Reinet Investments SCA / Key word(s): Miscellaneous The Board of Directors of Reinet Investments Manager S.A. announces the results of Reinet Investments S.C.A. for the six-month period ended 30 September 2024.

Reinet Investments S.C.A. (the 'Company') is a partnership limited by shares incorporated in the Grand Duchy of Luxembourg and having its registered office at 35, boulevard Prince Henri, L-1724 Luxembourg. It is governed by the Luxembourg law on securitisation and in this capacity allows its shareholders to participate indirectly in the portfolio of assets held by its wholly-owned subsidiary Reinet Fund S.C.A., F.I.S. ('Reinet Fund'), a specialised investment fund also incorporated in Luxembourg. The Company's ordinary shares are listed on the Luxembourg Stock Exchange, Euronext Amsterdam and the Johannesburg Stock Exchange; the listing on the Johannesburg Stock Exchange is a secondary listing. The Company's ordinary shares are included in the 'LuxX' index of the principal shares traded on the Luxembourg Stock Exchange. The Company and Reinet Fund together with Reinet Fund's subsidiaries are referred to as 'Reinet'.

Cautionary statement regarding forward-looking statements This document contains forward-looking statements which reflect the current views and beliefs of the Company, as well as assumptions made by the Company and information currently available. Words such as 'may', 'should', 'estimate', 'project', 'plan', 'believe', 'expect', 'anticipate', 'intend', 'potential', 'goal', 'strategy', 'target', 'will', 'seek' and similar expressions may identify forward-looking statements. Such forward-looking statements are not guarantees of future performance. Actual results may differ materially from the forward-looking statements as a result of a number of risks and uncertainties, many of which are outside Reinet's control. The Company does not undertake to update, nor does it have any obligation to provide updates or to revise, any forward-looking statements. Reinet Investments S.C.A.

BUSINESS OVERVIEW

All investments are held, either directly or indirectly, by Reinet Fund.

(1) Calculated using period-end foreign exchange rates.

PERFORMANCE NET ASSET VALUE The NAV comprises total assets less total liabilities, and equates to total equity under International Financial Reporting Standards. The increase in the NAV of € 407 million during the period reflects increases in the estimated fair value of certain investments including British American Tobacco p.l.c. ('BAT'), Pension Insurance Corporation Group Limited ('Pension Corporation'), other listed investments and Prescient China funds, together with dividends received from BAT and Pension Corporation. Offsetting these increases are decreases in the estimated fair value of certain investments including NanoDimension funds and other investments, together with realised losses on certain investments, the dividend paid by the Company and accrued expenses in respect of management and performance fees. Details of the Company's NAV and details of movements in key investments can be found on pages 2 and 3 of this report.

Reinet records its assets and liabilities in euro; the strengthening of sterling against the euro offset by the weakening of the US dollar against the euro during the period resulted in an overall increase in the value of certain assets and liabilities in euro terms. Applying current period-end exchange rates to the March 2024 assets and liabilities would have resulted in an increase in the March 2024 NAV of some € 84 million.

SHARE BUYBACK PROGRAMME As at 30 September 2024, there was no share buyback programme in progress.

The Company repurchased 14 151 395 ordinary shares between November 2018 and May 2022 under five share buyback programmes. The cost of the ordinary shares repurchased amounted to € 222 million, plus transaction costs.

Details of each completed share buyback programme to date can be found in note 7 to the consolidated unaudited financial statements at 30 September 2024.

All ordinary shares repurchased are held as treasury shares.

NET ASSET VALUE PER SHARE The NAV per share of the Company is calculated by dividing the NAV by the number of shares outstanding (excluding treasury shares) of 181 790 891 (31 March 2024: 181 790 891).

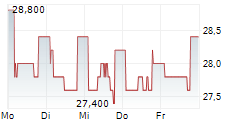

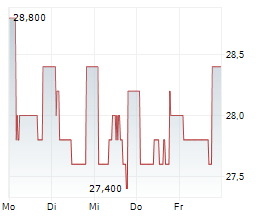

SHARE PRICE The Company's indicative share price as quoted on the Luxembourg Stock Exchange increased by 14.4 per cent in the period from € 22.20 at 31 March 2024 to € 25.40 at 30 September 2024. The total shareholder return since inception (taking into account the initial price of € 7.1945 and including dividends paid) is 9.0 per cent per annum. The growth in NAV, including dividends paid, reflects a 9.0 per cent compounded increase since March 2009. The Company's ordinary shares are listed on the Luxembourg Stock Exchange, Euronext Amsterdam and the Johannesburg Stock Exchange; the listing on the Johannesburg Stock Exchange is a secondary listing.

