~ Third Quarter Revenue Increased 36% to $6.1 million YoY~

~ Revenues For The Nine Months Increased 11% to $17.3 million ~

~ FY2024 On-Track to Deliver Revenue of North of $24.0 million, an Increase of 20% YoY ~

~ On Track to Achieve Operating Cash Flow Breakeven in The First Quarter of 2025~

MARLBOROUGH, Mass., Nov. 19, 2024 (GLOBE NEWSWIRE) -- ConnectM Technology Solutions, Inc. (Nasdaq: CNTM) ("ConnectM" or the "Company"), a technology company focused on the electrification economy, today announced preliminary results for the quarter ended September 30, 2024.

ConnectM is an AI-powered B2B technology electrification platform working within the $1.7 trillion market to displace fossil fuels. The Company made its public market debut on the Nasdaq on July 15, 2024. ConnectM's revenue growth lies in three largely untapped segments:

- Smart Heating & Cooling with a focus on Heat Pumps ("Building Electrification")

- Two, three, and four-wheel commercial electric vehicles; last mile delivery ("Transportation & Logistics")

- Distributed Energy Resources including Solar, Battery and EV Charging ("Distributed Energy")

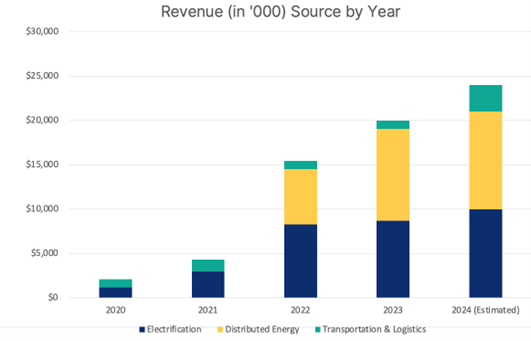

The table below sets forth sustainable Growth over the Last Five Years

Key Company Highlights

- Revenue in Q3 2024 was $6.1 million, compared to $4.45 million in Q3 2023. Revenue in the first nine months of 2024 increased 11% to $17.3 million, compared to $15.6 million in the same period last year.

- Successfully amended Forward Stock Purchase agreement to remove future settlement liability at maturity, resulting in a $26.1 million increase in Stockholder Equity.

- Company continues to eliminate overhang from go public event, successfully converting $13.7 million of debt with debt-to-equity swap at $2.00 per share.

- As part of the Company's ongoing efforts to make advanced heating technology accessible, ConnectM launched its AI-powered heat pump, for residential and light commercial use. Integrated with ConnectM's Energy Intelligence Network, the heat pump is optimized for performance, energy efficiency and reduces customer energy costs.

- Completed its first acquisition since go public event, entering into an agreement to acquire a controlling interest in DeliveryCircle, a nationwide tech-enabled delivery company which connects businesses looking for a last-mile delivery solution. This strategic acquisition expands ConnectM's Transportation & Logistics segment in the United States.

Bhaskar Panigrahi, CEO and Chairman of ConnectM, commented, "I am thrilled to report preliminary top line growth while completing significant milestones early on. We recorded revenue of $6.1 million and $17.3 million, a 36% and 11% increase, respectively, from the prior year periods for the three and nine months. Our revenue growth was driven by improvements in our three segments, Building Electrification, Transportation & Logistics, and Distributed Energy. While focused on growing our top line, we are encouraged by our ability to reduce the cost of revenues, which speaks to the increased efficiency across all our operations.

We have much to be proud of since our July 2024 public debut. The management team quickly prioritized balance sheet optimization - deleveraging the balance sheet and eliminating $2 million in annual interest expense while bringing $4.2 million in fresh capital to the Company. As the Company leader and a fellow shareholder, I, along with others within management, purchased a total of 455,000 shares during the open trading window, demonstrating management's alignment with shareholders and our shared belief in the growth trajectory of this Company.

Operationally, we have reduced our operating expenses, strategically prioritizing the growth of our business through Managed Services Agreements ("MSAs") and new product introductions, such as our AI-powered heat pump, and continued to grow through accretive acquisitions such as DeliveryCircle and Green Energy Gains. MSAs are a preferred risk adjusted growth play where we earn a high percentage of MSA partner revenue via our electrification platform subscription service. This strategic structure reduces our acquisition risk by giving the Company the option to acquire an MSA partner based on their performance and transformation post adoption of our platform.

Lastly, I have strong conviction that the future is bright for ConnectM. My team and I are focused on continuing to grow revenue and taking category leadership positions across our three operating segments. As you can see by our aligned investment interest, we are committed to creating meaningful catalysts for growth with the goal of increasing long-term value for all shareholders."

Outlook

For the fourth quarter and full year 2024, the Company expects revenues of approximately $7 million and $24 million respectively.

About ConnectM Technology Solutions, Inc.

ConnectM is a technology company focused on advancing the electrification economy by integrating electrified energy assets with its AI-powered technology solutions platform. The Company provides residential and light commercial buildings and all-electric original equipment manufacturers with a proprietary Energy Intelligence Network platform to accelerate the transition to all-electric heating, cooling, and transportation. Leveraging technology, data, artificial intelligence, contemporary design, and behavioral economics, ConnectM aims to make electrification more user-friendly, affordable, precise, and socially impactful. As a vertically integrated company with wholly owned service networks and a comprehensive technology stack, ConnectM empowers customers to reduce their reliance on fossil fuels, lower overall energy costs, and minimize their carbon footprint.

For more information, please visit: https://www.connectm.com/

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). We have based these forward-looking statements on our current expectations and projections about future events. All statements, other than statements of present or historical fact included in this press release, regarding our future financial performance and our strategy, expansion plans, future operations, future operating results, estimated revenues, losses, projected costs, prospects, plans and objectives of management are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may," "should," "could," "would," "expect," "plan," "anticipate," "intend," "believe," "estimate," "continue," "project" or the negative of such terms or other similar expressions. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about us that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this press release. We caution you that the forward-looking statements contained herein are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond our control.

In addition, we caution you that the forward-looking statements regarding the Company contained in this press release are subject to the risks and uncertainties described in the "Cautionary Note Regarding Forward-Looking Statements" section of the Current Report on Form 8-K filed with the Securities and Exchange Commission on July 18, 2024. Such filing identifies and addresses other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and ConnectM is under no obligation to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Contact:

MZ North America

(203) 741-8811

ConnectM@mzgroup.us