Achieves 6.3% Revenue Growth for the First Nine Months of 2024 Compared to 2023

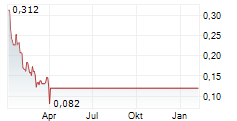

NEW YORK, NY / ACCESSWIRE / November 19, 2024 / 1847 Holdings LLC ("1847" or the "Company") (NYSE American:EFSH), a holding company specializing in identifying over-looked, deep value investment opportunities in middle market businesses, today provided a business update and reported financial results for the third quarter ended September 30, 2024.

Q3 2024 Highlights and Subsequent Events

Cash and cash equivalents, and restricted cash of $10.2 million as of September 30, 2024

Disposition of ICU Eyewear; eliminated $4.8 million of net liabilities from the balance sheet

Sold High Mountain Door & Trim Inc. ("HMDT"), a division of 1847 Cabinets for approximately $17 million, more than double the original purchase price

Completed $11.1 million public offering; eliminated $6.9 million of additional debt from the balance sheet

Signed definitive agreement to acquire the previously announced millwork, cabinetry, and door manufacturer based in Las Vegas, Nevada (the "Target") with unaudited revenue of $33.1 million and net income of $10.4 million for the trailing twelve months ended September 30, 2024. Scheduled to close on or before December 3, 2024

Mr. Ellery W. Roberts, CEO of 1847 Holdings, commented, "We believe the past few months have been transformative for 1847 Holdings as we executed a series of strategic initiatives designed to position the Company for sustained growth and maximize shareholder value over the long term. We remain committed to executing our strategic arbitrage model-acquiring undervalued companies, enhancing their performance, and selling them for a profit. This strategy allows us to leverage market inefficiencies by acquiring assets at lower valuations, improving their operational or financial performance, and then unlocking value through sales or spin-offs at higher valuations. A prime example of our strategy is the recent sale of HMDT. By effectively executing our approach to enhance asset value-sometimes beyond what is reflected in the Company's reported financials-we were able to sell the business for $17 million, more than double its original purchase price, despite a trailing twelve month net loss of approximately $2.3 million attributable to 1847 Holdings. This highlights our ability to unlock value through operational improvements and strategic decision-making.

"We aim to replicate this model with our next acquisition Target, which reported a net income of $10.4 million for the trailing twelve months ending September 30, 2024, with a purchase price of approximately $18.75 million. We ended the third quarter of 2024 with $10.2 million of cash and cash equivalents, and restricted cash that can be used in part to close this transaction. Additionally, the successful completion of our $11.1 million public offering allowed us to eliminate $6.9 million of debt, significantly strengthening our balance sheet. The disposition of ICU Eyewear further reduced net liabilities by $4.8 million. With a strong acquisition pipeline, we expect the upcoming acquisition to significantly boost profitability, deliver substantial cash flow, and negate the need for near-term capital raises. We believe these efforts establish a robust platform for sustainable growth and enhanced shareholder value. By leveraging our industry expertise and operational acumen, we intend to continue to identify and capitalize on high-return opportunities, reinforcing our proven growth model. We remain dedicated to driving value through strategic acquisitions as we expand and fortify our portfolio for long-term success," concluded Mr. Roberts.

Q3 2024 Financial Highlights

Total revenues were $4,759,090 for the three months ended September 30, 2024, as compared to $4,676,365 for the three months ended September 30, 2023.

Revenues from the construction segment increased by $12,336, or 0.3%, to $3,805,621 for the three months ended September 30, 2024 from $3,793,285 for the three months ended September 30, 2023. The increase in revenues was primarily attributed to an increase in new multi-family projects and an increase in the average customer contract value.

Revenues from the automotive supplies segment increased by $70,389, or 8.0%, to $953,469 for the three months ended September 30, 2024 from $883,080 for the three months ended September 30, 2023. The increase in revenues was primarily attributed to an improved supply chain with manufacturers, although inventory challenges within the supply chain to meet customer demands continue to persist.

Total cost of revenues was $2,002,772 for the three months ended September 30, 2024, as compared to $1,869,779 for the three months ended September 30, 2023.

Cost of revenues for the construction segment increased by $181,309, or 14.6%, to $1,425,247 for the three months ended September 30, 2024 from $1,243,938 for the three months ended September 30, 2023.

Cost of revenues for the automotive supplies segment decreased by $48,316, or 7.7%, to $577,525 for the three months ended September 30, 2024 from $625,841 for the three months ended September 30, 2023.

Total personnel expenses were $2,406,855 for the three months ended September 30, 2024, as compared to $1,663,261 for the three months ended September 30, 2023.

Total general and administrative expenses were $2,205,498 for the three months ended September 30, 2024, as compared to $1,427,256 for the three months ended September 30, 2023.

Total professional fees were $711,024 for the three months ended September 30, 2024, as compared to $592,202 for the three months ended September 30, 2023.

Total operating expenses were $8,172,328 for the three months ended September 30, 2024, as compared to $5,883,608 for the three months ended September 30, 2023, resulting in a loss from operations of $3,413,238 for the three months ended September 30, 2024, as compared to a loss from operations of $1,207,243 for the three months ended September 30, 2023.

Total other expense, net, was $2,501,551 for the three months ended September 30, 2024, as compared to $4,379,472 for the three months ended September 30, 2023. Such change was primarily due to a decrease of interest expense of $975,919, a decrease of amortization of debt discounts of $554,156, an increase in gain on change in fair value of warrant liabilities of $109,300 and an increase in gain on change in fair value of derivative liabilities of $3,166,458, offset by an increase in loss on extinguishment of debt of $1,642,701 and an increase in other expense of $1,285,211.

Net loss from continuing operations was $5,557,789 for the three months ended September 30, 2024, as compared to a net loss of $5,136,715 for the three months ended September 30, 2023.

About 1847 Holdings LLC

1847 Holdings LLC (NYSE American: EFSH), a publicly traded diversified acquisition holding company, was founded by Ellery W. Roberts, a former partner of Parallel Investment Partners, Saunders Karp & Megrue, and Principal of Lazard Freres Strategic Realty Investors. 1847 Holdings' investment thesis is that capital market inefficiencies have left the founders and/or stakeholders of many small business enterprises or lower-middle market businesses with limited exit options despite the intrinsic value of their business. Given this dynamic, 1847 Holdings can consistently acquire businesses it views as "solid" for reasonable multiples of cash flow and then deploy resources to strengthen the infrastructure and systems of those businesses in order to improve operations. These improvements may lead to a sale or IPO of an operating subsidiary at higher valuations than the purchase price and/or alternatively, an operating subsidiary may be held in perpetuity and contribute to 1847 Holdings' ability to pay regular and special dividends to shareholders. For more information, visit.

For the latest insights, follow 1847 on Twitter.

Forward-Looking Statements

This press release may contain information about 1847 Holdings' view of its future expectations, plans and prospects that constitute forward-looking statements. All forward-looking statements are based on our management's beliefs, assumptions and expectations of our future economic performance, taking into account the information currently available to it. These statements are not statements of historical fact. Forward-looking statements are subject to a number of factors, risks and uncertainties, some of which are not currently known to us, that may cause our actual results, performance or financial condition to be materially different from the expectations of future results, performance or financial position. Our actual results may differ materially from the results discussed in forward-looking statements. Factors that might cause such a difference include but are not limited to the risks set forth in "Risk Factors" included in our SEC filings.

Contact:

Crescendo Communications, LLC

Tel: +1 (212) 671-1020

Email: EFSH@crescendo-ir.com

SOURCE: 1847 Holdings LLC

View the original press release on accesswire.com