Share prices as at 30 September 2024 and 31 March 2024 were as follows:

GLOBAL MARKETS BACKDROP During the period, geopolitical uncertainty increased with global markets continuing to be impacted by the effects of the Ukraine crisis, turmoil in the Middle East and high interest rates and inflation. Whilst inflation and interest rates have started to fall, the extent and impact of on-going world-wide factors remain uncertain.

Reinet has no direct exposure to Russia, Ukraine or the Middle East through its underlying investments or banking relationships and has not experienced any significant direct impacts in respect of interest rate fluctuations or inflation. Reinet has various banking relationships with highly rated institutions, and a well-diversified approach to cash and liquidity management.

Reinet continues to value its investments in line with the International Private Equity and Venture Capital Valuation ('IPEV') guidelines and its approved valuation procedures and methodologies. All investment valuations have been prepared using latest available data, including exchange rates and listed share prices as at 30 September 2024. Discussions have taken place with fund managers and investee companies to determine any significant changes in value and any impacts related to the various geo-political areas of conflict, volatility in stock and currency markets, interest rates, inflation and exposure to certain financial institutions. Future valuations will take into account any new impacts of the above, which could affect the valuation of underlying investments.

INVESTMENTS Reinet seeks, through a range of investment structures, to build partnerships with other investors, specialised fund managers and entrepreneurs to find and develop opportunities for long-term value creation for its shareholders.

Since its formation in 2008, Reinet has invested some € 3.8 billion, and at 30 September 2024 committed to provide further funding of € 412 million to its current investments. Details of the funding commitments outstanding are given in the table on page 11 of this report. Commitments totalling € 96 million were funded during the period, no significant new commitments were made.

Major items impacting the NAV, significant changes in carrying value and new investments during the period under review are described below.

LISTED INVESTMENTS

BRITISH AMERICAN TOBACCO P.L.C. The investment in BAT remains one of Reinet's largest investments and is kept under constant review, considering the company's performance, the industry outlook, cash flows from dividends, stock market performance, volatility and liquidity.

During the period under review, dividend income recorded from BAT amounted to € 68 million (£ 56 million), being BAT's second 2024 interim dividend of some € 34 million (£ 28 million) received in August 2024 together with the third interim dividend of some € 34 million (£ 28 million) with a record date of 27 September 2024. The third interim dividend will be paid on 1 November 2024 and has been included as a receivable in the NAV as at 30 September 2024.

The first 2024 interim dividend of some € 33 million (£ 28 million) was received in May 2024 and was recorded as a receivable in Reinet's March 2024 results.

Reinet holds 48.3 million shares in BAT (31 March 2024: 48.3 million), representing some 2.18 per cent of BAT's issued share capital.

The value of Reinet's investment in BAT amounted to € 1 581 million at 30 September 2024 (31 March 2024: € 1 359 million), being some 24.0 per cent of Reinet's NAV (31 March 2024: 22.0 per cent). The BAT share price on the London Stock Exchange increased from £ 24.06 at 31 March 2024 to £ 27.24 at 30 September 2024; this together with the effect of sterling strengthening against the euro in the period, resulting in an increase in value of € 222 million.

In its 30 June 2024 half-year report, BAT reported that performance is in line with expectations, and that it is on track to deliver its full-year guidance. In the first six months of 2024, BAT increased its organic new category contribution and expects to deliver further improvement in revenue and profitability across new categories for the full year. BAT is a highly cash generative business, which is committed to continuing to reward shareholders with strong cash returns. It has made progress in enhancing financial flexibility which enabled the initiation of a sustainable share buy-back programme. BAT expects to progressively improve its performance to deliver a 3-5 per cent revenue growth, along with mid-single digit adjusted profit from operations growth on an organic constant currency basis by 2026.

