities | 75,790 | 72,705 | ||||||

| Long-term liabilities | ||||||||

| Accrued interest and accrued liabilities, related party | 73 | 73 | ||||||

| Notes payable, less current portion | 538 | 265 | ||||||

| Lease liability | 518 | 1,011 | ||||||

| Other long-term liabilities | 501 | 452 | ||||||

| Total liabilities | 77,420 | 74,506 | ||||||

| Stockholders' deficit | ||||||||

| Series A Preferred stock; $0.001 par value; 2,000,000 shares designated, 0 shares issued and outstanding | - | - | ||||||

| Series B Preferred stock; $0.001 par value; 1 share designated, 0 shares issued and outstanding | - | - | ||||||

| Series C Preferred stock; $0.001 par value; 3,000,000 shares designated, 502,000 shares issued and outstanding, respectively | 1 | 1 | ||||||

| Common stock; $0.001 par value; 35,000,000 shares authorized; 10,692,891 and 10,675,802 shares issued and outstanding, respectively. | 11 | 11 | ||||||

| Additional paid-in capital | 78,708 | 78,340 | ||||||

| Accumulated (deficit) | (120,631 | ) | (113,923 | ) | ||||

| Accumulated other comprehensive income | 1,684 | 551 | ||||||

| Total OmniQ stockholders' deficit | (40,227 | ) | (35,020 | ) | ||||

| Total liabilities and deficit | $ | 37,193 | $ | 39,486 | ||||

| OMNIQ CORP. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (UNAUDITED) | ||||||||||||||||

| For the three months | For the nine months ended | |||||||||||||||

| ending September 30, | September 30, | |||||||||||||||

| (In thousands, except share and per share data) | 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Revenues | $ | 18,549 | $ | 17,244 | $ | 55,923 | $ | 65,111 | ||||||||

| Cost of goods sold | 14,599 | 13,235 | 42,031 | 51,494 | ||||||||||||

| Gross profit | 3,950 | 4,009 | 13,892 | 13,617 | ||||||||||||

| Operating expenses | ||||||||||||||||

| Research & Development | 261 | 482 | 1,128 | 1,464 | ||||||||||||

| Selling, general and administrative | 4,355 | 5,585 | 14,944 | 17,667 | ||||||||||||

| Depreciation | 90 | 146 | 298 | 349 | ||||||||||||

| Amortization | 228 | 418 | 686 | 1,276 | ||||||||||||

| Total operating expenses | 4,934 | 6,631 | 17,056 | 20,756 | ||||||||||||

| Loss from operations | (984 | ) | (2,622 | ) | (3,164 | ) | (7,139 | ) | ||||||||

| Other income (expenses): | ||||||||||||||||

| Interest expense | (929 | ) | (898 | ) | (2,640 | ) | (2,575 | ) | ||||||||

| Other (expenses) income | 268 | (1,000 | ) | (1,032 | ) | (2,473 | ) | |||||||||

| Total other expenses | (661 | ) | (1,898 | ) | (3,672 | ) | (5,048 | ) | ||||||||

| Net Loss Before Income Taxes | (1,645 | ) | (4,520 | ) | (6,836 | ) | (12,187 | ) | ||||||||

| Provision for Income Taxes | ||||||||||||||||

| Current | 46 | 215 | 94 | 509 | ||||||||||||

| Total Provision for Income Taxes | 46 | 215 | 94 | 509 | ||||||||||||

| Net Loss | $ | (1,599 | ) | $ | (4,305 | ) | $ | (6,742 | ) | $ | (11,678 | ) | ||||

| Net Loss | $ | (1,599 | ) | $ | (4,305 | ) | $ | (6,742 | ) | $ | (11,678 | ) | ||||

| Foreign currency translation adjustment | (277 | ) | 510 | 1,133 | 1,227 | |||||||||||

| Comprehensive loss | (1,876 | ) | (3,795 | ) | $ | (5,609 | ) | $ | (10,451 | ) | ||||||

| Reconciliation of net loss to net loss attributable to common shareholders | ||||||||||||||||

| Net loss | (1,599 | ) | (4,305 | ) | $ | (6,742 | ) | $ | (11,678 | ) | ||||||

| Less: Dividends attributable to non-common stockholders' of OmniQ Corp | (7 | ) | (8 | ) | (22 | ) | (24 | ) | ||||||||

| Net loss attributable to common stockholders' of OmniQ Corp | (1,606 | ) | (4,313 | ) | $ | (6,764 | ) | $ | (11,702 | ) | ||||||

| Net (loss) per share - basic attributable to common stockholders' of OmniQ Corp | $ | (0.15 | ) | $ | (0.55 | ) | $ | (0.63 | ) | $ | (1.50 | ) | ||||

| Weighted average number of common shares outstanding - basic | 10,697,247 | 7,891,444 | 10,696,435 | 7,788,262 | ||||||||||||

| OMNIQ Corp. | |||||||||

| RECONCILIATION OF GAAP MEASURES TO NON-GAAP MEASURES | |||||||||

| The nine months ended | |||||||||

| (In thousands) | September 30, | ||||||||

| Adjusted EBITDA Calculation | 2024 | 2023 | |||||||

| Net loss | (6,742 | ) | (11,678 | ) | |||||

| Depreciation & amortization | 984 | 1,625 | |||||||

| Interest expense | 2,640 | 2,575 | |||||||

| Income taxes | (94 | ) | (509 | ) | |||||

| Stock compensation | 356 | 1,548 | |||||||

| Nonrecurring loss events | 1,237 | 2,596 | |||||||

| Adjusted EBITDA | (1,619 | ) | (3,843 | ) | |||||

| Total revenues, net | 55,923 | 65,111 | |||||||

| Adjusted EBITDA as a % of total revenues, net | (2.90% | ) | (5.90% | ) | |||||

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/66652c7c-6e5d-434f-82e7-63005581ca5a

https://www.globenewswire.com/NewsRoom/AttachmentNg/c8fdc59b-73f0-4e46-a49b-804c39435a68