Further information on BAT is available at www.bat.com/annualreport

OTHER LISTED INVESTMENTS Other listed investments comprised:

GRAB HOLDINGS LIMITED Grab Holdings Limited ('Grab') is a leading superapp platform in Southeast Asia, providing everyday services that matter to consumers, including food deliveries, mobility and the e-wallet segment of financial services. Grab offers a wide range of on-demand services across 480 cities in eight countries.

Reinet holds 10 573 666 shares in Grab with a market value of € 36 million (31 March 2024: € 31 million). The increase in value reflects the increase in the share price during the period, offset by the weakening of the US dollar against the euro.

Further information on Grab is available at www.grab.com

SPDR GOLD SHARES SPDR Gold shares ('GLD') is the largest physically backed gold exchange traded fund in the world. Over the long-term, gold can provide a hedge against inflation and offer some protection against value changes in turbulent economic and political times.

Reinet holds 230 000 shares with a market value of € 50 million (31 March 2024: € 44 million). The increase in value reflects the increase in the value of gold during the period, offset by the weakening of the US dollar against the euro.

Further information on GLD is available at www.spdrgoldshares.com/usa

TWIST BIOSCIENCE CORPORATION Twist Bioscience Corporation ('Twist') is involved in the fields of medicine, agriculture, industrial chemicals and data storage, by using synthetic DNA tools, and has created a revolutionary silicon-based DNA synthesis platform that offers precision at a scale otherwise unavailable.

Reinet holds 444 497 shares in Twist with a market value of € 18 million (31 March 2024: € 14 million). The increase in value reflects the increase in the share price during the period, offset by the weakening of the US dollar against the euro.

Further information on Twist is available at www.twistbioscience.com

UNLISTED INVESTMENTS Unlisted investments are carried at their estimated fair value. In determining fair value, Reinet Fund Manager S.A. relies on audited and unaudited financial statements of investee companies, management reports and valuations provided by third-party experts. Valuation methodologies applied include the NAV of investment funds, discounted cash flow models and comparable valuation multiples, as appropriate.

PENSION INSURANCE CORPORATION GROUP LIMITED Pension Corporation's wholly-owned subsidiary, Pension Insurance Corporation plc ('Pension Insurance Corporation'), is a leading provider in the UK pension risk transfer market.

During the first half of 2024, Pension Insurance Corporation concluded new business premiums of £ 3 billion (first half of 2023: £ 6.5 billion) across nine schemes with clients including Next, De Beers, and TotalEnergies. The transaction with TotalEnergies UK Pension Plan, covering £ 1.2 billion of liabilities, was won in part due to the strong relationship forged with the trustees in the decade since Pension Insurance Corporation insured £ 1.6 billion of the TotalEnergies pension plan liabilities. A further £ 1.6 billion of new business was either in exclusivity, or signed, as at the end of August 2024.

At 30 June 2024, assets held amounted to £ 47.7 billion (31 December 2023: £ 46.8 billion) and insurance liabilities stood at £ 42.1 billion (31 December 2023: £ 41.2 billion). Pension Corporation's solvency ratio increased to 234 per cent at 30 June 2024, up from 211 per cent at 31 December 2023.

In its 30 June 2024 half-year report, Pension Corporation reported that it had a strong half year as it focussed on developing its offering for trustees seeking to de-risk their members' pensions, including launching their streamlined service for small schemes, known as 'Mosaic'.

Pension Corporation continuously works to improve its already excellent levels of service for its policyholders, a key part of its strategy, and was rewarded with multiple awards based on its customer service offering. The number of pensions insured now stands at 348 600 (31 December 2023: 339 900) and pension payments made in the first six months of 2024 amounted to a record £ 1.1 billion.

Pension Corporation continues to invest in UK infrastructure and housing based on its partnership approach and intends to invest significantly more in these areas over the coming years.

In April 2024, the shareholders of Pension Corporation approved a dividend of 11.0 pence per ordinary share. Reinet's share of the dividend amounting to some € 85 million (£ 73 million) was received in May 2024. In September 2024, the board of directors of Pension Corporation approved an interim dividend of 11.0 pence per ordinary share and a special dividend of 8.0 pence per ordinary share. Reinet's share of these dividends amounting to € 150 million (£ 125 million) was received in September 2024.

In August 2024, Fitch affirmed Pension Insurance Corporation's Insurer Financial Strength rating at A+ (Strong) and Long-Term Issuer Default rating at A.

Reinet's shareholding in Pension Corporation remained at 49.5 per cent in the period under review.

Reinet's investment in Pension Corporation is carried at an estimated fair value of € 3 469 million at 30 September 2024 (31 March 2024: € 3 436 million). This value takes into account Pension Corporation's adjusted equity own funds value at 30 June 2024 of some £ 6.3 billion (31 December 2023: £ 6.3 billion) adjusted for dividends paid in September 2024 of £ 253 million, corresponding valuation multiples drawn from industry data for a selected UK insurance peer group as at 30 September 2024, and a discount of 10 per cent which takes into account the illiquid nature of Reinet's investment.

The increase in Reinet's estimated fair value of Pension Corporation over the six-month period is mainly due to an increase in comparable company multiples derived from public information of listed peer group companies in the UK insurance sector, together with the strengthening of sterling against the euro in the period, offset by the payment of the September 2024 dividends as set out above.

The investment in Pension Corporation represented some 52.6 per cent of Reinet's NAV at 30 September 2024, compared to 55.6 per cent at 31 March 2024.

Further information on Pension Corporation is available at www.pensioncorporation.com

PRIVATE EQUITY AND RELATED PARTNERSHIPS TRILANTIC CAPITAL PARTNERSTrilantic Capital Partners ('Trilantic') is composed of Trilantic North America and Trilantic Europe, two separate and independent private equity investment advisors focused on making controlling and significant minority interest investments in companies in their respective geographies. Trilantic North America currently targets investments in the business services and consumer sectors, and currently manages five fund families. Trilantic Europe primarily targets investments in the industrials, consumer and leisure, telecommunication, media and technology, business services and healthcare sectors, and currently manages three fund families.

Reinet and its minority partner invest in certain of the Trilantic general partnerships ('Trilantic Management'). Reinet and its minority partner, through Reinet TCP Holdings Limited, invest in two of the current funds under Trilantic's management. Reinet also directly invests in three additional funds under Trilantic's management. The terms of investment applicable to Reinet's investment in the Trilantic funds provide that Reinet will not pay any management fees or carried interest. In addition, Reinet receives a share of the carried interest payable on the realisation of investments held in the funds once a hurdle rate has been achieved.

Reinet TCP Holdings Limited invests in Trilantic Capital Partners IV L.P. ('Fund IV') and Trilantic Capital Partners IV (Europe) L.P.; these funds are in the process of realising the remaining underlying investments.

Reinet is invested in Trilantic Capital Partners V (North America) L.P. which is in the process of realising the remaining underlying investments.

In 2017, Reinet invested in Trilantic Capital Partners VI Parallel (North America) L.P. (collectively with its parallel vehicles, 'Fund VI') and Trilantic Energy Partners II Parallel (North America) L.P. (collectively with its parallel vehicles, 'TEP II'). These US-based funds are focused on North American opportunities with TEP II being especially focused on the energy industry sector; these funds are in the process of realising the remaining underlying investments. Reinet's investment in Trilantic Management and the above funds is carried at an estimated fair value of € 432 million at 30 September 2024 (31 March 2024: € 443 million) of which € 3 million (31 March 2024: € 3 million) is attributable to the minority partner. The estimated fair value is based on unaudited valuation data provided by Trilantic Management at 30 June 2024, adjusted for movements in listed investments and cash movements up to 30 September 2024.

The decrease in the estimated fair value is due to net distributions of € 8 million, together with the weakening of the US dollar against the euro in the period.

Further information on Trilantic is available at www.trilantic.com TRUARC PARTNERS FUNDS, CO-INVESTMENT OPPORTUNITIES AND MANAGEMENT COMPANY TruArc Partners LP ('TruArc') is a middle market focused investment management firm led by a team that has worked together since 2005 and has deployed over $ 3 billion of capital. TruArc focuses on companies in attractive sub-sectors of Specialty Manufacturing and Business Services. The TruArc investment team works closely with its operating partners and portfolio management teams in an effort to generate value through a transformational growth strategy focused on both organic growth and acquisitions.

Reinet is invested in Snow Phipps II, Snow Phipps III, TruArc Fund IV, TruArc Structured Opportunities Fund, in two co-investment opportunities alongside Snow Phipps III, and in the management company.

Reinet has committed to invest € 16 million ($ 18 million) in TruArc Structured Opportunities Fund as part of the first close. This amount will increase at subsequent closings. As at 30 September 2024, € 4 million of capital has been called.

Reinet's investment is carried at an estimated fair value of € 365 million at 30 September 2024 (31 March 2024: € 372 million) based on the unaudited valuation data provided by TruArc at 30 June 2024 adjusted for cash movements up to 30 September 2024.

The decrease in the estimated fair value is due to net distributions of € 1 million, together with the weakening of the US dollar against the euro in the period.

Further information on TruArc is available at www.truarcpartners.com

COATUE FUNDS Coatue Management L.L.C. ('Coatue') is a global investment firm focused on technology-related investment opportunities led by its founder, Mr Philippe Laffont. Coatue invests in public and private markets with an emphasis on technology, media, telecommunications, the consumer and healthcare sectors.

Reinet is invested in Coatue Structured Offshore Feeder Fund LP and Coatue Tactical Solutions CT Offshore Fund B LP (together the 'Coatue Structured Funds').

The Coatue Structured Funds seek to invest in structured investments in both publicly listed and privately held technology companies, focusing on investments that offer downside protection while retaining upside potential. The Coatue Structured Funds focus on privately negotiated transactions leveraging Coatue's sector experience and platform resources to source proprietary transactions. Coatue seeks to employ a strategy that will opportunistically fund both offensive and defensive transactions such as M&A, and establishing paths toward accelerating organic growth. Coatue believes there is a substantial universe of potential investment opportunities and that the market could produce significant structured capital opportunities.

Coatue generally focuses on companies that it believes are: 1) powered by a strong underlying trend; 2) established winners or breakout leaders within a category or trend; 3) pursuing a large total addressable market; 4) operating business models with strong unit economics; and 5) led by visionary founders and experienced management teams.

Reinet's investment is carried at an estimated fair value of € 155 million at 30 September 2024 (31 March 2024: € 73 million) based on unaudited valuation data provided by Coatue at 30 June 2024, adjusted for cash movements up to 30 September 2024.

The increase in the estimated fair value reflects capital contributions of € 85 million, offset by the weakening of the US dollar against the euro in the period.

Further information on Coatue is available at www.coatue.com

ASIAN PRIVATE EQUITY COMPANIES AND PORTFOLIO FUNDS Milestone China Opportunities fundReinet is invested in Milestone China Opportunities Fund III L.P. ('Milestone III'), a fund managed by Milestone Capital. Milestone III is in the process of realising its remaining underlying investments.

The investment in Milestone III is carried at an estimated fair value of € 3 million (31 March 2024: € 13 million) based on unaudited financial information provided by Milestone Capital at 30 June 2024, adjusted for movements in listed investments and cash movements up to 30 September 2024.

The decrease in the estimated fair value reflects distributions of € 10 million in the period.

Further information on Milestone is available at www.mcmchina.com

Prescient China funds and management company Reinet is invested in the Prescient China Equity Fund, the Prescient China Balanced Fund, the Prescient China Growth Enhanced Absolute Return Fund and the management company.

The Prescient China Equity Fund uses a systematic, quantitative approach to seek long-term capital growth by investing primarily in China 'A' shares listed on the Shanghai and Shenzhen Stock Exchanges by virtue of Prescient's Qualified Foreign Institutional Investor status granted by the China Securities Regulatory Commission.

Prescient China Balanced Fund invests in equities following a similar strategy to the Prescient China Equity Fund and also in bonds, cash and derivatives with the objective of generating inflation-beating returns at acceptable risk levels.

Prescient China Growth Enhanced Absolute Return Fund aims to achieve long-term capital growth at significantly lower return volatility than conventional multi-asset China investment strategies. The fund will predominantly invest in mainland Chinese equities, bonds, cash, money market instruments and derivatives.

All funds are managed by a subsidiary of Prescient Limited ('Prescient'), a South African fund manager, with the team based in Shanghai.

Reinet's total investment is carried at an estimated fair value of € 145 million based on unaudited financial information provided by Prescient at 30 September 2024 (31 March 2024: € 124 million).

The increase in the estimated fair value reflects increases in the value of underlying investments offset by the weakening of the US dollar against the euro in the period.

Further information on Prescient is available at www.prescient.co.za

Asia Partners funds Reinet is invested in Asia Partners I LP and Asia Partners II LP.

Asia Partners I LP is the inaugural fund of Asia Partners Fund Management Pte. Ltd. ('Asia Partners'), a Singapore-based growth equity investment firm. Asia Partners II LP, a successor fund, was launched in April 2022.

Asia Partners bases its investment strategy on the long-term growth potential of Southeast Asia, the rapid growth of innovative technology and technology-enabled businesses in the region, and target investments in the $ 20 million to $ 80 million range, often described as the 'Series C/D Gap' between early-stage venture capital and the public capital markets.

The investment in Asia Partners funds is held at an estimated fair value of € 37 million (31 March 2024: € 34 million) based on unaudited financial information provided by Asia Partners at 30 June 2024, adjusted for cash movements up to 30 September 2024.

The increase in the estimated fair value reflects capital contributions of € 4 million offset by the weakening of the US dollar against the euro in the period.

Further information on Asia Partners is available at www.asiapartners.com

SPECIALISED INVESTMENT FUNDS NanoDimension funds and co-investment opportunities ND Capital ('NanoDimension') is a venture capital firm founded in 2002 that invests in disruptive technologies in and at the intersection of the life and physical sciences, accelerated by data sciences. Their core belief is that scientific disciplines will continue to converge, and that some of the biggest breakthroughs will occur at the intersection of two or more disciplines. The focus of each fund is to invest in and support the establishment, technology development and scale up, growth and commercialisation of portfolio companies. They believe that these disruptive technologies address some of the biggest societal problems. Investments range from molecular diagnostics, cell and gene therapies, organs on chip, DNA synthesis and DNA editing, energy storage and electrical propulsion systems for aviation. They invest predominantly across the United States and Europe with additional investments in Canada, Denmark and the United Kingdom.

Reinet is a limited partner in NanoDimension II L.P., NanoDimension III L.P., NanoDimension IV L.P. and ND Capital Opportunity Fund I L.P., and is invested in one co-investment opportunity alongside NanoDimension II L.P.

At 30 September 2024, the estimated fair value of Reinet's investment amounted to € 75 million (31 March 2024: € 107 million) based on unaudited valuation data provided by NanoDimension as at 30 June 2024, adjusted for movements in listed investments and cash movements up to 30 September 2024.

The decrease in the estimated fair value reflects decreases in the value of underlying investments and the weakening of the US dollar against the euro in the period, offset by capital contributions of € 6 million.

Further information on NanoDimension is available at www.nd.capital

OTHER INVESTMENTS Other investments are carried at their estimated fair value of € 62 million at 30 September 2024 (31 March 2024: € 75 million).

The decrease in the estimated fair value reflects distributions of € 1 million together with decreases in the value of underlying investments and the weakening of the US dollar against the euro in the period.

Further information on Reinet's investments, corporate governance and sustainability reporting may be found in the Reinet 2024 annual report which is available at www.reinet.com/investor-relations/reports.html

TOTAL COMMITMENTS Funding commitments are entered into in various currencies including sterling and US dollar and are converted into euro using 30 September 2024 exchange rates.

The table below summarises Reinet's investment commitments as at 30 September 2024.

(1) Commitments calculated using 31 March 2024 exchange rates. (2) Reflects exchange rate movements between 31 March 2024 and 30 September 2024. (3) Amounts calculated using 30 September 2024 exchange rates, which may differ from actual exchange rates on the transaction date. (4) Negative amounts reflect the cancellation of unpaid commitments in respect of fully exited investments. (5) Commitments noted represent only Reinet's share of the investments at 30 September 2024, additional commitments payable by the minority partner amount to € 2 million in respect of Trilantic.

CASH AND LIQUID FUNDS Reinet holds cash on deposit principally in European-based banks and in liquidity funds holding highly rated short-term instruments.

Reinet's liquidity is measured by its ability to meet potential cash requirements, including unfunded commitments on investments and the repayment of borrowings, and at 30 September 2024 can be summarised as follows:

The undrawn borrowing facilities comprise a revolving facility with Bank of America, N.A. and with Citibank N.A. (see page 12).

Reinet may sell further BAT shares or use such shares to secure additional financing facilities from time to time.

BANK BORROWINGS BORROWINGSDuring the period under review, Reinet repaid £ 50 million to Citibank N.A. in respect of a fixed-rate margin loan. The remaining loan balance of £ 50 million was extended for three years on a floating-rate basis, with an option to convert to a fixed-rate in future. At 30 September 2024, the estimated fair value of the loan amounted to € 60 million (31 March 2024: £ 100 million fixed-rate margin loan with an estimated fair value of € 115 million).

In addition, Reinet has a fixed-rate £ 100 million margin loan due to Bank of America, N.A., which is repayable in March 2025. At 30 September 2024, the estimated fair value of the loan amounted to € 119 million (31 March 2024: € 114 million).

The movement in the estimated fair value of both loans reflects the strengthening of sterling against the euro in the period and the decrease in the discount rates used (due to decreases in market interest rates), offset by repayments made during the period.

Some 11 million BAT shares have been pledged to collateralise these two loans.

Reinet has a facility agreement in place with Citibank N.A. up to August 2027 and with Bank of America, N.A. up to March 2025. These facilities allow Reinet to drawdown the equivalent of up to € 300 million (£ 250 million) in a combination of currencies to fund further investment commitments. As at 30 September 2024 and 31 March 2024 no funds have been drawn under these facilities.

Refer to page 56 of the Reinet 2024 annual report for a description of Reinet's policy on foreign exchange exposure.

OTHER LIABILITIES Minority interest, fees payable and other liabilities, net of other assets comprise:

The minority interest liability is in respect of a minority partner's share in the gains and losses not yet distributed arising from the estimated fair value movement of investments in which they have interests.

Tax provisions relate to realised and unrealised gains arising from the investments in Trilantic Capital Partners, together with withholding and corporate taxes relating to the investment in United States land development and mortgages.

The BAT dividend receivable had a record date of 27 September 2024 and a payment date of 1 November 2024.

A provision of € 27 million has been made for the six-month period in respect of a potential performance fee as at 30 September 2024 (31 March 2024: € 90 million) based on the indicative closing price of Reinet shares of € 25.40. In order for a performance fee to be payable at 31 March 2025, the volume weighted average market price of the Company's share, determined by taking into account volume and price information on the Luxembourg Stock Exchange, Euronext Amsterdam and the Johannesburg Stock Exchange over the last 20 trading days of the current financial year, needs to exceed € 22.60.

The performance fee (if applicable) and management fee are payable to Reinet Investment Advisors Limited.

INCOME STATEMENT

INCOME Dividend income from BAT recorded during the period amounted to € 68 million (£ 56 million) (30 September 2023: € 65 million (£ 56 million)). Dividend income recorded for the six months to September 2024 was in respect of BAT's second and third 2024 interim dividends, each amounting to £ 0.589 per share (2023: £ 0.577 per share), with the third 2024 interim dividend having a record date of 27 September 2024.

Dividend income from Pension Corporation amounting to some € 85 million (£ 73 million) was received in May 2024 and € 150 million (£ 125 million) was received in September 2024, for a total of € 235 million (£ 198 million).

Interest income is earned on bank deposits, investments and loans made to underlying investments.

Realised losses on other investments were mainly in respect of an investment held in a company which was liquidated during the period. This investment was written off over the years; the unrealised loss has been reversed and the investment fully realised in the period.

EXPENSES The management fee for the period ended 30 September 2024 amounts to € 26 million and is based on Reinet Fund's NAV of € 6 184 million at 31 March 2024 (30 September 2023: € 24 million, based on Reinet Fund's NAV of € 5 721 million at 31 March 2023).

A performance fee may be payable for the year ended 31 March 2025 if certain conditions are met. The performance fee is calculated as 10 per cent of the Cumulative Total Shareholder Return as defined in the Company's prospectus, published on 10 October 2008 as last amended on 25 August 2020, including dividends paid, over the period since completion of the rights issue in December 2008 up to 31 March 2025, less the sum of all performance fees paid in respect of previous periods. A provision for the potential performance fee of € 27 million was accrued in respect of the six-month period ended 30 September 2024 (30 September 2023: € 12 million).

Operating expenses of € 4 million include € 1 million in respect of charges from Reinet Investments Manager S.A. (the 'General Partner') and other expenses.

FAIR VALUE ADJUSTMENTS The investment in 48.3 million BAT shares increased in value by € 222 million during the period under review. Of this, € 185 million was attributable to the increase in value of the underlying BAT shares in sterling terms, together with an increase of € 37 million due to the strengthening of sterling against the euro during the period under review.

The investment in Pension Corporation increased in value by € 33 million which includes an increase of € 94 million in respect of the increase in market multiples and € 91 million due to the strengthening of sterling against the euro, offset by a decrease of € 152 million due to the movement on Pension Corporation's adjusted equity own funds value in the period under review, which is mainly in respect of the payment of the dividend (refer to pages 6 and 7 for more detail).

The unrealised fair value adjustment of € 10 million in respect of other investments includes an increase in the estimated fair value of Prescient funds, together with the realisation of unrealised losses noted above, offset by a decrease in the estimated fair value of NanoDimension funds and other investments. The above amounts include the effect of changes in foreign exchange rates in the period under review.

Borrowings are carried at an estimated fair value reflecting the discounted cash flow value of future principal and interest payments taking into account prevailing interest rates. An unrealised loss of € 9 million arose during the period in respect of the Citibank N.A. and Bank of America, N.A. loans as a result of decreases in market interest rates together with the strengthening of sterling in the period.

MINORITY INTEREST The minority interest expense arises in respect of the minority partner's share in the earnings of Reinet TCP Holdings Limited.

DIVIDEND A cash dividend of some € 63.6 million or € 0.35 per share (excluding treasury shares held) was paid in September 2024, following approval at the annual general meeting on 27 August 2024. The Company only declares an annual dividend.

CAPITAL STRUCTURE As at 30 September 2024 and 31 March 2024 there were 195 941 286 ordinary shares and 1 000 management shares in issue.

As at 30 September 2024 and 31 March 2024 the Company held 14 151 395 ordinary shares as treasury shares. The voting and dividend rights attached to the treasury shares are suspended. Therefore the total number of voting rights at 30 September 2024 and 31 March 2024 was 181 790 891.

FINANCIAL STATEMENTS The consolidated unaudited financial statements at 30 September 2024, on which this announcement is based, have been approved by the Board of the General Partner on 18 November 2024.

SHARE INFORMATION The Company's ordinary shares are listed and traded on the Luxembourg Stock Exchange (symbol 'REINI', Refinitiv code REIT.LU), on Euronext Amsterdam (symbol 'REINA', Refinitiv code REIT.AS) and on the Johannesburg Stock Exchange (symbol 'RNI', Refinitiv code RNIJ.J) with the ISIN number LU0383812293; the listing on the Johannesburg Stock Exchange is a secondary listing. The Company's ordinary shares are included in the 'LuxX' index of the principal shares traded on the Luxembourg Stock Exchange.

DATA PROTECTION The Data Protection Information Notice is available on the Company's website (www.reinet.com/investor-relations/data-protection.html), which is intended to provide investors with detailed information regarding the processing of their personal data, as well as the Privacy Policy (www.reinet.com/privacy-policy.html), which is intended to provide users of the Company's website with information regarding the processing of their personal data resulting from the use of the Company's website and/or from requests made via the Company's website.

Reinet Investments Manager S.A. General Partner For and on behalf of Reinet Investments S.C.A.

Website: www.reinet.com End of Inside Information | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Language: | English |

| Company: | Reinet Investments SCA |

| 35, Boulevard Prince Henri | |

| 1724 Luxemburg | |

| Luxemburg | |

| Phone: | +352 22 72 53 |

| E-mail: | info@reinet.com |

| ISIN: | LU0383812293 |

| Valor: | 4503016 |

| Listed: | Regulated Unofficial Market in Berlin, Frankfurt, Munich |

| EQS News ID: | 2033765 |

| End of Announcement | EQS News Service |

2033765 20-Nov-2024 CET/CEST